How to Budget – And my example

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Everybody manages their budget in its way. There is no single way of doing it. For me, the essential part of a budget is to track your expenses. It is essential. There are many reasons why it is crucial.

You need to know how much you are spending. Then you need to know how much you still have at the end of the month. Seeing your entire monthly budget will help you manage your spending.

In this article, I go over why you need a budget. I also talk about how I manage my budget. It is only one of the ways to do it, but if it works for me, it may work for you!

What is a budget

For many of you, this is obvious. But we will start with the obvious anyway. What is a budget? I am talking about a personal budget, from a single person to a family. I am not talking about corporate budgets.

A budget is an estimate of your income and your expenses. You can use a monthly or yearly budget. Or even a weekly one if you feel like it. You use it to keep track of your expenses and see how much you can still spend. At its simplest, a budget is simply the amount of money you can spend each month.

A lot of people are using categories in their budgets. For instance, they give 300$ to the Food category each month. Whether you use categories or not is not essential. The most important thing is the amount of your budget.

Ideally, it should be lower than your income. For instance, with a current income of 6000$, you budget for 5000$. The rest is what you save by default. Of course, there will be months when you will be over your limit. In that case, the idea is that you will compensate during other months by spending less.

Some people also include savings in their budgets. With that, you can account for each dollar you get each month. You get a zero-based budget if your balance is always zero at the end of the month.

There is no such thing as the best budget strategy. As you can see, there are many variations, and you should use the one that best suits your needs. On the other hand, there is probably the best strategy for each person.

Do you need a budget?

There is no best budget. But everybody serious about its finance needs one. There are many advantages. At the bare minimum, tracking your monthly expenses is very helpful. For some people, this will be enough. But you will need more than that if you struggle with your money.

When I started taking care of my finances, I started with a strict budget. But over time, I started caring more about tracking my expenses than my budget. If you are disciplined enough, tracking your expenses is enough. If you are not that disciplined, you can do a real budget.

But allocating money to spending categories will be even more helpful for many people. An analogy I like is this one:

You would not build a house without blueprints

and you should not spend money without a budget

Just as blueprints are a plan for your house, your budget is a plan for your money.

The most obvious reason to get a budget is not to spend more than you make. If the sum of your expenses is higher than your income, you are in trouble. By having a budget, you always know how much money you got left during the month. And you should use this to understand how much you can spend. It does not have to amount to your entire income. You should budget for less than your income. It will allow you to save money easily.

Another reason is to avoid bad spending habits. Once you have a budget, you will see all your expenses together. It can make you realize that some small costs are accumulating very quickly. If you get a coffee at $ 4$ every workday, that is $ 20 a week, $ 80 a month, and $ 960 a year. I am sure you can cut that coffee price to $ 1. A lunch at $ 10 each day accounts for 2400$ a year. You can take it from home.

Seeing all my accumulated expenses showed me I was spending too much on some things. For instance 2015, I spent almost 3400 CHF on home computers. I was having fun. But I could have fun with less than half of this.

Before I saw the actual amount, I did not realize it was that much. Recurring monthly expenses can also be an issue. I was always told that 100 CHF a month is not much. But once you put it for a year, it is 1200 CHF. And if you have several of these expenses, it can make a massive sum.

It leads us to the following: having a budget will help you save money. Once you realize how much you spend on everything, it is time to reduce these expenses. Maybe your budget is fine. But most likely, there are areas where you can save more.

It is a continuous effort to improve your financial situation. You do not have to restrain yourself. But you can always spend it more smartly. Find out these significant recurring expenses and optimize them! For instance, I saved a lot on my car insurance and mobile plan. Find out these small expenses that sum up quickly and optimize them! Every little bit helps!

Finally, once you have a budget, you will control your finances. It helps you worry less about your finances. You will not worry about it once you get a budget and respect it. Once you get used to it, it becomes automatic.

To learn more about budgeting, you can read about the different ways to keep a budget.

How I budget

A simple Google Sheets template to start tracking your expenses and earnings and have an overview of your budget! Know your savings rate without effort!

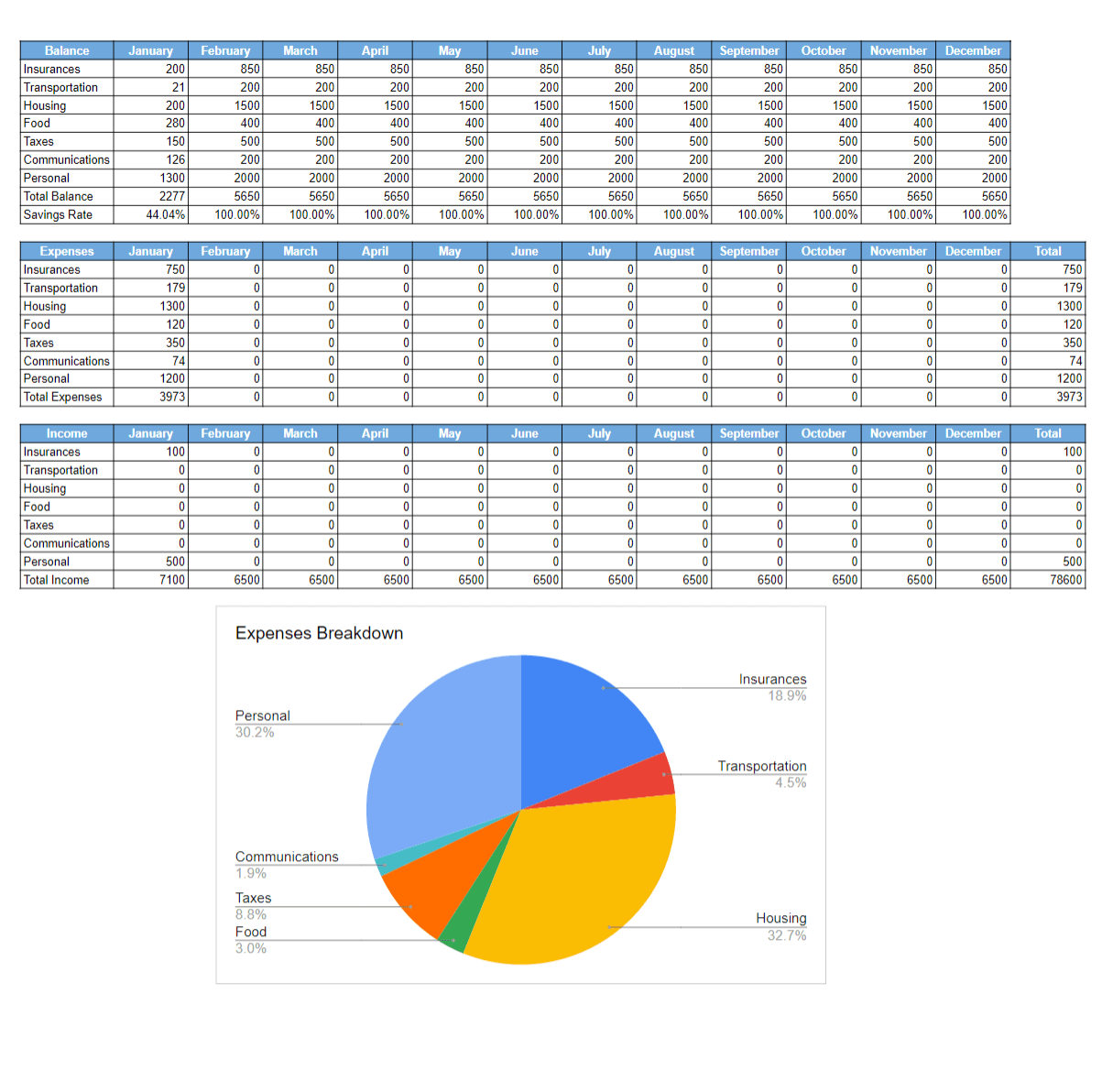

Now that you know you need a budget, we can see how I do my own. I work with a monthly amount. I defined several categories of spending. Each category has a monthly amount. What I do differently than most people is that the sum of the categories always equals my income.

For instance, when I started budgeting, my salary was 5950 CHF per month, and my categories were:

- Apartment (1400 CHF): Rent, power bills, …

- Communications (250 CHF): Internet, phone bills, and various internet services

- Insurances (350 CHF): Health insurance and legal insurance

- Food(600 CHF): Groceries and going out meals

- State (650 CHF): Taxes

- Transportation (400 CHF): Gas, car insurance, car maintenance

- Personal (2300 CHF): The rest (Books, gifts, going out, …)

The total is 5950 CHF. It works very well for me because I also keep track of the current savings rate. My goal is not to fill the Personal categories. But to have a reasonable savings rate. I do not recommend this to everyone. But it worked well for me.

With this strategy, some people may spend too much on the Personal category. You can set the total to your income minus your savings goal. For instance, you can set the total to 4500 CHF. It would give you a Personal category of 850 CHF.

Over time, I have stopped setting an amount for each category. I keep track of my income separately. However, I keep track of every single expense.

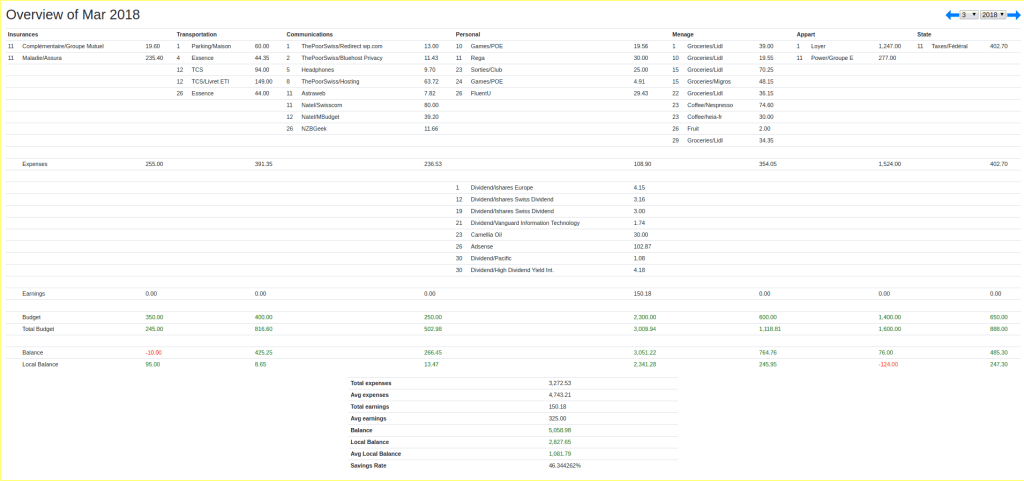

Even if I spend 1 CHF, I try to keep track of it. I think it is vital. Of course, I may miss a few of the smallest ones, but it is rare. The only time when I am not that precise is on vacation. I try to. But, I am often lazier and overestimate a bit on vacation. For instance, here is my budget for March 2018:

One thing I do not do is pay myself first. It can work for a lot of people. But I do not like this strategy. I believe paying yourself first is a strategy for lazy people. If you are smart enough with your budget, you do not need it. If you have issues saving, you may give it a try.

That’s it! There is nothing fancy going on here. I do not do anything special, but it works. You do not need anything very complicated for your budget. Just account for your expenses and income, and keep your costs low. And you should be set!

Conclusion

By now, you should now believe you need a budget. You also find out how I manage my budget. It is only one way to manage it. There are many ways to do it and no best way. The most important thing is that you track your expenses!

As for whether you need an actual budget with an amount you can spend per category, that is up to you. When I started, I needed one, but now I only care about the tracking part. I still like having categories because it helps me visualize my expenses. But I do not set an amount for each category anymore.

You may have noticed that I did not mention budgeting tools in this article. I am using a tool called budgetwarrior. But it is a geek tool. I doubt it would be beneficial to my readers.

Again, there is no best budgeting tool. Many tools do it just fine. You will have to find the one that works best for you. Spreadsheets are fine! I advise you to have it online (Google Sheets, for instance) to ensure you do not lose it. But paper is fine as well. You do not need to pay for a budget tool.

A lot of Americans are using Personal Capital (free for budgeting). There is also You Need A Budget (YNAB). But YNAB is not free. I do not recommend spending money to manage your budget. I do not think you need anything else than a single spreadsheet to manage your budget. There are tons of software to do this. You can look around to find the one that suits you the best. Do not hesitate to test several of them.

That’s it! If I did not already convince you, I hope I have convinced you to have a budget or, at least, to track your expenses.

If you are interested in my budget, you may be interested in my budgeting mistakes as well.

How do you manage a budget? Do you do something different? What tool do you use?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Manage your money

- More articles about Save

- How to fake your Savings Rate with Math

- How to Go Paperless in 2024? And why?

- 11 Personal Finance Myths You should ignore

Hello Baptiste

I’m using a Kakebo (Japanese financial planer where they teach their kids with it) to track my expanses and defining my saving goals as i struggled alot with the budgeting software and spreadsheets.

Its super simple but for my case super effective

i can confirm just tracking it with pen and paper and seeing how you spend your money makes you more mindful how you spend your next cents.

Hi Oli,

Thanks a lot for sharing, this is very interesting. I had no idea about Kakebo before!

Having everything in front of you is very useful!

The way I manage our budget (family of 4 with 2 young adults) is using an annual budget split in 12 months, with one worksheet per year divided in monthly tabs.

I have groups of expenses (House, Food, Family, Auto/moto, etc.) and items within that (For House: mortgage, utilities (gaz, water, electricity, Internet. etc.), insurances/taxes, etc.) which all constitute the lines. For each there’s the monthly total, the budget (that get’s revised every year to be adapted if deemed appropriate) and YTD (year to date, so as to spread expenses paid yearly like health insurance to benefit from 2% discount and lower “fortune taxes” or spread over time like car maintenance, tyres change. etc.

Holidays are a separate tab per trip, which allows to compare value for money for different holidays. These are taken into account into the December tab that sums up everything for the year, including taxes once the final values is known a year or more later.

One of the goals is to differentiate between essential and superfluous in case of unemployment or other difficulty.

Hi Pedro,

Thanks for sharing!

Are you updating back in time to account for taxes?

It looks like you are very well organized. I personally never spread any large expense, I want to see my real monthly savings rate, but it does not matter much in the end since the yearly values will be the same.

It’s indeed great to be able to cut the superfluous quickly should you need to do it.

Hello Baptiste,

Thanks for the article, indeed budget for individual is quite simple to organize and to follow but managing a budget for a family is of another level of magnitude. I guess you realized that already.

I did start a serious family budget on new year 2021 and it was quite a difficult and chaotic ride. A lot of time spend, I lot of discussion if not straight conflict raised and sometimes even frustration as I still couldn’t figure out every metric I was looking for out of the spreadsheet. It still help in a way but there are some month where I’m wondering if it’s really worth the effort if it doesn’t change much on the result at the end.

For 2022 I had to simplify a lot the categories and adopt a better cash flow strategy. No more tracking of Revolut and Neon personal account, automated category for many recurring expense on our bank/card statement. But we still have a lot of work to do to improve our finance, hopefully the budget will help us to take better decision but it’s only the first step, then it’s a matter of changing our habits to improve the situation after years of more or less bad spending habits.

I should write the story more in detail, I’m sure if could be interesting and help others on some point and maybe I could get advise back to help us in the next steps.

Hi Eluc,

It’s actually not that bad with only three people so far. But my wife is also relatively frugal. We very rarely have more than 50 expenses for a month, so it’s easy to keep track of everything.

But we don’t budget anymore, only track all our expenses. And at the end of the month, we just see what’s left and it turns out to be working quite nicely for us.

You should definitely share this story in detail on your blog (or on mine? ;) ).

Hi thepoorswiss,

a very good article and blog.

I have a question for you. I’m starting to create my budget, but I don’t know how to manage in my spreadsheet Cash ATM and Revolut debit card.

Every month I withdraw money from the ATM and I charge my Revolut account. I put in my spreadsheet those like a cost, but at the end of the month the money isn’t all gone, because sometime I’ve still got money in may pocket and in my Revolut.

How can I manage this difference in the spreadsheet? Can you recommend me a spreadsheet template?

Thanks in advance

Frédéric

Hi Frédéric,

That’s a good question :)

For me, cash withdrawal and charge of Revolut are not expenses. They should not be part of your expenses. Withdrawing money does not make you less rich, it’s just a move from two of your assets.

On the other hand, once you use Revolut to buy a Coffee, you need to add this expense to your budget.

Now, if you want to track the movement from one asset to another, it’s more asset tracking than budget. I do not track every single move in my assets. What I do is, at the end of the month, I get the current value of each of my assets and I put them in my asset tracking. That way, I more or less know how much money I have in total each month.

Does that make any sense?

Thanks for stopping by!

Hi poorswiss,

I would share with you a app that I recently found on the Android PlayStore. This application is “Money Manager Expense & Budget” (https://realbyteapps.com/).

I tested this apps for a couple of weeks and I found it very good.

You can fix your budget. And create your account and record your incomes or expences.

You can register also the “transfert” from a account to another.

Give me a feedback if you’ll try it.

Good luck

Frédéric

Hi Frédéric,

I didn’t know this app. It does look quite interesting. And it looks really well done.

Are you planning to use it as your main budget tool?

Personally, I much prefer doing my budget on a computer rather than a phone since I do not like phones. I do not want to install more apps on my phone. But I know that people like phones more and more.

Thanks for stopping by!

I love seeing how other people manage money! I’m awful at blowing my budget in the first few weeks of the month, then just throwing it out the window. I’m slowly getting better!

I’m always jealous of the top notch finance people that can live without a budget haha. I’m def not one of those people!

HI simplisticsteph,

Thanks for stopping by :)

Don’t worry, we have all been there ;) I cannot live without a budget either and used to spend much more. If you blow money early in the month, you could try to automate your savings with automatic deposit into your savings or even broker account. This can help.

Good luck with your budget ;)

Awesome post. How do you spend so much in a month?! But I guess you’re one of those “rich Swiss.” LOL!

Thanks :)

Actually, the month I’ve posted the overview is less than 3300 CHF monthly expenses. I don’t think it’s too bad :P What do you think ?

My average is very high though, I’m working on reducing it. I was more a dumb Swiss with too much expenses haha :)