Early retirement and social security

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Some people want to retire early, so they rely on a Safe Withdrawal Rate and follow the model from the Trinity Study. But in many cases, people will receive some social security payments.

How do we factor these payments in since they can start after retirement starts? I am exploring a few simulations with social security and historical Trinity Study simulations to answer that question.

Social Security in Switzerland

While the simulations can apply to any social security system, it is a good idea to refresh on social security in Switzerland.

What we call social security in Switzerland is the first pillar. How much you will get from the first pillar is based on multiple factors:

- The number of years you contributed

- The average salary during your working life

- Special contributions for caring for children or relatives

If you have always contributed to the first pillar, you will receive something between 1225 CHF and 2450 CHF monthly. Just keep in mind that there is a penalty for married couples where the maximum will not be 200% of the maximum but only 150%.

So, this is not a negligible amount, and we should account for it in our retirement simulations.

Social Security and standard retirement

Some people still rely on a Safe Withdrawal Rate model to retire at the reference age. In many cases, these people will still receive social security.

In this case, it is easy to factor social security into the model. Indeed, you can simply remove social security from your expenses, just like any other planned income in retirement.

For instance, if you are planning for 120’000 CHF per year expenses in retirement and will receive 20’000 CHF per year from social security, you only need to account for 100’000 CHF in yearly expenses.

This will greatly reduce the amount you need to accumulate to retire. This is why having any income in retirement can help significantly.

Social Security and Early Retirement

For early retirement, the use of social security is a bit more difficult. Indeed, if you retire at 50, you will only receive social security after 15 years.

So, we need to take into account two important factors:

- How long after retirement will social security kick in?

- How much expenses will social security cover?

I will try to run simulations to cover multiple coverage and years to see what this does. By coverage, I mean the percentage of your retirement expenses that your social security payments will cover. For instance, if you spend 5000 CHF per month and receive 1000 CHF per month, you have a coverage of 20%.

Of course, I cannot run every simulation possible because there are infinite combinations, but I will try to cover enough of these to see what happens.

For each simulation, I will use the dataset of US Stocks and Bonds from 1871 to 2013. The portfolios will be rebalanced yearly, and withdrawals will be made monthly. Monthly US inflation is also accounted for.

Also, since I cannot cover each portfolio, I will cover the portfolio with 80% stocks and 20% bonds. This is a very common portfolio.

Social security after 5 years

First, we will examine what happens if social security starts after 5 years. This is where social security should help the most since it will help very early on. Given a retirement age of 65, this means retiring at 60.

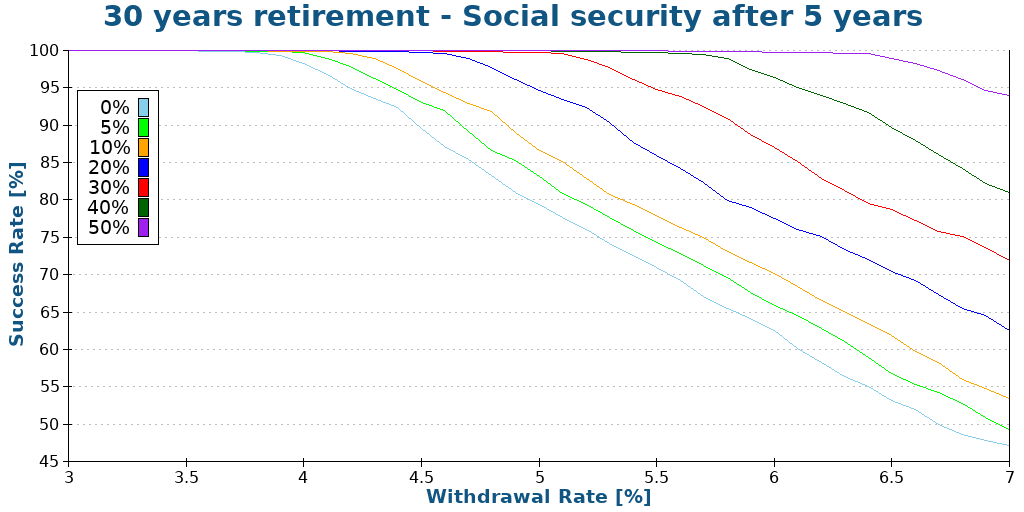

So, here are the results for a retirement of 30 years with social security kicking in after 5 years, different coverages, and different withdrawal rates.

First, it is easy to see that social security can have a significant impact compared to no social security (0% coverage means no social security). Social security would make higher withdrawal rates safer.

For instance, if you aim for a 95% success rate, you could use the following withdrawal rates for each coverage:

- Without social security: 4.20%

- With 5% coverage: 4.40%

- With 10% coverage: 4.60%

- With 20% coverage: 5.00%

- With 30% coverage: 5.50%

- With 40% coverage: 6.20%

- With 50% coverage: 6.80%

If you can increase your withdrawal rate, it means you reduce the amount of money you need to accumulate to live. So, social security will make your early retirement easier.

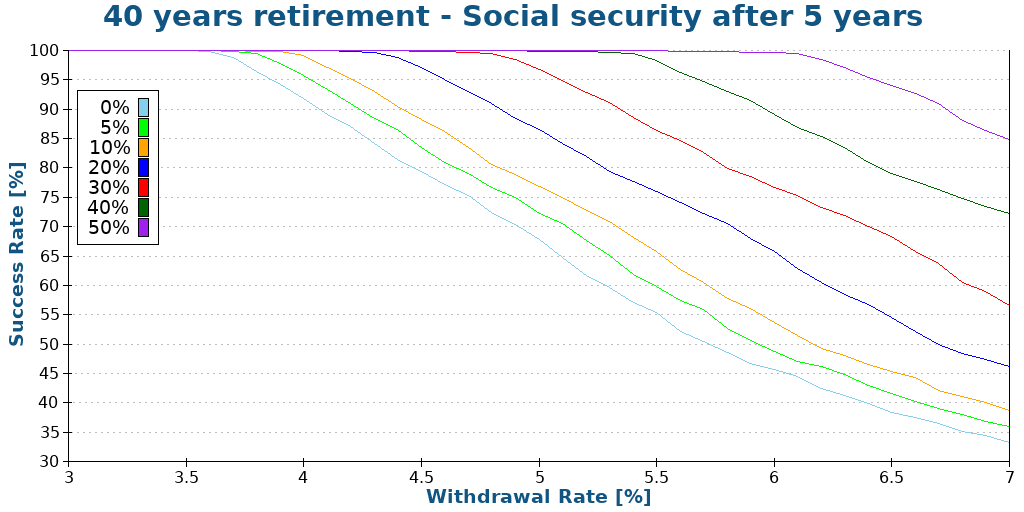

Thirty years is a short retirement period, so we must see what happens with a retirement of 40 years. This would sustain up to 100 years old, so it should be enough for most people.

As expected, over 40 years, all success rates are lower. Indeed, sustaining for a longer period is harder.

But, the impact of social security is still very strong. We still go from a 4% safe withdrawal rate to about a 6.5% withdrawal rate, depending on the coverage. And for people interested in failsafe withdrawal rates, 50% coverage would still not fail at a 5.5% withdrawal rate. A significant improvement. So, social security is a great improvement even at 40 years of retirement.

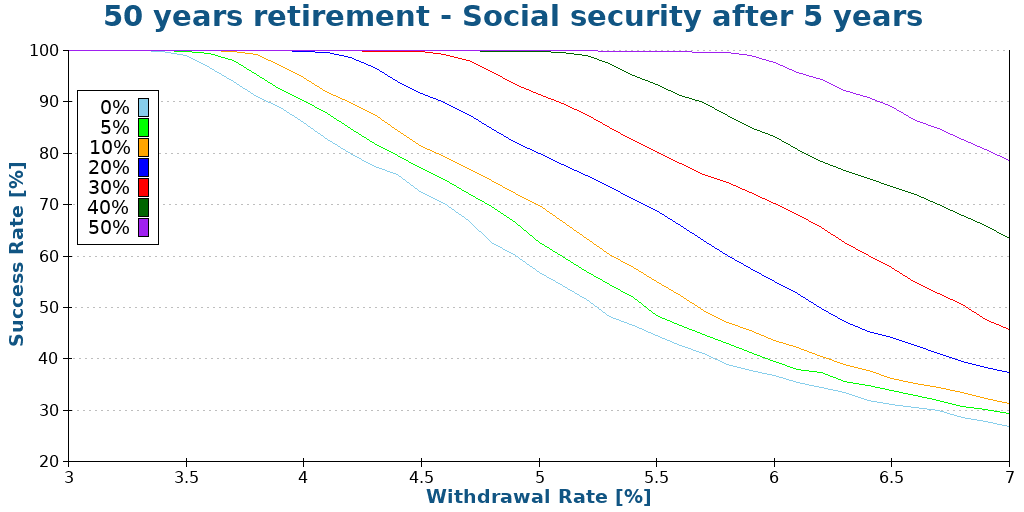

Let’s see what happens for 50 years. Since this would take you all the way to 110 years, it is a very conservative retirement plan.

The results are still very impressive over 50 years. Since most simulations could fail early, having social after only five years definitely improves the results. Covering even 5% or 10% of your expenses with social security is already a great improvement.

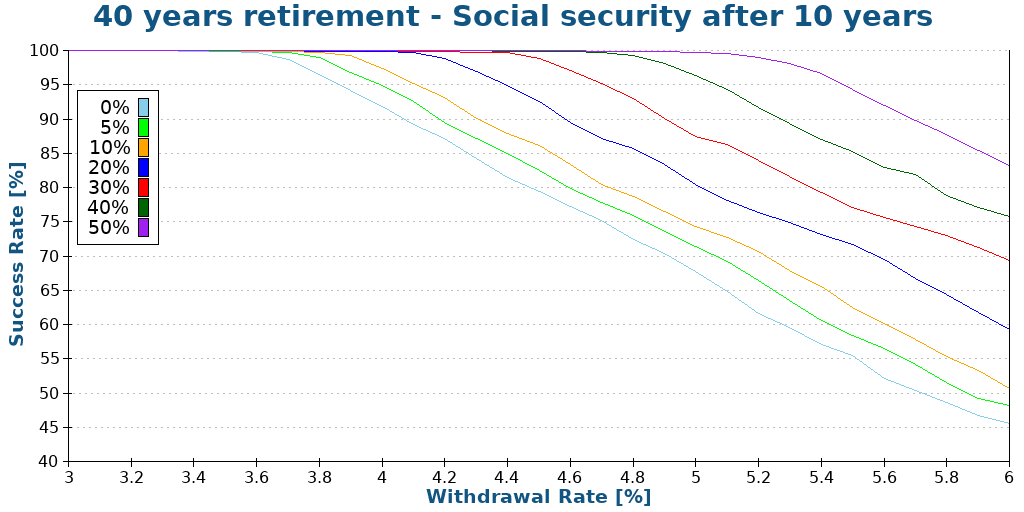

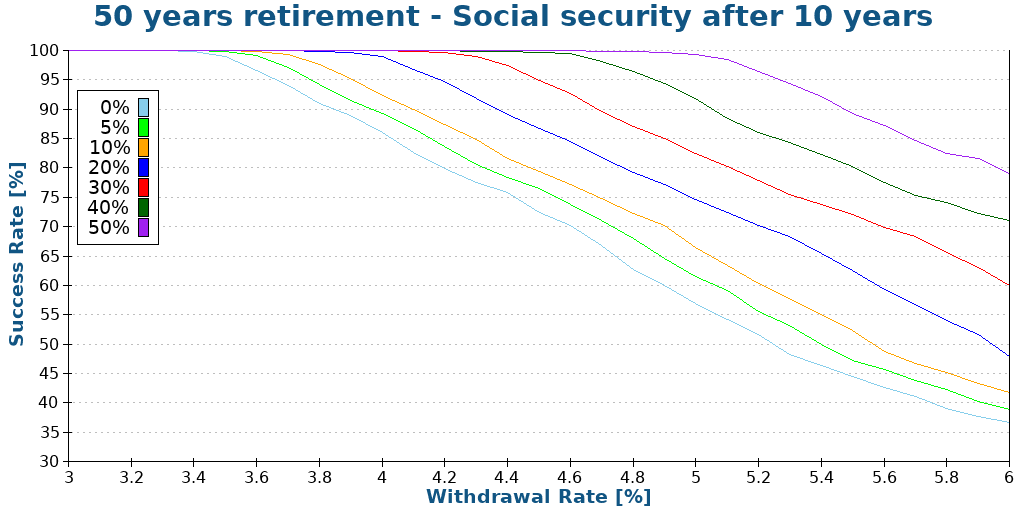

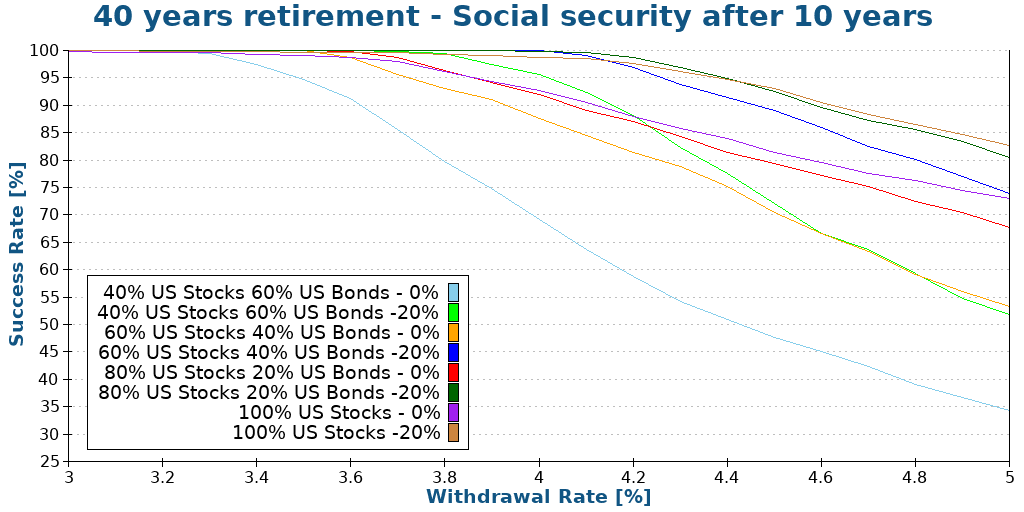

Social security after 10 years

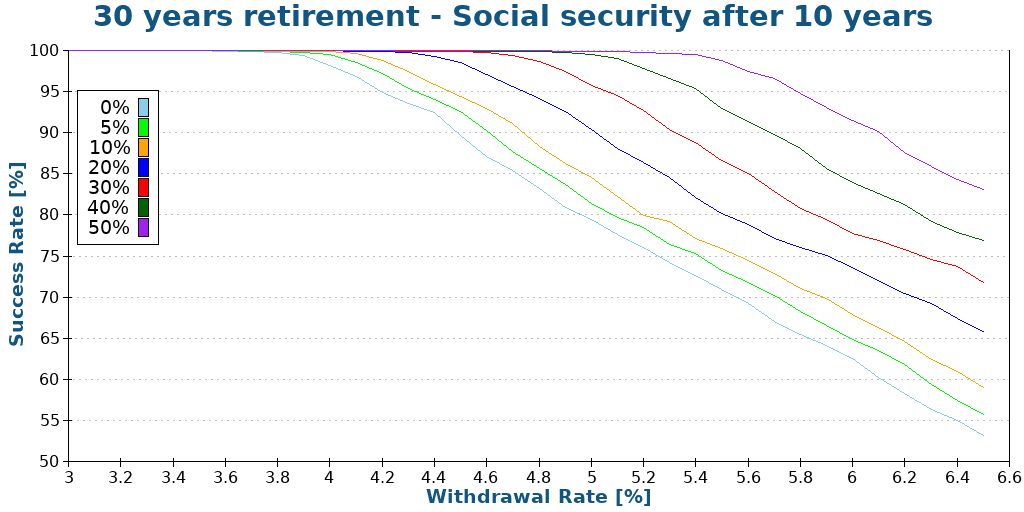

However, getting social security after only 5 years means retirement is not so early. So, we must look at longer periods. Let’s start with social security starting ten years after early retirement.

Again, we start with 30 years of retirement and different parameters.

While not negligible, the effect of social security is significantly reduced compared to the previous examples. Since social security only starts after 10 years, the portfolio has time to be depleted.

Nevertheless, we can still see even a small coverage by social security could help you raise your safe withdrawal rate. It is probably not rare for social security to cover at least 20% of the retirement needs. And such coverage could mean increasing the withdrawal rate from 4.10% to 4.70%.

Let’s see what happens after 40 years:

Not a lot changed in this case. All the success rates are getting lower, but the impact of social is still significant.

Let’s jump over to see what happens for 50 years of retirement.

Once again, everything shifted slightly to the left. However, the impact of social security is still important.

Overall, I am surprised by these results. Even if social security is delayed by ten years, we still get some significant improvement in our success rates.

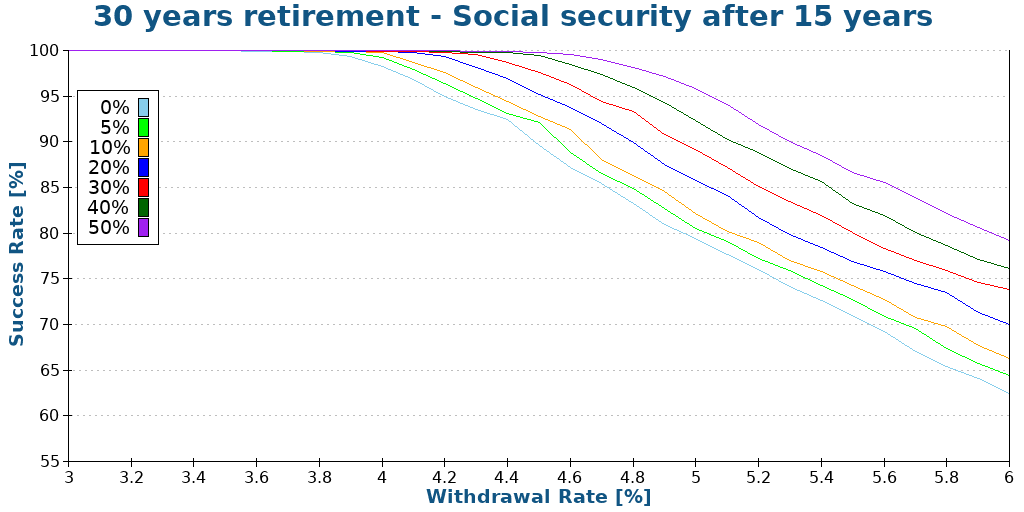

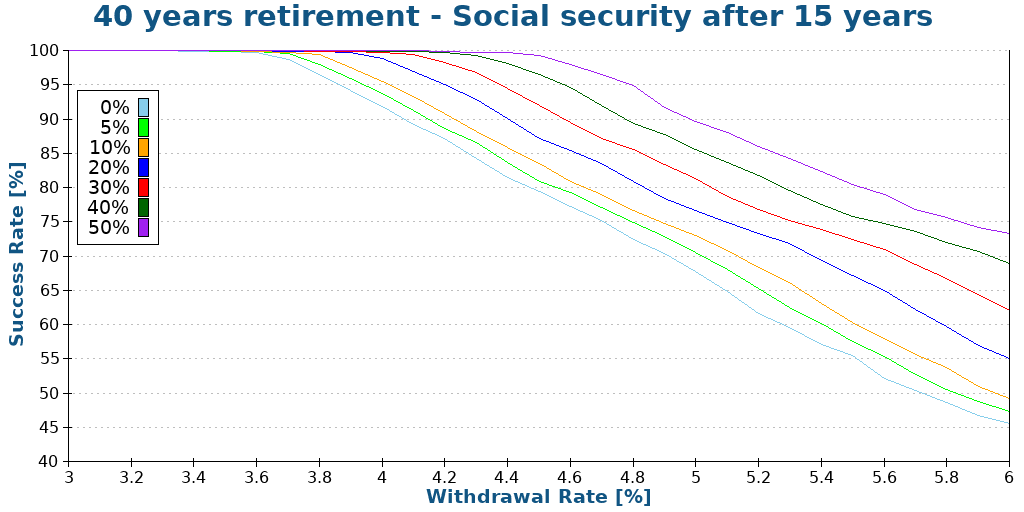

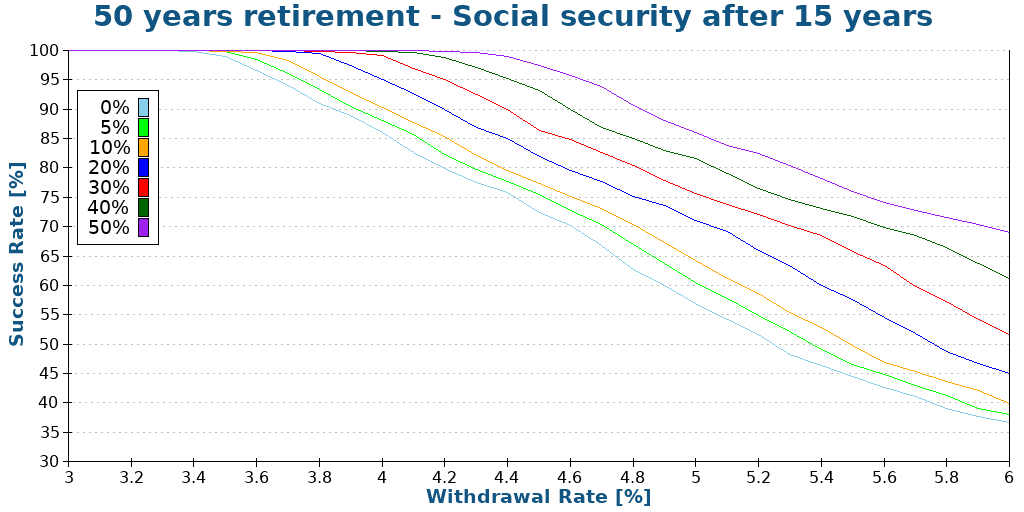

Social security after 15 years

Let’s continue with social security only coming after 15 years.

Now that social security only comes after half the retirement, it has significantly less effect than before. This makes sense because the portfolio now has many years to fail before social security starts to help.

However, the effect is still here. If you can cover a significant portion of your expenses with social security, social security would either increase your chance of success or allow you to use a higher withdrawal rate.

The impact is almost the same in this simulation, but the success rates are all lower. Even in this case, 5% coverage by social security would still help increase your withdrawal rate by about 0.1%, which is not a lot but also not insignificant.

Let’s complete our testing with 50 years of retirement.

We can see that it is getting difficult to sustain good results within 50 years, as was the case in the other scenarios. But even with a coverage of 10%, you would still profit from social security.

Overall, if social security starts only after 15 years, it starts to show its limits. The impact is not as significant as in the other simulations. Nevertheless, the impact is still there. I was not expecting such an impact after 15 years.

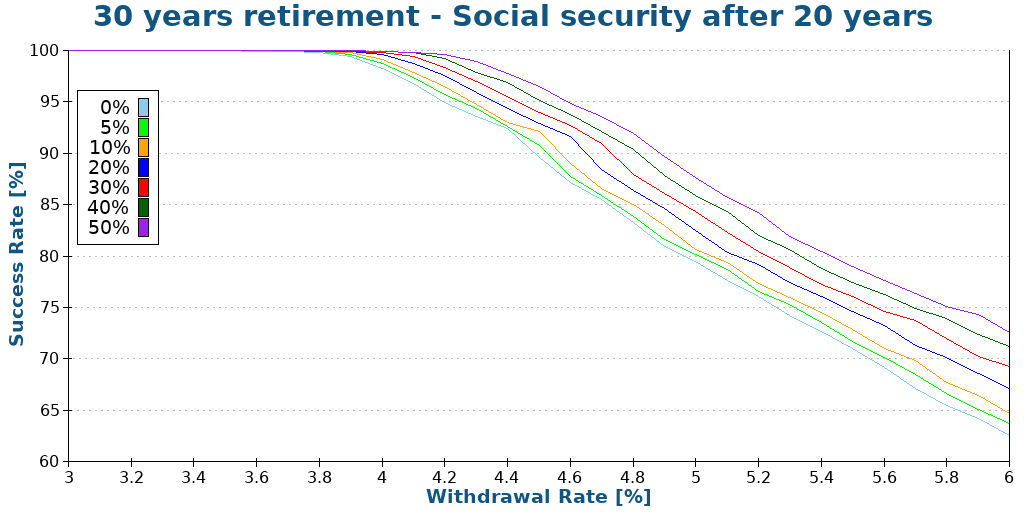

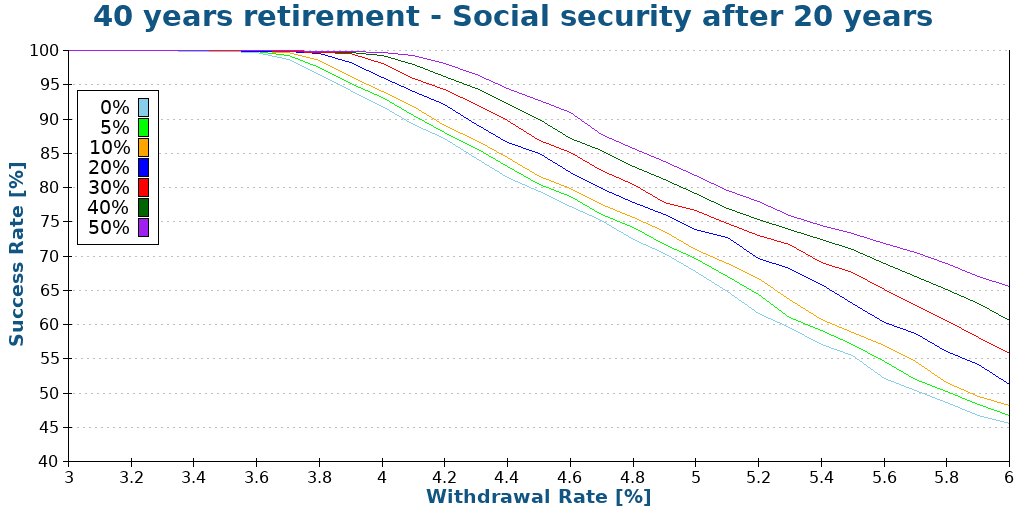

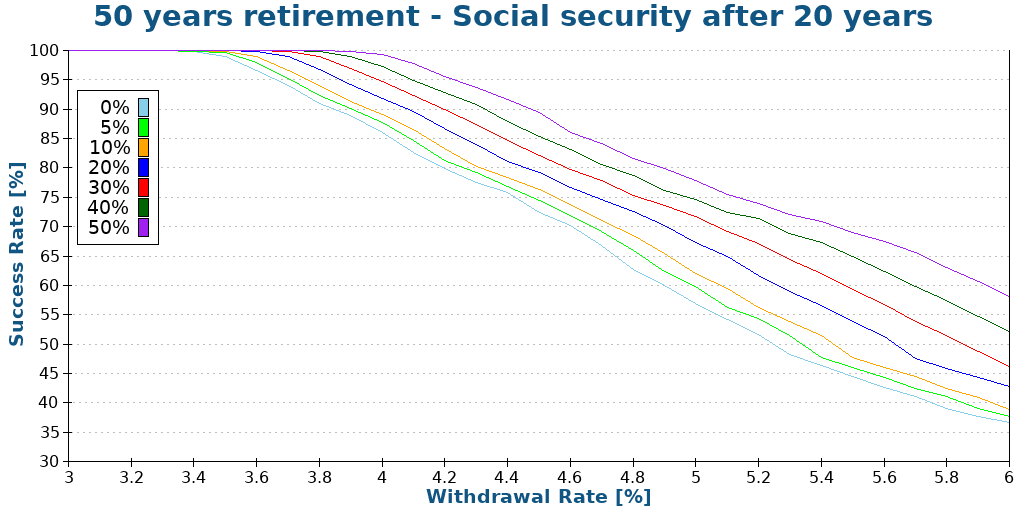

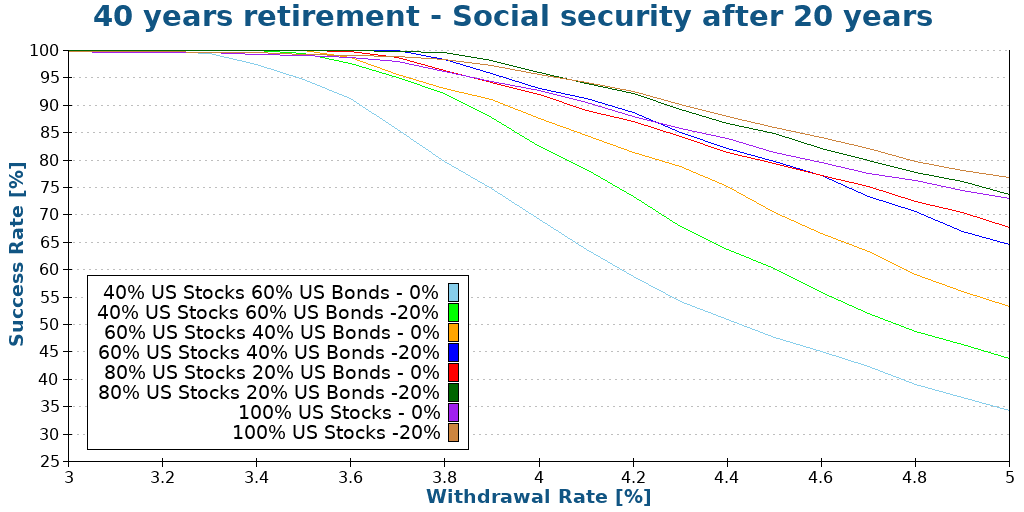

Social security after 20 years

Let’s conclude this with social security after 20 years. For instance, if you were retiring in Switzerland at 45, you would get social security after 20 years.

We now start to see the limits of social security. The portfolio needs to sustain 20 years before any help from social security starts to make a difference.

At 95% success rate, the difference in withdrawal rate is only 0.4% between 0% and 50% coverage. This is not negligible, but this starts to be little to consider. During this time frame, we need to consider uncertainty because it may take longer.

We can see that the impact is more or less the same again. There is still an impact, but you need significant coverage from social security to make a difference.

The impact is slightly more significant in this test. But when planning for 50 years of retirement with your portfolio, you are unlikely to rely on social security. It may help, but it is hard to say how much you should rely on it.

Overall, social security after 20 years still helps your retirement chances of success. So, you could either increase your withdrawal rate or simply be happy that your retirement will be safer if you get social security.

Different portfolios

Finally, let’s see the impact when we change portfolios but keep the same social security coverage.

We will start with 40 years of retirement, social security after 10 years, and 20% coverage.

It is slightly challenging to read, but there are a few interesting things in this graph.

First, the impact is significant for any portfolio. This is good news for a conservative portfolio because the success rates are often lower. So, having an excellent way to increase the success rate is great for conservative portfolios.

Second, the impact is almost the same for each portfolio. This is interesting because I was expecting more variance.

Then, we can also look at 40 years of retirement but with social security after 20 years and with 20% coverage.

The results are slightly different here. In this case, social security has more effect on conservative portfolios. The increase in success rate is more important for portfolios with high allocation of bonds.

Be careful

When accounting for social security, we must be extra careful for several reasons.

The reference retirement age may change while you are in early retirement. If you account for social security after 15 years but only get it after 20 years, this may significantly increase your likelihood of running out of money.

And we should not exclude the fact that in a significant amount of years, the system may entirely fail. Many people are very pessimistic about social security, even in a country like Switzerland. So, it is better to play it safe.

Finally, the coverage by social security may significantly change over time. These days, social security payments do not follow inflation. So, over time, the coverage of your expenses by social security may change significantly.

Conclusion

If you are expecting to retire early, social security may well increase your chances of success. For people retiring early but not extremely early, social security may even play a significant part in their retirement plan.

Indeed, social security starting 5 or 10 years after the start of retirement can make a significant improvement to the success rate of your retirement plan.

Now, we must be careful about the probability of not having social security or social security covering a smaller portion of our expenses than anticipated.

So, it could make total sense to take social security into account. But it would probably be better to account for only half of it.

Currently, I am not planning to account for social security in my plans. But as I grow closer to retirement, I will refine my plan, and I may consider social security.

What about you? Are you relying on security for retirement? Is it part of your plan?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

I am sorry if this is not on the topic, but the point about the mandatory AHV contribution, even if not working, until the retirement age (65) is an important factor (I’d be grateful if you could move it to a separate thread if req’d – I am facing this situation myself). This is can be more than CHF25k a year (max). If you retire with 55 that’s CHF250k over 10 yrs. Add to this your spouse (you want to retire together) and the early retirement turns to be sweet-bitter due to the AHV load (getting ludicrous 2k p.a. back when you’re 65). The 2nd point is the fact that if not working, you cannot have a regular pension scheme (no Pillar 2, Pillar3a, just 3b is open to you but taxed immediately). You just get kicked out of your employer’s pillar 2 pension and have to manage the lump sump yourself. All the ‘active’ pension funds are more than happy to ‘manage’ the money for +0.6% p.a. (regardless its performance :o(). I have just started to look into this scenarios (and more than happy to be wrong), so welcome your ideas/ways to manage your early retirement. But from my current standpoint, CH is not a friendly place for early retirees due to the above, unless you have funds for a private banker to open a foundation for you (and hire you in there), or simply open a GmbH to be employed again just for the AHV sake.

You are entirely correct, it’s entirely important. I am talking about this here as one of the disadvantages of retiring in Switzerland: Early retirement and social security. This is something that must be taken into account, but there is also no way around that.

And you are right that you have to manage your second pillar fund yourself, but I see this as an advantage. There are some great vested benefits offer like Finpension: Finpension Vested Benefits Review 2024 – Pros & Cons

* I would prefer having my money with them than with my current pension fund.

I don’t think this makes Switzerland a bad place to retire early. There are other advantages. But it’s definitely not the easiest place indeed.

Thanks Marius. You‘re exactly outlining the situation/dilemma I find myself in with Social Security and the „Pillars“. Would be helpful if we would have some best practices to reduce/avoid contributions to AHV/AVS (i.e. GmbH, Side Gig etc.).

Yes, this basically becomes a 0.3% tax on your wealth till you are 65.

It would be great indeed to point at some possible workarounds. I see many become “self-employed” and have a small gig that is enough to meet the AHV minimum contribution. Creating a GmbH and to be employed and pay the minimum could be an alternative, but I haven’t found a discussion of these options online.

I think it’s more than just a tax on your wealth. I understand that if you’re lucky enough to have a foreign or private retirement pension before 65 that’s also taxed.

Correct. The AHV contribution is computed on “wealth + 20 * yearly pension income”.

It’s roughly a max 0.3% rate on your wealth and 6% (20*0.3%) on your pension income.

So if you retire on the 2nd pillar and draw a pension or have a foreign pension, that one is also included in the computation.

The documentation is here: https://www.ahv-iv.ch/p/2.03.e (and it’s surprisingly readable for such a document!)

Hello Baptiste,

thank you very much for writing it.

What’s I would also find useful is geyting some concrete examples with CHF values.

Say a couple earns 200k on average from 25-50 years old and at 50 years old they want to retire and they need say 120k per year for retirement. How much money would they need to accumulate and how much pension can they get from pillar 1 and pillar 2 (asking annuity instead of capital) as of 65 and how it changes the capital to be accumulated.

It would be super useful, if we had 5 different typical scenarios that would already provide some tangible real CHF values! It would be even better if it had some tax and social security deductions simulation (like how much you would need to contribute to pillar 1 in pre-retirement based on the fortune) and how much taxes would be deducted on income elements (pension and dividends that always come from a stock portfolio).

I understand that these simulations can be quite complex due to different assumptions and tax situations in cantons – but it would be super useful!

Thank you for all the valuable content!

Norbert

Hi Norbert,

Thanks for your feedback. As you say, all of these simulations would be very specific.

I will try to rerun these simulations using Swiss stocks and bonds in the future and try to add more specific scenarios, but I have no idea when I will the time to do that.

Should I take early retirement with a foreign pension we said that I would have to contribute to AVS with regard to that foreign pension until age 65.

What about money I withdraw from my ETFs during that time. I understand that capital gains are not taxed in CH, but would they be subject to AVS contributions as if they were an income? Thanks

I did not understand the first part of your comment.

For the second part, money withdrawn will not be counted as income. However, dividends will be counted as income and will be counting towards your taxes. However, it should not count towards AVS (contributions should be based on wealth).

Thanks Baptiste for your reply. As to the first part, it was merely a contextualisation, namely that I understand that any (foreign) pension income would be subject to AVS. contributions until the age of 65 if I took early retirement.

Thanks for the clarification, it makes sense! I was trying to turn it into a question :)

As to the obligation to contribute to the AVS if you are no longer working before 65, does property and rental income from outside Switzerland get taken into consideration for the basis of the calculation?

My understanding is that property outside CH isn’t counted for calculating income tax in CH, but does the same apply for AVS contributions?

The second part of my question concerns rental income from outside CH, is it counted for AVS? And is it counted for CH in one tax?

Thanks

Hello! I don’t know about the AVS part of your question – would be nice to learn from others.

As for the taxes – even though your property abroad and rental income from that property aren’t taxed in CH, it’s critical to declare them both. Your Swiss income and wealth tax rates are being adjusted based on what you earn and what do you have abroad.

Dear Baptiste,

Sorry if I misunderstood but what do you mean exactly by 50%, 40% etc coverage?

Kind regards

Max

Sorry,

I just saw you answered this question.

Can you make a simulation going beyond 50pc?

I’m asking as I hope (hope meaning of three don’t change the rules in the meantime) to retire in a few years time on a pension from an international organisation which would cover all my basic expenses and live off my investments (almost 100% invested in ETFs, mainly SandP500) for “luxuries” such as travel, gifts to children, etc. Would that mean that a simulation could be made on a 90 or 95 per cent coverage? And if so what would the sage withdraw rate be?

Thanks

Max

This is very niche use case. I unfortunately can’t cover all cases :)

Most people in early retirement will have a small coverage only from social security.

I will consider adding more use cases on a next update, but can’t promise anything.

Hi Baptiste

Thanks for that. But I do consent with Dror: 1st pillar in Switzerland for early retirement/FIRE is not more than a bonus and it’s difficult to rely on (especially as it comes at high cost, as mentioned by Patrick).

Just a question, if I am reading that right: 1st pillar kicks in at 63 at the earliest (with severe deductions). If you calculate “in 5 years” (meaning I would be 58 by now) and a “50 year retirement”, does that mean I would need to become 108 year old?

Hi Timo

It’s not more than a bonus if you are far from retirement. If you want to retire 10 years before official retirement age, it may become very interesting.

Yes, the length of the retirement must be chosen according to how long you plan to be retired for. So, if you think you are going to leave until 98, you can use 40 years as a reference. And 50 years will indeed take you to 108.

Not sure I understand what you mean by “coverage” 0-50%. Is this how much of your expenses are covered by Social Security / 1st Pillar?

Yes. 50% coverage would mean half of your expenses are paid by social security.

Thanks for the clarification! Great work.

Thanks for modeling this. I’ve done something similar with the withdrawal toolkit from ERN.

One thing that is still unclear about Pilar 1 for me, is how many years you have to pay in as a minimum to see any benefits. If I only work in Switzerland for 10 years, does this result in anything, as the minimum payment period you find quoted online is always about 44 years.

Hi Chris

You will get something even with 10 years of contribution. Basically, you will receive 10/44 of the full pension for your average salary.

You can read my article about the first pillar for more information.

Social security contributions are mandatory till 65. When not working (aka early retirement and unemployment), those are charged on one’s wealth instead. It amounts to roughly 0.1-0.3% of one’s wealth.

See https://www.ahv-iv.ch/p/2.03.e

Hello, does it mean that an unemployed person (ex. early retiree) still has to make mandatory contributions to the 1st pillar even without having gainful employment income?

Thank you

Yes.

The document I linked has more details and examples. But an example, a single person with a wealth of 1M CHF, would have to pay roughly 2000 CHF per year till reaching age 65.

Yes, everybody should continue contriubting to the 1st pillar, even unemployed, early retiree, students, …

That’s correct, but that’s not the point of this article :)

It depends.

If you assume living only on the capital, then the 0.1-0.3% contributions to pillar 1 till 65 should be factored in as a cost.

I am not saying you should not take it into account (we totally should) and it’s an important of what we will spend in retirement. I am just saying that this article is about how to factor social security pension helps (or not) early retirement.

Thanks to point this out. It is a signicant amount to be paid. I will start to receive AHV at 63 years with an 8% “penalty”.

Thank you Baptiste for your in-depth work.

As I’m more in the must wait at least 20 years box, I’m not counting on it too much. It can only be a bonus :)

Thanks, Dror!

Indeed, if you have 20 years in front of you, social security is mostly a bonus :)

That’s pure speculation. If we’re not receiving the AHV it is likely that the financial system will also be in debris.

That’s not speculation, that’s math. If you retire 20 years before 65, you should not rely too much on social security.