Revolut Review in Switzerland 2024: Pros & Cons

| Updated: |(Disclosure: Some of the links below may be affiliate links)

A major issue with many payment cards is their tendency to impose high fees on foreign currency transactions. For instance, if your currency is Swiss Francs and you make a purchase in dollars, you’ll be required to pay a certain percentage of the transaction cost. Often, card issuers charge over 2% in fees for such transactions. Fortunately, Revolut offers a solution to this problem.

Saving money on foreign transaction fees is made easy with Revolut. Unlike banks that typically offer unfavorable exchange rates, Revolut provides you with the best available exchange rates. If you frequently purchase items in other currencies or from different countries, having a Revolut card is essential to keep your expenses in check.

On top of that, Revolut has many other services.

| Monthly fee | 0 CHF |

|---|---|

| Users | 15’000’000 |

| Card | Mastercard prepaid |

| Currencies | CHF and more than 20 |

| Currency exchange fee | Free for small amounts, then 1.0% and weekend 1% |

| Top-up CHF | Free with Swiss IBAN |

| Languages | English, French, German, and Italian |

| Other features | Stocks, cryptos, … |

| Depositor protection | 0 CHF |

| Established | 2015 |

| Headquarters | London, United Kingdom |

Revolut

Revolut is a company from the United Kingdom. They are pretty young. They started in 2015. They offer a prepaid debit card. Except in a few cases, there is little difference between both (unless you want to go into debt).

With Revolut, both MasterCard and Visa are available. They are almost the same for most usages. You can use it online and even withdraw money at an ATM. They offer two types of cards:

- Virtual Debit Card: You can generate it in your Revolut account. You can use it online with its number.

- Physical Card: You can order a physical debit card for a small fee.

But the interesting thing about Revolut is that foreign exchange transactions are cheap! There are no foreign exchange fees. However, while Revolut used to provide the interbank exchange rate, they do not anymore. Since 2023, they have provided the Revolut Exchange Rate, which means nothing, except that they can now add their own surcharge.

So, foreign exchange transactions with Revolut are not free anymore. On average, users are reporting about 0.4% surcharge.

This surcharge is still better than many banks. But there are some interesting alternatives at this level.

It is entirely worth having a new card for these savings. Moreover, since my employer’s headquarters is in the United States, I may travel more than usual, which means I will save even more money.

Since its inception, Revolut started offering many new features:

- Support for cryptocurrencies directly from the application.

- Insurance on some of your purchases

- Premium And Metal plan for users that need even more features

- Saving vaults for your money with saving goals

In 2019, Revolut got a European Specialised Bank License! It is a big deal for the company. They operate as banks in EU countries but not yet in Switzerland. When operating as a bank, your deposits are protected by the European Deposit Insurance Scheme (EDIS) up to 100’000 EUR.

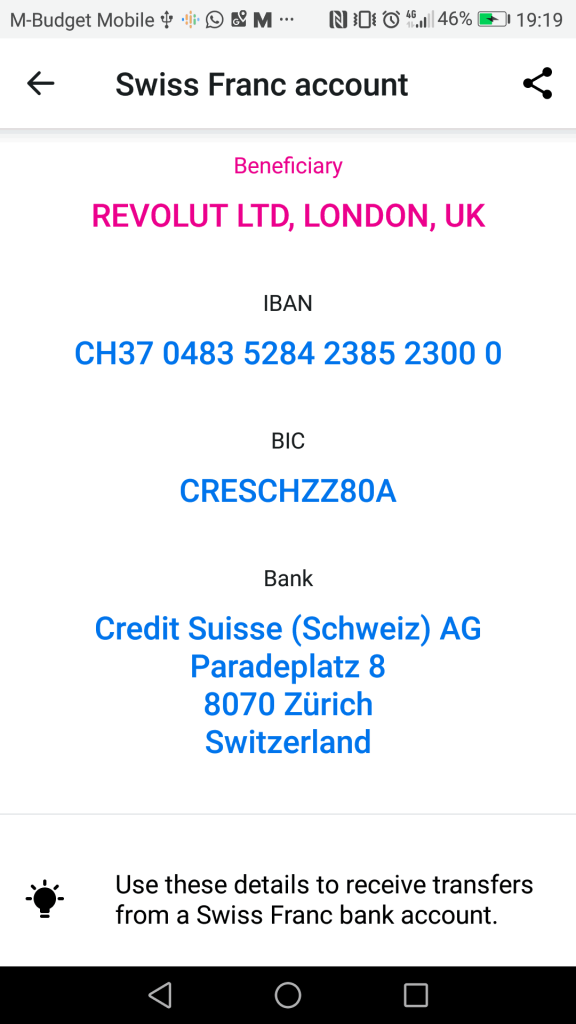

At the same time, Revolut obtained a Swiss IBAN. This is an essential point for Swiss users since it allows them to easily top up their accounts for free.

If you plan to use Revolut to save money on foreign fees, you will be okay with the free Standard plan! You can always upgrade to another plan later.

Sign up for Revolut

Now you are ready to sign up for Revolut. You have to install the application on your smartphone. There is no way around it. It is excellent for most people. But for people like me who dislike phones, it is not perfect. But I guess I have to live with mobile apps now!

Nevertheless, it is pretty straightforward. You can go to the Revolut website to get a direct link to the application to download. You can also search for Revolut in your phone application store (Google Play or App Store).

Once you have installed the application, you can go through the registration process. You will have to enter standard information about yourself. You will also have to scan your ID. At some point, you will have to top up Revolut for authentication. You can use your Wise card now to top it up. And this will be free!

Once you have done this, you can start using a virtual card or order a physical card. You must pay 6.99 CHF for the delivery if you order a physical card. It should be the only time you pay anything to Revolut. My card arrived quite quickly, four working days, I think.

How to Top Up Revolut for Free

Since the Revolut card is a prepaid debit card, you must top it up. You cannot use it if you do not have any money on your card. You have several choices to top it up:

- A debit card: Expensive!

- A credit card issued in your country: Expensive!

- Another credit card: Expensive!

- A bank transfer: Generally free!

You should only use free options to top up your account. Anything else does not make sense. There is no point in spending more money than what you will save on foreign exchange fees.

Top Up Revolut with Swiss IBAN

You can directly transfer money to your bank account.

Revolut offers a Swiss IBAN in Swiss francs. You can transfer money directly from your Swiss bank account into Revolut. And this is a real CH IBAN from a Swiss bank! You will not pay any fee for the transfer!

Revolut offers bank accounts for most European countries, making it straightforward to transfer money from most countries.

You can now transfer money for free to your Revolut account directly from your bank account. You only need to wire money from one account to another to top up your account.

To do this, go into the app and click on Add Money (The big button is like a plus sign). Then, you can select “Transfer to your Revolut account”. They will give you all the information necessary for a bank transfer to their account. Be careful when you enter the reference number because this is how they will identify you.

Once you have sent the payment, the money usually takes one working day to appear in your account.

Detailed Revolut Fees

I said foreign transactions are cheap with Revolut. Unfortunately, this is not always true, even with Revolut. There are a few details that are important to know.

First, not all currencies are treated equally by Revolut. There is a 1% fee for Thai Baht, Russian Rubbles, and Ukrainian Hryvnia, while all other currencies are free.

However, there is a monthly limit of 1000 GBP for free transactions. It is equivalent to 1000 GBP (1250 CHF) for other currencies. You will pay a 1.0% fee if you exchange more than this.

Also, the rates are different during the weekend. Revolut will charge a 1.0% extra fee on each exchange transaction during the weekend. You can find more details on the official Revolut price explanation.

In the best case, an exchange costs about 0.40% with Revolut. In the worst case, it can be expensive, with a 2.5% fee. You need to be careful when doing your exchanges during the week. Be aware that some currencies will charge you more. And you should avoid using Revolut for large transfers as well!

Also, it is worth restating that Revolut no longer offers interbank exchange rates.

Alternatives

We can quickly compare Revolut with some alternatives.

Revolut vs Neon

All the services you need to pay, save and invest, in a neat package, with extremely good prices!

Use the poorswiss code to receive 10CHF!

- Pay abroad for free

- Invest with great fees

In Switzerland, Neon is a big contender to Revolut.

Since Neon deposits money in a bank in your name, the money is insured for up to 100’000 CHF under Swiss depositor protection. Revolut has a banking license but does not operate (yet) as a bank in Switzerland. So, your money is safer with Neon.

When you pay with the card, all currency exchanges are cheap with Neon. Revolut has some limits on cheap exchanges. However, Neon uses the Mastercard exchange rate, which is about 0.4% worse than the interbank rate. Revolut provides the so-called Revolut Exchange Rate, which is also about 0.4% more expensive than the interbank rate. The Revolut Exchange Rate is less transparent than the Mastercard Exchange Rate.

Also, bank transfers in other currencies are not free with Neon. These transfers are generally cheaper with Revolut.

Revolut is a multi-currency account. Neon only lets you hold Swiss Francs.

As for reputation, Revolut has a poor reputation with many issues. Neon is currently free of controversies and has a good reputation in Switzerland.

Since I started using Neon, I have not used my Revolut account. I much prefer Neon over Revolut for their safety and professionalism. Neon is now as cheap as Revolut.

To learn more, read my comparison of Neon vs Revolut.

Revolut vs Wise

Wise is probably Revolut’s biggest competitor.

Revolut and Wise are digital bank accounts focusing on currency exchanges at a fair price.

Overall, Wise has a much better reputation. Many controversies tarnished Revolut reputation.

Both services are on the same price level.

- Wise has fees on each currency conversion, which is very transparent.

- Revolut has a surcharge of 0.40%, which is not transparent and not visible in the app.

- Revolut has free conversions for up to 1250 CHF per month.

- Wise prices are simpler than Revolut fees. Indeed, Revolut has different fees during the week and weekend. Revolut also has different fees for different currencies (called exotic prices).

While Wise focuses on its core business, Revolut tries to do everything from its app. Indeed, Revolut offers crypto, stocks, and commodities from within the app. You can even book stays using the app. I do not see this as an advantage. I prefer having a few apps doing a good thing than a single app trying to do everything.

I should also mention that Wise has been profitable for a while Revolut only had a single profitable year since its creation.

Overall, I prefer Wise over Revolut for its reputation and for not trying to do too much. But both apps are interesting. Since the latest changes in 2023, Revolut is no longer cheaper than Wise.

For more information, you can read my detailed comparison of Revolut vs Wise.

Revolut vs N26

Of the main competitors of Revolut in Europe is N26.

Both Revolut and N26 are digital bank accounts. Both have a bank license, but Revolut has not yet implemented it. So, N26 has a slight advantage in terms of regulations and safety.

Interestingly, both companies have a poor reputation, which has generated several significant controversies.

N26 is cheaper than Revolut since all primary services are free. Indeed, payments in other currencies are always free with N26. However, Revolut has some substantial limitations. Also, N26 allows you to withdraw EUR for free in your country five times a month, while Revolut only allows 200 EUR per month.

When it comes to Switzerland, N26 has very poor support of Switzerland. Indeed, they have no Swiss IBAN. So you have to deposit EUR into your account, which is inconvenient for people.

Also, N26 does not support CHF in the app. This means that you cannot have a balance in CHF and that any payment in CHF will go through a currency conversion with the card provider, which is not free.

So, N26 is probably better in Europe, but Revolut is much better in Switzerland.

To learn more about these two, read my detailed comparison of N26 and Revolut. Or, you can read my review of N26.

FAQ

Is Revolut a bank?

Revolut has a digital banking license, that makes it a digital bank. However, since they got that license after getting started, many of their accounts are not under the license.

Is Revolut free?

It depends on how you use it. There are limits under which it is free. For instance, you can convert 1250 CHF per month for free, during weekdays, but you would have to pay a fee during the weekend. So, make sure you check their fee schedule in advance.

Who is Revolut good for?

Revolut is good for people that want to use this card to travel and pay relatively low fees abroad and in foreign currencies. These people should not hold too much money on their accounts.

Who is Revolut not good for?

Revolut is not good as primary bank account. It is not good if you a transparent exchange rate or want to hold a lot of money on your account.

Revolut Summary

Revolut offers a debit card without any fees for currency exchange. On top of that main feature, they have plenty of advanced features such as stock trading, cryptocurrencies and sub-accounts.

Product Brand: Revolut

3

Revolut Pros

Let's summarize the main advantages of Revolut:

- Cheap currency exchanges during the week.

- Can hold many currencies in the account.

- Very fast transfers to other users.

- Fast transfers to other bank accounts.

Revolut Cons

Let's summarize the main disadvantages of Revolut:

- Very poor transparency on exchange rates

- Expensive during the weekends.

- Free exchanges are limited to 1250 CHF per month.

- Expensive for some exotic currencies.

- Revolut has a poor reputation.

- There are reports of many people getting their accounts blocked and losing access to their money.

Conclusion

I like using a travel card. It is free and saves me a lot of money each year. Every time I travel to another country, I use my travel card to pay for everything! I have never had any issue getting it accepted anywhere.

I am also using it to pay online on foreign websites. For instance, I often have to pay in EUR or USD if I order something on eBay. With my Revolut, the conversion is free at an excellent exchange rate!

A travel card is a perfect companion to your local payment card.

However, many people had issues with Revolut and got their accounts blocked without proper communication. There are also many negative online reviews about Revolut. So, you should still be careful not to trust Revolut with too much money.

I never had a lot of money in my account. My rule is not to have more than 500 CHF on my Revolut account.

All the services you need to pay, save and invest, in a neat package, with extremely good prices!

Use the poorswiss code to receive 10CHF!

- Pay abroad for free

- Invest with great fees

If you do not want to trust your money with a foreign bank, you could use Neon bank for your purchases abroad. They also have free transactions in foreign currencies and abroad. This means you can have the advantages of Revolut with the benefits of a local bank. For more details about how I use cards, read about my entire payment card strategy.

Although I still have my Revolut card, I mainly use my Neon card now. It is more practical, more transparent and about the same level of fees.

Finally, if you do not know what to choose between Revolut and Wise, I have written an entire article about Revolut vs Wise.

Have you ever tried a Revolut card? Which payment card do you use?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best banks

- More articles about Save

- Radicant Review 2024 – Pros & Cons

- Interview of Julius Kirscheneder, Founder of The Neon Bank

- Neon Bank Review 2024: The Best Swiss Digital Bank

Revolut now has a swiss IBAN with Credit Suisse, my experiences:

Advantages:

1. Transparent and competitive pricing for FX transactions (at interbank rates)

2. Up to 200£ equivalent free ATM withdrawals worldwide each month (free version)

3. Immediate push notifications for all transactions incl. rates etc.

4. Multiple currency accounts for free and free exchange up to certain amount (6000£ equivalent each month)

5. Flexible security options in App (e.g. NFC, limits, etc.)

Disadvantages:

1. Surcharge on FX rates at weekends

2. Not yet covered under deposit insurance in EU

3. Delivery cost for card

Hi Hans,

Very good points you are making here!

I am not sure 200 GBP free withdrawal really makes a difference though. It is very little. The use as a payment card is much more interesting for me.

I agree that they could send the card for free. And that the price during the weekends is pretty bad.

Thanks for stopping by!

Any reason to not use the TransferWise card and not bother with revolut at all

Hi Saurabh,

Yes, there is one main reason, TransferWise is not free! You pay around 0.30% on each currency conversion. Revolut is 0% and therefore better ;)

Thanks for stopping by :)

From December 2018 Revolut has a Swiss IBAN to top up. After the bank transfer it takes up to 2 working days to get your money on Revolut account.

Hi Roman,

Yes, I have seen that :) It’s really good news! I have a post scheduled about that :) They also got an European Banking License.

Thanks for stopping by :)

Hey Roman,

do you have a link for that (long overdue, and long-awaited) info? I couldn’t find it on their site, nor on their community.

Anywho, I created my Revolut account and I now I just need to decide which card should I request (MasterCard vs Maestro. I think I’ll go with the MasterCard.

I’ve created a Revolut account but did not request the card right away since I first needed to set up my TransferWise account.

After a couple of days, I’ve received a promotion offer from Revolut to order the card for free if I do it within a certain number of days. Not sure if this will always work, but it’s might be worth to try.

Hi Gingo,

Wow, that’s lucky for you! I did not know about this. But it may be worth it indeed to wait a few days for this!

Well done!

Thanks for stopping by :)

Hi

Oh no. I hope it wasn’t me who drew attention to your profile. I hope you still get a few months of fee free transactions before they fix the bug ;)

Sorry for causing any troubles.

Always grateful for the thorough research you do for the community!

Thanks 😊

Hi,

No problem, I drew attention upon myself by asking on Twitter ;)

For now, it is still free. I will see how long it last. I will switch to bank transfer once it is not free anymore.

I am glad to be useful :)

All the best

Hi,

I tried the TW website too, and it appears that they’re charging fees there as well. Is it possible they made these unfortunate changes recently and now you can’t top up using the Cumulus card without being charged a fee?

The bank transfer option works for me. It’s just a little more convenient to do the topup via a credit card.

Hi RB,

I don’t understand. I just went to the TW website and charging by credit card is still free for me.

They could have changed the prices for new users or they are rolling out a new update on the price and it still didn’t touch my account. I’m going to ask on Twitter what’s going on.

Are you trying to charge CHF ?

Yes, bank transfer should always be free but it’s really less convenient indeed.

Hi RB,

I got an answer from TW. They confirmed that your case is the normal case. Everybody should pay fees for topping with a card. And apparently, they don’t know why I can top up for free on my account. It must be a bug or something :s That means, I’ll probably start paying a fee very soon.

I’m sorry about the mixup in the article. I was basing my information on my account. I will update the article to reflect this new information soon.

Thanks :)

I received the TransferWise Debit Card (in my case it took almost ~2 weeks after ordering it). That being said, it was free :)

Almost immediately after I got the debit card, I tried out to transfer fund from TransferWise to Revolut! That worked nicely, without additional fees. This is indeed a nice workaround, but I do hope that Revolut will soon provide a CHF IBAN with a Swiss Bank. I read on their blog that they’re working on it, but they’ve been saying that for a while. Assuming it will come one day, fingers crossed that TransferWise is not going to change their pricing policy during that time.

I’m interested in hearing how you top up your TransferWise using your Cumulus Credit Card without fees? When I try to do that, the standard fees for Credit Cards appear (2.60 for 200CHF).

Hello RB,

I’m glad you received your TransferWise card without any issue, although there was some delay ;)

I’t s a great workaround indeed, but as you said it would be better if we could directly do it on Revolut. We have to hope it stays the same for now with TW. If they make it not free, we’ll have to find another solution.

I don’t do anything special to charge it with my Cumulus credit card. One thing I noticed though is that it’s free from the TW website. But there are fees from the TW mobile application. It’s totally dumb… They almost got me when I tried to do it from the mobile application. Did you try the web application or the mobile one?

Thanks for stopping by :)

Thanks for your article. I ordered a Revolut card recently and topped it up using bank transfer. My bank is with Postfinance and I transferred 200CHF to their CHF IBAN. The money arrived 2 days later, but to my surprise, a horrendous fee was charged – only 194 CHF arrived in the Revolut account! That’s 6 CHF for 200 CHF, i.e., 3%, which is way worse than the fees of any major credit cards.

I must have done something wrong. I can’t imagine they’d charge that much. I’m trying to get in touch with their support team, but I got a message saying that they’re extremely busy and I should expect an agent to get in touch with me in one (!) day! I have to say, so far my experience with them hasn’t been that great.

I was trying to do the shortcut and not go via TransferWise. I think I’ll give it a last shot and open a TransferWise account and use the approach described in this article. If that works – great! If not, I’ll stick with my Cumulus Mastercard.

Thanks for all your insights. It’s been really helpful.

Hi RB,

Sorry about your bad experience with Revolut!

I never tried with their CHF IBAN since it’s not from a Swiss bank and therefore not free transfers. In fact, I wouldn’t really be surprised by the 3% transfer fee. This is very high, but fees between banks are often that high between countries unfortunately.

Let me know if you are able to do the TransferWise way. For me it works great. I transfer money to my TW account with my Cumulus credit card and then transfer it again to Revolut. All without any charges. I’ve used my Revolut card online and also in two countries these days and I haven’t had any issue either for topping or for withdrawing.

I hope your issue will be fixed!

Thanks for the insightful article!

I live in Austria and currently have three “free” credit cards, i.e., I pay no monthly maintenance fee. Indeed, all three cards charge FX commission on payments when I pay with them abroad.

Both Revolut and Transferwise still seem to have significant disadvantages for me: I need to prepay to have the desired spending power (which I could) and I would add quite some complexity to my financial setup. Living and working almost entirely in Euro-countries, the benefit of not having to pay FX commissions seems minimal.

So, to make such a card really interesting for me (product developers at Revolut and Transferwise, listen ;-) I’d love to see a true credit card which can be settled monthly with a direct debit from my existing checking account. A loyalty program on top of this would be nice to have too! Having this, I would switch and cancel two other cards immediately.

Thanks and cheers

MFF

I’ve been able to send money to my Revolut by transfer from my bank account. Simply select “Fees borne by beneficiary” and transfer to the Revolut CHF account.

They do have a CHF account, just not in Switzerland. Note, it took about 1.5 – 2 days for the money to arrive in Revolut.

Hi Derek, this is good to hear :)

Unfortunately, my bank does not have no such option.

Yes, you are right. I was not very clear in the article. They do have a CHF IBAN but not a CH IBAN ;)

Thanks for sharing your experience :)