You do not need to pay for a budgeting app!

| Updated: |(Disclosure: Some of the links below may be affiliate links)

I strongly feel that most people need a budget. And everybody should track their expenses. However, I think that there is no need to pay for a budgeting app at all!

You should not spend money on your budget to save money on your budget!

Nevertheless, there are still many people that pay for their budgeting application. For most people, there is no need for a fancy application.

I do not think you will recoup any of the costs. And I believe that most features are useless, if not harmful.

Here is why you should not pay for a budgeting app.

Budgeting apps

There are many budgeting apps out there. And some of these apps are quite expensive.

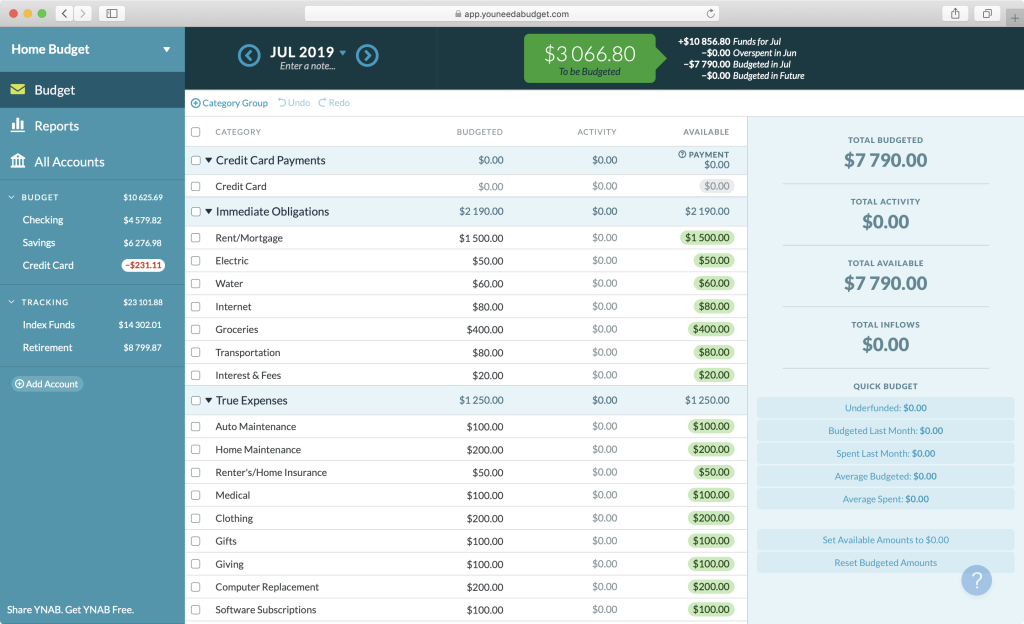

For instance, one of the applications that people recommend a lot is YNAB. It costs 84 USD per year. And another one is Personal Capital, which is all over the place. This one is free, but they are trying to sell you expensive investments via their service. For me, this makes it a costly application that I would not use.

These applications provide a wide array of features. But in the end, they are budgeting apps. And you probably do not need as many features as you think!

I do not see why one should pay money to save money.

You do not need a budgeting app

I do not even think that most people need a budgeting app.

To keep track of your budget, what do you need?

- A way to track your expenses, ideally in different categories

- A way to track your earnings, preferably in different categories

- One group per month

- One group per year

- A simple way to compute your balance and your savings rate

I think that is the only thing that most people need. And you know what fulfills all these requirements? A spreadsheet!

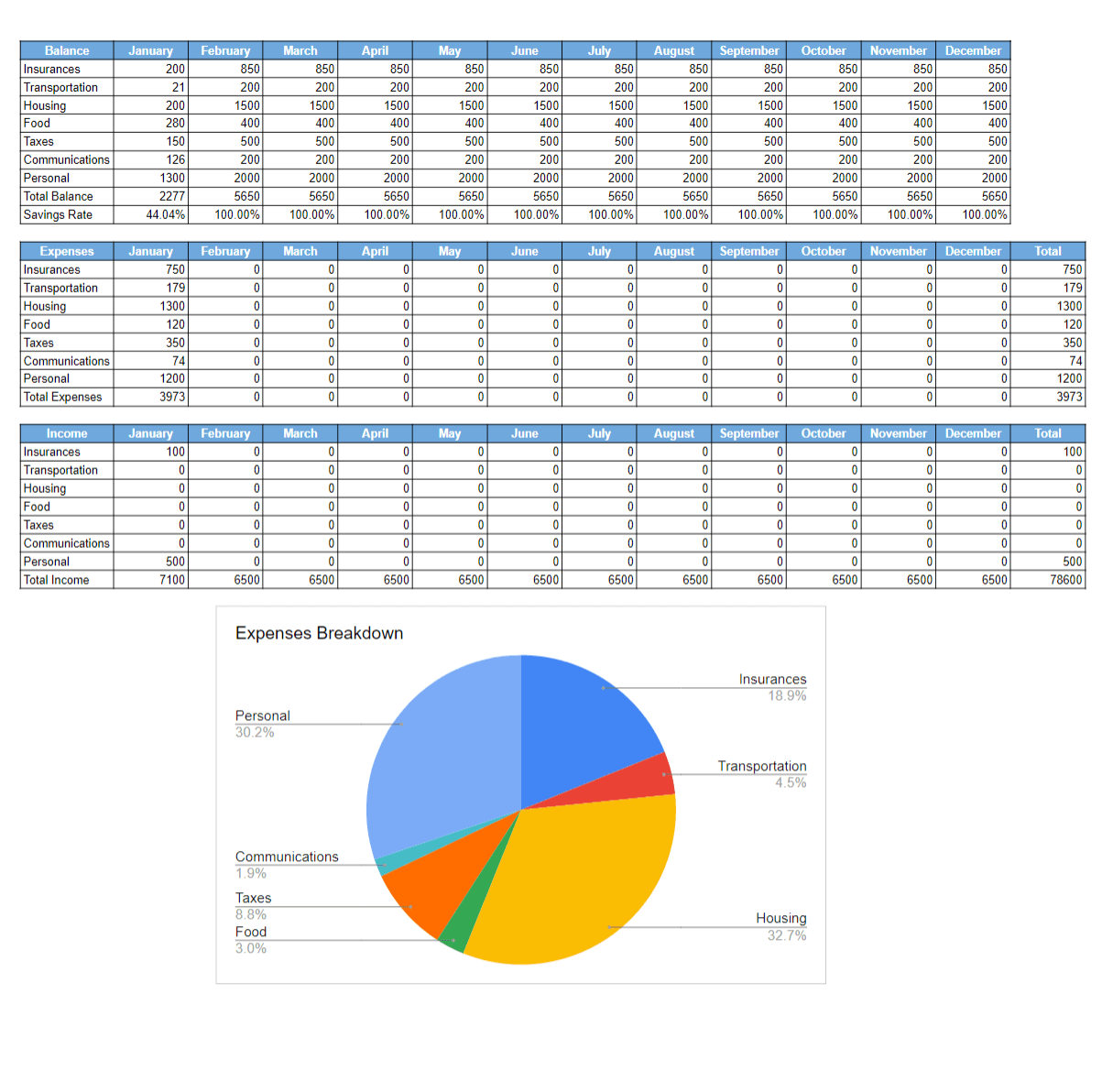

A simple Google Sheets template to start tracking your expenses and earnings and have an overview of your budget! Know your savings rate without effort!

A spreadsheet is the only budgeting app you will ever need!

Moreover, a spreadsheet also has a significant advantage: you know what you are doing! You will know exactly which numbers are going where and what is happening with your money. This is much better than merely trusting an application that gives you money advice.

You do not need fancy features

Many people will argue that a simple spreadsheet lacks some advanced features. And this is true. But do you need these advanced features? Probably not!

Fancy features are often a distraction

First of all, you do not need to see the state of your investment portfolio every single day. If you need to look at your bank account, seeing the state of your portfolio will serve no purpose at all.

I think it is the contrary. It will distract you from your main goal. And you will then waste time looking at everything on your personal finances.

Do not take me wrong. It is a good idea to stay informed about everything that is going on with your finances. But it is not a good thing to become obsessed with your numbers. Since you will not sell today, you do not need to know how much is in your broker account. Checking once a week should be sufficient in most cases.

Automation makes you complacent

You may have already read that I do not like money automation. I think it is a mistake.

It is the same when using a budget application that does everything for you.

First of all, you do not know what is going on. I think it is essential to understand what is going on with your finances. I much prefer to enter my expenses myself than to have a tool scan through my bank account to find them.

We should not forget that an automation tool cannot track everything. What about this purchase that you had to make cash? What about purchases in another country? You want to track them accurately. And no application will help you do that. So if you will enter some of your expenses and earnings manually, why not enter them all manually?

I spend maybe 15 minutes each week on my budget! If you are not prepared to spend that little time on your budget, you are probably not ready to be serious about your finances.

And another thing is essential: every budget is different! I do not think there is a single correct budget method that will work for everybody.

A central application is not the best security

And finally, I think that having a single application having access to all your financial information is not a good idea. I believe this goes against good personal finance security practices.

If the company gets hacked, the hacker will access all your information. It can include sensitive information, depending on what the application collects. You should be careful with services trying to collect a lot of information. It is much easier for a hacker to attack one service than ten.

This fact is even truer if you are careless with your login and password. Maybe you are using a very strong password with your broker. But perhaps you are not using a strong password with your Personal Capital account. If somebody gets a hold of this, he will have all the information he needs.

No application will ever handle all your services

Even if you have the fanciest budgeting application, it is unlikely that it will be able to communicate with all your financial services.

For instance, you are likely to have:

- A bank account or several

- A credit card or several

- A broker account or several

- A P2P Lending account or several

Are you sure your application can track them all?

I, for sure, have not found a budgeting application that can connect to all my services. Granted, it is much better in the United States. In Europe, we are pretty late in the banking technology game. But even in the U.S., I am sure many people cannot centralize all their services.

If you cannot have all your services in the same place, what is the point of having the central service in the first place?

There are some free budgeting app

As I said, I think the best budgeting application is a simple spreadsheet. I do not believe that anybody needs anything fancier than that.

For me, the best budgeting application is Google Sheets! You can have it everywhere. It is free. And it is automatically synchronized by Google. You do not have to save it.

But you can also use a local spreadsheets application like Office Excel, for instance. It will work as well. But you will not have mobile access as easily. And you need to worry about saving your budget.

Now, if you feel you need more, some fancier applications are still free:

- Mint.com is free, and it can centralize some of your data online in one place and manage your budget. I would recommend Mint to get started since it is free!

- Personal Capital is free if you do not use their investment services. I do not like it, but if you are careful, you can use it for free. And it is really powerful and looks good. There is no denying it.

- Wally.me is also a strong option.

- Tons of other options. Just search for free budgeting applications on Google.

I have not tested any of these services. But I have read a lot about the first two, and I am not convinced of their value.

If you used any of these applications, please let me know what you think of it and what it brings you!

Conclusion

A simple Google Sheets template to start tracking your expenses and earnings and have an overview of your budget! Know your savings rate without effort!

I hope that by now, you agree that you do not need to pay for a budgeting app. You only need a single spreadsheet with multiple sheets to do your budget.

I think that fancier budgeting applications are doing more harm than good. First, you lose money, and the budgeting application will not make you recoup that. Then, it makes you lazy since you have nothing to do yourself. And finally, you do not understand what is going on.

I believe that people should be in control of their finances.

You may ask why there are so many people using and recommending paid budgeting applications online. The answer is very likely to be affiliate programs! Most of these paid applications offer money to people who send them new customers. And some people recommend things they do not even use.

If you want something fancier with many features, you can give it a try to Mint, which is free. If I were to use a complete budgeting application, that would be it.

If you are interested in budgeting, I wrote an article on how I budget.

I do not have an excellent example of a budget spreadsheet. Would you like me to make a simple one and share it on the blog?

What about you? What application do you use to manage your budget?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Manage your money

- More articles about Save

- How to fake your Savings Rate with Math

- A few ways to simplify our life

- The 13 Steps of My Monthly Personal Finance Routine

I haven’t gotten your sheet. It say’s it’s on its way, but I don’t have it so far… It’s not in my junk-mail either. Can you please send it? Thanks you!

Totally agree! Excel is my go-to budgeting tool! I use a cash-based system so no need for fancy tracking or even to link anything through a third party. Give me my old-fashioned basic spreadsheet every day!

Hi Robyn,

I am glad to see I am not the only one that thinks like that!

Too many people are relying on complicated tools to do simple things!

Thanks for stopping by!

From my side we use Excel :). Simple template with some charts, money spent, categories, what did we budget. And thats it.

Personal capital i belive we cannot use it. Only guys from the US since it asks for a postal code :(

Hi Mr. Firecracker,

Excel is perfectly fine for budget and net worth tracking! It has all the features one needs. And it’s great because you know exactly what is going on!

Yes, Personal Capital is only for people in the U.S. (maybe Canada?).

Thanks for sharing!