March 2018 Update – Excellent month

| Updated: |(Disclosure: Some of the links below may be affiliate links)

It is now time to make the point about March 2018. Compared to the very poor February month, March 2018 is a great month :)

Not a lot of things happened this month. But that is not bad. I like quiet months. And I saved a large part of my income this month. This is great after a bad month.

March 2018

In March 2018, I managed to save 46.57% of my income :) This is my best savings rate ever!

With only 3258.94 CHF of expenses, this is also a very low expense month :)

Here is the breakdown of these expenses:

- Insurances: 255 CHF: Average

- Transportation: 391.37 CHF: Above average. I had to pay the TCS insurance.

- Communications: 223.18 CHF: Well above Average. I had to pay for the hosting of the blog. I also had to pay for several internet fees.

- Personal: 108.44 CHF: Much below average, almost did not spend anything on me

- Food: 353.85 CHF: Average.

- Apartment: 1524 CHF: Above average. I had to pay the power bill. On a better note, it is now the first month with my reduced rent!

- Taxes: 402.70 CHF: Below Average. Only had to pay the federal taxes this month.

I do not think I can stay this low next month. But I will try!

I am still wondering whether I should keep my TCS insurance. I have the full world cover for car issues, and travel cancellation insurance. It is not a lot of money, but I am not sure it is really worth.

Earlier this month, I computed my Financial Independence (FI) Ratio. With the results of this month, my FI ratio went from 3.5% to 3.67%. Nothing spectacular, but still an increase :)

I invested 2’000 CHF more in my broker account and 1’000 CHF in my third pillar account. Since the stock market did pretty poorly, my net worth did not increase much. It is now standing at 56’288.12 CHF. I am still thinking of simplifying my portfolio. But this is not a good time to sell any ETF now.

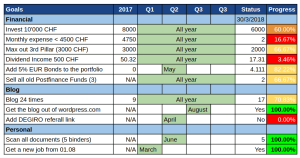

2018 Goals

Let’s take a look at the status of my goals:

I have invested 60% of my goal, and my third pillar account is almost fully maxed out. That is pretty good. I also managed to stay under 4500 CHF in expenses this month. I did not change my bond allocation, and my last remaining PostFinance fund is still not sellable. I received quite a few dividends this month. But I’m still well below my goal. I think I will not meet this one this year. I posted many posts this month, including an extensive review of DEGIRO.

I am on track to blog more than 24 times this year. I have a few ideas for posts this month as well! My personal goals were already reached last month.

Next Month

Normally, April should be pretty good as well, but not as good as this.

I wanted to buy a few home automation devices for my hobby as my birthday gifts. I have waited for more than a year now to buy them and it should not account for a lot of money. Instead, I will need to buy wedding rings. Since I have greatly underestimated the price, I can not buy both the rings and my devices. I will delay my hobby for a few more months (now undefined time).

What about you? How were your finances in March?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Dear Mr. TPS,

I have a practical question.

In our modern world whatever we do online, we are asked to provide login and password. I’ve noticed that sometimes it takes even A4 page of notes with new logins a year! And I see that this trend is increasing since there are always more and more services available online.

Do you have any practical tips regarding storing and managing logins/passwords?

Regards,

Hi Mr. TPP,

That’s an excellent question. I have an article about protecting your online services.

My strategy is to use LastPass with a very strong master password and a hardware Yubikey. I have a few passwords that are not in LastPass: all my work passwords, my bank passwords and my Google password (and obviously, my LastPass password).

Thanks for stopping by!

Great article,

Thank you

It’s a nice feeling getting a good month after a bad one but what’s important is the overall progress and it seems like you are doing just fine.

Thanks :)

I agree that I should probably consider at least the YTD savings rate more closely than the monthly savings rate :) I also should consider Quarterly Savings rate as well.

Thanks for dropping by.

Congrats on that impressive savings rate. Saving almost half of your income is something we should all strive for. Keep feeding your investments as you have been doing in March. No sense in feeling bad about your net worth not increasing much. As you know the stock market fluctuations can make your net worth vary a lot from month to month. As long as you keep those savings high and passive income growing you should be fine. Thanks for sharing.

Thanks DivHut! I agree, I should not feel bad with these fluctuations, but I’d rather see my net worth go up more. Thanks for stopping by.

Nice saving rate! Aim for the stars and try to catch this 50% saving rate ;) Keep up the good work!

Hi Mr Road To Fire,

Thanks. I’m definitely going to be aiming for that elusive 50%!

Thanks for stopping by :)

ohh! excellent month ! It suprrised me . I hope April will be good enough so that you can buy the devices after buying the wedding ring .

Thanks :)

I will let you know if I’m able to buy the devices as well.