6 keys to avoid the pitfalls of financial independence

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Today’s article is written by Dror Allouche, talking about some essential concepts to avoid the main pitfalls of Financial Indepedence. Dror has been financially independent in Switzerland for more than one year.

When the Financial Independence bug bites. It can become an obsession.

Some people fall into the trap and sacrifice everything for the big dream…

- Time: The search for financial optimization can take up a lot of time and energy. Sometimes, for very small savings.

- Relationships: “No honey, finish the book alone please. Daddy still has to finalize the house accounts”.

- Happiness postponed: no longer recognizing today’s good fortune for tomorrow’s potential happiness: “When I achieve financial independence, I’ll be…”.

- Health: All I have to do is stop going to the gym. It saves me X and I can work overtime instead.

- Experiences: My daughter is passionate about gymnastics. But frankly, paying so much for a show featuring the world’s best competitors… No way. We’re forgetting an important factor: “Memory dividends”. Experiences create unforgettable memories.

Hunting for the next toy…

It’s been a long time since I’ve done that. Being interested in a new technological toy. I’m lucky enough not to have many needs.

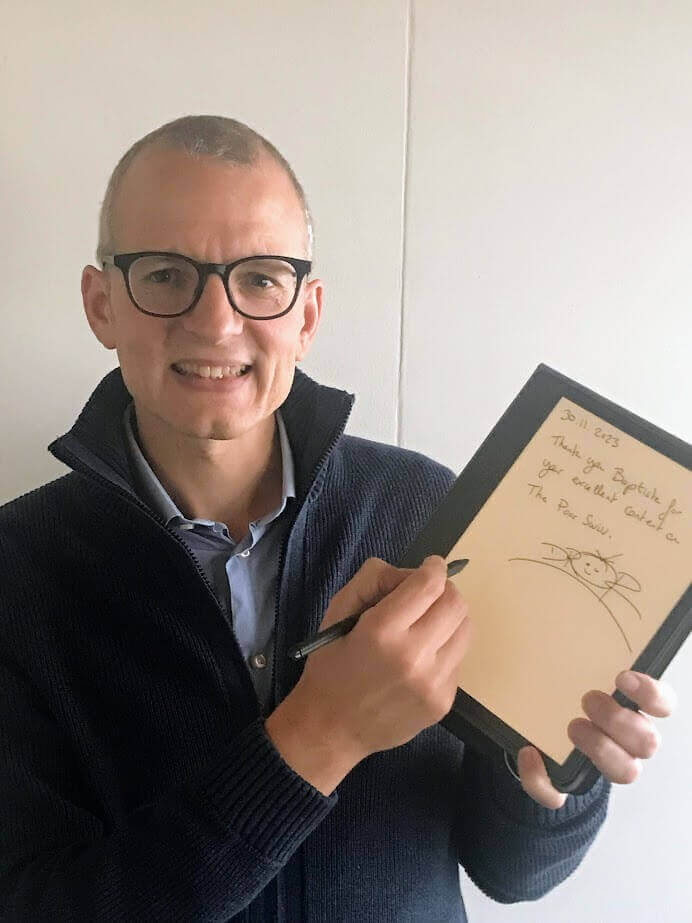

But recently, a subject that has long fascinated me, “writing digitally like on paper”, came up. I saw that Kindle, a tool I use daily (I read 30 to 50 books a year), had launched a “Scribe version” that lets you reproduce the feeling of taking notes on paper.

I was hooked. I started reading the reviews, the advice, the competing products. You might say, I’ve got time, as I’m FI.

Sometimes, I get the impression financial independence is becoming the giant Kindle of a life project. Not to mention those who read, get informed about everything but never take the plunge. The theoretical experts.

Despite everything I’ve written above, I believe that financial independence is an exciting project. It’s much more than a quest for money. It represents a form of freedom. The freedom to do what you want, when you want, and with whom you want.

And if I have to restart from scratch, I’ll do it again with these six principles in mind.

1. Embrace a clear philosophy.

Recently, one of my banks called me.

- “We have a great proposition for you.”

- “I’m a passive investor who only uses ETFs.”

- “That’s right, we have an offer for passive investors too.”

- “What does it offer me that an ETF doesn’t?”

- “It allows you to do better than the market when the market is stagnating or falling.”

- “No thanks.

If you do better than the market, it’s because, at some point, you make decisions to try to beat it. A few years ago, I strategically decided to index the market. Recognizing its superiority. The last thing I want to do is offend him! I’m just trying to replicate it.

This decision has facilitated all my other choices. I’m (no longer) afraid of missing an opportunity. The phone call from my banker, cryptos, a particular stock, a real estate project….

I’m not saying my choice is better than the others. I have people around me who have done very well with other asset classes.

I’m just saying that making my decision makes all the others easier.

2. Accept that you can’t control everything

Make 100% sure your project will work. It’s a noble idea. But it’s denying reality.

Nobody can predict future market returns, inflation rates, or your lifespan. There are at least 3 (major) elements missing from the equation.

I often surprise people who jump at the chance to challenge me.

‘But how can you predict that”

“I can’t predict anything, I accept the risk inherent in the project”

Let’s make peace with uncertainties.

3. Taking pleasure in the moment

There are some interesting things in what we’re doing right now. (Yes, there are, I assure you!) Let’s focus on them too, and learn to enjoy.

I really like the book “The Practising Mind” by Sterner Thomas. He explains how he had his “aha” moment. By focusing on his daily activities, he found happiness and greater productivity.

An interesting paradigm shift might be:

- Before: I try to do things as quickly as possible to live my dream of financial independence.

- After: I take pleasure in what I do. By doing so, I become more productive. This accelerates my financial independence project.

4. The illusion of focus: not everything will be rosy

This psychological concept applies well to the quest for financial independence.

No, not everything will be rosy when you’re financially independent.

- The grown-up’s teenage crisis.

- The stove that breaks down

- Tensions in the relationship

And there are even things that could become more difficult.

I discovered one of them the hard way.

I have a strong ability to manage and accept risk. This has been reflected in my professional career and also in my investments. When the markets were down, I didn’t hesitate to go all in.

But then I discovered that living with market risk without being able to intervene by reinvesting (a form of loss of control) was much harder. When you become financially independent, you (in theory) no longer have the same reserves to reinvest when the markets go down…

5. Test your passions and experience new things

Test your passions

“When I’m financially independent, I will teach yoga to children.”

Don’t wait until you get there to realize you don’t like it.

Set aside some time in your diary to try it out.

I started my blog before I stopped my corporate career under a pseudonym. When I stopped, I had no doubt it would be part of my second life.

Writing brings me joy, satisfaction, and opportunity. This article is one of them!

Live your experiences when you still have the chance…

In the book Die with Zero, Bill Perkins makes an interesting connection between the stages of our lives and what we can do. Even if you have the financial means, you won’t be able to climb Everest by the time you’re 75. So, even if it delays your project a little… Make time for your passions on the road to financial independence.

6. Create several options for yourself

I like the concept of the book “Design Your Life“. It suggests imagining several different lives. It doesn’t matter whether you live them or not. The feeling of having more options gives us confidence.

I once read that the number of deaths suddenly increases in the first few months of retirement. When you pursue financial independence, you tend to identify with the project. Imagine not liking what you’ve planned. That could be a cause for depression.

But not for you anymore…

You have a few alternative options.

Conclusion

If you’ve made it this far, you may be thinking,

“Is it worth living this dream?”

I’ll let you answer.

For me, it’s a big yes.

Pursuing my financial independence project:

- Boosted my first professional career,

- Offered me unique moments of freedom with my family at a time when my children needed it most (not sure they’ll tell you the same)

- Gave me the time and energy to discover and develop my passions.

- These led me to a second professional career (coaching) that I live by choosing my constraints. I’m under no pressure to earn money, and I make a point of working no more than 6 hours a day.

But more than all that, financial independence gives me a feeling of freedom, which brings me great satisfaction.

Every Financial Independence project is different. The journey is as interesting as the arrival. So enjoy the ride.

I wish you all the best.

Dror

Thanks a lot to Dror for sharing his experience with us again! If you are interested in his story, you can read the interview I did with him.

Special offer from Dror

You are looking for financial independence or just achieved it, or living it?

Make the most of each phase with support from Dror, a certified professional coach (having been through all the phases).

Dror is offering the first ten readers a special offer on his coaching. The first ten responses will get a full 90-minute 1:1 coaching session with Dror.

Get a head start on your New Year’s resolution with quality coaching!

Here is how to proceed: Email Dror at dror@optionstogrow.com with the title “I’m interested TPS” and a short presentation of yourself. Dror will send you a link to his calendar for the first 10 readers.

I tested one of his 90-minute coaching sessions. And I already got much more than I thought possible over such a short period. So, I think there is a lot of value in coaching.

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book