How to file your taxes with Swiss and foreign securities in 2024

| Updated: |(Disclosure: Some of the links below may be affiliate links)

One question I often get is how to file taxes with stocks and dividends. This becomes especially popular when we add foreign stocks and dividends to the mix.

Many people are afraid of investing because they think it will make filing their taxes complicated. But in practice, it is not complicated to file taxes even with a large ETF portfolio.

In this article, we see how to file your taxes with Swiss Stocks and dividends, which is very simple. And with U.S. Stocks and dividends, which is slightly more complicated.

Filing taxes

In Switzerland, taxes are different for each canton. Each canton has its software and forms to complete your tax form. However, most of the forms are very similar and have similar names. So, if you can file your taxes in one canton, you should not have many issues filing them in another.

Since taxes differ in each canton in Switzerland, I need to take an example. So, I will take Fribourg as an example with the Fritax 2020 software. You can use this example to file your taxes for your canton. The concepts should be the same for each canton, but the software to fill them will differ slightly.

Some of the Swiss tax apps are better than others. I have not tested many of them, but from what I have seen, Fritax is probably average. It is not always intuitive, but it is relatively easy to use.

Unfortunately, Fritax is not available in English. So I will use the French version for my screenshots. The forms will be the same in German as well.

If you do not know why I am using U.S. ETFs, you may want to learn about the advantages of U.S. ETFs. They are related to how you will file your taxes with U.S. securities.

Swiss Securities

First, we start to see how to declare Swiss securities. These are the securities that are subject to the Swiss dividend withholding taxes. Indeed, the Swiss tax office will withhold 35% of the dividends. Your broker will do this directly.

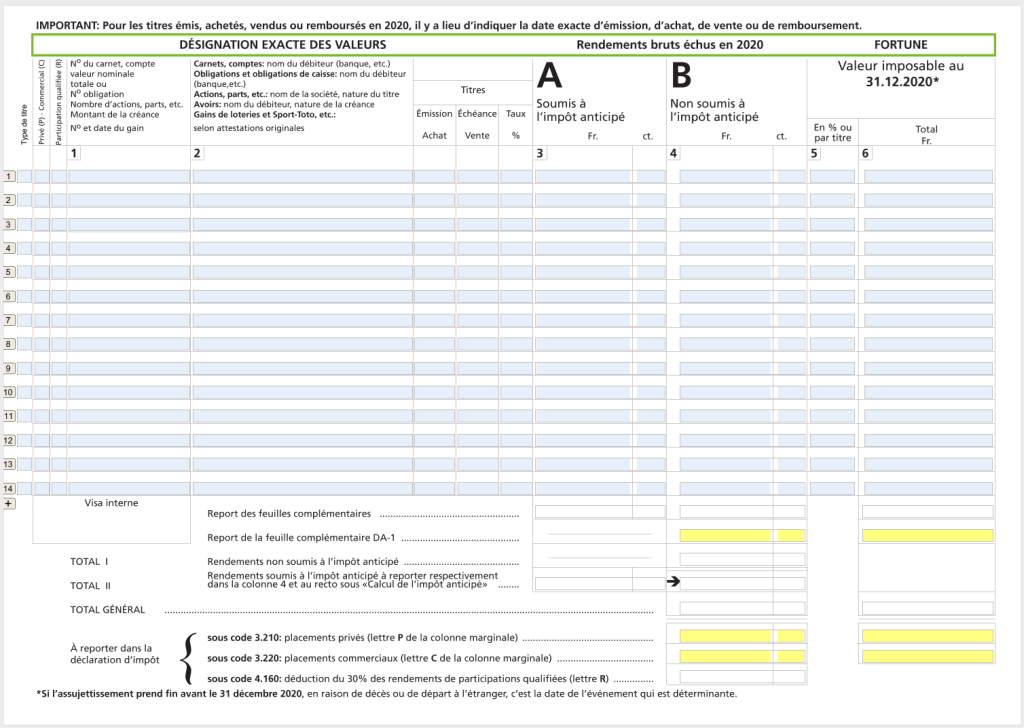

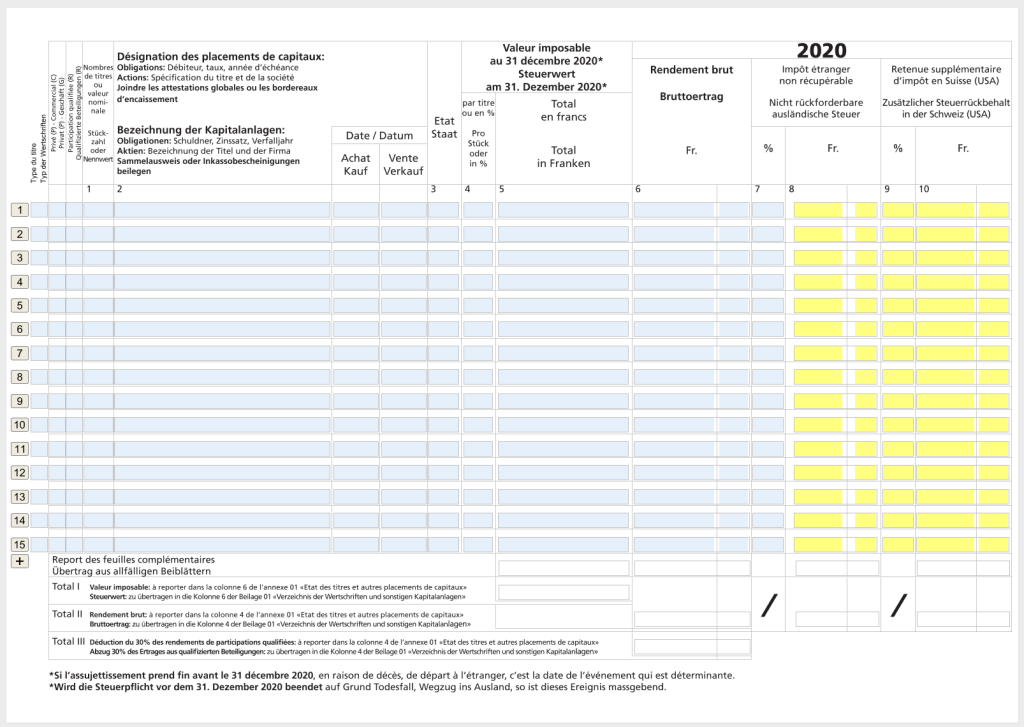

In your tax declaration, you will have a form to enter all your assets (bank accounts, bonds, stocks, and lottery gains). In my French software, this is called “Etat des titres”, which translates to “Status of the securities”.

Here is the form before filling it:

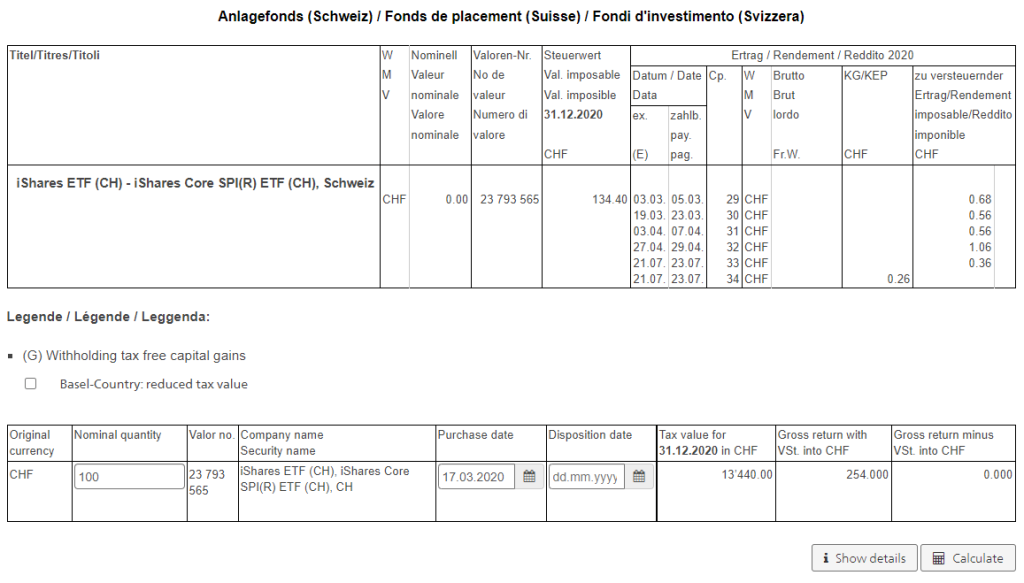

In this form, you must list all of your Swiss securities, whether stocks or ETFs. Since I am recommending investments in ETFs, I will take an ETF as an example. But you would do exactly the same with a stock. For example, I will use CHSPI, the Swiss ETF I use in my portfolio.

You must indicate this is a security (choice 3) in the first column on each line. You must then indicate that this is a private asset (choice P) in the second column.

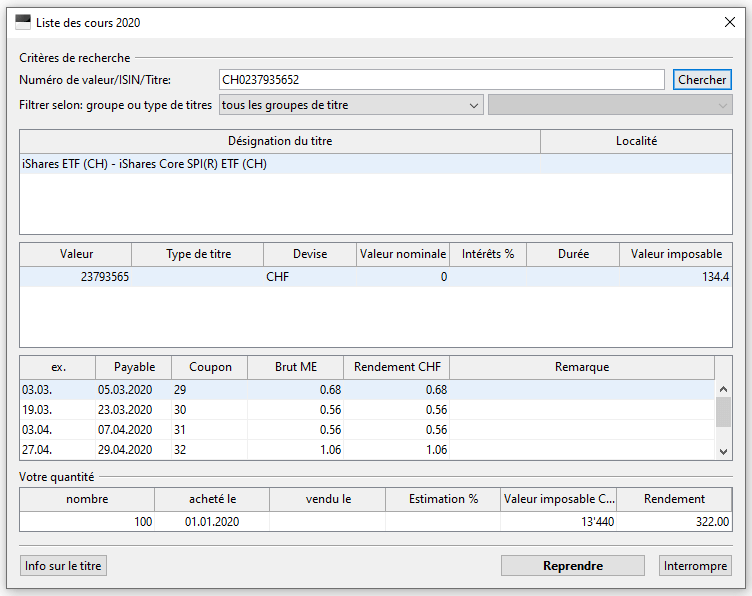

Then, you can press the “Listes des cours” (Lists of prices) to search for the prices of a security. This assistant will help you with your dividends and prices. You can enter the ISIN number of your ETF and press search (Chercher). For instance, the ISIN number of CHSPI is CH0237935652. You can find the ISIN number of each ETF on the website of the fund provider.

Then, you will see all the taxable income for this security. You can enter the number of shares, the buy date, and the taxable value, and the taxable dividend will be calculated for you. For instance:

The date will be considered to compute the dividends for this security. If you enter a date that is after some dividends have been issued, they will not be considered. And they will automatically compute the taxable wealth with the security value at the end of the year.

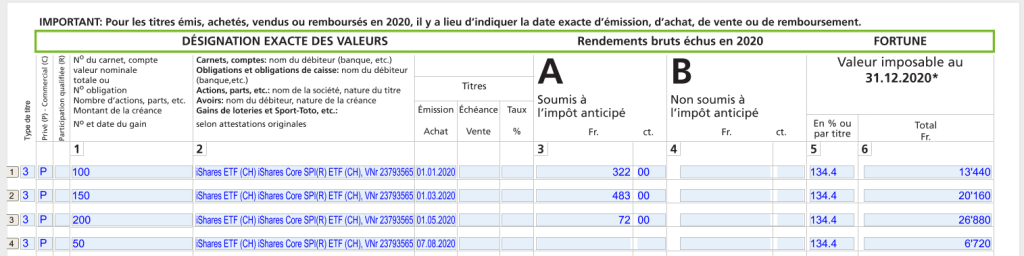

Here is an example of what this could look like.

The totals are automatically done at the end of the form. And these values are propagated into the rest of the forms.

If you already have securities before the beginning of the year, you have two options. If you file your taxes right after the year without losing your tax declaration, you can keep all the buy operations from the previous year. Or you can use the total number of shares at the beginning of the year with a single entry and a date like the last year of the previous year. I have already done that in the past, and I have never had any issues.

If you have sold securities during the year, you must also declare them. You can use a purchase date and sold date to let the software compute how many dividends you received before selling the shares. In that case, the software will automatically set the taxable value to zero.

Using ICTax

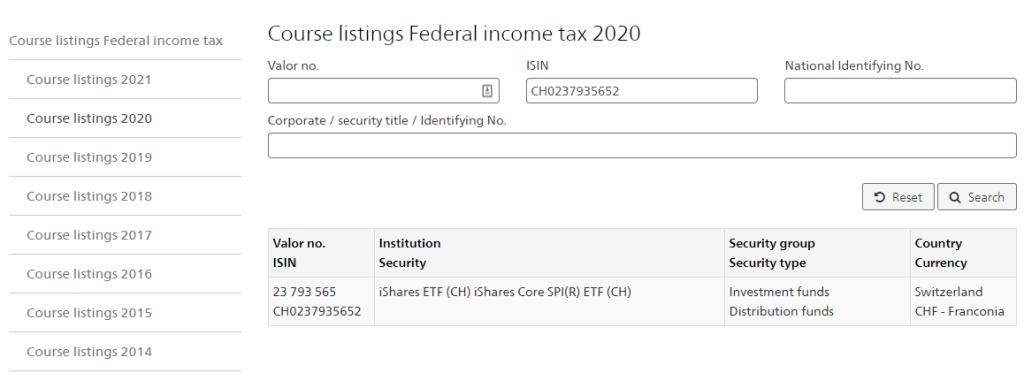

Unfortunately, not every Swiss taxes software allows you to get all these numbers inside the app. So, in this case, you will have to use the ICTax website. This is the reference for all the official end-of-year prices and currency conversions to file your taxes. One good thing is that this website is available in English, contrary to the tax software.

You can go to the website and search for the ISIN again:

And then, you can click on the ETF of your choosing. After that, you must do the same as before with the tax software. You will be able to enter the number of shares and purchase date. The website will automatically compute the tax value and the gross return. You can then copy these values directly into your tax declaration.

It is much less practical to file taxes like this than having the software do it for you. But in any case, it should not take you long to complete your Swiss securities.

It is also a good reason to keep your trading limited to a few ETFs. If you are buying many securities during the entire year, you will have to enter many lines. But it is not as complicated as many people believe.

If your ETF is not on ICTax, you can ask them to add it to the system. But most well-known ETFs should already be there. I have never had an issue so far.

U.S. ETFs / Securities

For U.S. ETFs and securities, it can get a little more complicated because there are a few possible cases.

First, it will depend on which broker you are using. If you are using a Swiss broker, you will pay two deductions:

- 15% withheld by the Swiss broker

- 15% directly withheld at source by the Internal Revenue Service (IRS)

If you are using a broker like Interactive Brokers, you will only see the IRS’s direct deduction. This is a foreign tax.

You need to use the DA-1 form to claim back foreign tax. You need to use the R-US 164 form to claim back Swiss withholding if you use a Swiss broker.

These forms are attachments to the form we covered in the previous section. And they are extremely similar. The difference will be in setting the percentages that you can claim back.

If you use other foreign securities, the idea remains the same, except that the percentages will differ. You will have to find the percentages for both columns for your situation.

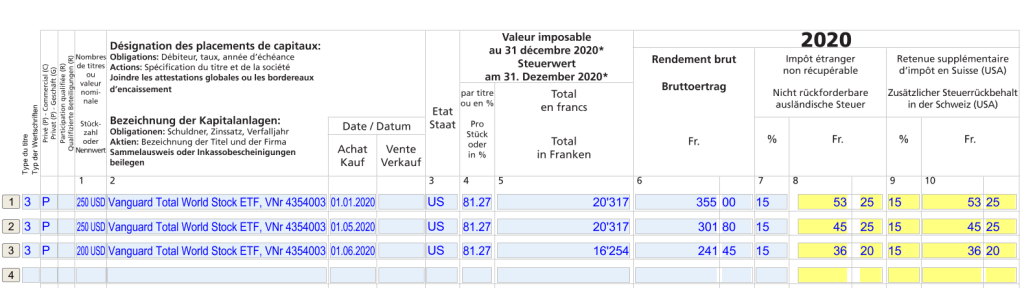

In this case, Fritax did an excellent job since they put DA-1 and R-US 164 together. Therefore, there is only a single form to fill for foreign securities. This is a great idea!

Here is the empty combined DA-1 / R-US 164 form:

As we can see, it is extremely similar to the previous form. And it works exactly the same way. You must still select that this is an action and part of your private net worth. Then, you can use the same assistant to get all the tax information by pressing the “Liste de cours” button on top of the form.

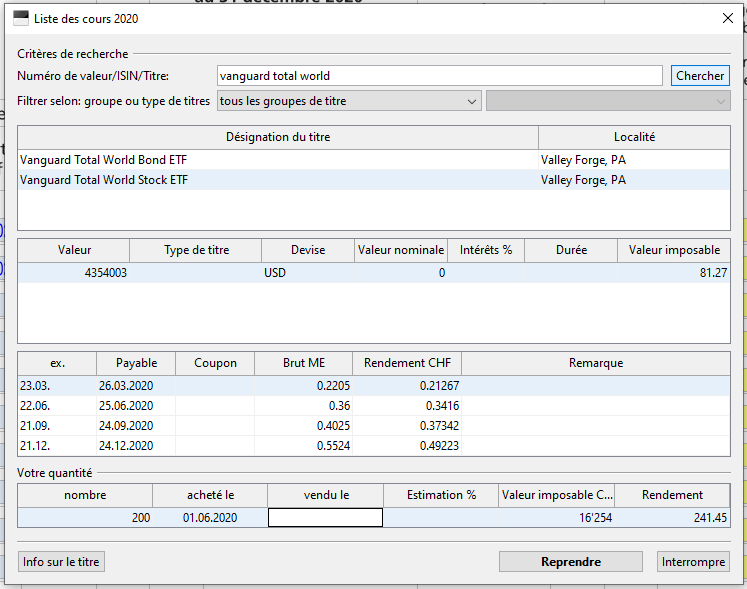

They have all the information, even for U.S. ETFs, such as Vanguard Total World (VT). Here is an example of how to fill it with VT:

Once you have filled a line, you still need to select the country in column 3. This will be the US in our case.

Then, you need to update columns 7 and 9 with the percentages for your case. If you only fill the DA-1 form (with Interactive Brokers), you must set column 7 to the value 15. If you are filling the R-US 164 form (with a Swiss broker, for instance), you must set column 9 to the value 15.

Then, the tool will automatically compute how much taxes were withheld in both cases. And Fritax will automatically fill in the total.

Here is a filled DA-1 form with both sides filled:

If you use Interactive Brokers and only pay 15% of dividends withholding, you can change column 9 to the value 0.

All the other details are the same as for the Swiss securities, so you can look at the previous sections to get all the information. But with the Fritax software, it is not that bad to file your taxes with foreign securities. As you can see, the DA-1 and R-US 164 forms are almost the same as the standard securities form.

It is important to note that the DA-1 deduction is generally only applied if you have more than 100 CHF in foreign withholding. It does not change how you file your taxes, but knowing this may avoid a surprise when receiving your tax decision.

Using ICTax

If your tax software does not support getting the values directly from it, you can use the ICTax website for foreign securities too. It will give you all the dividends in CHF and the tax value of your securities at the end of the fiscal year.

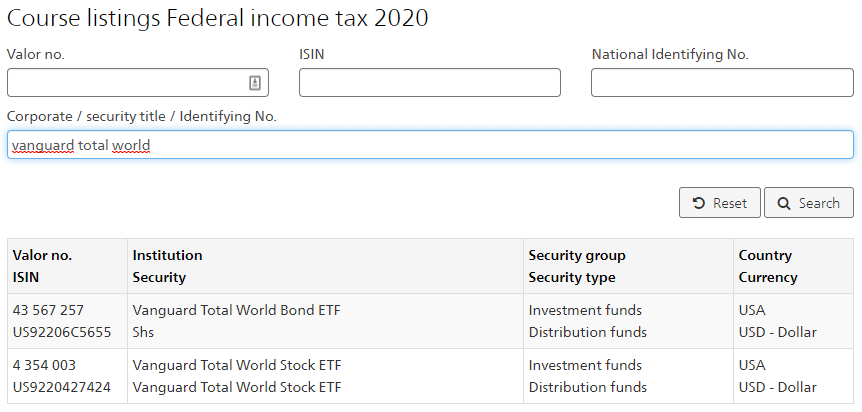

This will be done exactly like we did for Swiss securities. For instance, you can search for Vanguard Total World on the website:

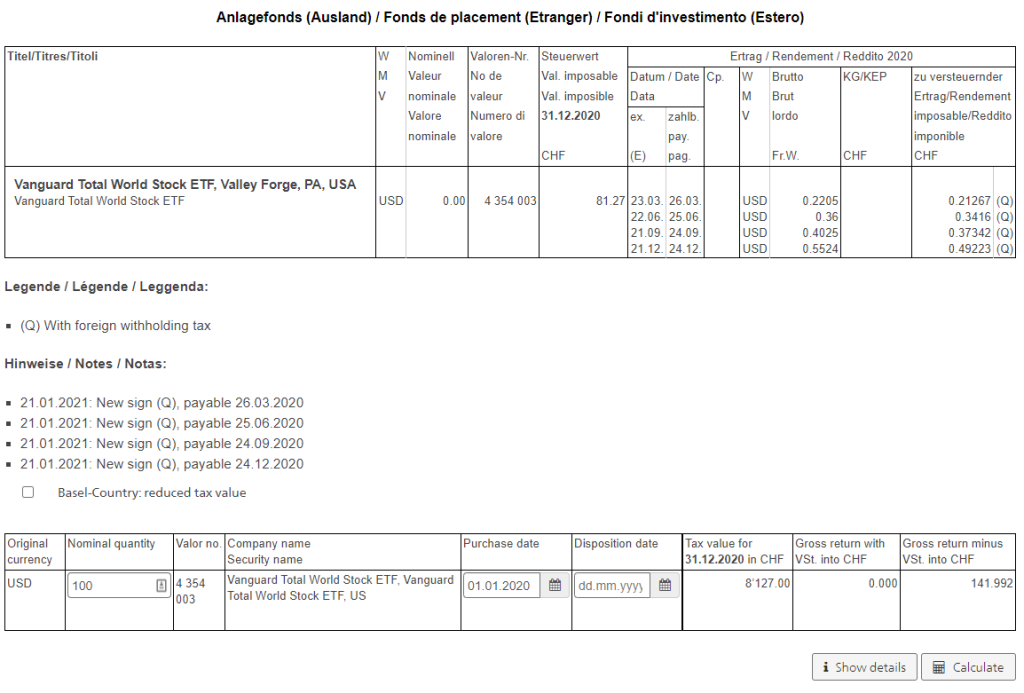

Make sure you choose the Stock version and not the bond version (unless you have both, of course). And then, you can fill it up like before. For instance:

Then, you will only have to copy these values into the DA-1 or R-US 164 form and select the correct withholding percentages. It is not more complicated than for Swiss securities.

Attachments

The tax office will request documents attesting to your dividends, capital gains, and net worth.

Some Swiss brokers will propose some special documents for taxes. And some people believe that only these reports are valid. But that is not correct. Even foreign brokers have documents that Swiss tax offices accept.

For instance, I use an annual activity statement report with Interactive Brokers. This contains all operations, all dividends, and the status of my shares at the end of the year. I have never had any issue with that. You can get this from the Reports tab. In there, you can generate an activity statement for the entire year.

Conclusion

There you have it! Following these simple steps, you can file taxes with Swiss and foreign securities! It is not as complicated as many people believe.

Even for U.S. Securities, it is not complicated. You must fill out an extra form (DA-1) in the best case and two in the worst case (DA-1 and R-US 164), but these forms are almost the same as for Swiss securities. So, I do not think this is a big deal.

If you are wondering why we need to fill all these lines, it is for the system to compute exactly how much you got from dividends. Since dividends are taxed as income, this must be precise. And only by indicating each buy and sell date will you get a precise amount.

Hopefully, this will help you file your taxes with securities.

If you want more tax information, I have an in-depth guide about Swiss taxes.

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Investing Fundamentals

- More articles about Investing

- S&P 500 Index – Invest in 500 Companies At Once!

- How to Choose an ETF or an Index Fund

- How to invest for your children in 2024?

I am using a US Broker (Robinhood, Schwab) so there is no automatic withholding tax. However, I am paying both Swiss and US taxes when I file and report my dividend income. Currently I get about 4000 CHF a year in dividend income, but expect to increase this over the years.

Would you know how to avoid this double tax from both US and Swiss?

Hi Paka

I am not sure I understand. Are you subject to both US and Swiss taxes? I am guessing by being a US citizen. In that case, I don’t really see how to avoid taxes if they are due.

Yes, I pay US tax 15-20% on dividends as per the usual tax rate for US citizens. Additionally I pay Swiss tax on the same dividends when I report them on my Swiss tax return, I believe the tax rate is 35%. So I am paying around 50-55% tax on these dividends.

Thanks for any hints. Appreciate it.

As mentioned by Barbara, you won’t pay 35% taxes on dividends, this is simply withholding tax. Once you fill your tax declaration, you can deduct this from your taxes in Switzerland.

As for the US part, I don’t know what you can do, maybe you reclaim it as well in this case, but I am not expert in US law for US citizens.

No, you don’t pay a fixed 35% on dividends in Swiss tax. In Switzerland dividends count towards your income and your total income is taxed depending on how high ist is. The 35% withholding tax on dividends and interest in Swiss banks is only taken preemptively and is calculated against the total tax owed, therefore would be restored to you, but isn’t applicable to a foreign broker.

Dear Baptiste,

Thanks again for your wonderful blogposts!

I am Swiss resident and no connections to US. I started investing last year from Interactive Brokers and invested about 5K in stocks and ETFs and had some 10k

USD cash in IBKR account by end of last year.

My issue is I invested total of 5K in the form of multiple socks (10+) & ETFs (2) and I bought even same company stocks/ ETF on multiple dates, I wanted to ask:

Do I need to make each line entry for each stock/ETF with dates in the Swiss tax system or rather just make one line entry stating IBKR portfolio which summarises my yearly dividend income and wealth in US stocks at the end of year based upon my IBKR annual statement.

Hi Yash

Yes, normally you should enter each of your stocks even those you have sold. That way, the tax office can see all your dividends and capital gains.

Sometimes, they accept to only enter the stock that you have at the end of the year and stocks that have had dividends. But I am not sure that’s a good guideline in general.

Hello Baptiste,

Thanks a lot for your help. All really helpful here

I have a question regarding dividend declaration?

I own 3 ETFs (1 S&P500, one CORE MSCI EUROPE and one MSCI EM) all domiciliated in Ireland. I’m using Interactive broker and I got their dividend summary and in “Revenue Type” is says “Qualified – Other Exempt From Withholding” and it seems nothing was taken as withholding.

Am I missing something or doing something wrong?

Thanks a lot!!

Hi Andrea

No you are correct for an Irish ETF. The 15% US withholding was done before it reached the fund, so you never have to declare them. And it’s not subject to Swiss withholding either.

What about tax form 1042S? Do you need to file it for US ETFs because of dividents?

Looking at this:

https://www.irs.gov/individuals/international-taxpayers/who-must-file#:~:text=Every%20withholding%20agent%20must%20file,not%20required%20on%20the%20payments

it seems like it needs to be filed.

Hi S,

This form is not necessary to fill if you are a Swiss tax residents. You don’t need to send anything to the IRS.

Hi Baptiste, we’re filing from Zurich. How do you declare the cash portion in the investment account? We just filed as ‘bank account’ last year and attached the IBKR annual report. But I’m sure it was the wrong way to do it. Because I didn’t add Wertschriften separately (we have ZURN, a few US stocks and VT). So confused.

Hi Suri

I declare the cash simply as a bank account like you did. It’s like a foreign bank account.

But any foreign stocks should go to DA-1 while Swiss stocks can go on the same page as the bank accounts.

Any foreign stocks should go on DA-1 form? I thought only US ones or if more than 100 CHF in tax can be claimed back?

I declared my German portfolio (German bank) with mostly IE…. ETFs just normally in the same form where you also list your bank accounts. And for 2021 they accepted it, even though the Number of the ETF should give away that it’s a foreign one? That form also has a column for (without 35% withholding tax”, that wouldn’t apply to any Swiss stocks or securities? Because Swiss banks automatically deduct this?

My understanding is that any foreign securities should go to DA-1 and then we should set the two withholding columns accordingly based on the domicile.

For IE, since you can’t reclaim anything, it probably does not matter too much and it will depend on each tax office.

If you are below a limit, Swiss banks don’t withhold taxes on the interest. This likely explains the column you are mentioning.

I looked it up and the instructions from canton Zurich for the DA-1 form explicitely state that if you don’t have 100 CHF in taxes to claim back, you should not put foreign stocks on that form.

Interesting, I have always filled my US stocks in DA-1 and never got any issue even before reaching the 100 CHF threshold.

Hi Baptiste,

I opened an IB account last year, so your article comes in handy for filling out the 2023 tax declaration!

There are some questions for which I would appreciate your advice:

1) I have some cash in USD and CHF in my IB account. When I generate the IB report I get a total CHF cash amount. Do you know if it is possible to only report the total amount in CHF in my tax declaration?

2) Last year I purchased a very small amount of VOO shares for which the withholding amount is less than 100 CHF. As I can not claim back the withheld taxes, do I still need to fill out the DA-1? Can I declare my VOO shares under “État des titres > Fonds de placement”?

3) In the IB report I also see activity for “Stock Award Grant for Cash Deposit”. Do you know if this needs to be declared, and how can I do it?

Thank you in advance!

Hi Andrea

1) I believe you have to declare of your cash positions, at least that’s what I do.

2) Yes, you need because the dividend itself will need to be taxed as income. And the value will be taxed as wealth.

3) I would not declare it directly, but declare the shares (IB shares I believe for affiliate links) in the DA-1 as well.

Hello,

At what yearly dividends threshold would you say is worth filling out that DA-1 form and claiming the remaining 15% withholding taxes back?

I am a newbie who started 1 year ago with IB and got about $30K last year invested in VOO and VT mainly. The dividends were ≈400 CHF and my accountant, who filled the taxes for me, said it was not worth it and simply took yearly dividends amount and deducted the wit-holding tax (≈50 CHF), claiming that as kind of net income from my investments. He did not submit individually each of the stocks as you suggest in this article.

Hence I was wondering whether that would make sense when you have larger amounts of money/dividends or I am definitely not getting the best accountant :)

many thanks!

Hi bapt

Generally, there is a minimum of 100 CHF under which you cannot get back the amount. So 100/15%=666 CHF.

However, I would always fill out everything properly because the total value is also important and dividend should be taxed as income anyway.

Hi Baptiste,

As always this guide it is extremely helpful… and the blog in general! This has helped my a lot since I moved here. I have a quick question regarding taxes. I have seen on one hand that unless you have +100CHF retention dividends you can not to fill the DA-1 for claiming back the double taxation. And the second one, is that if you have +$60K in invested capital in U.S, for example in stocks and ETFs you need to do a tax declaration there as well in addition to what you report to the SWISS authorities, is this something that you have heard about?

Hi Follower,

Your first point is correct. The minimum for DA-1 claims is 100 CHF per year. There is not much we can do about that.

Your second point is not correct. You don’t need to do a tax declaration in the US. The 60k USD generally refers to the limit of the us estate tax, which only applies at death. However, this limit is different in Switzerland. You can read this article to know more: Should Swiss investors worry about the U.S. Estate Tax in 2024?

Many thanks Baptiste!! This is much appreciated 😊

Hi Baptiste,

This guide is really useful for understanding how taxes for ETFs work for my tax filing!

I have a related question hopefully you might be able to help with. As well as ETFs I also have a cash balance in US Dollars in my IB account. With interest rates rising this means I also earned some interest :) In my tax return software (canton Zurich) there are two options on where to input the amount I earned in interest either “with witholding tax” or “without witholding tax” would you know which one would be correct here?

Also thanks for creating such a useful blog this was what inspired me to start my investing journey!

Hi Dave

I am glad this was useful!

If you are using IB, you don’t pay withholding tax on cash interest, so you need to set it “without withholding tax”.

Hi Baptiste,

This is my first year filing taxes in CH and your articles have been so helpful!

May I ask you, for VWRL (Ireland-domiciled, traded on SIX, dividends paid in USD), am I correct it is still considered a foreign security and needed to be reported via DA-1, even though it’s traded on SIX?

My securities are held with Swissquote, and their documents don’t show the 15% withholding tax. (My guess is it’s because the 15% was held at source.) In this case, do I put 15% or 0% withholding on the DA-1 form?

Thank you in advance!

Hi Claire,

I am glad it was helpful!

Yes, it also have to be on DA-1, regardless of where it’s traded. What matters is where the dividends come from.

You have to put 0% because we are exempt of any tax levied by Ireland, with a tax treaty.

Some of it is taxed at source, for instance 15% for US dividends, before they reach the fund, but you cannot reclaim that.