November 2020 – An uneventful yet expensive month

| Updated: |(Disclosure: Some of the links below may be affiliate links)

November 2020 is over, and it was another of these 2020 months. Nothing much happened during this month because we could not see many people and several things were canceled.

At least, we are both healthy. And this was the last month before we move to the new house. We are really looking forward to that. This will keep us occupied! And this will keep our mind off this boring virus.

We still had to buy quite a few things this month for the new house. But we now have everything we need except for the summer things. We spent much more than I anticipated.

So, let’s see what happened to us in November 2020 and the status of our finances.

November 2020

This month was not very eventful. A lot of things are still closed due to the latest measures regarding COVID-19 in Switzerland. We did not do much, and we did not see many people either. We still went to two meals with friends, but we limited each of them to four people.

Currently, the limit is still for up to 10 people, but we try to limit ourselves to a maximum of five. I think it is important to play our part. But it still sucks. Even for an introvert like me, it gets boring.

At least, we are both healthy, and our finances are okay. So, we cannot complain much about the coronavirus. But I wish our government did a better job at containing the virus, especially in the second wave.

We finished buying the furniture for the new house. We had to buy a washing machine and a dryer this month. This made a big hole in our finances. But at least, we found an acceptable deal on Black Friday. Normally, we are done with all the big expenses for furnishing the house.

Unfortunately, we spent more than I anticipated on this item. We went over-budget on several items. We will have to start being more careful again next year!

I hope that we will still be able to have some holiday parties with a limited number of people. But I am not sure this will be the case. But at this time, we will be in the new house. So, there will be enough to do not to be bored!

This month, we have started the last planning steps for the move to the new house. We have planned all the packing, the move itself, started some little packing and got rid of a few things that we will not move to the new house.

There is not much to report about this month, so let’s delve into the details of the month.

Expenses

Let’s see the details of our expenses in November 2020:

| Category | Total | Status | Details |

|---|---|---|---|

| Insurances | 1196 | Above Average | Health insurance and household insurance |

| Transportation | 90 | Average | Parking and fuel |

| Communications | 84 | Average | Internet and mobile |

| Personal | 2914 | Well above average | Furniture, gifts, and health bills |

| Food | 382 | Above Average | Standard groceries and one trip to Aligro |

| Housing | 1236 | Average | Just the rent |

| Taxes | 2796 | Slightly above average | Standard taxes and withdrawal taxes |

Overall, we spent 8699 CHF in November 2020. This is definitely not the level of expense that we want to aim for. We spent almost 1700 CHF on furniture this month. On top of that, there was a birthday and a wedding. Together, that is 500 CHF in gifts for a single month. Normally, these two expenses are extraordinary. But I am worried about our level of expenses. Our average expenses have been going up every single month this year.

We will have to be more careful next year!

Overall, we saved 38% of our income this month. This may sound high, but this month we had extra income coming in that will not be there next month. So this would have been much with lower income.

2020 Goals

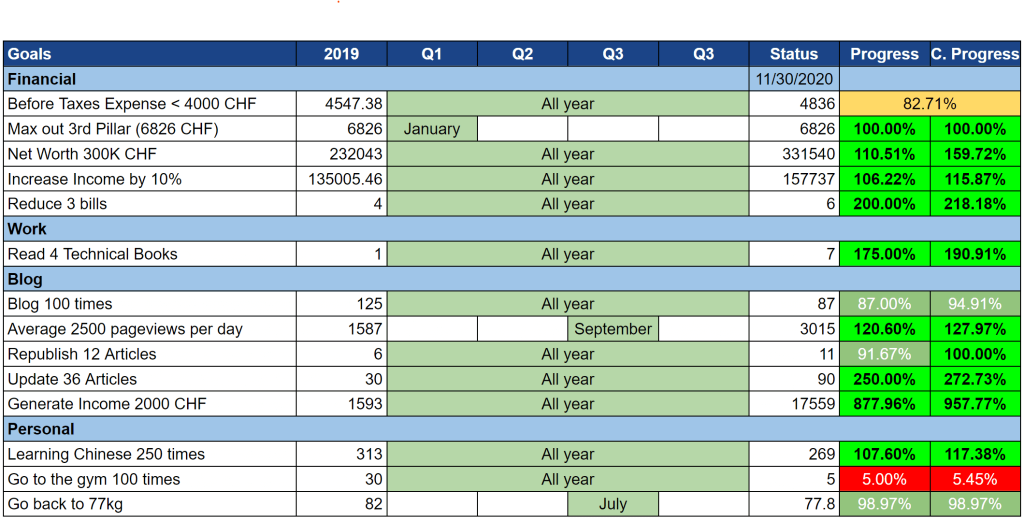

Let’s take a look at our goals by the end of November 2020:

Next month is already the last month to make progress on our goals. But since most of them are doing okay and some of them are definitely lost, I will not do anything very different next month.

The only goal that we need to work more on is our expenses goal. But given the end of year bills and this month, we are far from reaching it. But we are still below 5000 CHF expenses before taxes, so there is that at least.

Other than that, our goals are doing great. We are well ahead of our targets. We need to make these goals a little more ambitious next year!

Net Worth

Let’s take a look at our net worth as of November 2020:

We passed the next milestone in our journey, the 330K net worth. Our net worth continues its course in the right direction.

Nothing special happened to our net worth this month. We had a large income, but our expenses were not very low either. The stock market did nicely, even though we are not fully invested yet. So this helps.

For now, this net worth increase does not translate into a highly increased FI Ratio. Currently, we stand at around a 16% FI Ratio. Our average expenses are increasing, and I take our average expenses into account for this. Now, our expenses in retirement will hopefully not be that high since the taxes should be lower. Nevertheless, it is way too early to imagine them for now. So, as long as our net worth increases and we keep our expenses before taxes reasonable, we will be fine.

Overall, I am happy about the evolution of our net worth. We can aim for 375K next year even with the large expense we will have for the house. But for this, we will have to put back our other expenses into a proper shape. So, it should be okay, but we will have to be careful.

The Blog

Overall, the blog did relatively well this month. There was a slight increase in traffic for the blog. It is not a huge boost, but I will take it!

On the income side, it did really as we saw in the goals part. But this is extraordinary because it came mostly from a quarterly payment. But even if it is extraordinary, it is a great thing.

I have written many articles in advance. This is great because I have already written enough articles to not worry about them while moving to the new house.

Since some French articles started to get some traction, I went ahead and translated 10 more articles. This brings the total to 30 articles translated. I will wait again now to see if this gets more traction before doing the next batch.

Other than that, I have not done anything extraordinary on the blog. I have started planning the next steps for the blog for 2021. I am starting to have a better vision for the blog for next year. But it is not entirely there. We will see how it goes. In any case, I will continue doing what I like and try to help as many people as I can.

What did you think of my blog this month? As usual, your feedback is essential!

Next Month – December 2020

The major event for next month will be the move to our new house. We have been waiting for that for a long time. We will be moving in mid-December. And most of the month will be spent preparing for the move, moving, and then get installed.

Given the crazy year of 2020, it would have been so much better if we had moved one year earlier. We are thrilled to move now. And our budget will be happy once we will have finished buying the new furniture for the new house.

Financially, there should not be anything extraordinary about December 2020. I do not think we will start to see the big bills for the house coming before next year. On the other hand, there will be a few yearly bills to pay. The power bill is coming and the car insurance as well. December will be expensive.

Regarding the blog, there will be one small difference. I will not post between the 24th and the 31st of December. I do not think many people read blogs these weeks, and I want to have a buffer for moving to the new house.

If you had to read only one post from this month, I would recommend my post about broker bankruptcy.

I am starting to have the (probably stupid) idea of turning my budget tool into a Software as a Service (SaaS) tool. What do you think of this idea?

What about you? How was November 2020 for you?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Just found your blog today. I have been following BudgetsAreSexy and AffordAnything for years, which are amazing. They are American and your blog is the first European one I’m seeing with the same concept. Love the minimalist design. If I were ever gonna make a website, this would be my inspiration. Wishing a lot of success.

I miss Switzerland (visited in 2016)!

Warm regards from Portugal

Hi Fahim,

Thanks a lot for your kind words! I am glad you like the design (or lack of design!). I am trying to keep it simple, people should come for my content not for my fancy design.

Thanks for stopping by!

Nice blog. Happy you found a new house. Around me, prices are IN-SANE and finding a new house is just depressing.

VERY BAD on the Gym front !!!!

Do you have a index of happines and of Return to Society ?

:-P

Hi KRLS,

Yeah, house prices are very high right now. There are still some states with good prices, but then you may sacrifice other things to go live there.

No, we do not follow an index of happiness. It’s going up at least now that we moved and are making all our rooms pretty! And it will still go up once we are fully installed :)

Thanks for stopping by!

Great post! I assume that you are just talking about your finances/goals. Does your wife also have goals/manage financials?

Hi Stef,

Actually, we manage everything together. I mostly set the goals, but I would not set where my wife would not be on board. But it’s true that several of the goals are purely personal since I am blogging here.

She also has some goals and some financials of her own. But the large part of our financial goals is managed together.

Thanks for stopping by!

Congrats! you almost nailed all goals for this year, even though you did not meet your gym goals, you almost meet your weight goal, if you are not so swiss precise. haha

I am inspired by your goal setting and tracking habit. I will try it in 2021.

What expense app do you use? I use YNAB but I find it really horrible in terms of UX…

Hi Fast Track :)

Yes, we did pretty well on our goals. But several of them were too easy. I am trying to make it a bit more difficult next year.

As for my weight goal, it’s not that bad because now I am back where I wanted, just a little late on the goal.

For my expenses, I use a tool I wrote myself. The problem is that it’s difficult to install and use. I am thinking of making it available to more people, but there is a lot of work left.

Before that tool, I was simply using a Google Sheets.

Thanks for stopping by!

Hi TPS,

You mention the YTD of your net worth of 44% but I was wondering could you also let us know how much your net worth when up compared to previous month? Might also be interesting to compare…

Cheers

Hi John,

I will try to post this as well from next month :) Don’t hesitate to remind me next month if I forget!

In November 2020, our MTD growth was 3.4%.

What about you?

Thanks for stopping by!

Cheers TPS! I always compare my MTD NW % that’s why I am asking and for November I had quite a big surprise with 10.6% so I was wondering if I did not have a mistake somewhere… on the other hand October was quite bad with -1%.

Hi John,

Wow, congratulations on getting 10.6% in one month! That’s pretty amazing!

Hi Mr. Poor Swiss,

First of all, many congrats for the achievements and thank you for sharing this. Your blog really gives a lot of encouragement and hope to those starting on this journey!!

I had a question on your income of CHF 17,000+ from the blog. This looks fantastic, but where does it actually come from? Would be great to have your advice/insights (maybe even a blog!) on the mechanics of how one can generate supplementary income through blogging.

Thanks again.

Hi FIRE Beginner,

Thanks for your kind words :)

Keep in mind that this is for the entire year, not per month. It’s still great though :)

It’s entirely from affiliate marketing, mostly with Swiss services.

There are tons of blogs on affiliate marketing out there, I am really no expert.

If you are interested, I would encourage starting reading about affiliate marketing on the internet but be careful, there are a lot of dishonest bloggers about affiliate marketing, don’t buy a course on them, most of them are pretty bad and the content can be found for free.

And do not believe people that tell you it’s easy and requires little work or that it’s passive income… It’s nothing of that :)

Thanks for stopping by!

Many thanks for the helpful reply! And, for sure, this is hard work and anything but passive income – that comes across quite clearly in the content/quality that you produce :)

Are there 1-2 bloggers/links on affiliate marketing that you could recommend (just to help get the reading started in the right direction)?

I would only recommend two people:

* Miles Beckler on his blog and on Youtube

* Andrew Fiebert and Matt Giovanisci (ok, that’s three), for instance, https://www.listenmoneymatters.com/how-to-start-a-blog/ and moneylab.co