Category: Retirement

It is never too early to learn about retirement, even if you just started working.

Indeed, it is very important to learn how retirement and early retirement work. We will all retire eventually, so learning about it makes sense.

Trinity Study with world stocks in 2024

Trinity Study simulations are generally done with US stocks, but would they work with international stocks? We will find out!

6 keys to avoid the pitfalls of financial independence

Dror talks about important keys and concepts to avoid the pitfalls of financial independence. We learn from his experience with early retirement.

Early retirement and social security

How can we factor social security into early retirement scenarios? Social security may be interesting, but it needs to be well planned.

Save taxes with staggered withdrawals in 2024

Because of the tax system for retirement withdrawals, staggering the withdrawals over multiple years can save taxes. How does it work exactly?

Frankly Vested Benefits Review 2024: Pros & Cons

Frankly Vested Benefits is a new vested benefits account, by Frankly. We review its advantages and disadvantages in depth.

Can you retire early with Swiss Stocks and Bonds?

Can we retire early with only Swiss stocks and bonds? We find out with Trinity Study simulations with historical Swiss stocks and bonds data.

Yuh 3a Review 2024 – Pros & Cons

Yuh 3a is a new third pillar from Yuh. I examine their pros and cons in details to see whether we should use Yuh 3a!

The truth about 3b pillar accounts

3b products have nothing in common with the 3a and are terrible products most of the time! Here is why you should not use a 3b!

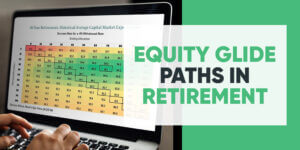

Equity Glidepaths in Retirement

Changing the stock allocation over time may be interesting in retirement. Do equity glidepaths improve your retirement success?

Happily Back to work after 1 year of retirement – Dror’s Story

After one year of retirement, Dror is going back to work and building a coaching business. We catch up and see what happened!

How to sustain your capital in retirement?

Many people want to sustain their capital in retirement. But is that even possible? We can look at historical data to find out!