5 Main Ways to Budget to save more money

| Updated: |(Disclosure: Some of the links below may be affiliate links)

There are many ways to budget for personal households. And there is no such thing as the best way to budget that will work for everybody.

Many people use many different ways to budget their life. As long as the way you choose works for you, it is enough. You just need to find the best way for yourself.

I thought it would be interesting to go over the main ways to budget for your personal finances that exist. And I also share my experience with budgeting.

What is a budget?

First, what is the definition of a budget? We focus on personal budgets, not on corporate budgets that are much more complex.

For me, a budget is a plan for revenue and expenses. A budget is made for a specific period. For personal households, a budget is generally monthly. And the goal is that your revenue for this period is higher than your expenses. That way, you can save money and live within your means.

Now, we will see that there are several ways to budget your personal finances.

1. Category-Based Budget

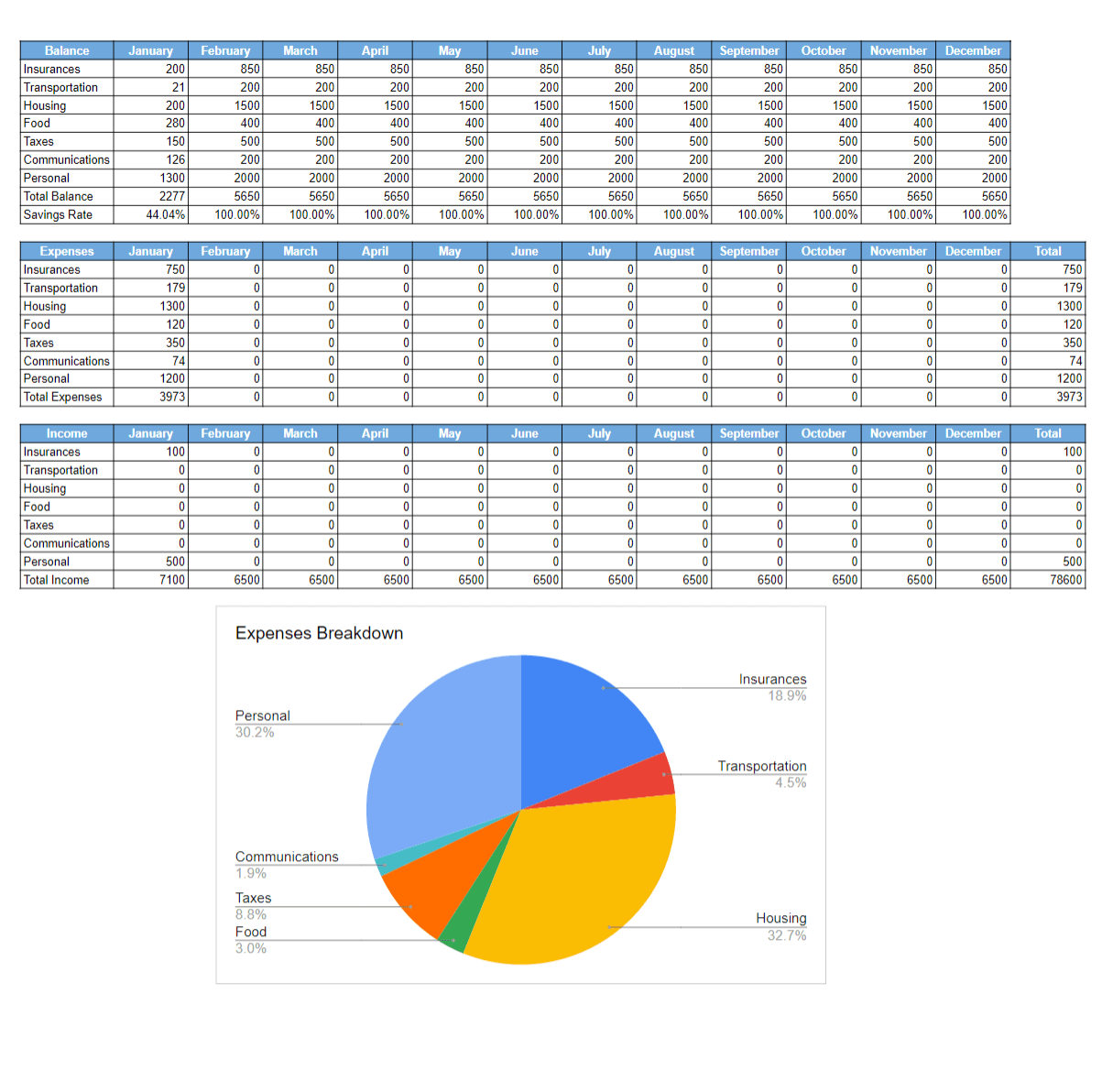

A simple Google Sheets template to start tracking your expenses and earnings and have an overview of your budget! Know your savings rate without effort!

The most common of the ways to budget is to allocate an amount to each category of your expenses.

For instance, you could spend 300 CHF per month on Food. Or you could allow yourself to spend 500 CHF per month on entertainment.

It is up to you to decide on your spending categories. For instance, here are the categories we have been using for our expenses:

- Insurances

- Taxes

- Personal

- Communications

- Food

- Apartment

- Taxes

There are no right or wrong categories for your budget. It is up to you to decide on which categories you want to budget for. I would just recommend you keep it simple. Having more than ten categories is probably too complicated. But again, it is up to you!

The tricky part is, of course, to allocate the proper amount of money to each of your categories. For this, the sum of your budget should be lower than your monthly income. If you do not have a fixed income, take the average of the last twelve months as the maximum for your budget.

On top of that, you should ideally budget for some savings. If you want to force yourself to save 10% per month, your total budget should be 90% of your income.

Setting the amount for each of your categories is then up to you. It is easier for stable categories like insurance. But it is more difficult for entertainment.

This budget technique still allows you to overspend in some of the categories. But you will see when you reach your budget. And it will be up to you to stabilize your expenses in that category over time.

2. Envelope Budget

An envelope budget is another way to budget.

It is still a category-based budget, but you will have envelopes for each category. The basic idea is to use physical envelopes with cash inside each. You will also have to allocate amounts to each of your categories.

At the beginning of the month, you will withdraw your salary in cash and fill the envelopes. With this technique, once an empty envelope, you cannot spend more for this month. At the end of the month, you can keep the cash in each of your envelopes for the next month. Or, if you prefer, you can move it to a savings account.

As with the first way to budget, you can leave some extra room. That way, you will save money every month. Saving money should be the goal of everyone who wants to get their finances in order.

Now, you can also do that without cash. I would not be comfortable with my salary in cash at home. You can do that on your budget system or budget notepad. Then the only difference is that once an envelope (a budget category) is empty, you cannot spend anything from this category until the rest of the month.

3. Zero-Based Budget

A zero-based budget (or zero-sum budget) is another form of a category-based budget. With this way of budgeting, you will allocate a purpose to each dollar you earn. The total of your budget must be equal to your income.

First, you will allocate some amount of money to all of your categories. But on top of that, you will also allocate money to your savings. For instance, you can allocate 100 dollars every month to your emergency fund. And you can also allocate 200 dollars every month to your retirement accounts.

Once you get extra income, you will update your budget to decide when the new money goes.

This way of budgeting holds you very accountable for your expenses. But it can be difficult in some situations. If your income is variable, this is almost impossible to follow. And it is not great at handling irregular expenses either. But many people find this to work well for them.

This budget has been made popular by being recommended by Dave Ramsey.

4. Anti-Budget

The Anti-Budget is probably the simplest form of budget there is. Paula Pant introduced the Anti-Budget technique.

The idea of this budget is very simple: Pay Yourself First and forget the rest. You need to set an amount you want to save every month. Once you receive your income, you set this amount in a separate account. And then, you are allowed to spend what remains in your main account.

There are two advantages to this budget:

- You are guaranteed to save money.

- It is extremely simple.

Of course, it is not perfect. One trap with this budget is that many people will be too content with saving little. If you decide to save 10% for the rest of your life regardless of your income, you will increase your expenses significantly over the years.

So, if you opt for this way of budgeting, you should adapt the amount you save regularly. If your income increase significantly, you should probably try to increase this amount.

5. No Budget

Many people can save money without a budget. However, most of these people are tracking their expenses!

Even if you do not set a limit for your groceries, you should still track the amount you spend on your groceries every month. That way, you will see if it is increasing or if something should be done to improve this budget category.

Now, not having a budget is not for everybody. Some people will overspend if they do not have a set budget for each of their categories. But if you have a good relationship with money, you may not need a budget. There is nothing wrong with not having a budget!

Tips for keeping a good budget

Regardless of how you keep a budget, here are some tips that could help you have a good budget.

Do not get too strict with yourself

Having a good budget is essential. But living a good life is very important too.

If, because of your budget, you cannot enjoy some pleasures in life, you are probably under a too strict budget. There is nothing wrong with a restaurant once in a while!

And you can also celebrate achievements from your budget. If you were always over budget before and you finally get your finances in check, you can treat yourself.

You just need to find a good balance!

Consider the big picture

When you are budgeting, you need to consider the big picture.

For instance, if you are over budget for your food category but under budget for your entertainment budget, you are still perfectly fine.

Also, if you are over budget for one month but your budget for the year is good, you do not have to worry.

You should not forget that not every month is alike. Some months, there will be emergencies or surprises. It is just life! If one month is too high, try to compensate for the next month.

Your budget is not set in stone

Regardless of which of these ways to budget, you should not set and forget your budget. Many people think that their budget can never change. But in practice, this can change.

It will depend on how you budget, of course.

If you budget to reach a specific savings rate, you need to be careful about not using that as an excuse for spending more when you get more income. It is something a lot of people are doing. They are keeping their original savings rate and increasing their expenses once their income increase.

There is nothing wrong with using some of your new income to increase your lifestyle. But if you increase your expenses at the same rate as your income, you will fall into the trap of lifestyle inflation. You should try to save a little more when increasing your income.

The other case when you need to update your budget is when your situation changes. If you have children, you will increase your expenses to a new level. If you move to another state, you will also need to consider the costs of your new place.

Review your budget

For each of these ways to budget, you should review your budget occasionally. For instance, at the end of each month, I review my expenses in detail.

You do not have to spend much time obsessing over the budget. But you should make sure it is up to date. And you should make sure you are not spending too much.

Some people only review their budget once a year, while others will need to review it weekly. How often your view your budget depends on how much control you need over your finances.

Even if your budget is in a good state, you should avoid spending money on things that you do not use, for instance. If you still have subscriptions for services you never use, now is the time to cut them.

Do use the excuse of having a good budget for not reviewing your expenses.

My experience with budgeting

When I started improving my finances, I created a budget for myself. I set several categories for my expenses.

I started with a budget in which the sum of my categories was equal to my income. And when my income was increasing, I was also increasing my budget. Initially, it was working okay, and I was still saving money.

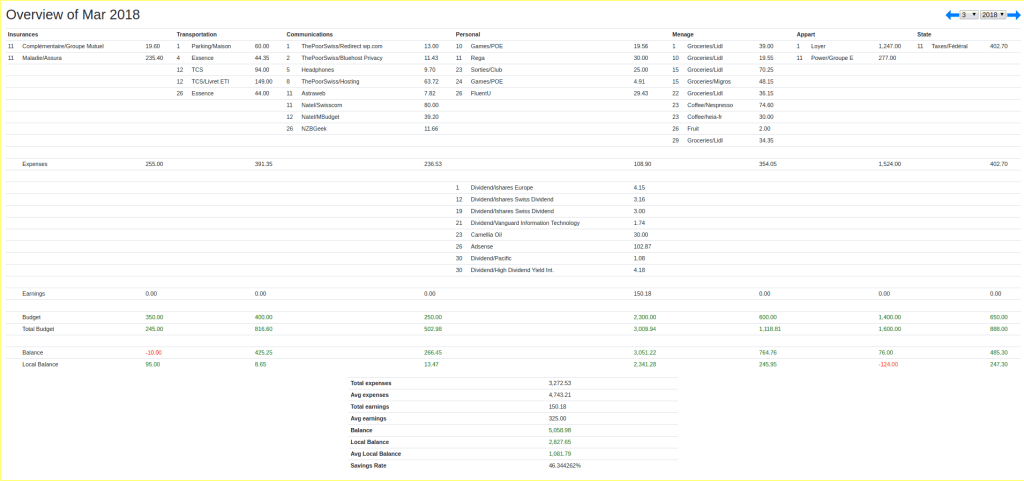

For instance, here is one of my monthly budgets:

But then, seeing the margin in my budget, I allowed myself to spend more and more. Instead of saving more when my income increased, I spent more.

After this, I realized I should not grow my budget when my income increased. It sounds simple, but it took me a while to achieve this.

After a while, I stopped budgeting. I am still tracking my expenses, and I think I will never stop. It is essential for my personal finances. To not spend too much, I keep track of my savings each month. Tracking my expense is what helps me keep them in check.

As you can see, over the years, I have used several ways to budget. I started with a simple category budget. And then, I moved to separate my savings from my budget. And finally, I ended up simply tracking my expenses and focusing on my savings rate.

Conclusion

So, you can see that there are several ways to budget. And there is no such thing as the best budgeting technique. Everybody will have a technique that works for them.

Some people need a strict budget. Others will only need to track their expenses. And some people will not even do that and will do just fine. But it is essential to consider these ways to budget and choose the one that suits you the most. Maybe your favorite one is not even on my list!

I am not telling you which budget you should use. But if you are struggling with your finances. I encourage you to start tracking your expenses and reviewing them month after month. Then, if this is not enough to improve them, you can set a budget and try to stick with it.

Over the years, people will improve the way they budget. For instance, I started with a strict budget that was close to a zero-based budget. And then, I moved towards only tracking my expenses and relying on my savings rate.

Now, if you have a budget, you will probably need a way to write it down. You should keep it simple. You probably do not need to pay for any budgeting app. For most people, a simple Google or Excel sheets will suffice. And for many people, a paper budget is more than enough!

If you are in a couple, you may want to pay special attention to your finances as a couple.

What do you think about these ways to budget? Do you have a budget?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Money-Saving Tips

- More articles about Save

- Quickly Learn Chinese Online with FluentU

- How to raise a baby frugally in Switzerland with Mama Bear Finance

- The Best Internet Plans in Switzerland for 2024