How to Calculate Your Net Worth Easily

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Your Net Worth is a fundamental personal finance metric! It will tell you how much your assets are worth or how much you are worth. It can also tell you how close you are to being Financially Independent. Your net worth is one of the best personal finance metrics that you should always keep track of.

Computing your net worth is not very difficult. However, there are some subtleties when doing it. And it is essential to get it right.

In this article, we see how to calculate your net worth. It will tell you how much your possessions are worth. Having a clear idea of your exact net worth is very important. It will help you to see how far you are from reaching your goals. If you keep track of it, you will also see how well you are doing.

Your Net Worth

The basic idea about net worth is simple. Your net worth is the sum of your assets minus the sum of your liabilities. In mathematical terms:

Net Worth = Assets – Liabilities

We will see in detail how you can calculate these two parts. Once you know your net worth, you will have a better idea of where you are.

Many people are surprised that their net worth differs greatly from what they expect.

For instance, many people with high incomes and many assets think they have a high net worth. But many times, these people also have a lot of debt. When they consider everything, their net worth can be tiny or even negative.

On the other hand, some people living frugally can have a significant net worth.

Your assets

First, you will need to compute the sum of your assets.

Your assets are everything you own of value. I say of value because you should not account for every small thing in your net worth. There are a few rules you need to be aware of when you take assets into account:

- You should only account for items that are liquid enough.

- You should not account for things that are depreciating too fast.

- You should be very careful about accounting for the value of things. It is not as easy as taking the cost you paid for the item.

Here are the main assets and how to calculate them into your net worth.

Cash

Your cash is the first asset you should consider.

First, this is your cash in your wallet and at home. Some people may have some cash in a safe as well. Then, it is the cash in your savings and checking accounts. This cash is directly available.

Once again, there is no need to count the pennies in your swear jar! Overall, your cash should not account for much of your entire net worth. If cash makes up a lot of your net worth, you should consider starting investing.

All the services you need to pay, save and invest, in a neat package, with extremely good prices!

Use the poorswiss code to receive 10CHF!

- Pay abroad for free

- Invest with great fees

Bonds and Stocks

Then, you should also account for your invested money. This cash is mainly the money in your broker account. It could also be your money in stocks, bonds, or Certificates of Deposit. This money is available, but you first have to sell something. Often you do not want to use this money until retirement. Or until the goal you are saving for is reached. If you are using a Robo-Advisor, you can also account for it here.

Be careful about the currencies of each investment. You should convert everything into your base currency. For instance, I convert everything to CHF before doing the sum.

Retirement Accounts

The third thing is your retirement money. For example, in the United States, that would be your 401(K) and IRA accounts. In Switzerland, this includes the second pillar and third pillar.

Not everybody is accounting for retirement accounts in their net worth. I advise you to do it. It will depend on your goal and why you want to grow your net worth.

Second Pillar

Before we see how to do it, why should you integrate your second pillar into your net worth? Why would one want to integrate the second pillar into the net worth? One could argue that you cannot take it out before retiring. And it is also possible that we may be unable to take it out as capital in the future. Nevertheless, it is your money!

Even if you do not take it out as capital, it will grant you a pension. This pension will help you in retirement and, as such, should be part of your retirement plan.

Another good reason is to have a complete picture of your assets! The only way to have a good idea of your asset allocation is to take all assets into account.

Now, we can discuss integrating the second pillar into your net worth! This is fairly simple.

Every month, I contribute to my second pillar with my salary. And every month, I can log in to my second pillar account to see how much money there is. If you cannot see the monthly value with your second pillar, you can use the monthly contribution and add this to your current second pillar value. You should not forget to double that value since your employer generally matches your contribution.

And once you get a final number from the second pillar, usually once a year at least, you can update to get the actual number.

Third Pillar

For the third pillar, you always know exactly how much it is worth. So you should account for it. But, there are also limitations when you can withdraw the third pillar.

Nevertheless, your third pillar is an integral part of your net worth. And it should be accounted for properly.

Social Security

If your country has social security, you may consider integrating it. However, it is not easy to know how much you will get in advance. Therefore, I would advise against integrating any pension.

If you have the option for a lump sum in your country, it could be different. In Switzerland, the first pillar is social security. You cannot take it as a lump sum, and therefore, I do not include it in my net worth.

Real Estate

You should take the value of your real estate properties into account. If you own a house or an apartment, you should account for it in your net worth.

Be very careful about the estimation of the value of your house. A house may not be worth as much as you think. It could also be worth more. It is difficult to estimate the real value of the home.

There is something you need to account for if you own real estate. If you sell it, you will have to pay some fees for it. In general, you will lose about 5% of the property’s value when you sell. It is due to real estate taxes, notary, and realtor fees. These fees will depend a lot from country to country. I would advise taking this into account in your net worth!

If you rent in Switzerland, you probably have a rental guarantee deposit. It is a particular bank account tied to you and the house owner. Unless you have significant repair work when you leave your house or apartment, you will get the money back. So you should account for it in full.

Businesses

If you own a business, you can also include it in your net worth.

For instance, that could be a startup in which you invested. Or that could be a piece of a company that you own partly.

Now, you have to be very careful in estimating the value of a company. It is challenging to get a reasonable estimate. You need to be conservative in its value. You may think it is worth a lot of money. But you may be biased. You should rely on external evaluations if you want a good estimation.

Inheritance

Some people like to take their inheritance into account in their net worth. It is a bad idea since it depends on the sum and the time you will receive it. And there is never any guarantee on that.

First, you should only do that if you already know how much you will get. For instance, if your parents, or another family member, told you the sum they would give you, you can include it in your net worth. But you should still be aware that this number can change. And you still have no idea of when this will happen.

If I were to count my inheritance in my net worth, I would only account for a portion of it. For instance, you could know you will get 100’000 CHF as an inheritance from someone. You should account for half of it only or even only a third of it. It will help you not rely too much on it. It is better to account for a smaller number and get a larger one than the contrary! Some people like to account for their inheritance divided by Pi (3.14) or Phi (1.618).

And you should be aware that you do no know when you will get this inheritance. It could be tomorrow, and it could be in thirty years or more.

I think we should not count on inheritance to increase our net worth. But this may be different for people coming from a wealthy family.

Life insurance policies

Now, some people may also have life insurance policies. There are some cases when you want to account for that in your net worth.

If you have term life insurance, you should probably not account for it. You will only get something if you die. And you cannot know if this will happen before or after the term. You should not use term life insurance for your net worth. It should be used to help the people that are depending on you. Since nothing is guaranteed, you do not want to account for that.

Now, there is a case where you could take life insurance into account. It is when it is tied to retirement. It is widespread in Switzerland. Indeed, you can have a third pillar linked to life insurance.

If you decease before retirement, your family will get the payment. But if you reach retirement age first, you will get the amount directly. In that case, I think it should be considered since it can be paid in full if you reach a certain age.

Sometimes, it is a bit difficult to know the correct value. You do not want to account for the full amount because it is too far in the future. But you can account for the current release value. You can ask your life insurance provider for the release value over time of your policy.

For instance, in my case, I got the details of the value of my life insurance year by year until I retire. From this, I can estimate my policy’s monthly value by calculating the difference between two consecutive years. I made a big spreadsheet with this, giving me the current value of my life insurance to account for my net worth!

Finally, if you have whole life insurance with cash savings, you should also consider this cash savings part. You should not account for death benefits, only the cash savings value.

Other Assets

Finally, there is the value of some assets you could sell. I am not talking about any single book in your home.

It could be your car if it is valuable. But, I do not account for the value of my vehicle. It has a very low value, and the depreciation of a car is significant.

If you are a collector, your collection could have some value. For instance, paintings, stamps, or coins can have good value. Be very careful when estimating this. A car will depreciate extremely fast. If you want to account for it, do not forget to update its value over time.

And some things can take a very long time to sell. It is something essential to consider. Again, I do not account for anything here. Once I sell something, I add it as an earning to my budget.

Assets Formula

It gives us this formula for the value of your assets:

Assets = Cash + Bonds + Stocks + Retirement Money + Real Estate + Rental guarantee + Life Insurance + Real Estate + Misc assets

It should be reasonably easy to get all these values.

Your liabilities

Your liabilities are everything you borrowed from other people. It is money that you owe and not money that you own.

Mortgage

The most common liability for people is a mortgage.

If you have a house or an apartment, the first item in your liabilities is generally your mortgage. That is the amount of money you owe to the bank.

A lot of people consider that their home belongs to them. But this is not true. It belongs mostly to the bank. You need to be aware of that. For instance, we only own 20% of our house. The rest belongs to the bank. If we would not pay the interest payments, they could seize the house.

Contrary to many, I do not believe there is anything wrong with having a mortgage and even keeping it. It is generally a low-interest debt that you do not have to repay fast. But repaying it could lower your interest payment and improve your budget, especially in retirement.

Credit Card Debt

A second liability that people have is credit card debt.

If you use a credit card, you will most likely have to get your current credit card bill. I am talking here about the bill for next month. You should not include this in your liabilities. You will pay it next month. But some people decide to include it in their liabilities in their net worth. It is also acceptable.

On the other hand, If you have credit card debt, you should include it. You should quickly work on paying off your credit card debt. You pay very high interest on your credit card debt.

I do not have any credit card debt, and I do not include my credit card bill in my liabilities.

Student Loans

If you got a loan to do your studies, you should include it in your liabilities.

Fortunately, in Switzerland, very few people have student loans. But, in the United States, many people have student loans, and they can be substantial.

It is also some money you owe to a bank and, as such, should be removed from your net worth.

Other Loans

The last pack is composed of leasing and loans. The most obvious example would be car leasing or loans. If you have a car in leasing, it is not yours. It belongs to the company that lent you the money. If you are serious about your personal finance, you should not have any car loans.

Finally, do not forget about all the money you may owe other people — for instance, a loan from a friend or a family member.

Liabilities Formula

To put your liabilities again in a formula:

Liabilities = Mortgage + Credit Card Bill + Credit Card Debt + Student Loans + Leasing + Personal Loans

It is not very difficult. Hopefully, you will only have your mortgage in this category or nothing if you do not own a house.

In our case, the only liability we have is our mortgage. So, we have to deduct the mortgage from our net worth.

Keep track of your net worth

Now you have all the pieces to calculate your net worth.

Once you have all your numbers, you should keep track of them. It is an excellent thing to see how your net worth is progressing over time.

There are many ways to do this. If you are old school, you can do it on paper. But you should probably use a spreadsheet for this. You can use online spreadsheets for free on Google Sheets, for instance. Or you can use Excel or any other tool on your computer. Be careful not to lose the data!

Another way is to use a budget application for this. For instance, a lot of Americans are using Personal Capital. In Europe, more people are using YNAB (You need a budget). However, this tool is not free, and I do not think anybody needs to pay for a budget application. Many free tools can do that for you.

But I think that these are basic things that most people should be capable of doing themselves. It helps a lot if you know exactly where all the numbers are going.

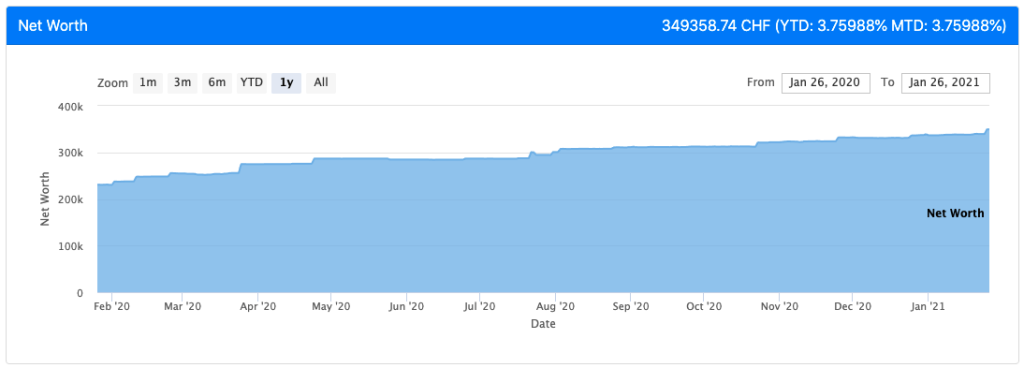

For instance, here is the graph of my net worth over a year:

It was not very eventful so far! There is a small jump every time we receive our salary. Since our net worth is fairly low, it does not increase much with the stock market. Our income has been the main driver of our net worth so far.

If you aim to reach Financial Independence (FI), your current net worth is a fundamental personal finance metric. It will help you compute your FI Ratio. You can see how to calculate your FI ratio based on your net worth.

Other Net Worths

What this article defines is the most common form of net worth. It represents your entire assets. But you can compute a few more net worths if you want.

Here are some other forms of net worth.

The FI Net Worth

The FI Net Worth is related to Financial Independence. If you plan to retire using a withdrawal rule, you should not consider all your assets.

Your net worth’s formula remains unchanged, but you will only consider some of your assets. If you can use this asset to sustain your retirement expenses, you can include it in your FI Net Worth.

For instance, cash and retirement accounts are part of this FI net worth. But your primary residence is not part of this. If you sell it, you must either buy another one or start renting. In the first case, you will not increase your net worth. In the second case, you will probably increase your expenses.

Another example is your car. If you have a car, it means you need it, so you will not sell it to sustain your expenses. And given the depreciation on the car, it is probably not a great asset anyway.

So, to get your FI Net Worth, you need to sum all your FI assets and remove all your liabilities.

If you want more details about this net worth, I have an article about the FI Net Worth and why it is important.

The Liquid Net Worth

Another form of net worth that can be worth tracking is your Liquid Net Worth. The idea is to only take your liquid assets into account for this net worth.

An asset is liquid if you can quickly transform it into cash in your bank account. For instance, your stocks and bonds in the stock market are very liquid. At worst, it will take a few days to reach your bank account.

On the other hand, your real estate properties are not liquid at all. It may take months to liquidate a property. So you should exclude these assets from the liquid net worth.

The same is true for your retirement accounts. Unless you are already retired, they are not liquid at all.

So, the Liquid Net Worth formula remains the same as the basic net worth, except that you only consider very liquid assets.

This form of net worth can be useful in two cases:

- In case of emergency, if you need a large amount of money.

- In case of a large buying opportunity (for instance, the house of your dreams at a fair price)

I am not yet tracking our liquid net worth, but I plan to do so. For now, almost everything we own is very liquid. But of course, our house is definitely not liquid!

Net Worth Tips

You should be very careful with estimating the value of some of your assets. For instance, it is not easy to get the exact value of a car. Therefore, you should use a conservative estimation. It does not help to think you have more money than you have!

You should try to split the assets from your net worth into categories based on their risk. For instance, bonds and the second pillar will likely have the same risk level. Stocks will have the highest risk level. And cash will have the lowest risk level. Doing so will help you have a good picture of your overall asset allocation. This is very important to understand where you stand!

Now, if you want to increase your net worth, there are many ways to go about it.

I believe that the most efficient way to do that is first to tackle your high-interest debt. It is your credit card debt and maybe your student loans. It is debt that is very costly because of the payments you have to make. Paying it back will increase your net worth. And it will also help you save more in the future.

Then, you also need to increase your returns on your money if you want to accelerate your net worth growth. If you have access to a high-yield savings account, this is an excellent place to start. Then, investing in the stock market is your next action.

Finally, you should optimize your budget to save money each month. There are many money-saving tips that you can try to save more. Increasing your income is also a perfect way to increase your savings! The more you save, the faster your net worth will increase.

Calculators

Now, some people do not like to do the calculations themselves and prefer to use calculators. It is much better if you can compute and track your net worth yourself. A simple Excel or Google spreadsheet will do that very well. You can also save the results. Moreover, it has the advantage that you can use it to track the value over time.

However, if you want to use a net worth calculator, plenty of them are available online. And you can use all of them for free. Here are a few that I liked:

These are my favorite calculators. But there are many other calculators out there. Feel free to do your research to find better ones. Let me know if you find a great one. Keep in mind that I am not using one.

Conclusion

In summary, your net worth is the value of what you own minus what you owe. If you sold all your valuable things and cashed out all your accounts, and paid all your debts, then you would be left with your net worth.

Your net worth is a fundamental metric. It should grow over time, and you should track its progress. Also, If your goal is early retirement, increasing your net worth should be your primary goal.

You must be aware that all your assets are not equal in your net worth. One thing you may want to do is compute your FI net worth for Financial Independence.

What about you? How are you computing your net worth? How much is your net worth? Are you doing something different?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Hello,

Do you think you could share the Excel file you use to organize and calculate your net worth?

Many thanks!

Dan

Ps: Very helpful content, thank you an please keep it up =)

Hi Dan,

Unfortunately, that’s not an excel file, but an entire application. I plan to try to share it in the future, but it’s currently not ready to be used by others and very difficult to install.

If you are a Linux / C++ geek, feel free to contact me if you want to try it, but otherwise, it’s going to frustrate you more than others.

Seriously you should consider to launch a web application or an esay to install tool / app. I am sure a lot of people would be willing to pay for such a tool :)

Actually, I talked about that in my article about my tool budgetwarrior, and there does not seem to be much interest :)

First of all, thanks for the blog. It has really helped me get my finances in order.

My apartment is my biggest asset and the mortgage is the biggest debt. Any tips or blog post on estimating its value? So far I have used two easy strategies: keep price I paid; get the value from tax declaration, which is much lower. Neither is being updated as time passes, so they both seem bad.

Thanks!

Hi Edd,

I would definitely not use the tax value, it’s too low. I personally use the price I paid for the house. But since it’s been less than one year since we moved in, it’s still accurate.

What I plan to do in the future is try to get an estimation from my bank (the one I have the mortgage with) for the house. I would like to update the value of my house every 4-5 years.

Other than that, you can try to look at the market in your area and see how it moves, but it’s not very accurate.

A suggestion about tools to keep track of net worth. If you use a robo-advisor (e.g. M1 Finance, Betterment, Wealthfront in the US), you can link your accounts and it will automatically track your net worth, make projections based on your spending and savings rates, retirement timing, etc.

Hi Leo,

I do not know any tool that will get numbers fro each of your accounts.

Wealthfront and Betterman for example, let you link all of you banking and investment accounts from other institutions so that you can track your net worth in real time! You can also link your real estate projections from the realtor site (Zillow, Redfin, etc.). But, of course, some people are not comfortable with linking all accounts..

Oh, I understand your point, now. Yes, these companies allow that but they are not available to Swiss investors :)

To the best knowledge, there is a good application that will link to accounts here.

Thank you, Mr. The Poor Swiss. Your website has been very helpful as I prepare to move to Switzerland from the USA (for professional reasons). I believe in a frugal lifestyle and try to save/invest whenever possible rather than spending on things that I do not need. Your website has been a wonderful resource.

I am glad this is helpful :)

Good luck moving!

Hi There,

I was wondering if you could advise on a free tool or spreadsheet template to track wealth. I was ideally looking for a tool being able to calculate investment performance on a time weighted average but that might be too much to ask.

Hi Nick,

I am afraid I do not know any good one. I would use Google Sheets, but then it would require you quite some work to get started.

Hi there, thanks for this article. I wanted to ask if/how you would include rental properties in your FI net worth? They are of course much less liquid than stocks/bonds, but they can be drawn from. Would be great to get your thoughts!

Hi LadyFIRE,

No, I would not.

However, I would count the rental income from these properties towards my FI Number. So, if I can cover half of my expenses with my rental income, my FI number would be reduced by two and I would have to accumulate twice less money. So, it would be integrated somehow :)

Thanks, that helps a lot! I do foresee my strategy being more focused around passive income vs. drawing down capital, so reducing my FIRE number makes tons of sense to me. Cheers for the reply!

There is also the new FIRE NW tracker/calculator at http://www.fireleap.com. It also lets you do forecasting and see stats in the “Explore” section.

It may not be a a complete substitute for spreadsheets, but certainly a good supplement.

Hi Androgen,

I did not know this calculator. The data it provides by country is quite interesting. I like the Explore section. I just do not want to create yet another account just to enter my data.

Thanks for sharing!

So close to 100K….I get the obsession with the spreadsheets/tracking….. Keep up the good work!

Thanks :)

Yes, getting close. I often get obsessed with spreadsheets, tables and lists :P But I think it’s a good idea to be a bit obsessed with a budget :)

Nice post! It’s good to see another FI blogger from Switzerland. I happen to have spent some time there living and working in Basel and I absolutely loved it! I’m also at the beginning of the FI journey and found all the spreadsheets and budgeting quite therapeutic (strange, I know).

Take it easy..

Thanks HTSC :)

Basel is a pretty nice city! Seems we are around the same progress (I’m around 6-7 %). I also find spreadsheets, tables and lists very therapeutic, not strange for me :P

Good luck on your journey to FI.

I think the last 100k will be the hardest.. Just waiting to reach the FI phase and say sayonara… Uhh-ohh. I’m so eagerly awaiting mine :)

Btw I liked the Pillar series :)

Hi Lexandro

The last 100K are the hardest because that is the one you are really eager to get :P I can understand that :) I’m far from it though.

Thanks :)

Nice work. It is very important to track net worth. The first 100k is always the hardest. But you are almost there. Keep at it!

Thanks DD :) I’m sure gonna be happy to reach the first 100K :)

Hi MRMr P.SWISS

silly question from my end…the comments above say you are getting close to 100k but I see from the graph that you are over 100k? If anything you a close to 200k? Or I am miss reading the graph? Thanks for clarifying.

Hi Jay,

The comments are old and I have updated the article in the meantime, with a new graph.

We should reach 500K this year if everything goes well.

Whoop whoop way to go congratulations on the 500K mark Mr Poor Swiss well deserved!! I am at 200.38k and excited to start doing or creating good habits that will help me see this number grow to FI and hopefully FIRE! thanks for all the tips and knowledge really ever so grateful I came across your blog. I am up all night sometimes reading from one article to another until late hours I don’t even remember my neflix pw coz I no longer have time to watch any of that :)

Thanks :)

It’s fun indeed to look at it but we should not obsess over that simple number :)

Haha, thanks for your kind words but don’t forget to sleep ;)