Spending less will not make you rich

| Updated: |(Disclosure: Some of the links below may be affiliate links)

I want to touch on an important subject today, the biggest lie of personal finance. You will often read success stories from people getting rich by tracking their expenses and having a budget or doing simple things.

However, these stories often miss some critical context. In practice, you will not get rich simply by spending less. You may save more money, but this is quickly limited, especially in such an expensive country as Switzerland.

So, I want to discuss the problems with this biggest lie in personal finance.

Success stories

If you are reading personal finance blogs and news, you have probably read these kinds of stories:

- 38-year-old retiree: America, stop wasting your money on these seven things – if you want to retire early

- Live by these five rules and become rich

- Our six steps to retire by 40

There are many stories like that on websites like CNBC, Forbes, and Marketwatch. But this does not mean these stories are good for the readers.

They all discuss how everybody can get rich easily by following simple rules. The simple rules or habits generally are tracking your expense, budgeting, focusing on your financial freedom, and cutting down on spending. They often suggest cutting down your daily coffee will save you so much money.

The problem is that most of these stories miss the main point: people do not retire very early by spending less – people retire very early by saving a huge portion of their income.

We have seen before that your savings rate is the driving factor for the time it will take you to retire. And there are two ways to get a very high savings rate:

- A very high income

- A very low level of expenses

Many early retirees in the United States live in a trailer or have 300K USD or more in income when they retire. Neither of those things is something that everybody can do.

So, why do these blogs and news outlets share these stories? Simply because they sell! People want to hear that things are easy and they can get rich without doing much. If you tell people that it is hard to retire at 35, they will not like it. And websites only want to write about things that make their readers happy.

Income is a crucial factor

Many people do not want to read this: Income is an essential factor in reaching financial goals.

Optimizing your expenses is excellent, no doubt about this. But you quickly reach a point where you cannot spend less without living in an RV or in the woods. Many people do not want or cannot live like that.

So, if you want to increase your savings rate without decreasing your expenses, you only have one choice: increase your income.

Unfortunately, increasing income is not as simple as reducing expenses. And some jobs indeed have more opportunities than others. That is not to say that people cannot increase their income. However, increasing income is easier in some careers than in others.

There are many ways to increase your income:

- Focus on your career

- Develop a side hustle

- Invest in bonds, stocks, or other assets

Ultimately, it mostly boils down to building your human capital and investing in income-generating assets.

Most people do not have money to save

Another problem with saying people can become rich by spending less is that most households save very little. Sure, they could cut their expenses a little, but the capacity to lower their expenses is extremely limited.

I looked at savings statistics from The Federal Statistics Office (FSO). I am using data from 2015 to 2017, the latest available for the data I am looking for.

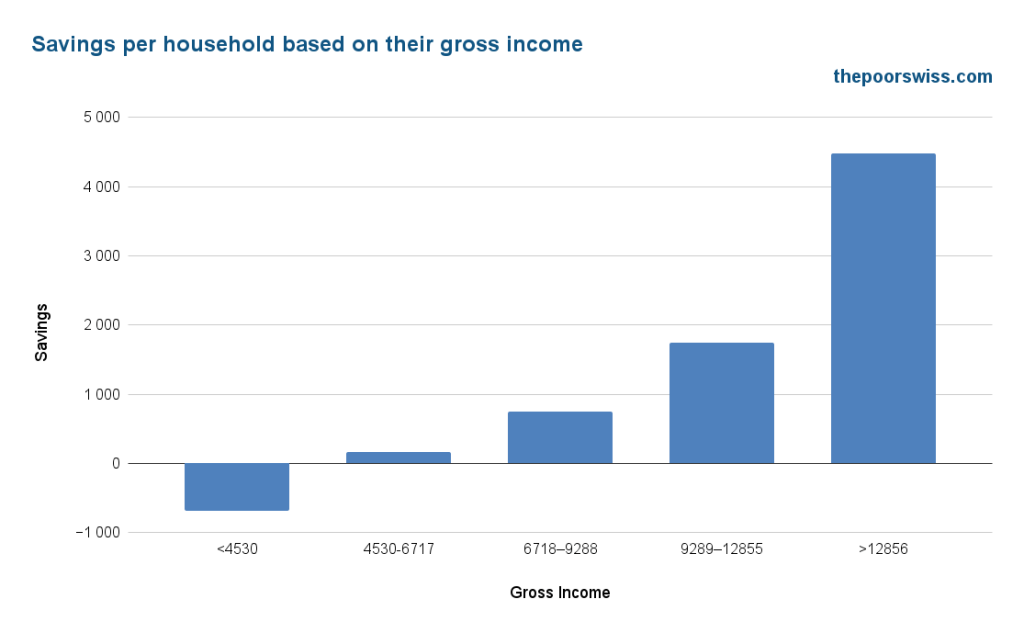

This graph shows how much each 20% of households save, based on their gross income. We can see that 20% of the population does not save money in a month. And the next 20% save less than 200 CHF per month. 60% of the households in Switzerland save less than 1000 CHF.

Asking a household with less than 4500 CHF in Switzerland to accumulate 1.5 million CHF by age 40 to retire early is unreasonable. To retire early, such a household would need to spend extremely little. They would need to spend so little that they could not live in Switzerland.

But people will argue that people are not careful with their money. And it is entirely accurate. Most people are unaware of how much they save and how much more they could save.

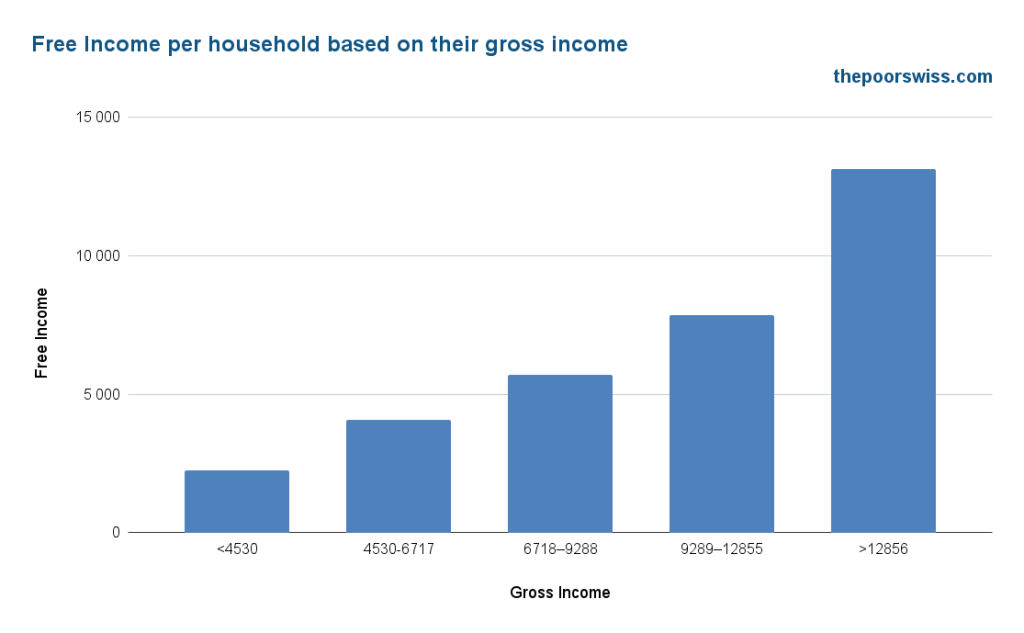

But we can look at another statistic, the free income of these same households. The free income is how much you have left after mandatory deductions, taxes, and health insurance.

We can see that most households have a significant amount of free income. But at this point, they have no places to live, nothing to eat, and nothing to wear. At the very least, you will need 1500 CHF to live in Switzerland, which is very low. We are talking about the bare minimum to survive, not live.

So, the 20% of households that earn less than 4530 CHF, with a free income of 2249 CHF on average, removing 1500 CHF to survive, would have about 750 CHF left. So, the best savings rate they could achieve is about 24%. Based on the 4% rule, this would take about 32 years to achieve “early retirement”.

And again, that is with barely surviving and not counting any insurance, health costs, no leisure, and no transportation. This is an unrealistic lifestyle.

Even the next bracket would only save about 44% by barely surviving. But if we take what they spend (based on the statistics), remove everything unnecessary, and remove 20% of that total (assuming they can save more), they would only get about a 27% savings rate.

Even doing the exercise for the third bracket would give a 32% savings rate. This is not necessarily the best they can achieve. Some people can save more than that. But again, it depends on the lifestyle you want. And we are talking here bout necessities. I have not included leisure, going out, or even communication as a necessity.

Also, I have considered that people can cut their expenses by 20%. For most households, this is already difficult.

We can take our expenses as an example. We are not big spenders but also not minimalists. Without taxes, we spend an average of 4500 CHF to 5000 CHF monthly. Considering such a lifestyle, you would need at least 10’000 CHF of net income after taxes to retire in less than 17 years. And this is with a perfect track record.

Having such an income generally means a few years of study. So, starting work at 25, having an average savings rate of 50%, would take you a retirement of around 42. It is not bad, but not early enough to be on the news. And once again, this is with consistent savings and investing over 17 years, something most people can’t achieve.

These results show that you need a significant income to become financially independent (or rich) early. And this also shows that extremely early retirement needs a very high income or surviving on nothing (living with your parents or in an RV helps).

Getting rich is pointless

It is also essential to realize that getting rich is pointless. Having a million dollars will not change your life in one day. Many people think that becoming rich is what they want. But most people can have a great life without being rich. And being rich will not make people happy.

What matters with money is that you have enough money to not worry too much about it and live the life you want.

I want to achieve financial freedom to be independent of my day job. This would bring me security. But achieving this goal will not change my life entirely.

If you are living a sad life now, becoming financially free will not make you happy suddenly. Many people have discovered after early retirement that they were happier before. And many people have burned out on their trip to financial independence because they focused too much on their end goal and not enough on their current life.

Conclusion

It is essential to realize that early retirement or getting rich is difficult. And in fact, it may not even be possible for many people. This is not great, but this is how things are.

Too many online articles perpetuate the lie that early retirement results from a few good spending habits or a good budget. But in fact, it all boils down to having a huge income, which many people will not have, or having an absurdly low level of expenses (think living in the woods), which many people would not like.

There are no secrets to becoming rich! What matters most is building your human capital and investing in income-generating assets. Reducing your expenses is less important.

I am probably guilty of making several articles too optimistic about early retirement. Please let me know if you feel like this, and I will try to amend these articles. I have never considered early retirement easy. Early retirement is simple but far from easy.

I also do not want this article to be too negative. Most people spend too much and do not realize it. Cutting your expenses will help your financial goals. Depending on your goals, it may even be enough. But do not leave income out of the equation.

The term “Biggest lie in personal finance” was coined by Nick Maggiuli, a famous blogger. I recommend reading his article on the subject if you want to know more.

What do you think about this issue?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Manage your money

- More articles about Save

- How to Tackle and Pay Off Various Forms of Debt

- 12 Tips to Protect Your Online Personal Finances in 2024

- Digital Minimalism – Book Review

I started reading your articles when I moved to Switzerland a month ago or so. Great content and I must fully agree with this particular article.

Thank you (even though I am sure this is also one of your sources of income :)

PS: You have a typo above “But you quickly reach a point where you cannot spend less without leaving in an RV or in the woods” — I believe you meant “withouth living”

Hi Mike,

Thanks, I am glad you like it. It’s indeed a secondary source of income for me, but not major yet.

Thanks for mentioning the typo, it should be fixed now!

Thank you for this article, quite interesting. I will share here some of my thoughts:

-Having too much money/passive income has the issue of isolating you from society, because 99.9%+ of people have to work. Also, it has the problem of boredom because going to a michelin restaurant or holidays is something special for most, but if you are doing this everyday then it becomes something normal and boring, this applies to all like buying new things, etc.

-For me it’s more about the freedom and not what you can buy, freedom meaning to design your life as you really want

-Being entrepreneur/self-employed working remotely with a laptop offers many possibilities. For example if you like the sea/beach you can relocate near the coast to a nice flat and live there. Is this retirement? No, still work to do but seems best of both worlds, you don’t get bored/isolated because there is work to do, and at the same time you have your dream life near the coast. I realized where you live affects your life immensely, who you can meet, activities you can do, weather, etc.

-Of course, being self-employed involves a lot more stress and responsibilities, and risks also than a fixed salary job. Yes risks are higher, but the income increase possibilities could be also higher. I started with regular corporate jobs, but after having terrible bosses and very bad experiences about the hiring/firing process I decided I would go ahead and go my own way as long as I could sustain myself, there were ups and downs but around 1.5 years later I keep going and happy with the decision

Thanks for sharing your thoughts, this is very interesting!

It’s true that doing nothing is not something that most people would enjoy! Man was not made to do nothing. I want the freedom to do what I want, but this does not mean I wan to do nothing, although I want to do less.

It’s a good point about being self-employed remotely. This gives you most of the freedom you need. Congratulations on moving to self-employed!

Great article…

We can read a lot about FIRE and early retirement and so on, but first, everyone one should ponder about their individual priorities in life.

My most valuable resource is time for myself and my loved ones and my core value is freedom.

Both would be easily to achieve with early retirement…

I worked in a large corporation for many years and retirement sounded so desirable as I didn’t love what I do…

Since I became a freelancer and really like my job, the retirement piece is less important to me.

Funny side note: I never had such a high savings (-> investment) ratio than now, while I actually only work around 9 months per year…

For sure it helps to live in a low cost, low tax country and earning a high salary in „expensive“ countries across Europe…

COVID was „great“ as it also made remote work much more accepted.

Best regards from work in Switzerland

Hi Alexander,

Well done! It’s great that going freelancer helped you achieve what is desirable to you!

There are solutions with a good job and a good life balance that will help tremendously!

“if you are living a sad life now, becoming financially free will not make you happy suddenly.”

This is quite wise, thanks for the article.

“ Life is what happens when you’re busy making other plans.” – John Lennon.

Glad you liked it!

Let’s not forget life :)

Hi Baptiste,

I fully agree with your post, getting early retired is not easy, as it is sold in a lot of FIRE blogs. But we should consider that our way of leaving/thinking in Switzerland and in others EU countries is very different from the US. So living in a trailer will not be considered here, but is an option for the US.

I agree that only focusing on reducing spending will no make you able to retire early and that your income is the biggest factors that will drive your saving rate.

But ultimately, it’s your own willingness to allocate a big portion of your income to saving and investments that will allow you to retire early.

Cheers, S

Hi S,

We indeed have different ways of living. I have no issue with people living in a trailer, as long as they are transparent with the fact that this allowed them to retire early, not skipping on their coffee :)

Good point about willingness. A strong will is very independent to reach any goal, especially for such a goal as early retirement.

the secret… is that there IS no secret

Exactly! But people don’t like reading this!

Great article. However I have a question.

You wrote that “We can see that 20% of the population does not save any money in a year. And the next 20% save less than 200 CHF per year.”

Shouldn’t this be per month?

Hi Corinne,

You are right, I will fix this, thanks for letting me know!

Hi BW,

My uncle is an excellent example of reckless spending. He was a captain of big tank ships and after a voyage of 6 months, he returned home with about $30k, which for a poor country like the ones in eastern Europe was a small fortune in the early 90s. He was spending 6 months/year on the sea and 6 months at home. But at the end of those 6 months at home, he had to borrow money from friends to survive till the next paycheck. This thought me a good lesson and had this saving and FIRE mentality even before the FIRE movement got invented.

I found your blog and started reading about FIRE just a couple of years ago but by that time I already owned a few properties which generated some passive income. Your blog convinced me to diversify and add indexes to my investment portfolio. I’m in my late 30s, don’t think I’ll manage to retire before 42 but I’m really close. I’m not a minimalist either, I’m living my life but spending my money wisely.

My 2 cents for anyone starting on this journey:

– there are some sacrifices that one has to do but they are not impossible and not that challenging

– never pay rent more than 20% of your household net income. Rent weights the most on the budget. If you are single and cannot afford the rent, share the apartment. If you are a family and cannot afford rent in the city, try to find smth cheaper outside the city

– never stay in a job for more than 3 years unless they promote you. Always learn new things try to get better at what you do and constantly apply for better-paid jobs.

– I’ve been living in Switzerland for about 8 years but most of my spending is done in Germany(food, household stuff, car services, gas, leisure activities, and so on). Some swiss ppl will hate me for this but I’m here in Switzerland just in “transit”, not planning to stay here to grow old

– bring your own food to work. You might be considered anti-social for that but not spending those 20fr on lunch and 5fr for coffee every day will save you about 5000fr/year

With those considerations in mind, we manage to save about 63% on a 12k monthly family income.

All the best,

Decebal

Hi Decebal

Thanks for sharing this story! Many people indeed need a personal example to really handle their finances properly and avoid these issues.

63% savings rate is excellent on 12k monthly! Well done.

I agree that too many people stay in the same position for too long. Switching not only helps income but also helps experience which in turns makes you more valuable.

As for the 20%, I am not sure it’s always possible for low-income families. REnting is quite expensive indeed and will limit your savings capacity. But you cannot afford not to rent in some conditions.

You can also bring your food to work and still be social. I used to bring food to work almost every day (before WFH) and I still ate with my colleagues in the company restaurant.

Hi Decebal,

I wish to add a few comments to your post, as I used to think like you when i first moved to Switzerland.

1 and 2. Spot on!

3. Compare the lower income places (lidl, denner and always look for savings). I can no longer justify shopping in germany unless its once every quarter for cleaning solutions. Everything else is either cheaper or the same in Zurich. If I factor in a loss of a day travelling as well as the gas prices, it simply doesnt make sense. It does make sense in the case that you live either very near or on the boarder.

4. You can deduct a lot of it from taxes.

Hello Baptiste, Thank you for this article.

I agree with you, we have to take advantage of all the elements of the equation. (income, economy, and investment)

The focus is too often on savings.

For my part, I focused on income. For the savings part, we didn’t live on a budget but more on a philosophy.

The material brings us only ephemeral joys. We didn’t align our expenses with our earnings.

A good salary, coupled with these principles allowed us to save, to reinvest quickly. And to finally reach financial independence around the age of 43.

And you’re right, it’s good to have goals but we shouldn’t tie them to our happiness.

Our happiness is now.

Hi Dror,

Thanks for sharing!

Great idea to focus on things that bring true joy, not the 5 minutes of unpacking joy of a toy :)

As my father told me recently, this is not a dress rehearsal, this is life! We can definitely get caught up in trying to achieve goals for later in life, while forgetting that your life is passing by right now. Good to save, but good to enjoy life at the same time. I think cutting down on expenses and tracking how much you should be able to save is a must if you want to be able to save consistently, but you definitely can’t rely on just that. And if you want the big bucks, it often requires a poor work/life balance or a job with a lot of stress and responsibility that can consume your life. As usual in life, i think somewhere in the middle is fine for most – earn as much as you can without stressing yourself out and that you can still enjoy your life while saving for later. Good article.

Hi Daniel,

That’s an excellent point, the middle ground is likely ideal. Spending less than what we earn is necessary, but that should not be a huge priority indeed.

And we should enjoy the journey, not only the goal. The goal in itself will not instantly change everything.