What is a 1e pension plan (pillar 1e)?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

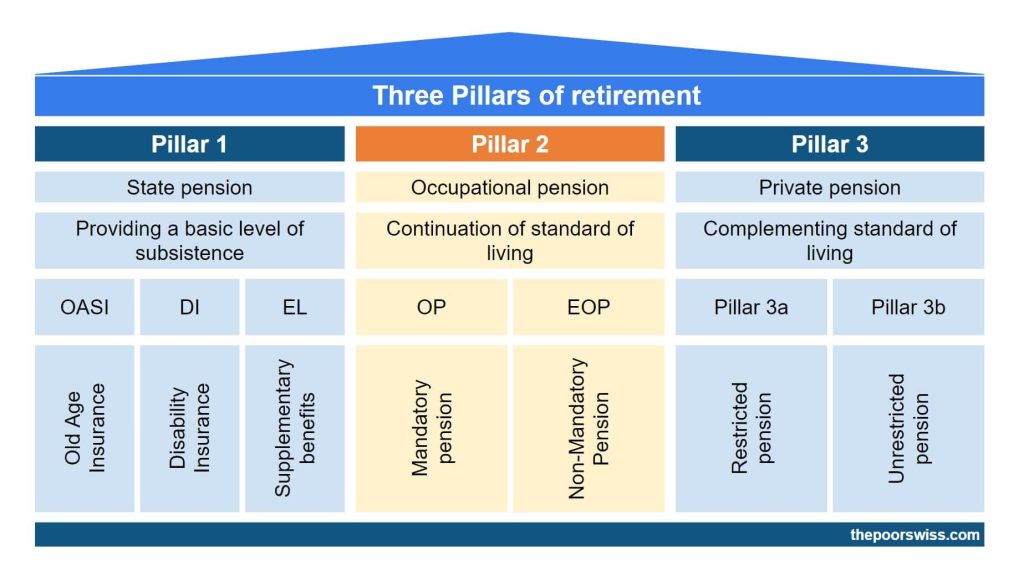

I have talked in detail about the retirement system in Switzerland, the so-called three pillars. However, I have not yet talked about a not well-known part of this system: 1e pension plans.

In this article, I want to cover in detail 1e pension plans. These pension plans are sometimes called pillar 1e. We will see what it is all about, who can profit from it, and more!

1e Pension Plans

In Switzerland, most people are aware of the existence of the three pillars, even if many people are not entirely knowledgeable about them. However, most people do not know about the 1e pension plans or pillar 1e. The reason is simple: it is reserved for people with a very high salary.

While the name is 1e, it is closer to the second pillar than the first one. A 1e pension plan covers a salary higher than 1.5 times the maximum coordinated salary (86’040). So, the 1e pension plan will cover salaries between 129’060 CHF and 860’400 (maximum covered by the second pillar). Therefore, if you have a lower salary, you cannot profit from a 1e pension plan.

Another reason people do not know about it is that employees cannot choose to invest in 1e pension plans. It is up to the employer to provide a 1e plan for their employees. So, even if your salary is higher than this limit, your employer would still have to enroll you in such a plan for you to profit.

It is important to note that people with a 1e have both a 1e and a second pillar. If you are eligible for a 1e pension plan, only the part of your salary higher than 129’060 CHF will contribute to the 1e plan. The rest will go as usual to the second pillar.

As for contributions, they are the same as the second pillar. You generally contribute some percentage of your monthly income to the second pillar. And your employer contributes some percentage as well. The same is true for your 1e pension plan. The difference is that your contribution is split between your second pillar and your 1e pension plan.

For these two reasons, most people do not know about this pillar.

Advantages of the 1e pension plan

While not well-known, this pillar is very interesting for employees.

Indeed, employees enrolled in a 1e pension plan can choose their investment strategy. Where most second pillar pension funds are extremely conservative and have extremely low returns, a 1e fund can be much more aggressive and yield nice returns in the long term.

This can make a major difference in the long-term for your retirement assets.

This also makes the 1e pension plan very interesting for additional contributions to the second pillar. With the second pillar, additional contributions are not great since the returns on (most) second pillars are really bad. But if the money is invested heavily, the second pillar contributions become as interesting as the third pillar contributions, but with a much higher yearly limit.

On the other hand, since your assets are invested, there is no guaranteed interest rate. So, not only are the returns not guaranteed, but you can lose money in your retirement assets. So, you must choose your investment strategy according to your risk capacity and asset allocation.

There are also advantages for employers since this could make them more attractive in the job market.

As of 2020, there were about 5 billion CHF managed in 1e pension plans in Switzerland. While these plans have existed since 2006, they only started becoming popular in 2017 because, before that, the pension funds had to bear the losses, making this plan unattractive for fund providers. But now, employees are bearing the losses (and profits, of course), so more providers are offering such plans.

Disadvantages of 1e pension plans

There are a few disadvantages to these 1e pension plans.

The first disadvantage is that very few people can profit from it. Even in Switzerland, most people will not have access to a 1e because of the high salary required. And even if they have the necessary salary, their employer may not offer this option.

The second disadvantage is that a 1e pension plan will tie you to an employer. Indeed, when you change employer, you will have to transfer these assets to a new provider. It means that you will be forced to sell these assets. If this happens at the wrong time in the stock market, it could be detrimental. If you are transferring to a vested benefits account, it may be easier since they will be reinvested again. But if you transfer to another employer, they will likely be poorly invested again (unless the new employer has a good 1e again).

But there are a few exceptions to this disadvantage.

- If you transfer from one employer to another and they both use the same 1e foundation, it should be possible to transfer your shares directly. This is possible with Finpension 1e, for instance.

- Some 1e foundations also have vested benefits accounts. And these foundations often have a path between the 1e and the vested benefits accounts. For instance, you could transfer the shares directly from Finpension 1e to Finpension Vested Benefits.

Other differences

There are a few other differences between the standard second pillar and the 1e pension plan.

In most cases, you will not be able to get a pension from a 1e pension plan. You will only be able to get a full capital payment. Other than that, the rules for withdrawal (and early withdrawal) are the same as for the second pillar.

An important difference is that assets are segregated per investor (or sometimes per strategy). In a standard second pillar, the funds are put together, and the fund pays for retirees with the money coming from the current employees. In pillar 1e, the money is entirely for you. You only pay the investment fees. This is a great advantage since you can profit more from the stock market’s performance and choose your strategy.

Example of 1e pension plan: Finpension 1e

Finpension is a great company! They already have the best third pillar and the best vested benefits accounts. And they also have a 1e pension plan offer: Finpension 1e (previously known as yourpension). They started with the 1e, continued with the vested benefits, and finally went into the third pillar.

They are a great 1e foundation offer as well. They let you invest in one of 10 different investing strategies. Some are very conservative, while others are very aggressive. This solution is great for young people and people close to retirement. And as usual, they are using index funds to minimize the fees.

With Finpension, your money is entirely segregated from other employees of the same company. That way, you can use a very conservative (yet more aggressive than a bad second pillar) strategy and profit even if some of your colleagues are more aggressive. And the contrary is possible, too: you can be aggressive and profit even if most of your colleagues are conservative.

So, if you are looking for a good 1e foundation for your employees or want to recommend one to your boss, Finpension is a great choice!

Conclusion

Overall, the 1e pension plan is a great option to improve the returns on your second pillar. The main problem is that it is only offered to a tiny portion of the Swiss population. First, you need a very large salary to enroll. And second, it is still up to your employer to enroll its employees. You cannot enroll by yourself.

This kind of pillar should be offered to many more employees. And we should be able to enroll by ourselves like we choose the third pillar. But I doubt it will ever change. (And maybe I am salty because I do not have access to one).

If you can enroll in such a plan, it is an excellent opportunity if your risk capacity allows it.

With that, you know all you need to know about the 1e pension plan, the least well-known part of the three pillars system.

If you have access to a 1e pension plan, I would love to hear about your experience with it.

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Very interesting article.

What do you mean by “vested benefit”?

Hi Paul,

vested benefits are second pillar accounts when you are not employed. You can read about them in my second pillar article.

In German it’s called “Freizügigkeitskonto”.

In French: “Compte de libre passage”.

In Italian: “Conto di libero passaggio”

I still miss a very relevant point here as we have a lot of expats in Switzerland who won’t probably stay in Switzerland until the legal retirement age.

What happens with the 1e assets when you decide to leave Switzerland or stop working at 55?

I guess you can for sure transfer them to a Freizügigkeitsstiftung and wait for your retirement age but then you would need to pay capital gain tax so even in this case I guess it’s just better to aim for a higher salary, pay the income tax and invest the money in ETFs and Stocks (if you are part of the C-Level of a corporation and if you have any influence on the pension strategy of your company)

The same rules as for the second pillar apply. You can transfer them to a vested benefits account. And if you get a compatible vested benefits account (valuepension and yourpension for instance), you could transfer the shares directly.

In any case, you will pay a tax on withdrawal on the entire amount. In any case, this money will go to the second pillar, you cannot choose not to invest in the second pillar for the mandatory percentage each month. So, a 1e is almost always better than a second pillar directly since most second pillars are terrible investemetns.

This means that it is possible to have the 1e portfolio paid out when emigrating to an EU or EFTA country, as it is part of the extra-mandatory part anyway.

Thank you (y)

I never heard the term 1e. I would say it’s no so widely used. Most companies split the 2nd in pillar in two parts and that’s it.

Yes, it’s definitely not widespread :)

I evaluated a 1e solution for our company this year. As as partners we control the full stack of money flow from clients to our own pockets ;-) . So we’re able to set our salaries, expenses and dividend payments as we please depending on how good a year goes.

I seems an interesting addition to a traditional PK solution for better earning employees.

However there are a few issues:

It really only makes sense for salaries above 150k a year due to fees.

Existing PK Sparguthaben can not be transfered to the 1e solution. At least not from a traditional PK to a modern 1e provider like yourpension. So one starts with 0 capital when setting up a 1e solution.

Capital gains in the 1e account will be taxed when one takes out the money at some point (presumably when retiring). For younger people it might be more lucrative to opt for a higher salary, pay more taxes every year and invest money directly in to the stock market and benefit from tax free capital gains. The same logic applies to Säule 3a payments.

Once an employee leaves the company he will have to leave his 1e plan. And if the new employer does not offer anything comparable he would have to put the money from his 1e acount in to a traditional PK solution. There are grey area solutions like transforming the 1e account in to a Freizügigkeitsaccount at the same provider and just not mentioning that to the new employer and his PK. Even if the new employer offers a 1e solution one might have to sell the funds and buy back in with the 1e provider of the new employer. If markets are down or in a turbulent phase as during corona in 2020 this might be a rather nerve racking experience.

All in all it’s probably a better solution to add an 1e as compared to just plowing the full amount in to a traditional PK solution, especially for yearly salaries above 150k.

Hi BamBam,

Thanks a lot for sharing your experience with 1e!

Capital gains are indeed taxed indirectly at withdrawal time for the second pillar and third pillar. I still believe it makes sense to use 1e compared to a bad second pillar. But it may not make sense to contribute more than the default.

The point about leaving the company is absolutely important. I did not consider that in my article. This is definitely a big downside. I am wondering if you could transfer the shares from something like yourpension to valuepension since they are the same company. I will have to ask.

In the end, I agree that it’s still interesting, but many things have to be taken into account as you mentioned!

“It really only makes sense for salaries above 150k a year due to fees.”

… is this even true for low-cost challengers like finpension?

Thank you very much for summing up the virtues and drawbacks of 1e plans. I heard of 1e plans in late 2017 for the first time, but then was not yet eligible for them, so I forgot about them again.

Yur article reminded me “ouw, there was something”, and I recognized I am beyond the magical border now. Guess I need to have a talk with my pension plan commitee collegues and our CFO/CHO.

Hi,

I am glad this reminded you of doing that! I also want to do that with my employer.

Good luck!

Good article, thanks.

1e is not a pillar, but a pension plan. 1e pension plan for the second pillar.

One important point you missed is that your investments will be sold if you change the job. Possibly to a new employer which does not offer an equivalent plan. This violates the usual buy and hold tactic.

So it is probable that you can loose money, and you are creating an additional dependency to your current employer.

Hi capmac,

Excellent point about the investments. I did not think about that. This could be a big disadvantage indeed! I thought of it as vested benefits. I will have to update this article for that!

I still believe that you could get around that if you first place them in a “Freizügigkeitsstiftung” that has a similar investment strategy like your 1e plan. (Finpension for example)

Are you sure that your assets need to be sold?

You are correct. If you move the money to a vested benefits account, you can transfer the shares directly if they are both from the same company. For instance, you can transfer shares from yourpension to valuepension. So, if you leave your job, this is actually okay.

Hi,

do you know how much of the salary above 129’060 CHF can be contributed? Is it before taxes?

thanks,

Hi Joe,

The contribution system is the same as the second pillar. You contribute a certain amount of money based on your age and your employer also contributes.

Great article, thanks !

I understand this is specifically for employees. Do you know if there is another system for independents (self proprietorships) ? I know of the 20% 3a contribution but there is a maximum so it is not really that great.

Hi John,

Good question. I believe (not entirely sure) it’s not possible if you are self-employed with a sole proprietorship. If you had an LLC, you could do that, but probably not without it.

Find access to a pension fund. There should be at least one for each industry also accepting self-employed people.

Or otherwise hire someone to work for you. You’ll have to provide him a pension fund and then you gain also access to that pension fund.

Mine is limited to 40% equities so is still fairly awful. Swiss pensions are a mess. Complicated and bad.

For some reason it is limited to salary over 150k for me (and I’m barely over that so never gave it much thought).

Hi Joe,

That sucks. I was thinking most of them were better than that.

Yes, it’s definitely too complicated and with not enough customization.

It’s possible that the limit is depending on each pillar 1e institution. They may be pickier than the limits of the law.

I thought the 1st Pillar was considered the AVS

That’s correct, pillar 1 is AVS. But pillar 1e is not pillar 1. And as said in the article “While the name is Pillar 1e, it is actually closer to the second pillar than to the first pillar”.