All you need to know about Car Insurance in Switzerland

| Updated: |(Disclosure: Some of the links below may be affiliate links)

In Switzerland, you have to insure your car. But, the system is quite complicated, with many options. And the insurance dealers will not make car insurance easy for you.

There are several different levels of insurance for your car. And only one level is mandatory. And there are even some options that are useless. But insurance dealers will always try to make you take as many options as possible.

In this article, I cover the details of the car insurance system in Switzerland. We will see the different levels of insurance and which one you should use. By the end of this article, you will know exactly what you need to pay for your car insurance.

And hopefully, you will be able to reduce your car insurance bills!

Car Insurance in Switzerland

In Switzerland, there are many kinds of car insurance. They are organized into three levels, each increasing the coverage by the insurance:

- Liability Insurance

- Partial Casco Insurance

- Collision Insurance

From these three car insurance levels, only liability insurance is mandatory. Each car should have liability insurance in Switzerland. The other levels are optional. But it often makes sense to add some coverage, as we will see in this article.

There is an exception. If you use leasing for your car, collision insurance will be mandatory.

On top of that, there exist plenty of options that you can add to your coverage. And each of these three primary levels has different deductibles and coverage as well.

Unlike health insurance, you must get all the coverage levels from the same insurance providers. So you need to look at your car insurance as a whole, not several parts.

I will consider that you have a car with Swiss license plates. If you have a car with foreign license plates, you do not need Swiss car insurance. But it is mandatory for every vehicle registered in Switzerland.

Liability Insurance

Liability Insurance, or Civil Responsibility, is mandatory for each car owner in Switzerland.

This insurance will cover the damage done to others. For instance, if you bump into another car, the other vehicle’s damage will be covered by liability insurance. The same thing occurs if you injure someone. The insurance will cover the medical costs of the person and their recovery.

This insurance will generally cover a substantial amount of money. In my case, it will cover up to 100 million CHF of damage. Since the law sets this insurance, each insurance will cover almost the same things.

One thing where the insurance can differ is in the deductible. Generally, the deductible is 1000 CHF for drivers below 25. And the deductible is 500 CHF for drivers that got their driving license in the last two years. And most insurances have zero deductible for other cases. Now, some insurances have 500 CHF or even 1000 CHF deductible as a base.

Unless you think you will have many accidents, you should take the cheapest liability insurance. Even if you have a deductible, it is better to take more affordable insurance. You will not use it often (I hope!).

Partial Casco Insurance

Partial Casco Insurance is optional for every car unless you lease your vehicle.

It covers you against many risks:

- Natural damages: hailstorms, landslides, floods…

- Collision with animals

- Damage to your windows

- Damage caused by marten

- Theft of your vehicle

- Acts of vandalism

- Personal effects: If they are stolen or damaged inside your car

The exact conditions of coverage will depend on each insurance. And each insurance will apply a different deductible to each category.

If your car is recent, it is generally a good idea to get this coverage. If you were considering using the full coverage (adding Collision Insurance), you would need Partial Casco coverage too.

If your car is older, it highly depends on where you park it. If you always park your car outside, it may be good to keep this insurance.

Since we have moved into our new house, my car has been protected from hail. And our new place is less susceptible to martens. Therefore, I have removed this coverage.

When comparing partial cascos, you must consider the price and the deductible. Sometimes, it can also be good to read the insurance conditions. Some insurance does not cover some incidents in some special conditions.

Collision Insurance

The last level of car insurance is collision insurance. If you get partial casco insurance and collision, this is sometimes called full casco insurance.

This car insurance will cover you if you are in a collision with your car. It will cover the damage to your car. This insurance is only if you are the cause of the accident. If you are not the cause, the liability insurance of the other driver will cover you.

Collision insurance is also optional unless you lease your car. But, it is a recommended option if your car is recent or if it is of value. The general advice is to keep this for the first five years. You may want to keep it longer if you have a high value car.

I am driving cheap cars. So, after four or five years, there is no point in keeping collision insurance. If I were driving a vehicle with much more value, I would keep it longer.

Now, there are some exceptions. If you are a worse-than-average driver for your car, you are better off keeping this insurance for a long time.

Remember that if the repair costs exceed the car’s value, the insurance could decide not to repair it. You will get the car’s value (minus the deductible), and then it is up to you to either repair the old car or buy a new one.

Occupants Insurance

Welcome to the big scam car insurance! The occupant’s insurance will cover accidents for the people that are traveling in your car. If there is an accident, this insurance will also cover damage to them.

It sounds good. But it is a big trap. In Switzerland, accident insurance is mandatory. So every Swiss people is already insured against an accident. And people with a Schengen visa in Switzerland must also have accident insurance. So for most people in Switzerland, occupants insurance is useless!

The only reason to get this insurance is if you regularly have people in your car that are not insured. This means they are not living in Switzerland, do not have a Schengen visa, and do not have mandatory accident insurance where they live.

If you are not in this case, like most people in Switzerland, you should not take occupants insurance. And if you already have one, cancel it and talk to the person that recommended it to you!

Bonus System

Each insurance provider uses a bonus system for their car insurance policies.

The bonus generally starts at 100%. It means you will pay 100% of your insurance. The way the bonus goes up and down is different for each insurance. But the underlying logic remains the same.

When you have no accident or do not use your insurance for a full year, your bonus goes down. The bonus is generally going down 5% at a time. But it could go down 10% at a time.

And once you have an accident, your bonus will go up, generally by 10%. The bonus can go higher than 100%. Some insurances have an option called Bonus Protection. If you take this option, your bonus will only increase after the second incident each year. You are allowed one incident each year with this option.

Something essential is that the minimum bonus is also different from one insurance to another. Some insurances have a minimum of 30% and others of 40%.

When you compare insurance, you need to compare the actual amount you will pay, not the total at 100%. Most insurance will show you the total amount, not the bonus-adjusted amount. Since insurances do not have the same minimum, you should never compare the full amount.

When you take on new insurance, you must ensure you will start with a low bonus! Unless you are a new driver, there is no reason to start with 100%. Generally, you can continue with the same bonus level you have now.

How can you pay less for your car insurance?

With all that we learned, we can do a few things to pay less for car insurance.

1. Do not hesitate to change car insurance

Many people do not want to switch car insurance. It is a mistake.

If you can change your car or simply your coverage, it is good to compare other offers. Even if your car insurance was the cheapest when you started it, it might not be the case anymore.

You need to make sure that the delay is correct. Some car insurance policies have a five-year duration. It is pretty bad, unfortunately. You can still change your insurance during that duration, but you cannot change your provider.

2. Reconsider your coverage

As a car gets older, you can reconsider your coverage. On a 10-year-old car, you do not need collision coverage. And you probably do not even need partial casco coverage.

It is essential to re-evaluate your needs every year for your car. For instance, after five years with my car, I have removed the collision insurance coverage. And one year after that, I removed the partial casco coverage as well.

3. Pay only once a year

Most car insurance providers will offer you a reduction if you pay once a year only.

Generally, you can choose to pay your car insurance every quarter, every semester, or once a year. But the more often you pay it, the more money you will waste — for instance, my insurance bills 15 CHF for paying twice a year instead of once.

If this is too much to pay at once, you should improve your budget to have enough space for big bills. Everybody should be able to pay for this at once.

Since it is not a considerable amount of money, you should not be worried about opportunity costs.

4. Lower your bonus

An obvious way to lower your bill is to reduce your bonus level. But, it is not always easy or even possible.

If your bonus is already the minimum, there is nothing you can do, unfortunately.

If you do not have the minimum, the way to lower it is to drive one year without an accident. It should not be too complicated if you are driving carefully and without distractions.

If you are young, there is one way to lower your bonus. You can let your parents declare the car in their name. That way, the insurance will use their bonus level for the bill. Now, there are some issues with this. First, if you have an accident, you will increase the bonus level of your parents. Second, once you want your car insurance, your bonus will be higher than if you started directly with a car in your name. I do not like this technique.

You need to know that you do not need to start new insurance with a 100% bonus. You can discuss with your insurance dealers to start with a lower bonus directly.

And if you are not the best driver in the world, the bonus protection option is a great addition. It is cheap to subscribe to. And it can save you a lot of money if you do not have more than one incident yearly.

5. Increase your deductible

With a higher deductible, you will pay less yearly for your car insurance.

If you do not use your insurance often, it could be useful for your budget to reduce the deductibles in your insurance policy.

Of course, if you increase your deductible, you must be prepared for this expense. You need to consider this when you decide on your emergency fund.

6. Put your license plates on hold

There is one good thing about the car insurance system in Switzerland. If you do not drive your car for a while, you can put your license plates on hold.

When the license plates are on hold, you are not required to pay liability insurance. It means that your insurance will have to reimburse you the amount for the months without your license plates.

Now, not all insurance providers are equal. Some will reimburse the entire insurance premiums, while some will only reimburse a portion of it. But this remains an interesting technique.

7. Change car

How much you pay for your insurance will depend heavily on your car.

First of all, they will take the value of your car into account. The more valuable your vehicle is, the more you will pay. It makes sense since you are insuring something that is of higher value.

And second, the more powerful the engine of your car, the higher your premium will be. This has to do with the environment and the incident risk.

The base price of the car is important. But the age of the vehicle is even more critical. Depreciation will be taken into account when calculating the premiums for your car.

Given these facts, you should avoid getting a car with a lot of value. If you get a cheap car or a good second-hand car, you will pay less for your car insurance.

8. Choose an environment-friendly car

Some insurance providers will offer you a discount for some highly-economical cars.

Within this category, I mean hybrid cars and electric cars. But some companies are also offering discounts on cars with low consumption or low gas emissions.

You can save a substantial amount of money by taking such a car. For instance, Helvetia is discounting its premiums by 25% for electric cars. And you will also help a little in the fight against global warming.

Which car insurance should you choose?

Choosing a car insurance policy is not an easy task. The best insurance will depend on each situation. I cannot tell you which insurance is the best for your case.

First, you must decide which level of insurance you want to take for your car. For instance, you may use only liability insurance if you have an old car. Or you may choose to go with the full coverage if you just got a new car.

Then, once you have decided on the options you want, it is time to compare the offers available to you. There are many insurance providers in Switzerland. And there is not one that is the best for every situation.

For me, the best insurance is the cheapest one for my situation. But there are a few more things I will take into account when I compare different policies:

- The starting bonus. Since I have been driving for more than ten years, I expect to directly start at the minimum bonus.

- The deductibles of the different levels. Given the same price, I would rather have lower deductibles. But if possible, I could increase my deductibles for a lower price.

- The limits of coverage. Some insurances are pretty limited in what they cover. For instance, some insurance providers will directly cover you if you drive abroad. If I have a problem, I want to be covered.

Car insurance comparators

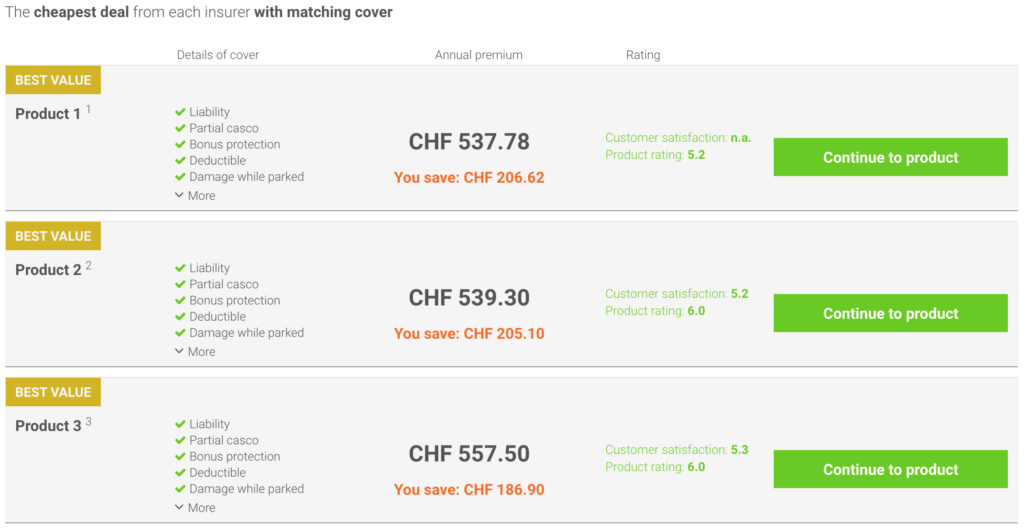

Given the massive choice of car insurance providers in Switzerland, it is better to use a comparator to find the best one.

Unfortunately, there are fewer great comparators for car insurance. It is a bit sad since the comparators for health insurance are very good. But for car insurance, this is not the case.

The best car insurance comparator, in my opinion, is the comparator from bonus.ch. They have a great choice of insurances. And their interface is pretty good. You will have to enter plenty of data before you can get an offer. But that is the case of every comparator.

The second car insurance comparator you should check out is the comparator from comparis. Usually, I like comparators from comparis. But I am not a fan of this one. For the simple reason that they do not show the insurance names directly. You have to click on each product, one by one, to get the real results. It is simply a bad design. But it also gets the job done.

So, first, you should try the comparator from bonus.ch. And if you do not like it, you should use the comparis. Of course, you can also use both to validate the results.

If you want, you can also go through an insurance broker. There are some good ones. Be careful that they may not offer you the best offer. Generally, they only work with a subset of insurance. It means they may not work with the cheapest ones available for your situation. And they are likely to try to get you extra insurance that you do not need.

Conclusion

The car insurance system in Switzerland is quite complicated. But, it is not as complicated as the health insurance system.

You need to make sure you do not take too much coverage. Most insurance will try to make you take as much coverage as possible, regardless of your situation. But in a lot of cases, you do not need full coverage. And you will likely never need occupants insurance.

And I feel like the prices for car insurance in Switzerland are fair. They are not cheap (nothing is cheap here). But they are affordable. And you have several choices you can make in what you can want to get covered or not.

And before you ask the question, I am currently with Helvetia for my car. My car is from 2013. I only kept the liability insurance on this car. At this point, my car is not worth much.

To learn more about insurance in Switzerland, you should also read about Health Insurance in Switzerland.

What about you? Which car insurance do you have? And what insurance have you taken for your car?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Personal Finance in Switzerland

- More articles about Save

- The role of the Swiss National Bank (SNB)

- The costs of daycare in Switzerland

- Household and Personal Liability Insurance

Hi Baptiste, great post as always!

I heard that there was a change in the LCA law last year which means we can cancel these 5-year policies after 3 full years of insurance. I though this could help here.

I can see that you do not recommend to lease a car and wanted to understand more about your point of view. I have a normal petrol car, considering selling and switching to a Tesla but purely from the TCO point of view. Besides lowering insurance, maintenance and petrol costs, there is a substantial positive financial impact in selling my current car, putting that money in stocks and leasing a new car at 2% interest rate. This is where the major advantage comes from.

What am I not seen?

Many thanks!

Yes, you are right this change will help in that case. I already used this to cancel an insurance last year and it’s definitely helpful.

I have since reviewed my stance on leasing: How should you finance a car in 2023?

I shoudl update this article to reflect this!

hey, my Axa adviser just got upset with me cause I found an Axa offer online reducing my cost by half! He astually refused to serve me saying he will cancel the contract but I insisted and here we are. 15y old Volvo deserves me to invest money in him, not the insurance ;)

Hi David,

I am not sure I understand. Did you find an online offer from AXA reducing your current AXA price in half? Why would he get upset if you are staying with AXA.

Unless the offer explicitly specifies new customers only, there should be no problem indeed. And even in that case, that sounds like a great basis for negotiation.

I also am having a bad experience with AXA. My insurance is up for renewal so they sent me a quote just slightly more than I had currently been paying. Quick check on the internet and online its less than half the price. No mention of only for new clients. Once you get to the end and choose AXA as your previous insurer it says you can’t complete online and an advisor will contact you. After discussing first with the online advisor and then the local agent they won’t budge on the original price. So I have no choice but to switch insurance companies. I think this is a terrible way to treat existing clients

That’s ridiculous indeed! Just for that, I would indeed cancel my insurance with them.

Hello – and thanks for this great article (and so many others which are truly a help for new arrivals like us to Switzerland)

Question: do any of the insurance companies include road service assistance (both here and when driving in the EU)?

Thanks Daniel :)

It depends on what you mean by road service assistance. Is that when your car is stranded somewhere? In that case, many of these insurances include it, yes. However, you have to be careful that several insurances have several tiers, and you often have to take the higher tier to get European coverage.

Hi MPS.

We’re planning on leaving Switzerland part way through a car insurance year and will be selling our car when we leave. Will we be able to claim back the amount we have paid upfront for the remaining part of the year when we are not actually resident nor have possession of the car?

Thank you in anticipation of your response.

Hi Grainne,

I believe you can get a refund if you deposit your license plates definitely.

Now, if you are abroad, you may have a hard time getting a refund to another country’s banks. I would recommend doing that before you leave if possible. In any case, you should deposit the license plates before you leave.

But you can contact the circulation office to get more information on that.

Thank you very much for getting back to me. I was actually asking about car insurance as opposed to the license plates though this is something I hadn’t thought of so I’m grateful for that. I will make contact with the insurance company themselves with regards to my original query. Best wishes.

Hi MPS,

Thanks for this thorough article.

A local salesperson hinted that I should check out PostFinance because they have a super aggressive pricing. I checked it out and they do come out really cheap, but strangely they do not come out in the search results of comparison websites like comparis.ch and bonus.ch. I wonder if there are other companies who don’t play the “comparison” game, but are still very cheap.

Also, another thing to consider is how organized the company is when you present a claim. Maybe it’s different here, but in Canada, not all companies honor claims with the same enthusiasm. It’s super hard to quantify and compare, but it would be awesome to be able to know which companies are not only cheap, but also regret-free.

Cheers

Hi JF,

I just did a comparison on comparis.ch for my car and I can see PostFinance as the cheapest for me. But it’s interesting that I have never seen it before. They may have added it recently. But it’s very interesting. And it is actually cheaper than my car insurance, this reminds me that I will have to change soon :)

I agree that not all insurance companies are equal when it comes to claim. I have seen several companies in action, and they are not all that great. However, it’s so difficult to get enough data on this. I can talk about my little experiences, but that’s not much value.

For everything, I have been quite happy with Helvetia, but they are not the cheapest anymore.

Thanks for stopping by!

Great site, totally up my alley, I love to think long term regardimg saving on recurring costs.

I am having the some thoughts as JF regarding claims handling. Would you say that most companies will have a straight forward approach as long a the coverage is the same?

We bought a new car, which I swore I never would do again after getting ‘had’ on a lease from Toyota Canada. Lesson learned, we bought this car in cash after saving monthly for 4 years (reverse financing :-).

The rates are 700-1200 fr. So it really comes down to Trust Pilot but if you or any other readers have some insight into whether the quality really drops with the lower prices, I’d completely appreciate it.

Rob

Hi Rob,

I have always opted for the cheapest insurance for my car and changed for each new car and never had any issue. I have not found that cheapest car insurances are worse.

Now, I have never tried fully online car insurance like smile.direct. But I do not think they would be any worse.

You also have to realize that it is unlikely to use their services. So it is better to look at the premium and deductibles and not worry too much about the customer service. In the end, they are entitled to reimburse you by the contract. But you may have to check the small letters in the contract for things that would be excluded.

Helpful !!

Thanks !!

Hi MPS,

Am I right in thinking it is the CAR that is insured in Switzerland, and not the driver? (unlike in the UK). So once you have these insurances on the car, anyone can drive it? Would that also apply to non-Swiss residents? Thanks.

Hi Sarah,

Yes, and no :)

When you take car insurance, you will still have to declare who is going to drive it. If someone else drives it frequently, it will need to be included.

In most case, if you have yourself car insurance, you should have little issues driving other people’s car. But you will still be less insured than the people owning the car.

So, yes, anyone can drive it, but only irregularly. If someone drives your car regularly, you will need to declare it.

And if yourself drive other people’s cars often, you may need to take a special insurance for driving these cars.

For non-swiss residents, I would think that the rules are the same as long as your driving license allows you to drive. But again, it will depend on how often you use the car.

Does that make sense?

Thank you! Yes, makes sense. Just talking about very occasional (even one-off) loaning of the car to visiting friends, so nothing regular. Appreciate the quick reply :-)

Hi Sarah,

Then, you should be fine! I have taken cars from my friends and family several times.

(I am no lawyer ;) )

Thanks for stopping by!

I am in the stages of searching got a car. I was thinking about a Prisus. Would you be ok with sharing with us what you drive?

Hi Robert,

To be honest, I do not know much about cars. As long as it takes me from A to B, I am fine with it.

I bought a new Hyundai i20 about 6 years ago. I am quite happy with it.

Thanks for stopping by!

good overview. The same applies to motorcycles as well, it works the same way.

For motorcycles, collision insurances is a bit more useful even on older bikes, as self-accidents are far more common than with cars.

Hi Mischa,

Thanks for sharing! I only had a scooter, never a real motorcycle! It’s good to know that this applies to it!

I guess it makes sense that it’s more interesting. But would you still take collision insurance for a 10-year-old motorcycle?

Or maybe they depreciate slower?

Thanks for stopping by!

As with everything, it’s not an easy answer. It depends on the personal and material value. If you don’t have collision insurance, you have to be prepared to lose the bike completely and not get anything at all from the Insurance. Happened to a friend of mine. So for your cheap daily ride, I’d probably go without.

I have an oldtimer bike which I have insured fully with collision. It has a high emotional value to me, so money is not the driving factor and in case of damage, I would try to fix it anyway, no matter if it was insured or not. It’s an old and low powered bike so the full insurance is only 250 CHF a year, which i think is reasonable.

I have a modern bike I bought new 3 years ago, which I also have insured fully. I might reduce that in the future. Other bike I have is a dirt bike which is only used off-road, so this one is only insured with liability as mandatory.

Depreciation is I think similar to cars, where “more premium” brands tend to hold their value a bit better and longer.

Hi Mischa,

Thanks a lot for sharing! It is very interesting.

I completely understand the emotional value and not wanting it to get destroyed!

Thanks for stopping by!

Interesting article MPS. I have an older car and I saved a lot of money by removing the full casco.

In terms of Insurance, I would also be interested to know what Life Insurance you have, if any. Its something I have only begun to think about.

Hi Gavin,

Thanks for sharing! Good to know that you were able to save a lot on your car as well!

I have one from Generali. But I have not done any good research on the subject. I cannot recommend you any life insurance.

Thanks for stopping by!