How should you finance a car in 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

We are currently considering buying a new car. So, we are faced with the question of how to finance our new car.

Should we pay it in cash? Should we use leasing, or should we take a car loan? I have researched to find out what we should do.

This article shares everything I have learned about the different ways to finance a car and which is best in what situation.

Ways to finance a car

When you want to buy a car, you have several options to finance this expense.

The first option is obviously to buy it in cash. It does not need to be physical notes. The payment is generally a bank transfer. But the car will be paid for in full before you can drive it. At this point, the vehicle belongs to you.

The second option is leasing, a popular choice for buying a new car. It is also the most complicated of all the options. Instead of paying a large amount upfront, you will pay a certain amount every month for a given period. You will be allowed to buy the car at the end of the period. Indeed, with leasing, the vehicle does not belong to you. It belongs to the bank.

The third option is to get a car loan from your bank. This form of financing is very similar to a mortgage. You may have to pay a small downpayment upfront. Then, every month, you will pay a given amount to repay the loan and pay interest to the bank. In that case, the car belongs to you as long as you pay your bills. If you default on your payments, the bank can get the car and sell it to make up their loss.

The last option to finance a car is a margin loan (a Lombard loan). This is a loan from your broker, with your portfolio as collateral. In that case, you can borrow a certain percentage of your portfolio’s value as cash and buy the car in full with this money.

So, how do we choose between these different methods? First, we must learn more about them because people ignore many things.

Buying a car with cash

Buying a car in full with cash is the simplest option to finance a car.

In that case, you need the car’s total value upfront before you can buy the car. Once the transaction is completed, the car is entirely yours. There are no conditions for insurance since the car is yours.

One advantage of paying for the car in full is that you will generally get a discount compared to paying with leasing. This discount usually ranges from 5 to 10% but may differ for each car dealer.

Buying a car with leasing

Leasing is a very popular option to finance a car these days.

The main reason for this popularity is that it allows people to buy cars they could not afford without leasing. So, many people purchase costly cars without a high income. This made leasing very unpopular in the personal finance community.

It is important to know that leasing has good conditions for new cars, but the conditions are worse for used cars. Some garages will not even offer leasing for used cars.

Leasing is more complicated than people think. First, you sometimes have to pay a downpayment upfront. This downpayment can vary highly from one leasing provider to another. Then, the leasing is generally only for a given duration, from 12 to 60 months. And finally, during the leasing, the car is not yours. At the end of the leasing contract, you can buy the car by paying the residual value. But you could also give back the car.

The monthly payments of the leasing are based on the value of the car (minus the downpayment and the residual value), the duration of the contract, and the leasing interest rate.

When buying a car in leasing, you are not getting any discount. Indeed, the car’s base price will be higher with leasing than when paying it in full.

On top of that, it is also essential to know that a leasing contract has a specific maximum number of kilometers per year. At the end of the contract, you must pay the penalty if you drove more than that amount. And these penalties can be pretty hefty.

During the leasing, you must keep full collision insurance, the most expensive car insurance in Switzerland. The leasing provider (the bank) wants its car to be protected.

The interest payments of the leasing are not deductible from your taxable income.

Finally, it is also essential to know that car insurance is more expensive for a car in leasing than for a car paid in cash. This difference is generally between 100 CHF and 500 CHF, depending on the insurance provider.

Buy a car with a loan

The third option is to finance a car with a loan, either a car loan or a margin loan. These two types of financing are very similar in how they apply to a car.

In that case, you still pay for the car in full, but you will use the money from the loan to do so. Since you have paid for the car in full, you can generally still get a discount, as if you had paid in cash. For the car dealer, it makes no difference.

Unlike leasing, the car belongs to you in full. So, you can choose the insurance you want.

Another advantage compared to leasing is that you can deduct interest payments from your taxable income. You can also deduct the debt itself from your taxable wealth.

Comparison for non-investors

Despite what I recommend on this blog, the truth is that most people do not invest their money. Therefore, they do not have an opportunity cost to use large sums of money. So, we will first compare these four methods to finance a car without opportunity cost.

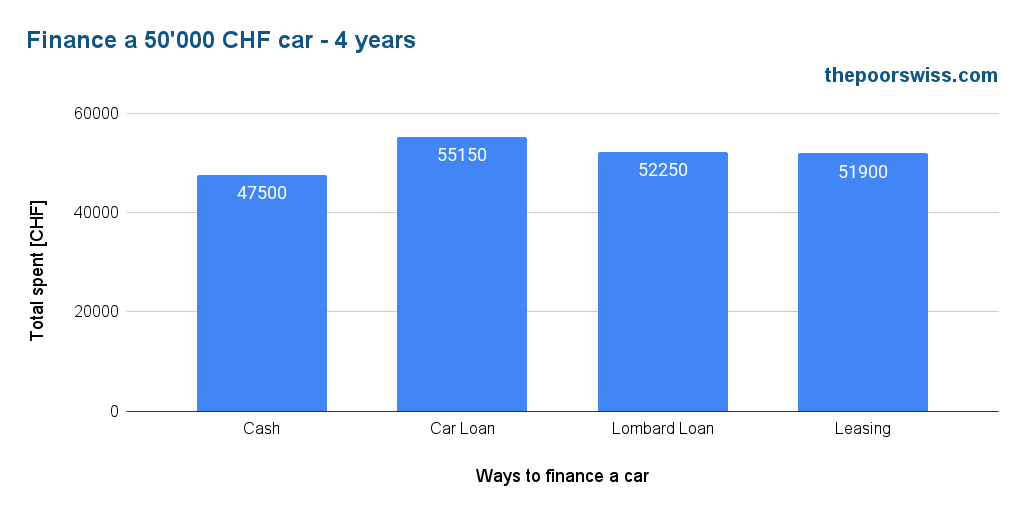

Here are the parameters for my simulation:

- The car base value is 50’000 CHF.

- The downpayment is 5’000 CHF (10%).

- Leasing costs 1% per year.

- The margin loan costs 2.50% per year.

- The car loan costs 4.50% per year.

- You get a cash discount of 5% if you do not use leasing.

- You have to pay an extra 200 CHF per year for leasing.

- The residual value of the car is 17’500 CHF.

- All loans will be made for 48 months.

I have tried to use numbers similar to what I observed in actual car dealers. You may find better deals sometimes, like 0% leasing. And downpayment and the residual value will vary highly. The actual rates are those I could observe when writing this article in March 2023. But generally, the leasing rate will be lower than the car loan rate, and margin loans will be in the middle.

So, based on these parameters, we get the following results over four years:

As expected, buying a car in full is the cheapest way to finance a car. Indeed, you get a discount, and you have no extra interest to pay, so you get the lowest price.

It is interesting to note that a car loan is the worst strategy to finance a car. The reason is that the interest rate is just too high. Margin loans and leasing have much better interest rates than car loans.

Finally, margin loans and leasing are the second best ways to finance a car under these conditions, with leasing slightly better. The margin loan is somewhat worse because of the higher interest rate. Even the price premium is insufficient to compensate for the higher interest rate.

Some people will argue that leasing is advantageous because you can also give back the car and not pay the residual value. Since you own the car in all three other cases, this is not an argument, so the residual value is yours.

Therefore, buying the car in full is the smartest option if you do not invest your money. Even a 0% leasing is worse!

In the worst case, people throw away about 7500 CHF using a car loan. And a margin loan or leasing is about 4500 CHF more expensive than buying the car in full.

So, why do so many people use leasing? There are two reasons. The first is that people do not do their research. And the second and main reason is that leasing allows people to buy cars out of their means. And people want that! It is the simple and sad truth.

Being able to buy something you cannot afford is not an advantage. It is a major risk.

Comparison for investors

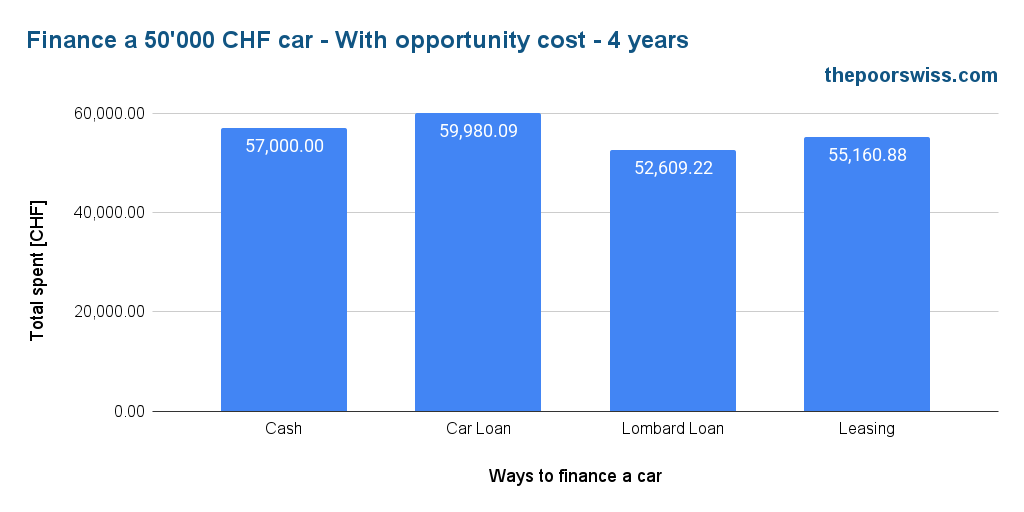

If you invest your money, a new parameter must be considered: opportunity cost. The opportunity cost is how much you lose by keeping your money out of your investments.

I expect an average of 5% per year from my investments. So, my opportunity cost will be 5% per year. So, if I spend 1000 CHF, I incur a cost of 50 CHF per year.

We can see what happens in the same simulation as before but now adding the opportunity cost:

We can see that the results are quite different when considering the opportunity cost. Before, buying a car with cash was the best option, but now it has become the second worst only.

This time, the cheapest way to finance a car is to use a margin loan. The reason is that this minimizes the opportunity cost by delaying most of the payment later on.

The Lombard loan is followed by the leasing, which has a significantly higher opportunity cost, but the costs are slightly lower, as we saw before.

Another interesting fact is that a car loan is once again the worst way to finance a car. With a car loan, the opportunity cost is slightly higher than leasing, and the general costs are significantly higher, making it a poor option. This is disappointing since this loan is specially made for cars.

Does that make a margin loan great in all cases? No! First, you need a substantial portfolio to get a 50’000 CHF loan. Then, there are significant risks when using a margin loan. And finally, a margin loan has a variable interest rate that can change daily. This can play in your favor but also mean your interest rate can increase quickly.

I would say that leasing is a slightly better option than a margin loan unless interest rates are very low and you have a very large portfolio, so your margin is low.

With a higher opportunity cost for aggressive investors, the gap between a margin loan and a leasing increase significantly.

It is also important to realize that a higher premium for not using leasing will also profit from the margin loan. So, leasing will become less attractive if you get a higher premium than 5% for buying the car in full.

Recommendations

We can base a few recommendations on these results.

If you do not have an opportunity cost, you should always fully finance a car. Doing that will be significantly cheaper than any other way to finance a car.

You should use leasing or a margin loan if you have an opportunity cost. You have to remember that the margin loan will be cheaper but riskier.

In any case, you should remember that you should only buy a car for which you could save the money in full. Leasing is not a good option if you cannot afford the vehicle. You should only buy a car within your means.

Leasing becomes less interesting if you can get a significant premium by paying in full. But leasing becomes more interesting if you cannot get a good premium. Leasing can also be limiting, while a margin loan is flexible but riskier.

Conclusion

In the past, I thought that the only way to finance a car that would make sense financially would be to finance it in full. Looking at these results, it seems I was wrong. Indeed, leasing or a margin loan may make sense to finance a car if you invest your money to reduce the opportunity cost.

At this point, I do not know exactly which method to finance a car I will use once we buy our next car in the next few years. But I know I will consider a margin loan or leasing.

And I will never say it enough: do not use leasing as an excuse to buy a car you cannot afford!

It is also important that maybe you do not need a new car. Sometimes a used car is the way to go. But used cars do not have great leasing options. In that case, cash or margin loans are probably best.

If you are interested in margin loans, you should read my article on margin loans. And you should also check Interactive Brokers because they offer excellent conditions for such loans.

What about you? How would you finance your car? Do you agree with my conclusions?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Money-Saving Tips

- More articles about Save

- How to Build a Simple Kitchen Cabinet for 30$

- The best Television plans in Switzerland for 2024

- The Best Internet Plans in Switzerland for 2024

Hey, thanks for the detailed explanation!

My 15+ years old car is about to die and I would like to buy something that can last 10+ years and it’s at least a bit funny.

I’m 23, making 90k, now expenses, and a NW of 100k with 0 debts. Does it sound silly to spend 30k for something to keep for 10+ years or until the wheel explodes?

I’m finding myself hard to find a balance between living like a broke student a enjoying material stuff

Hi Simone,

I think that spending 30% of your income on a car is a bitt silly. But of course, it will depend on the use of your car. If you use it a lot, you may want some more comfort for instance.

There is not great rule as to how much you should spend.

One good rule is to keep it for a long time indeed.

Hi Baptiste,

I am considering switching my car and this article is super useful. I am analysing the TCO across different options and I wonder if in your analysis you have taken into account:

1) the higher insurance premium forced by the Leasing option, or you just took a constant insurance cost for all the financing options?

2) I understand your analysis compares the “Total Spent” only and, unless I am wrong, that doest not take into account the fact that you will have the car worth 17.500 CHF at the end of the 4th year (in the Cash or Loan options).

If that is effectively the case, I am wondering if it would make sense to do a Cashflow analysis instead, discounting the yearly payments and including that +17.500 CHF at the end?

I might be off, but I run that exercise, and considering that positive sum of money at the end of the period (opportunity cost and tax back included) and the Loan is the wining options.

*Below the link to the spreadsheet for more details if anyone is interested in the analysis:

https://docs.google.com/spreadsheets/d/1gxKoTG4sc3BTljI-QM1aF9NX4z8KLQxnrgu3HLfUfXw/edit?usp=sharing

Hi,

1) Yes, I included 200 CHF extra for the leasing option for that case.

2) Correct, I am considering the total spent. But it does not really since I am adding a 17’500 CHF expense to leasing to buy the car at the end. So all options end up with a car with a value of 17’500 CHF.

In your spreadsheet, are you talking about a margin loan or a car loan?

In my analysis, I only took into account a normal loan given by the bank. Margin Loans are not yet for me :)

The normal Loan has a high interest rate, 4,4% vs a 2% with Leasing, and even though the yearly cost is way higher with a Loan, when I add the residual value expense at the end of the Lease (discounted it to get its present value) the NET is better for the Loan vs the Lease (reference to the spreadsheet, Cell U55 vs Cell U78 respectively).

I guess it depends on the actual residual value of the car, the higher the more convenient the Loan, the lower the more convenient the Lease. But as my parameters where very similar to yours, I though it was worth asking.

Thoughts?

Many thanks!

I am not sure I understand the logic. With a loan, you have to pay back the principal and the interets. So, you will have to pay 50’000 CHF, no?

Hi,

In you calculations, have you considered the deduction of the interest payments from the taxable income? Still a Loan ends up being the worst option?

Hi Bapt,

No, I did not not since I did not want to take several marginal tax rates into account. But it’s true that in practice this should be considered based on your marginal tax rate.

Without opportunity cost, loans will always fail.

Shouldn’t you consider depreciation of the car? And the fact that it might not be the same what the car deppreciates on the market if you self-finance it vs what the dealer takes into account for their residual value calculation?

Hi Nicolas,

I have not considered it because it is supposed to be in every case since you are left with the residual value in any case.

Now, if the residual value in leasing is not the same as the residual value for self-financing, this becomes important. However, this is very likely extremely variable from one car to another and from one car dealer to another. So, there is no way to take that into account easily into a simple simulations.

Hello Mr Poor Swiss,

What do you mean by saying: you should not buy a car that you can’t afford?

How do you compute that knowing that you have a small (absolute value) emergency fund? Are you talking about selling shares?

Thank you very much

Hi Matraca,

Good question. It’s difficult to put a definition on that. But what I meant is that you should only buy a car for which you could save the money entirely.

Already having enough shares or cash could be a definition. But just because you have 50K in cash does not mean you can afford a Tesla. I would say it’s more about income.

A person with 4000 CHF income per month and saving 500 CHF per month would need 100 months to afford a 50K car. So, this person would not be able to afford it.

Thank you for your explanation.

So it’s kind of a subjective definition where time takes an important place. Taking your example, what’s your acceptable amount of time in order to say: I can afford a 50k car ?

Thank you very much

It’s indeed very subjective. In my case, I would say that if I cannot save for the car in 2-3 years, I cannot afford it.

Be careful with leasing. There are a few pitfalls that might make you pay more. One of them is if you plan to return the car after the leasing period expires. The dealer will try to charge you a hefty price for small scratches or stains. Amounts of 10 kCHF are not unheard of. They do offer an alternative: a new lease from them. But the new lease will be more expensive, because this time you can’t shop around. Either way you lose.

If you buy with cash you can import a car which would cost a lot less. I bought a new car with 40k two years ago from Germany. The price for leasing in Switzerland was 65k or I could have got it with 60k if paying cash or with credit…

That’s a good point. If you plan to return the car, you must be extra careful.

And importing is a great way to save money. But don’t you pay more yearly taxes because they don’t recognize the energy labels?

There are no additional yearly taxes for the cars of European origins. What you might pay additionally is the CO2 tax (one time at the import). This is to be paid for the cars not older than 6 months. There are ways to avoid the CO2 tax. Find a car with Tageszulassung (registered for one day and than deregistered) which is older than 6 months. Some German dealers do it in order to be able to offer the car at a lower price. Another advantage is that you can have the car immediately and not wait for one year or so.

Thanks for sharing! I have very little experience with cars, even less wtih importing. I am going to consider that when planning our next purchase!

Heya! Thank you for the detailed analysis, as usual. I’m thinking of buying a car in the next year, and was considering loan before reading this, but now lease sounds like a better option. Being new to Switzerland, I was wondering if you can please tell me – if leasing, is it permitted to take the car outside of Switzerland for holidays (eg – for 2-3 weeks at Christmas and in Summer). Cheers!

Hi Andrei,

Yes, you can normally take the car outside of the Switzerland. You just have to be careful that your leasing allows for a given number of kilometers per year, so very long trips may impact that number.

I said normally, because the lease agreements may have fine prints that prevent you from doing that. But I think this should be rare.