How to Open an Interactive Brokers Account in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Interactive Brokers is an excellent broker from the United States. It is known for its cheap fees and unique investment product range. It is being used by many personal finance bloggers, for instance.

It is currently the best broker that allows access to U.S. ETFs. And U.S. ETFs are the most efficient ETFs for Swiss investors.

In this guide, I review how to open an Interactive Brokers account. It is not very difficult, but there are a few things you need to know before you start your application. And I also teach you how to optimize your account to save money!

Interactive Brokers

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

So what is Interactive Brokers (IB)?

IB is a brokerage firm from the United States. It was created in 1978 in New York, more than 40 years ago! IB is the largest brokerage firm in the United States and the leading foreign exchange (forex) broker. Interactive Brokers offers access to many instruments, such as stocks, bonds, options, futures, and more.

Interactive Brokers is a very well-known broker with an excellent reputation. It is known to be cheap compared to its competitors. I have already compared IB and DEGIRO in the past. This comparison showed that it is even less expensive than DEGIRO, the broker I used before.

An essential thing with IB is that, by default, they do not lend your shares to other people, such as DEGIRO does by default. But you have the choice, which is good! Indeed, you also can lend shares, and you will get some of the money from the lending.

If you want more information on IB, read my review of Interactive Brokers.

Why open an IB account?

So, why did I open an IB account? It is currently the best broker available to Swiss investors.

There are many reasons to prefer Interactive Brokers over other brokers.

- IB offers access to U.S. ETFs to Swiss investors, while many brokers are not.

- IB has excellent prices.

- IB offers access to many investing instruments.

- IB offers foreign exchanges at an excellent price.

- IB has an excellent reputation.

- IB has good financial strength.

So, we will see how one can create an account on IB.

Create an Interactive Brokers account

First, prepare some time in front of you. The account creation process on Interactive Brokers is not difficult, but it will take some time. You will need to answer a few questions, and you will need to wait a day for your account to be funded.

Interactive Brokers has several entities in Europe. The primary entity is IB UK, but one is in Luxembourg, and one is in Ireland, for instance. For Swiss investors, the best entity is IB UK because they offer access to a Swiss IBAN and give you access to US ETFs. For European investors, it does not make much of a difference.

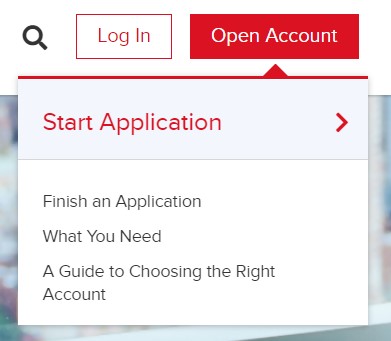

First, go to the account creation page and click “Open account”.

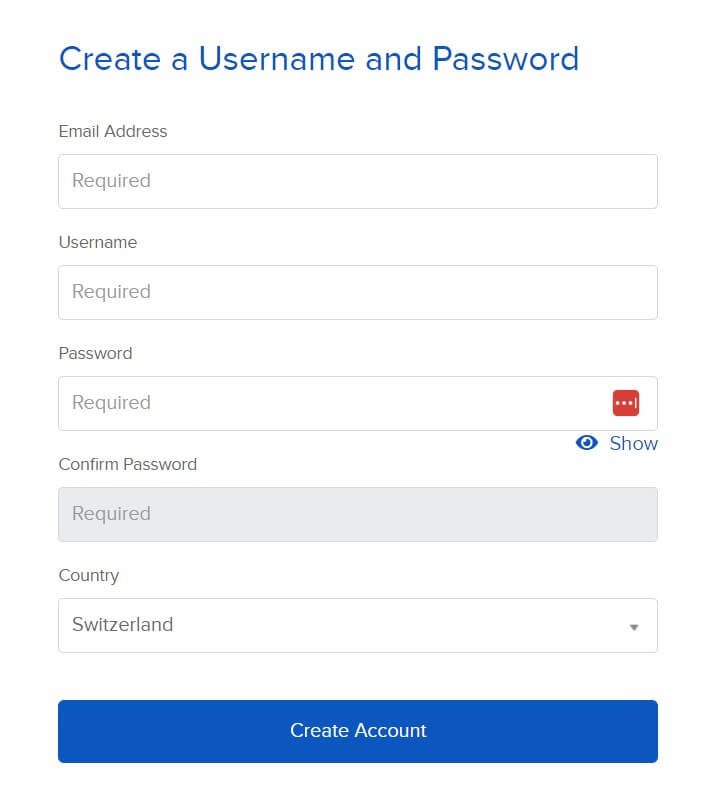

On the first page, you must enter your email, user name, and password for the account. Make sure to choose a good password and user name.

I would recommend making your password at least 20 characters long. A long password is essential to secure your online accounts! Make sure to remember it correctly as well!

You also need to enter your country of residence. If your country of legal residence differs, you must also enter it. You can then confirm the first page.

At this point, they will email you to confirm your email address. Just check your mail and choose to continue the application.

Personal information

On the second page, you will have to set your account type. I put it to Individual for this example. You can check the kinds of accounts to ensure you choose the one according to your needs. But most people will want either an Individual or a Joint account.

Then, you will have to enter the general kind of personal information. Nothing is special here, only what you are used to entering on each website. You will have to set your addresses as well.

Since this will be related to your taxes, it is essential to enter them correctly. You will also need to enter a valid phone number. IB will use this phone number authentication, so once again, enter it correctly.

IB has several types of accounts. You will need to select the type you want. The primary type of account is a Cash account, which is the type you probably need. A cash account means you need to have the money before each trade.

There are also Margin accounts (IB has some good information about margin accounts). Margin means you can use leverage for investing with money you do not have. Unless you know what you are doing, I recommend a Cash account.

Another thing you need to configure when you create an IB account is the base currency. Since I make most of my payments in Swiss Francs (CHF) and live in Switzerland, I chose CHF as my base currency.

You can always convert money from your base currency to any other currency. The base currency only matters for the interface’s display. If you choose CHF, you can still transfer USD and buy shares in EUR, for instance.

Currently, the CHF balance has a positive interest rate. If it becomes negative again, you will see a warning about the negative interest rate on CHF balances. You can get the current negative interest rate and limit here.

Now, you will also have to set up three security questions. You will need these questions if you ever need to recover your account. Make sure you choose questions from which the answer is not ambiguous (but not easy to find)! This procedure is, once again, a standard procedure.

Investment Questions

After this, you need to answer questions about your finances.

You need to tell how much your net worth is and how much income you have. You also need to say what your objectives are for your investments. For instance, you may want to invest for capital appreciation or fixed income.

All this information is here for regulatory reasons. I would advise you to answer them with honesty.

You also need to set which instruments you need to invest in. For instance, if you want to invest in stocks and bonds, you must select these options. I only chose stocks.

Stocks, bonds, options, and futures are among many other choices. You must also select which country (stock market exchange) you want to invest in.

You also need to confirm your phone number with a code.

Confirmations

At this point, you must agree to all the rules IB has for trading. Ideally, you may want to read them. But you probably will not!

If you want, you can also join the Stock Yield Enhancement Program. This program will allow IB to lend your shares to other people. With that, you will receive half of the profits.

Of course, there is a slight risk to that, and you may also be unable to sell your shares when you want or need to. I am not using that feature now. But I have tested this feature recently, and it works well.

At this point, Interactive Brokers will want proof of your identification. For this, you can upload a driving license, an ID card, a passport, or an alien ID card for IB to confirm your identity. You will also have to enter information about your tax status on the same page.

You will also have to fill in information about your employer and job. Usually, you also need to submit something as proof of address.

Fund your IBKR account

IB will fully activate your account once they receive funding.

You need to deposit the first amount for IB to validate your account. First, you need to declare how much money you will deposit. Then, IB will give you all the information necessary for the payment.

Make sure you correctly copy the IBAN. With banking transactions, you should always double-check all banking information before transferring. The transfer will be free since they have a bank account in Switzerland!

And do not forget to include the “Further Benefit to XXX” line! Otherwise, the money will not go directly to your account, and you must contact them to fix the issue. You must do that for all future deposits to your Interactive Brokers account.

Finalize your account

After you have funded your account, you can still do a few more things.

First of all, you can configure the market data. You should set your market data status to non-professional. And you should check that you are not buying any market data. Unless you plan to day trade, you do not need this data. You do not want to pay for it.

One great thing is that you have to use two-factor authentication (2FA). You have no choice. You must configure your mobile phone to use it as 2FA.

2FA is an essential part of online security. First, you need to install IBRK Mobile on your phone. This application is available for Android and iOS.

Once you have installed the application, you can register it as a two-factor authentication for your account. You will have to log in with your username and password, and you need to enter the code you received by SMS.

Finally, you can then choose a PIN for your future two-factor authentication. Remember that PIN since you must use it for each connection to Interactive Brokers.

If you do not know about 2FA and why it is necessary, read my article about online personal finance and security.

Wait for your account

At this point, you only need to wait for IB to create and fund your account.

It should not take too long. It only took one day for my account to be created and funded. It is pretty fast. The next day, I could directly make my first trade.

Optimize your IBKR account

Now that you have access to your account, there are two more things to finalize in your account.

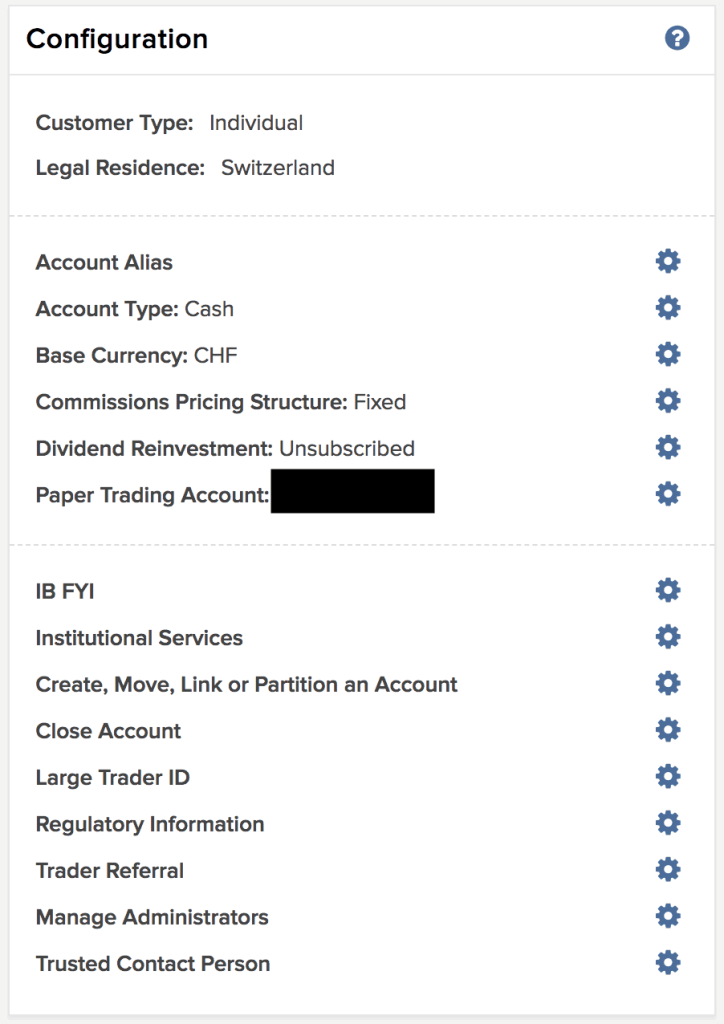

The first thing remaining at this point is configuring the Pricing System. I recommend you use the Tiered Pricing system. IB is cheaper than DEGIRO when you use the Tiered Pricing system.

You can make the change in your Account Settings. If you prefer the more predictable Fixed Pricing, you can also opt for it. There are some cases where fixed pricing is cheaper than tiered pricing.

Here are my settings just before I made the change to Tiered pricing:

The second thing applies if you are a Swiss investor and will invest in U.S. ETFs. In that case, you need to fill out the W-8BEN form. That is pretty simple. You can go into your Account Settings. Then, you must click the (i) blue button next to your name below Profiles. Then, you can click on “Update Tax Forms”.

They will then take you through the process, and you can fill out the W-8BEN tax form. This form will halve the dividend withholding from your American stocks and ETFs. This step is essential if you want to profit from the great tax efficiency of U.S. ETFs.

Some people have told me that it sometimes takes about one day for the account currency to be changed on the interface. You have to wait one day, and the issue should disappear. In the meantime, you may see some numbers in other currencies (likely GBP).

Another thing you can choose to do is to allow IB to lend your shares. By doing so, you will get 50% of the profits. This feature is called the Stock Yield Enhancement Program. However, there are some risks. I have tried it on and off over the last few years, but whether you think it is worth it is up to you.

Conclusion

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

The procedure is now complete! If you followed this guide, you now have an Interactive Brokers account.

With this great broker, we have access to U.S. Exchange Traded Funds such as VT, which makes the most significant part of my portfolio.

I have now been using IB for more than two years. And I am delighted with IB. Interactive Brokers is the best broker available to Swiss investors.

The next step is now to buy an ETF from Interactive Brokers. It is also relatively simple and only takes a little time.

What do you think about Interactive Brokers? Do you already have an account? If not, which broker are you using?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Hey Mr Poor Swiss,

thank you for super useful article, I just opened an account with IB and the deposit went rather smoothly too. For some reason, it’s telling me I don’t have permission to trade ETFs, though I tried only with a few basic Vanguard ones. Do you know what could be the reason?

The other thing I found a bit surprising is the access to relatively low number of Asian stock exchanges. Have you maybe heard about the online broker Monex in Australia, if they are any good? I see they advertise themselves as low cost and they offer access to quite a few ones.

Thank you for your feedback!

Hi Robert,

What ETFs are you trying to buy? If you are from the European Union (not Swiss, like me), you won’t be able to buy U.S. ETF like VOO/VT, you will have to buy European UCITS ETF.

Or, it could be that you did not select the proper stock exchanges when prompted for what you wanted to invest in when you created your account.

About the Asian stock exchanges, I do not know. I have never tried Monex. I have not invested in any Asian Stock Exchange directly.

Thanks for stopping by!

hey, thanks a lot for your quick reply. I’m a resident of Switzerland but a citizen of the EU, could that be the issue?

Regarding the European UCITS ETFs you mentioned, are there any among them that focus on the US stock exchange? Do you know maybe where I can find a list and description about them?

Thank you!

Hi Robert,

Yes, that could be the issue indeed.

Yes, there are plenty of European ETFs, you will find some of each of your needs. They are slightly more expensive and less tax-efficient, but it’s not the end of the world.

I am using justetf to find them. The ETF Screener is more than enough to find all the ETFs you need :)

Thanks for stopping by!

OK, thanks a lot for your reply!

Hi Mr Poor!

really nice Bloog!!

it is not so clear to me, if you are an EU person but with C permit you cannot buy US ETF or US stocks?

Hi Vic,

Honestly, I do not know. I would think that citizenship matters more than residency, but I am not sure.

You can try creating an Interactive Brokers account and see for yourself. You do not have to pay custody fees the first three months.

Thanks for stopping by!

Hi Mr. The Poor Swiss and all others,

Did you find out if the issue was related to citizenship or residency?

Did any of you create an account and try?

I’m quite interested in the answer since I’m also a EU citizen with a C-permit in CH…

Thank you!

BR,

Marco

Hi,

No, I am still not sure. I still think it’s about residency.

It would be interesting to know from someone that tried.

Thanks for stopping by!

Thank you for a great article! And do you know maybe how to transfer a degiro portfolio to IB? I don’t want to sell my PF and pay capital gain taxes in Germany. I would like to open a swiss IB account with my wife and transfer my degiro portfolio from germany.

Many thanks! :)

Hi Sasha,

There are several techniques for transferring a portfolio. IB supports many of them. It will mostly depend on which broker you are using right now.

IB has some information on the subject: https://www1.interactivebrokers.com/en/index.php?f=1544&p=transfer

But I have never done such a thing. You will have to contact both IB and your German Broker for this to work.

Thanks for stopping by!

Dear Mr The Poor Swiss,

Thank you for writing your blog, I really like it :)

So you have convinced me to open an IB account, however, I have a doubt. I am a Swiss resident with a B permit, so I do not fill a tax return, I am taxed at source. So, will I have any problem using IB? Will I have to declare anything regarding taxes to the authorities?

In addition, I think I will not be able to fill that form for getting the witholding taxes from U.S. ETFs back, since I do not fill a tax return… is that correct?

I also assume that any dividends I receive will be taxed at 35%.

Thank you for your time,

C.

Hi C.

I am glad you like it!

It should not be an issue, no. You are allowed to have shares when you are taxed at the source.

That’s not entirely correct.

* I believe (not entirely sure because of Permit B), that you can still fill the W8-BEN form that will lower your dividends withholding from 30% to 15% for U.S. shares and ETFs

* Unless you fill a tax declaration, you will not be able to reclaim the 15% withheld by the U.S. government

* 35% is for Swiss shares, 30% is for U.S. shares.

I hope this makes sense :)

Hello Mr. Poor Swiss,

Is IB a good option if you want to start low? I mean, investing a relatively low amount (2000-10000) mostly for learning purpose?

I am new to investing but interested in the learning-by-doing kind of approach. I know I may lose some cash early on due to the 10$ fee, but that would help me building some confidence before injecting more money.

Does that make sense or would you suggest another broker for that particular use case?

Kind regards

Hi Stéphane,

If you are going lower than 2000 CHF, I would not recommend it. But if you are just starting with more than 2000 CHF and trying to build some confidence, I completely recommend IB over all other options. You will pay very low fees (except for the custody fee) and you will have access to U.S. ETFs which are the best.

So in your case, yes, I would go with IB :)

Thanks for stopping by!

Thanks Mr. Poor Swiss for the great article.

Can you please advice if for starting to invest on IB it is better to use the free TradeStation Global?

Hi Enrique,

Looking at the fees, the only advantage of TradeStation Global is the absence of inactivity fees. And some of these fees are actually higher than IB Tiered model.

If you are serious about investing in the long-term, IB is probably better. But for smaller investing, TradeStation Global could be better.

Keep in mind that I never used TradeStation Global and did very little research, so these are just my two cents.

Thanks for stopping by!

I’ve been with IB for a few years and am a fan. For reasons that aren’t quite clear to me, my account ended up with IB UK. Did you weigh up the advantages of IB LLC vs. IB Luxembourg, IB UK, etc?

I need to find out whether accounts can be transferred between IB regional entities.

Hi Roving,

IB UK is the one for Swiss investors I believe. IB LLC is for U.S. investors.

I have no idea whether you can change.

Why do you want to change?

Thanks for stopping by!

FYI, I created an account and now they immediatly suggest the swiss IBAN CH2089095000010569674

Hi ILS,

Yes, now, they are finally showing the correct CH IBAN since the beginning.

Thanks for sharing!

Hello dear Mr. Poor Swiss

Could you please help me to find information on your blog about IB documentation needed for tax declaration in CH. I am currently using Swissquote, they provide a tax statement for 100 chf.

Many thanks

OW

Hi OW,

They do not have a tax statement. But they have an annual report that you can generate from the web interface. This is what I used for my tax declaration and there was no issue. The report is free with IB.

Thanks for stopping by!

Hi poorswiss,

I don’t understand what it means if an online broker is “lending your shares”. IB offers you additional profit when you agree to this. What’s the catch? What are the risks or the disadvantages? And what is actually happening if they lend your shares? I read rick’s comment above but I’m still not sure what it all means exactly.

Also, did I understand the difference between IB and Degiro correctly (regarding share-lending):

You can opt-in when using IB, without a penalty for not doing so, and you have to opt-out when using Degiro, with a penalty (higher fees) for doing so, correct?

Thanks for your blog and being active in the comment section answering questions, it’s really helpful :)

Hi EarnestPear,

You understand very well the difference between IB and DEGIRO.

Securities lending means that the broker can lend your shares to another investor. This something they do when investors are short selling. This means that investors are selling shares they do not have. They do this to gamble on shares going down.

The risk is smaller than people think. When the investor borrow share, they provide collateral instead. So, if the investor default while borrowing your shares, you still get the collateral back. The problem is when both the investor and the broker default at the same time. It is a very small risk. But I prefer tha approach of IB where you can opt-in for a bonus instead of opt-out for a fee.

Thanks for stopping by!

Hello Mr Poor

I recently came accross a discussion about Interactive Brokers.UK’s custodian…which apparently is also in US (as the main IB website).

Does this mean that, even if we are buying Irelend domiciled, UCITS ETFs we are still falling under the foreign investor witholding tax on profit, rom US? (this being as high as 30%…if your country doesn’t have a tax treaty)

Does this tax apply to all income: from dividends as well as growth, in case of acc. ETFs? Or when/how it applies?

And in this case, what’s the point of owning iShares Irelend domiciled and EU approved ETFs if I still pay taxex to US through IB?

I hope I missunderstood something because this just got really complicated to me :)

Btw, I am from Romania and Degiro is not an available option.

I plan to passively invest on the long run, by buying accumulating ETFs:

IWDA + EMIM + IUSN + AGGH

Thanks!

Hi IronM,

I am not sure I understand your question.

What matters generally is the domicile of the fund, not of the broker. For instance, if you buy VT (U.S. ETF), you profit from the U.S. CH tax treaty and you save 15% in withholding in the U.S. dividends.

IE ETFs are still efficient, but not as efficient as the U.S. ETF. The reason is that U.S. Dividends will be taxed (in the united states) before they even reach the IE ETFs.

So, if you have access to U.S. ETFs, you should go for it. If you do not have access, you should go with Ireland ETFs, they are the next best thing.

But that’s for Swiss people :) If you are Romanian, it will depend if you have a tax treaty with the U.S. (I have no clue) or not. If you have one, you can invest in U.S. ETFs, for the best tax-efficiency. Otherwise, it does not matter between U.S. ETF and IE ETFs (except that U.S. ETFs are slightly cheaper).

Does that make sense?

It almost makes sense. I mean, when we’ll we be taxed and by whom?

I own all my ETFs from iShares and they are all domiciled in Ireland. And yes, Romania does have a treaty, like Swiss, for 15%.

What you are saying, is that before the profit reaches Ireland (and eventually my account on Interactive Brokers), it will get taxed by US according to their treaty with my country?

And then I will need to declare it again in my country and pay my country’s specific taxes on income/gain?

That just sucks, if you pardon my french :)

Then the only reason I’m buying the more expensive ETF from Ireland is because Europe decided to ban the purchase of the more cheaper ETFs directly from US.

Comming back to my question, I was talking about a different, additional tax (I hope I’m wrong and missuderstood) that I will pay just because all ETFs custodians are in US and not Ireland. I’m just as confused as before :( I need to further research and come back…maybe I’m just mixing some terms here.

Thanks a lot for your time and your nice blog!!!

In Switzerland, you will be taxed only on the dividends and not for the capital gains. In Romania, I have no clue.

For Ireland ETFs that holds U.S. ETF, the U.S. governement will take 30% of the U.S. dividends before it even touches the fund.

For U.S. ETF, they will only take 15% and you can reclaim them later on.

On top of that, you will have to declare dividends as income. But capital gains will not be taxed (in Switzerland at least).

If that’s still not clear, maybe do a little more research indeed.

Cheers

Hi, so am I correct in understanding that for US domiciled ETFs they end up deducting 15% at source on your dividends which you can completely reclaim? (so net zero) but then you still pay your normal Swiss income taxes on the dividend income.

Hi Melissa,

Yes, that’s correct. After you have filled a W8-BEN form with IB, only 15% will be deducted. And then you can count that as already paid taxes in your tax declaration.

And your total dividends will indeed be counted as income.

Thanks for stopping by!