Spending less will not make you rich

| Updated: |(Disclosure: Some of the links below may be affiliate links)

I want to touch on an important subject today, the biggest lie of personal finance. You will often read success stories from people getting rich by tracking their expenses and having a budget or doing simple things.

However, these stories often miss some critical context. In practice, you will not get rich simply by spending less. You may save more money, but this is quickly limited, especially in such an expensive country as Switzerland.

So, I want to discuss the problems with this biggest lie in personal finance.

Success stories

If you are reading personal finance blogs and news, you have probably read these kinds of stories:

- 38-year-old retiree: America, stop wasting your money on these seven things – if you want to retire early

- Live by these five rules and become rich

- Our six steps to retire by 40

There are many stories like that on websites like CNBC, Forbes, and Marketwatch. But this does not mean these stories are good for the readers.

They all discuss how everybody can get rich easily by following simple rules. The simple rules or habits generally are tracking your expense, budgeting, focusing on your financial freedom, and cutting down on spending. They often suggest cutting down your daily coffee will save you so much money.

The problem is that most of these stories miss the main point: people do not retire very early by spending less – people retire very early by saving a huge portion of their income.

We have seen before that your savings rate is the driving factor for the time it will take you to retire. And there are two ways to get a very high savings rate:

- A very high income

- A very low level of expenses

Many early retirees in the United States live in a trailer or have 300K USD or more in income when they retire. Neither of those things is something that everybody can do.

So, why do these blogs and news outlets share these stories? Simply because they sell! People want to hear that things are easy and they can get rich without doing much. If you tell people that it is hard to retire at 35, they will not like it. And websites only want to write about things that make their readers happy.

Income is a crucial factor

Many people do not want to read this: Income is an essential factor in reaching financial goals.

Optimizing your expenses is excellent, no doubt about this. But you quickly reach a point where you cannot spend less without living in an RV or in the woods. Many people do not want or cannot live like that.

So, if you want to increase your savings rate without decreasing your expenses, you only have one choice: increase your income.

Unfortunately, increasing income is not as simple as reducing expenses. And some jobs indeed have more opportunities than others. That is not to say that people cannot increase their income. However, increasing income is easier in some careers than in others.

There are many ways to increase your income:

- Focus on your career

- Develop a side hustle

- Invest in bonds, stocks, or other assets

Ultimately, it mostly boils down to building your human capital and investing in income-generating assets.

Most people do not have money to save

Another problem with saying people can become rich by spending less is that most households save very little. Sure, they could cut their expenses a little, but the capacity to lower their expenses is extremely limited.

I looked at savings statistics from The Federal Statistics Office (FSO). I am using data from 2015 to 2017, the latest available for the data I am looking for.

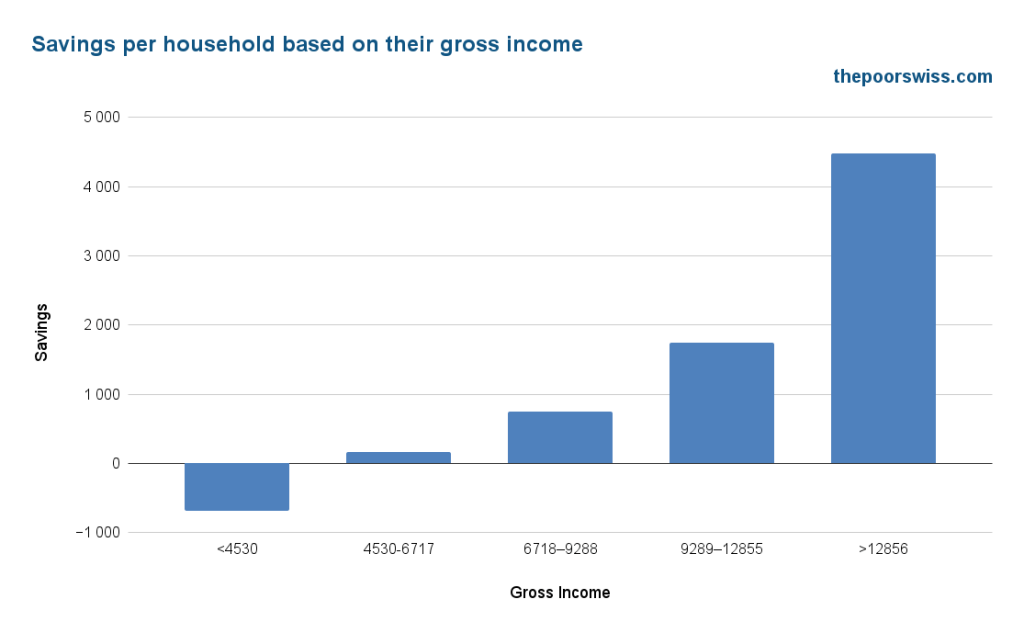

This graph shows how much each 20% of households save, based on their gross income. We can see that 20% of the population does not save money in a month. And the next 20% save less than 200 CHF per month. 60% of the households in Switzerland save less than 1000 CHF.

Asking a household with less than 4500 CHF in Switzerland to accumulate 1.5 million CHF by age 40 to retire early is unreasonable. To retire early, such a household would need to spend extremely little. They would need to spend so little that they could not live in Switzerland.

But people will argue that people are not careful with their money. And it is entirely accurate. Most people are unaware of how much they save and how much more they could save.

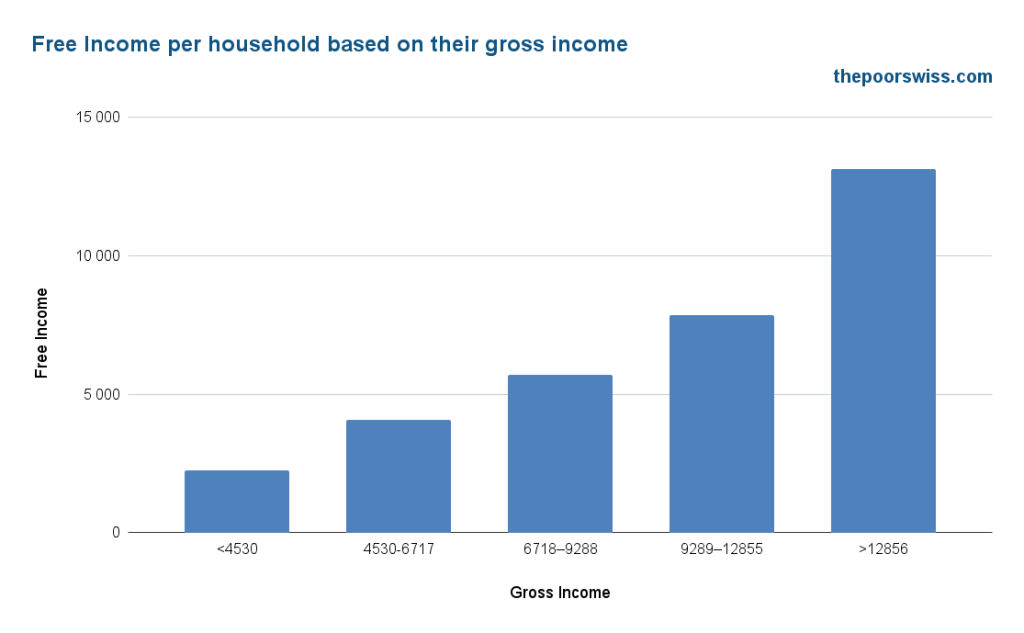

But we can look at another statistic, the free income of these same households. The free income is how much you have left after mandatory deductions, taxes, and health insurance.

We can see that most households have a significant amount of free income. But at this point, they have no places to live, nothing to eat, and nothing to wear. At the very least, you will need 1500 CHF to live in Switzerland, which is very low. We are talking about the bare minimum to survive, not live.

So, the 20% of households that earn less than 4530 CHF, with a free income of 2249 CHF on average, removing 1500 CHF to survive, would have about 750 CHF left. So, the best savings rate they could achieve is about 24%. Based on the 4% rule, this would take about 32 years to achieve “early retirement”.

And again, that is with barely surviving and not counting any insurance, health costs, no leisure, and no transportation. This is an unrealistic lifestyle.

Even the next bracket would only save about 44% by barely surviving. But if we take what they spend (based on the statistics), remove everything unnecessary, and remove 20% of that total (assuming they can save more), they would only get about a 27% savings rate.

Even doing the exercise for the third bracket would give a 32% savings rate. This is not necessarily the best they can achieve. Some people can save more than that. But again, it depends on the lifestyle you want. And we are talking here bout necessities. I have not included leisure, going out, or even communication as a necessity.

Also, I have considered that people can cut their expenses by 20%. For most households, this is already difficult.

We can take our expenses as an example. We are not big spenders but also not minimalists. Without taxes, we spend an average of 4500 CHF to 5000 CHF monthly. Considering such a lifestyle, you would need at least 10’000 CHF of net income after taxes to retire in less than 17 years. And this is with a perfect track record.

Having such an income generally means a few years of study. So, starting work at 25, having an average savings rate of 50%, would take you a retirement of around 42. It is not bad, but not early enough to be on the news. And once again, this is with consistent savings and investing over 17 years, something most people can’t achieve.

These results show that you need a significant income to become financially independent (or rich) early. And this also shows that extremely early retirement needs a very high income or surviving on nothing (living with your parents or in an RV helps).

Getting rich is pointless

It is also essential to realize that getting rich is pointless. Having a million dollars will not change your life in one day. Many people think that becoming rich is what they want. But most people can have a great life without being rich. And being rich will not make people happy.

What matters with money is that you have enough money to not worry too much about it and live the life you want.

I want to achieve financial freedom to be independent of my day job. This would bring me security. But achieving this goal will not change my life entirely.

If you are living a sad life now, becoming financially free will not make you happy suddenly. Many people have discovered after early retirement that they were happier before. And many people have burned out on their trip to financial independence because they focused too much on their end goal and not enough on their current life.

Conclusion

It is essential to realize that early retirement or getting rich is difficult. And in fact, it may not even be possible for many people. This is not great, but this is how things are.

Too many online articles perpetuate the lie that early retirement results from a few good spending habits or a good budget. But in fact, it all boils down to having a huge income, which many people will not have, or having an absurdly low level of expenses (think living in the woods), which many people would not like.

There are no secrets to becoming rich! What matters most is building your human capital and investing in income-generating assets. Reducing your expenses is less important.

I am probably guilty of making several articles too optimistic about early retirement. Please let me know if you feel like this, and I will try to amend these articles. I have never considered early retirement easy. Early retirement is simple but far from easy.

I also do not want this article to be too negative. Most people spend too much and do not realize it. Cutting your expenses will help your financial goals. Depending on your goals, it may even be enough. But do not leave income out of the equation.

The term “Biggest lie in personal finance” was coined by Nick Maggiuli, a famous blogger. I recommend reading his article on the subject if you want to know more.

What do you think about this issue?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Manage your money

- More articles about Save

- Frugality is personal – Spend based on your needs

- How to Calculate Your Net Worth Easily

- How to Budget – And my example

“Many people think that becoming rich is what they want”

This is crucial imo. The psychology behind this journey must not be underestimate.

It would be ironic reach the goal and realise that it’s not what you really needed to be happy.

Yes, exactly. Becoming rich is useless. But having the means to live the life you want and will make you happy is much more useful.

This is why I love your blog! It’s honest and not a bunch of stories that sell.

That being said, I do think most people get caught up in lifestyle inflation. I still live with a “student budget mindset” even though I graduated 7 years ago. I do treat myself here and there to things I wouldn’t have in the past, but most times I do not want /need to spend money on new clothing, fancy dinners out etc. This mindset, and of course a continual increase of income has gotten me to a current saving rate of 75%. Maybe someday my mindset will change, but I doubt it. I enjoy life, travel frequently, have fun with friends and do not feel deprived at all.

Thanks for sharing Eli! A savings rate of 75% is amazing. In our case, it would mean spend nothing since we already spend more than 25% on taxes :)

Having a low budget mindset is good if it fits the lifestyle and needs. But many people live below their means but are not happy doing that.

I moved to a low tax canton, a cheaper accomodation and got a new job with a higher income, plus do some side hustles to make my “vacation money”. But I think this works better when you don’t have kids… I’ve moved 4 times in the last 3 years.

I’m also curious to see if / how long I can keep up the savings rate (it’s somewhat of an experiment too). I think one larger expense like medical or a big trip would make the rate drop.

Yeah, moving around is best before any kids. And it depends on people, some have stronger ties to where they live. I have always lived in the same county :)

But moving to a low tax canton would make a huge difference for us.

Hi Baptiste,

Great and fair article.

I fully agree but I think good spending habits and a good budget is sane for yourself and the planet.

Thanks.

Tux.

Thanks tux!

Great article and glad to read that you are aware that accumulating money this is not the only aim in life, to be and feel happy is important above everything. We never know what the future holds, so reasoning is also part of the strategy.

Good to see you question yourself too (on the impact of your articles), this is not for everyone and shows you care for your readers. I love your blog.

Marina

Thanks for your kind words, I am glad you like it :)

I think it’s important for everyone to question oneself. And I hope my readers will question my writing if it goes too much out of target.

To me it feels you are on the right path, I pretty much identify with your blog. Your profile is also very similar to ours, small family, with a new home and 1.5 salaries to live with. We have nothing to complain. The only difference is while you know how to safe, we are crap at it, so we are trying to get better!

Thanks for sharing! And good luck for getting better at saving. Once you get a hang of it, it becomes natural!

For me, people obsessed with FIRE or saving as much as possible just found an excuse to justify how much they love accumulating money (or hate spending it).

And i personally know some of them: it’s not easy to deal with people like that.

What’s more, not enjoying your life in your best years, 25 to 45, to be financially independent doesn’t sound like a rational choice.

Just my 2 cents

Hi Andrea

It’s indeed dangerous to not enjoy the path to FIRE. Many people will never stop accumulating.

I believe we have a proper balance on our side, but we could sometimes ease off on the spending side, given our earnings.

Hi Baptiste,

You have a very good point here.

Paying attention to your expenses is an excellent basic, but you absolutely have to work on the other lever. Increase your earnings.

It took me 20 years to achieve some form of financial independence. And I worked a lot on the “increase my earnings” lever.

Thank you for this article.

Thanks Dror!

You did a great job on the earning part indeed. Growing one’s career and focusing on promotions is a very good way to reach FIRE.

Thanks for the article Baptiste. But I tend to disagree.

Looking at the broad statistics and claiming that someone can or can’t achieve certain financial goals, is not meaningful.

First of all, people tend to move across income buckets during their lifetime. And probably all of us went through <5k bucket, while we were 'poor students'. And many people will reach in their careers quite high levels of income. At different stages of life, and levels of income you need to adapt your tactics to reach your strategic goal.

In principle, it is a comprehensive optimisation problem, and if your point is that simple solutions (like minimising expenditures) don't work – then I would agree with you. Simple (oversimplified) solutions never work, especially in edge cases (like lower-income people).

Tackling a goal like FI requires an intelligent approach and not simple rules. It must be adapted to individual situations – in some cases, one needs to focus on maximising their income, in others to reduce the expenses, for most it will be a combination. And applying many different tools one can use to optimise their path (like relocation mentioned above, which is one of a dozen potential maneuvers one can do).

This is why if someone wants to pursue any major financial goal, they need to sit down, draft a plan, ideally run some scenarios and plot their path to the goal with a professional or someone experienced in finance, this exercise alone will show them the problems they are facing, and potential solutions to overcome them.

After all, if you are set on a 10-20 year journey, it is worth spending a bit of time plotting your course. This could save you a lot of time and effort. :)

Please don't take this personally, but I also thought it important to mention, since the line of reasoning you present is often used by people who look to justify why they can't achieve something, and thus not even try.

Hi T.C.,

Thanks for sharing your point of view.

There are indeed some cases where only spending less would work, but these are the exceptions, not the rule. In practice, most people would need to work on both fronts to achieve their financials.

It’s probably possible to reach any financial goal for everybody, but some people have clear advantages over others.

How can you sell FIRE products if you tell people they are never gonna be rich and never be able to retire early? It doesn’t work this way.

Btw, investing might make you some money, but most people won’t get rich out of that. Getting rich is hard work and excludes retiring early.

Hi,

That’s a good point, it’s easier to sell things when you tell people that it’s easy, but it’s making them a disservice.

I just want to say thank you for this article. It feels like a slap in the face comparing to what I usual read in any FIRE blog. I mean it in a good way, as a reality check.

Thanks, I am glad you like it, ILS!

We can take advantage of different cost of living in different countries.

E.g. 400.000 CHF is far too low for FIRE life in Switzerland, but it could be enough living in a small Greek town close to the sea where you can buy a flat for 50.000 CHF and live a decent life with 1.000 CHF/month passive income.

So life hack is: make and save money in a developed country and then get early retired in a quite developed but cheap country.

Hi Bruno,

That’s indeed a strategy that works well. But it’s not for everybody :)

Hi Bruno,

It’s an idea and it’s also a topic for many Swiss in the french area of Switzerland, but honestly, why should we have to leave our homes, families, and foundations and move to more affordable living countries just because we can not afford to retire and maintain the same standard of living here? Something is wrong. We are supposed to work for 44 plus years in Switzerland and yet we cannot keep up our own personal standards of living in our home country after all that? Never mind retiring early!