How to file your taxes with Swiss and foreign securities in 2024

| Updated: |(Disclosure: Some of the links below may be affiliate links)

One question I often get is how to file taxes with stocks and dividends. This becomes especially popular when we add foreign stocks and dividends to the mix.

Many people are afraid of investing because they think it will make filing their taxes complicated. But in practice, it is not complicated to file taxes even with a large ETF portfolio.

In this article, we see how to file your taxes with Swiss Stocks and dividends, which is very simple. And with U.S. Stocks and dividends, which is slightly more complicated.

Filing taxes

In Switzerland, taxes are different for each canton. Each canton has its software and forms to complete your tax form. However, most of the forms are very similar and have similar names. So, if you can file your taxes in one canton, you should not have many issues filing them in another.

Since taxes differ in each canton in Switzerland, I need to take an example. So, I will take Fribourg as an example with the Fritax 2020 software. You can use this example to file your taxes for your canton. The concepts should be the same for each canton, but the software to fill them will differ slightly.

Some of the Swiss tax apps are better than others. I have not tested many of them, but from what I have seen, Fritax is probably average. It is not always intuitive, but it is relatively easy to use.

Unfortunately, Fritax is not available in English. So I will use the French version for my screenshots. The forms will be the same in German as well.

If you do not know why I am using U.S. ETFs, you may want to learn about the advantages of U.S. ETFs. They are related to how you will file your taxes with U.S. securities.

Swiss Securities

First, we start to see how to declare Swiss securities. These are the securities that are subject to the Swiss dividend withholding taxes. Indeed, the Swiss tax office will withhold 35% of the dividends. Your broker will do this directly.

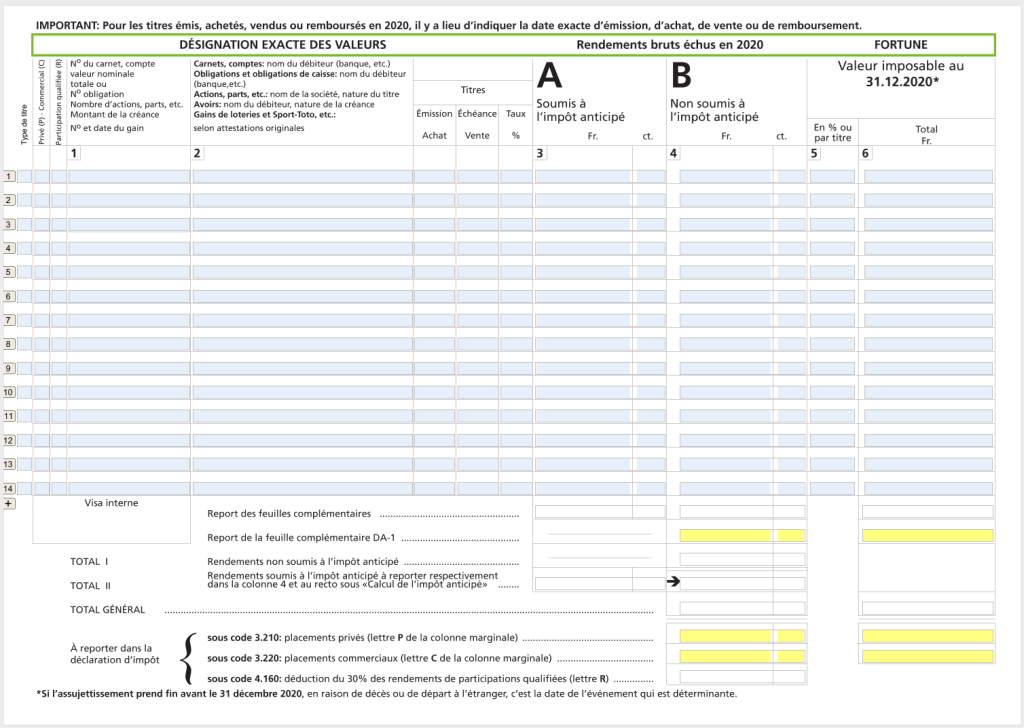

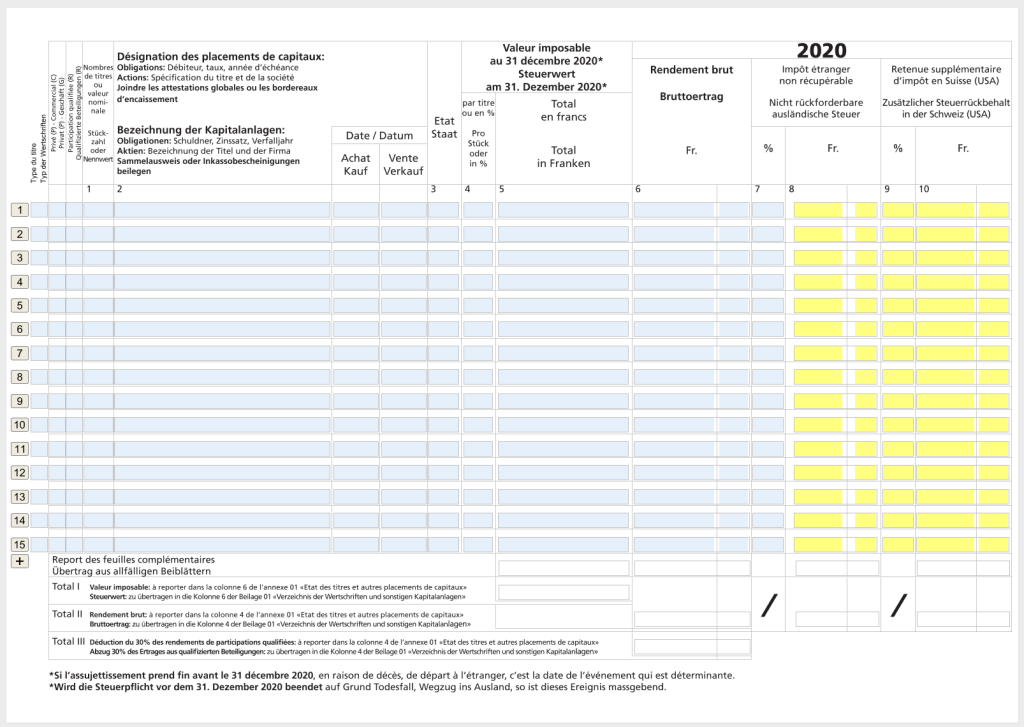

In your tax declaration, you will have a form to enter all your assets (bank accounts, bonds, stocks, and lottery gains). In my French software, this is called “Etat des titres”, which translates to “Status of the securities”.

Here is the form before filling it:

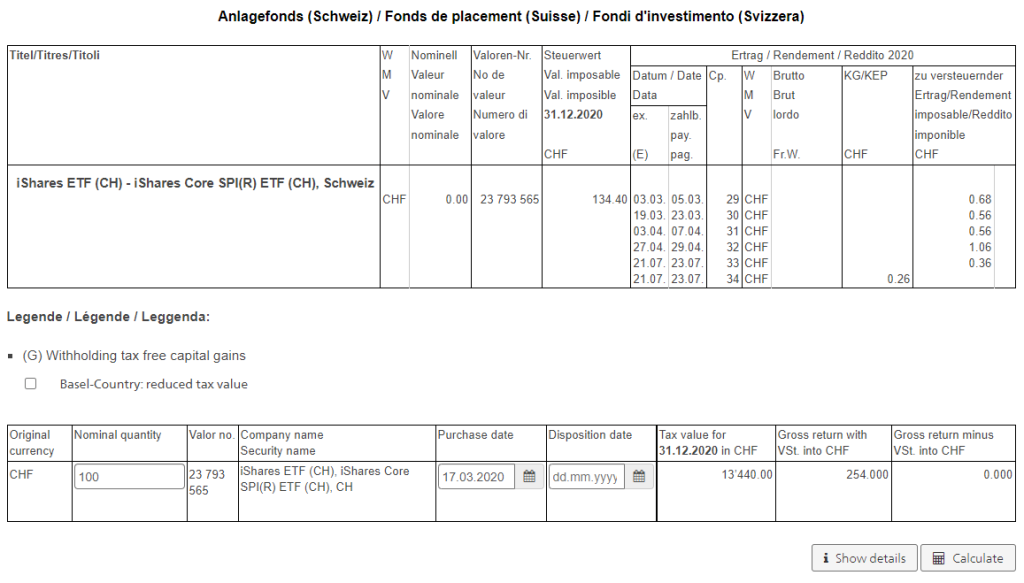

In this form, you must list all of your Swiss securities, whether stocks or ETFs. Since I am recommending investments in ETFs, I will take an ETF as an example. But you would do exactly the same with a stock. For example, I will use CHSPI, the Swiss ETF I use in my portfolio.

You must indicate this is a security (choice 3) in the first column on each line. You must then indicate that this is a private asset (choice P) in the second column.

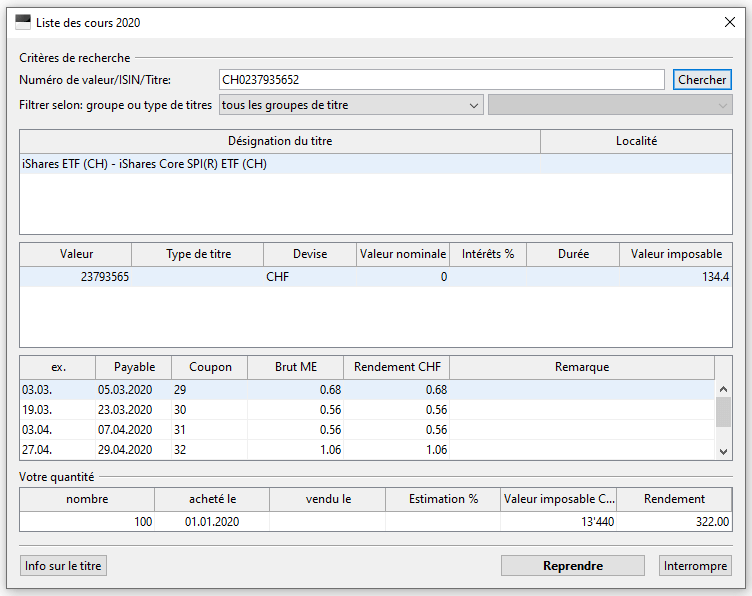

Then, you can press the “Listes des cours” (Lists of prices) to search for the prices of a security. This assistant will help you with your dividends and prices. You can enter the ISIN number of your ETF and press search (Chercher). For instance, the ISIN number of CHSPI is CH0237935652. You can find the ISIN number of each ETF on the website of the fund provider.

Then, you will see all the taxable income for this security. You can enter the number of shares, the buy date, and the taxable value, and the taxable dividend will be calculated for you. For instance:

The date will be considered to compute the dividends for this security. If you enter a date that is after some dividends have been issued, they will not be considered. And they will automatically compute the taxable wealth with the security value at the end of the year.

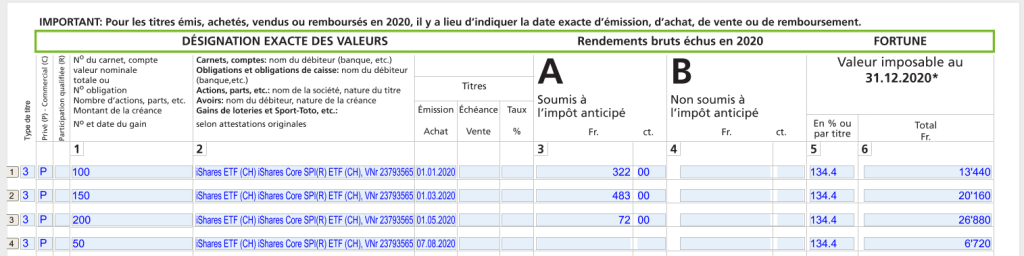

Here is an example of what this could look like.

The totals are automatically done at the end of the form. And these values are propagated into the rest of the forms.

If you already have securities before the beginning of the year, you have two options. If you file your taxes right after the year without losing your tax declaration, you can keep all the buy operations from the previous year. Or you can use the total number of shares at the beginning of the year with a single entry and a date like the last year of the previous year. I have already done that in the past, and I have never had any issues.

If you have sold securities during the year, you must also declare them. You can use a purchase date and sold date to let the software compute how many dividends you received before selling the shares. In that case, the software will automatically set the taxable value to zero.

Using ICTax

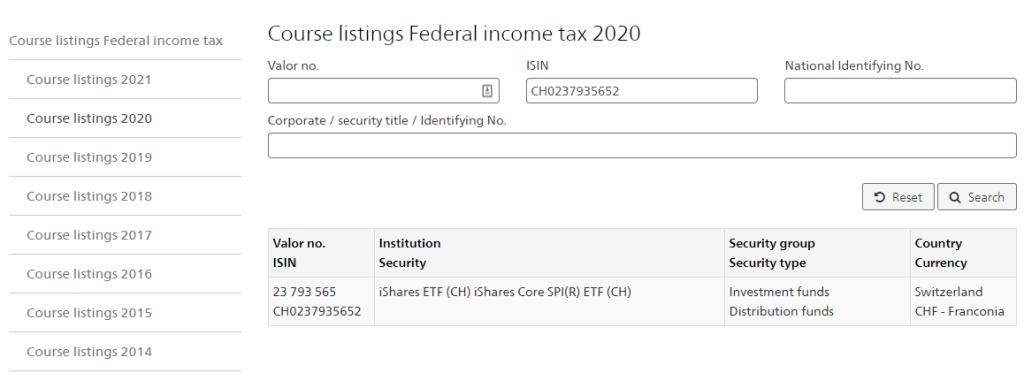

Unfortunately, not every Swiss taxes software allows you to get all these numbers inside the app. So, in this case, you will have to use the ICTax website. This is the reference for all the official end-of-year prices and currency conversions to file your taxes. One good thing is that this website is available in English, contrary to the tax software.

You can go to the website and search for the ISIN again:

And then, you can click on the ETF of your choosing. After that, you must do the same as before with the tax software. You will be able to enter the number of shares and purchase date. The website will automatically compute the tax value and the gross return. You can then copy these values directly into your tax declaration.

It is much less practical to file taxes like this than having the software do it for you. But in any case, it should not take you long to complete your Swiss securities.

It is also a good reason to keep your trading limited to a few ETFs. If you are buying many securities during the entire year, you will have to enter many lines. But it is not as complicated as many people believe.

If your ETF is not on ICTax, you can ask them to add it to the system. But most well-known ETFs should already be there. I have never had an issue so far.

U.S. ETFs / Securities

For U.S. ETFs and securities, it can get a little more complicated because there are a few possible cases.

First, it will depend on which broker you are using. If you are using a Swiss broker, you will pay two deductions:

- 15% withheld by the Swiss broker

- 15% directly withheld at source by the Internal Revenue Service (IRS)

If you are using a broker like Interactive Brokers, you will only see the IRS’s direct deduction. This is a foreign tax.

You need to use the DA-1 form to claim back foreign tax. You need to use the R-US 164 form to claim back Swiss withholding if you use a Swiss broker.

These forms are attachments to the form we covered in the previous section. And they are extremely similar. The difference will be in setting the percentages that you can claim back.

If you use other foreign securities, the idea remains the same, except that the percentages will differ. You will have to find the percentages for both columns for your situation.

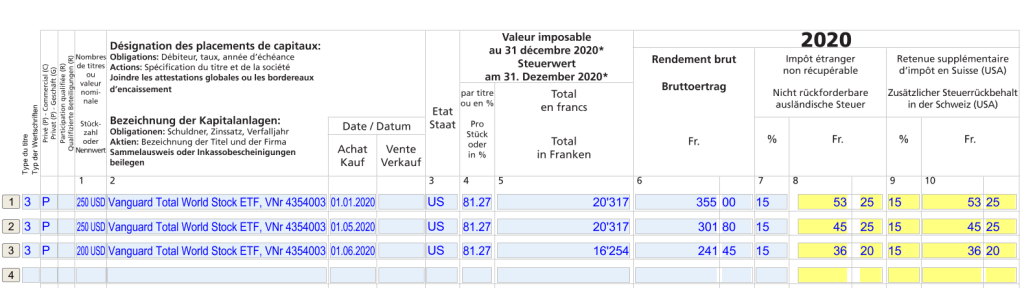

In this case, Fritax did an excellent job since they put DA-1 and R-US 164 together. Therefore, there is only a single form to fill for foreign securities. This is a great idea!

Here is the empty combined DA-1 / R-US 164 form:

As we can see, it is extremely similar to the previous form. And it works exactly the same way. You must still select that this is an action and part of your private net worth. Then, you can use the same assistant to get all the tax information by pressing the “Liste de cours” button on top of the form.

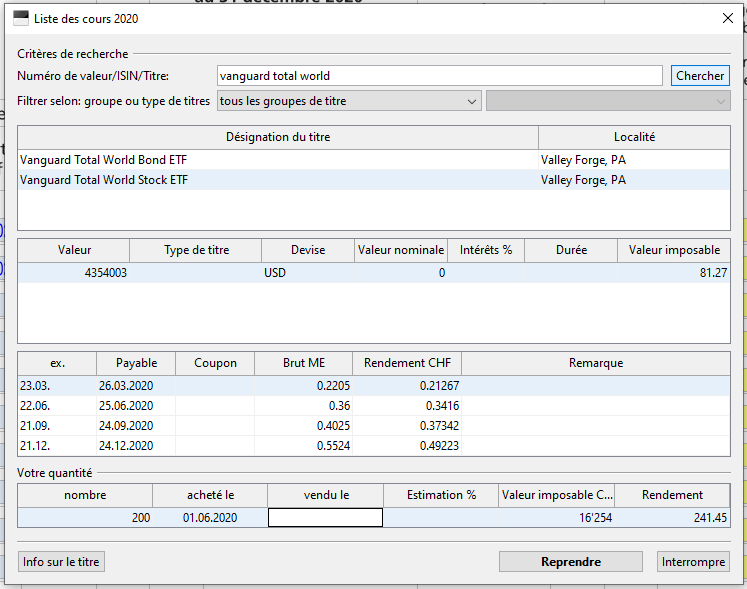

They have all the information, even for U.S. ETFs, such as Vanguard Total World (VT). Here is an example of how to fill it with VT:

Once you have filled a line, you still need to select the country in column 3. This will be the US in our case.

Then, you need to update columns 7 and 9 with the percentages for your case. If you only fill the DA-1 form (with Interactive Brokers), you must set column 7 to the value 15. If you are filling the R-US 164 form (with a Swiss broker, for instance), you must set column 9 to the value 15.

Then, the tool will automatically compute how much taxes were withheld in both cases. And Fritax will automatically fill in the total.

Here is a filled DA-1 form with both sides filled:

If you use Interactive Brokers and only pay 15% of dividends withholding, you can change column 9 to the value 0.

All the other details are the same as for the Swiss securities, so you can look at the previous sections to get all the information. But with the Fritax software, it is not that bad to file your taxes with foreign securities. As you can see, the DA-1 and R-US 164 forms are almost the same as the standard securities form.

It is important to note that the DA-1 deduction is generally only applied if you have more than 100 CHF in foreign withholding. It does not change how you file your taxes, but knowing this may avoid a surprise when receiving your tax decision.

Using ICTax

If your tax software does not support getting the values directly from it, you can use the ICTax website for foreign securities too. It will give you all the dividends in CHF and the tax value of your securities at the end of the fiscal year.

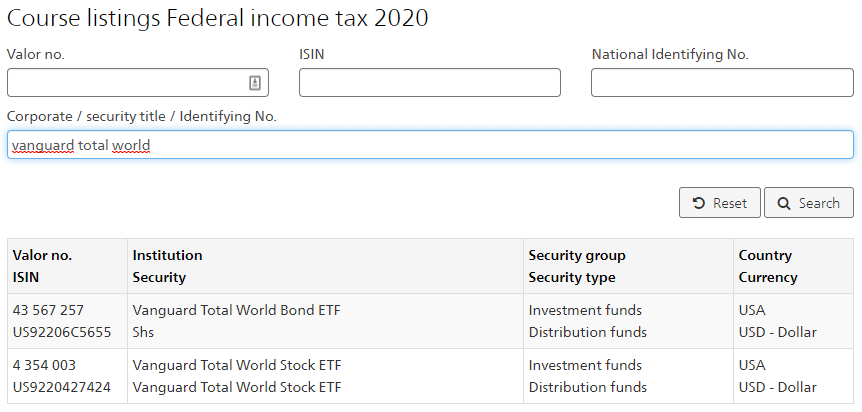

This will be done exactly like we did for Swiss securities. For instance, you can search for Vanguard Total World on the website:

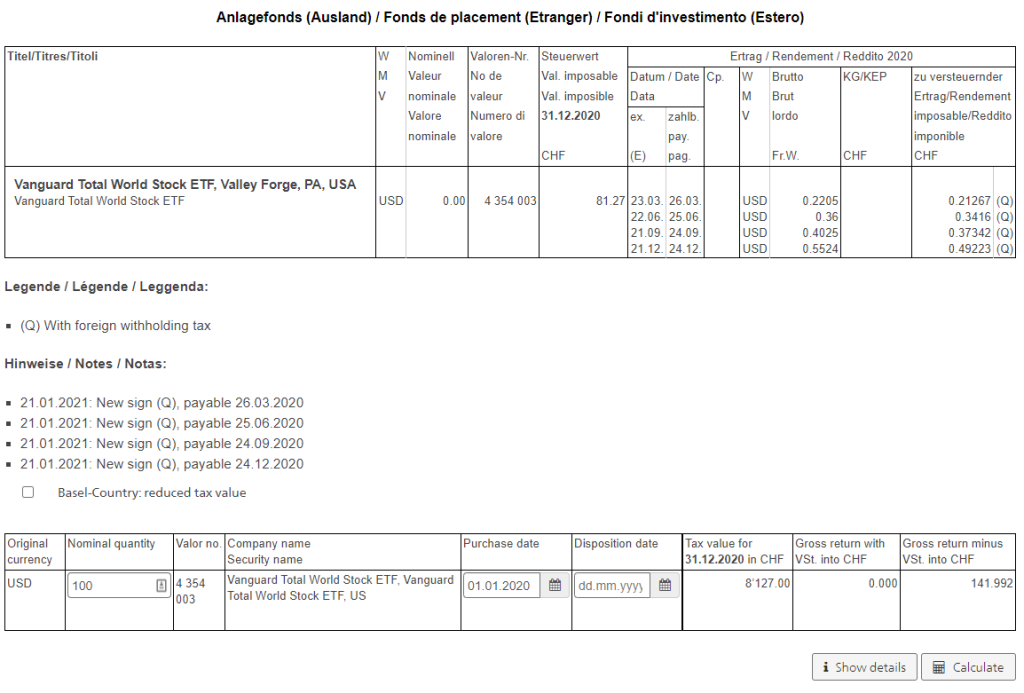

Make sure you choose the Stock version and not the bond version (unless you have both, of course). And then, you can fill it up like before. For instance:

Then, you will only have to copy these values into the DA-1 or R-US 164 form and select the correct withholding percentages. It is not more complicated than for Swiss securities.

Attachments

The tax office will request documents attesting to your dividends, capital gains, and net worth.

Some Swiss brokers will propose some special documents for taxes. And some people believe that only these reports are valid. But that is not correct. Even foreign brokers have documents that Swiss tax offices accept.

For instance, I use an annual activity statement report with Interactive Brokers. This contains all operations, all dividends, and the status of my shares at the end of the year. I have never had any issue with that. You can get this from the Reports tab. In there, you can generate an activity statement for the entire year.

Conclusion

There you have it! Following these simple steps, you can file taxes with Swiss and foreign securities! It is not as complicated as many people believe.

Even for U.S. Securities, it is not complicated. You must fill out an extra form (DA-1) in the best case and two in the worst case (DA-1 and R-US 164), but these forms are almost the same as for Swiss securities. So, I do not think this is a big deal.

If you are wondering why we need to fill all these lines, it is for the system to compute exactly how much you got from dividends. Since dividends are taxed as income, this must be precise. And only by indicating each buy and sell date will you get a precise amount.

Hopefully, this will help you file your taxes with securities.

If you want more tax information, I have an in-depth guide about Swiss taxes.

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Investing Fundamentals

- More articles about Investing

- What is Compound Interest? Is it Magic?

- What is the Modern Portfolio Theory?

- 13 Awesome Stock Market Facts that will surprise you!

Good morning.

Thanks very much for your content: always very useful.

I’ve a question that I wonder if you’d have some information: I’ve recently acquired Swiss citizenship in addition to my EU original one. In Interactive Brokers they select select one as the “Principal citizenship”. Would there be any legal or fiscal advantages of switching the record from EU to Swiss ? Thanks

Hi Ricardo,

I don’t think this would make a difference. What’s important is your tax residency and this did not change with your new citizenship.

Hi, Mr. The Poor Swiss,

Thanks a lot for all your articles. They have been a great guide for me when setting up all my investment structures.

Today I have my portfolio in IB and 2 ETFs: CHSPI and VUSA. I see that for the CHSPI dividends IB withholds 35% (as it’s Swiss security), but it does not withhold anything for VUSA so I have a few questions: Is that because VUSA is Europe-based (even it’s Vanguard)? Do I need to pay the tax on those dividends (if applicable) during the year or once a year when filling the tax declaration?

Thanks again for your great work!

Santiago

Hi Santiago,

I believe this is correct. IB will not withhold dividends on European ETFs. However, the US fiscal office will withdraw 15% of the U.S. dividends before they arrive to the funds, so, you are still “paying” a tax on dividends with European ETFs.

You will need to pay taxes on these dividends yes, in your tax declaration only.

Many thanks!

Hi The Poor Swiss,

Thank you for you content.

I have a couple of questions I would like to ask:

1. What does “US stock” means? I mean, if I buy shares of a Vanguard ETF on the Swiss Exchange, is it still considered a US stock? The element to consider is the exchange or the company of the fund (in this case Vanguard)?

2. So, if I understand correctly, if I invest in one ETF once per month, in my tax declaration I will have 12 lines because I have to indicate the 12 purchases, is that correct?

Hope you will see the comment! Thank you and keep up the good work!

Marzio

Hi Marzio,

1) I am talking about U.S. ETFs mostly. In that case, it’s neither the company nor the exchange that matters. It’s the domicile of the fund. Vanguard has funds in Europe and in the U.S. and these are two different matters for taxes.

2) That’s unfortunately correct, yes. It sucks, but that’s the way it is.

Hi Mr ThePoorSwiss,

Thank you very much for the kind reply. In the meantine I found another article of yours and I found thr answer to the first question.

If I may, I have another question regarding filing taxes: I understand how it works when you are investing because you only indicate the moment you bought the securities. However, when you sell (for rebalancing or for living off your portfolio), how should you indicate it? Because I assume you don’t really know which shares you sell, so how you know in which line you have to fill the “sold on” column? How does it work?

I hope it is clear…

Thanks!

Marzio

Hi Marzio,

That’s a good question. And I, unfortunately, do not know. Since these capital gains are almost always tax-free, I have not found any good source talking about how to fill a tax declaration about it.

I guess it does not matter which shares you sell (and indeed you wouldn’t know). If you just declare the sale, the number of shares will be correct for the total value and the number of shares for the dividends.

That’s what I would do, but you should consult with the local tax office if you are not sure about that.

Hello The poor swiss,

I am a 20 year old boy and I have been living in Switzerland for about 3 months (in the canton of Lucerne).

I have the B permit and I am working

I have already opened my account on DEGIRO and I want to start investing.

I just read your article, but I still have several doubts about the tax return.

Thanks to the B permit, my business taxes are deducted at source.

But I still haven’t quite figured out how to go about my investments.

I would initially like to create an accumulation plan with ETFs only, mainly world equities or at most European / American.

I have also read that if you are NOT a professional investor you do not have to pay capital gain taxes.

But do I have to declare these my income anyway?

Hi Denis,

Keep in mind that I have never paid tax at source, so I am not an expert here.

Generally, unless you generate more income than the limit (120K CHF per year of taxable income for most cantons), you do not have to file a tax declaration.

If you qualify (more than the limit), you will have to file a tax declaration and in that case, you will have to declare all this information.

There may be differences from one canton to the other, but I do not think you have anything special to do if you are taxed at source without a tax declaration.

Best regards

Very useful, thank you!

(PS: Back in 2014-2015, did you contribute to a famous french developer community?)

Thanks :)

(And yes!)

Hello,

thanks for the article.

In case someone invested into 3rd Pillar they need to file for tax return. Is it the same procedure as this ?

Hi Nick,

I assume you are taxed at source. I do not know exactly how tax returns work in the case of tax at source. I have never been taxed at source.

If you have to fill a full tax declaration when you ask for a tax returns, then, this will be the same. If you only get a simplified tax declaration, then you may not be able to reclaim this amount of foreign taxes.

Since this may change from one canton to the other, I would recommend that you contact your local tax office to get a clearer answer.

Hi, thanks for the article !

I just opened an IB account and bought my first shares, Swiss and US ones so far. Do I have to set anything special so that IB doesn’t tax me 30% for the US shares (but only 15% due to the double tax agreement) ? Additionally what is the total tax I would pay on the Swiss stocks dividends ? 35% sounds huge! especially if you have to pay additional revenue tax on the rest..

Thanks in advance !

ps: I am Swiss and living in Zurich

Hi arno,

Yes, you have to do something. If you go into your account settings, you can click the (i) button next to your name and you will have an update tax forms button. You can go there to fill the W8-BEN form. This will reduce the withholding from 30 to 15.

All dividends are taxed as income, so you will declare it in your tax declaration and it will be added to your income. So, it’s taxed differently for everybody, at marginal tax rate.

Now, 35% is not the tax rate, it’s the withholding rate. In your tax declaration, you can also declare this as tax already paid. So, this amount will count towards the amount of money you have already paid in taxes.

Thanks for stopping by!

Many thanks for the answer!

So that would mean that for American stocks we pay 15% + revenue tax and for Swiss stocks only the revenue tax on the brutto dividend ?

Swiss stocks being the more advantageous (for a Swiss person of course)

No, that’s not correct. With U.S. stocks, you can reclaim the dividends as well. So, there is no difference in taxation between U.S. and Swiss stocks. The only difference is the amount that is withheld.

It’s a complicated subject :)

Hello, thanks this is very useful.

Could you also maybe make an example with Degiro and the free iShares world and Emerging markets ETFs traded in Amsterdam?

I guess this is a tool and instrument many of the readers use.

Many thanks again

Hi Jerome,

Normally, this case should be the same as for a Swiss ETF since you cannot reclaim the 15% dividends that were lost before the funds.

But it’s a good idea, I will try to add an example when I have some time.

+1 – also interested in this exact scenario :)

Yes…same here…+1

Hi Poor Swiss,

Thanks for the informative article as usual. My case is investing in VT via IB with permit B and taxed at source. Do I have to file any tax form for dividends and stocks? Can I still apply for the 15% tax return on US stocks dividends or have to wait for permit C?

Best regards,

Vas

Hi Vas,

In general, people that are taxed at source do not need to file any tax declaration.

Now, depending on your state, you will have to file taxes if your income is higher than some limit (120K / year in most states).

I think that in some states, you can also request to file a tax declaration if you think you can get more deductions, but I am not sure how it works from state to state.

Unless you have a lot of U.S. dividends, it’s probably not worth it going to the trouble.

Thanks for stopping by!

Right on time Mr. The Poor Swiss, thanks a lot!!!

Useful and practical content, as usual.

I am glad it’s useful :)