Automate your investments with Interactive Brokers in 2024

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Interactive Brokers recently introduced a new feature to automate your investments: Recurring investments. Many people have been waiting for this feature for a long time.

Indeed, many people want to automate their investments as much as possible. And this was not possible before with Interactive Brokers. But now everything changed. You can entirely automate your investments!

So, we will see exactly how to automate your investments with Interactive Brokers and what that means.

IBKR Recurring Investments

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

Until recently, you had to make all trades by hand with Interactive Brokers (IB). I do not think this is a big deal since I make all my trades directly on the interface, and it is only a few minutes a month. However, many people want an extra level of automation.

As of December 2022, automated investments are now possible. Indeed, IB introduced a new feature called Recurring Investments. This feature lets the user configure some investments that happen at regular intervals.

For instance, you could configure IB to invest 5000 USD in Vanguard Total World ETF (VT) monthly and 1000 CHF in Nestlé every two months.

You can use this feature with US and European stocks and ETFs. However, you can only use this feature on stocks that allow fractional trading. Indeed, the IBKR Recurring Investments feature is based on fractional trading.

Fractional trading allows users to buy a fraction of a share instead of a full share. This is important for the recurring investments feature to work. So, you must first get permission to trade fractional stocks (in your account settings) before using recurring investments.

For your automated investment, you can select different schedules, and IB will choose the proper day based on your start date and schedule. Currently, it is possible to use these schedules:

- Daily

- Weekly

- Biweekly

- Monthly

- Quarterly

- Semiannually

- Annually

The monthly recurring investment will make the most sense for most European people. In the US, people are paid twice a month, so a biweekly frequency makes sense.

Similar orders from all customers using this feature will be grouped and executed. This is done through Volume-Weighted Average Price (VWAP) orders. This is a special order type on IB. It is not important to know the details, but it is essential to know that All users with recurring investments in the same stock or ETF on the same day receive the same average price.

If the order starts on a day when the market is closed, the order will start the next open day.

It is also interesting to know that if you do not have the currency necessary for the trade, IB will convert the currency automatically. The documentation is not entirely clear as to how this will be performed. But I trust IB will use a similar kind of order on the Forex market and that execution will be suitable.

It is important to note that recurring investments use the fixed pricing scheme of IB. Indeed, IB has two pricing schemes, Fixed and Tiered.

So, for US stocks and ETFs, for instance, you will pay the lesser of 1 USD or 1% trade value on most trades. If you buy more than 200 shares at once, you will have to pay 0.005 USD per share, which is unlikely.

So, overall, fees will be extremely cheap and similar to what you are used to paying on your standard investments.

So, without further ado, here is how to automate your investments with IB.

Automate your investments with IB

If you already have an account, you can start automating your investments now. If you do not, you must first create an Interactive Brokers account.

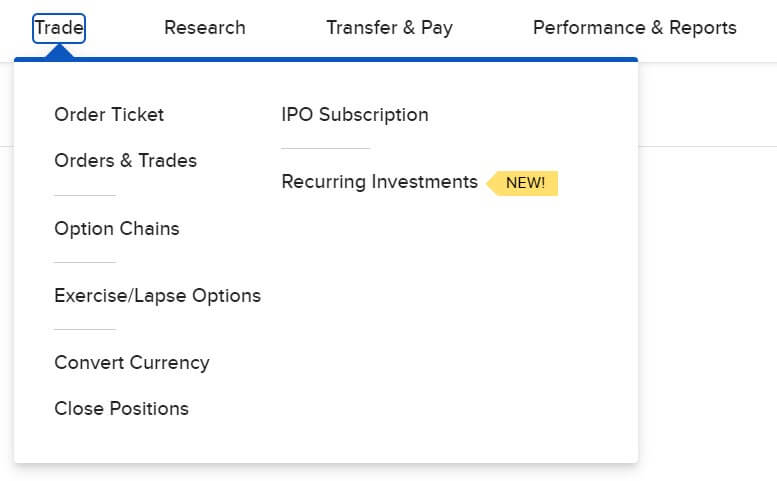

Now that we know everything we need, it is time to learn how to automate your investments with IB! The new feature is available from the menu under Trade.

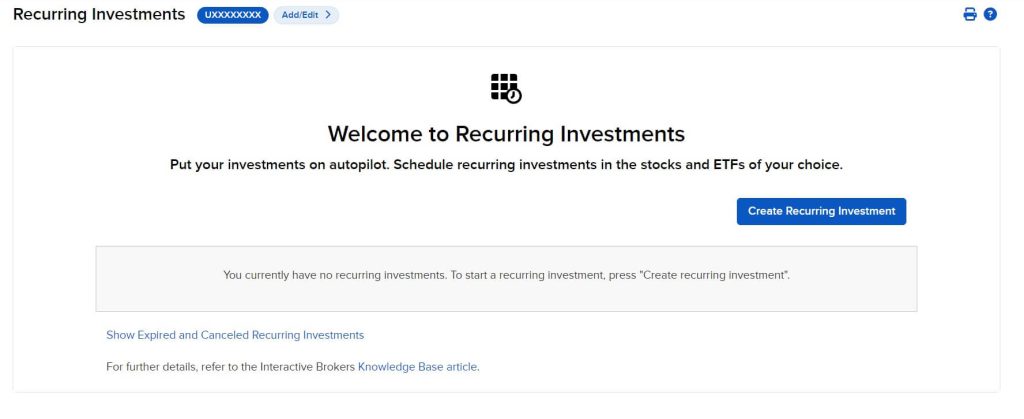

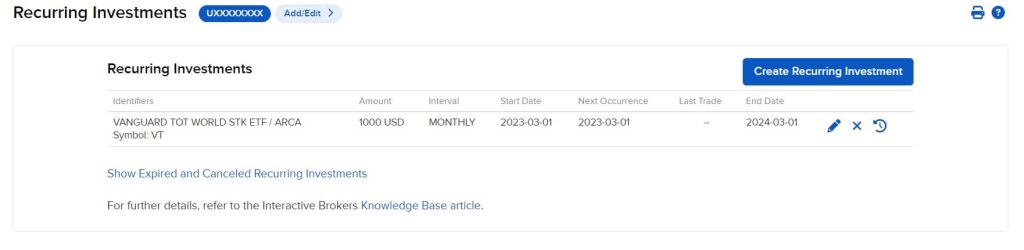

If that is your first use of this feature, you should arrive on a mostly empty page. Otherwise, you will see a list of your current recurring investments. From there, you can click the “Create Recurring Investment” button, and you will be able to create your first recurring investment.

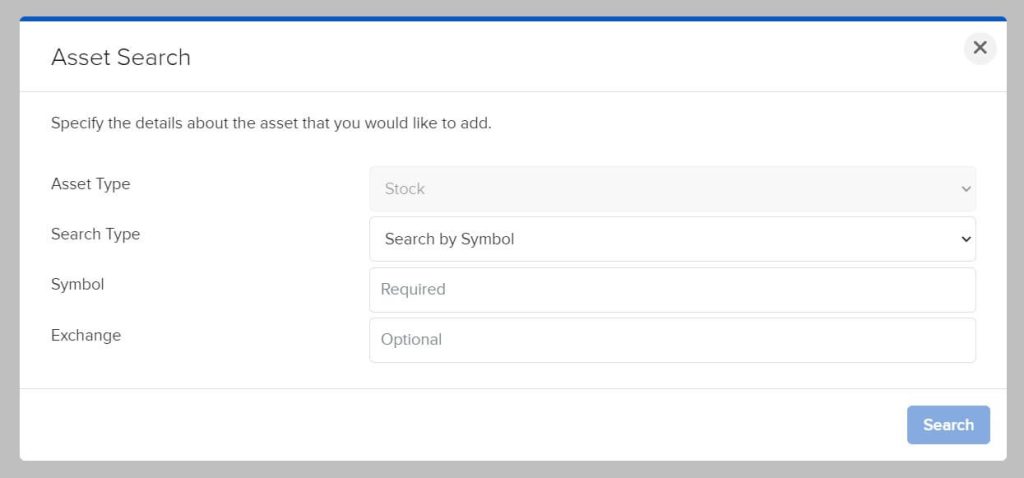

First, you must search for the investment you want to automate. For instance, if you want to automate your investments in VT, you can put VT in Symbol and press Search. This is simple.

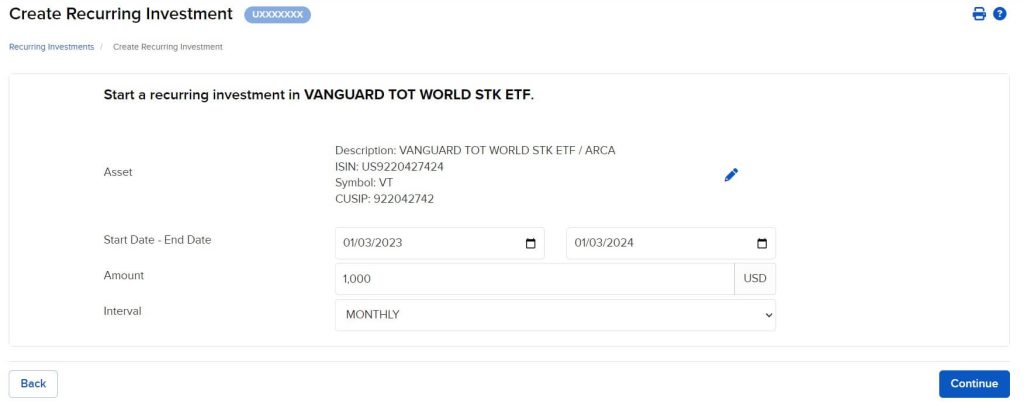

On the next screen, you can configure your recurring investment. First, you will need to select the start and end date. You can set them very far apart if you want to keep that recurring investments for a long time. In my example, I have set up one year.

Then, you can choose the amount. You cannot choose the currency because this is fixed based on the asset you have selected in the previous step. If you had chosen a Swiss share like UBS, you would have seen CHF on the second screen.

Finally, you can choose the interval. In my example, I have chosen monthly, but you can choose whatever you want.

Once you are ready, press Continue, and you will get an overview of the investment before finalization.

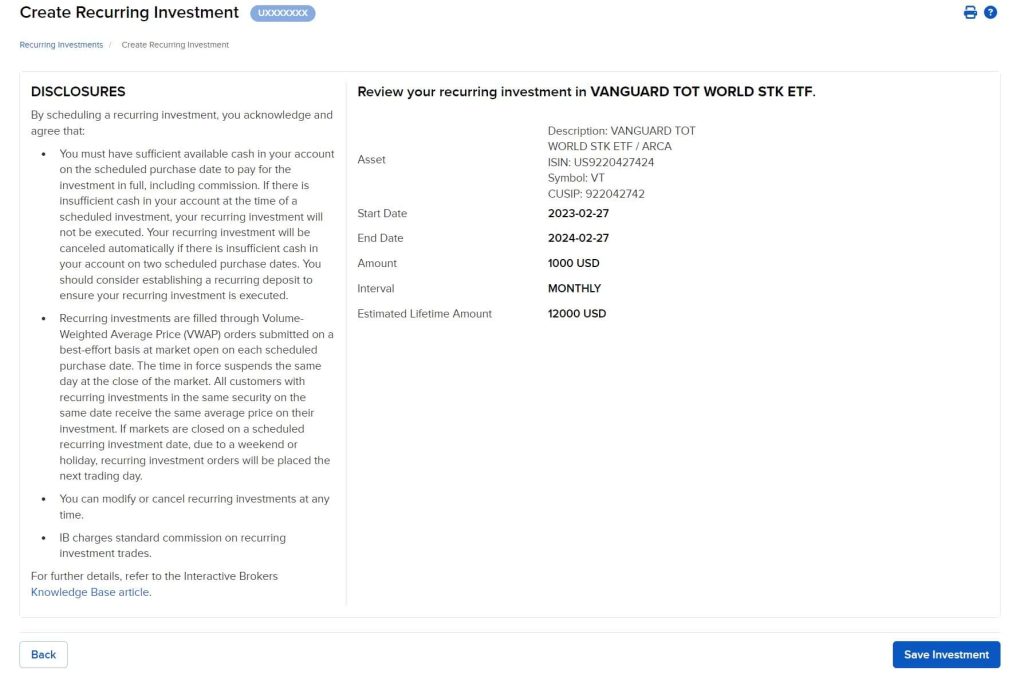

On this, you will get some disclosure information. You should read it at least once on your first recurring investment. Then, on the right part, you will get a summary of your automated investment.

For instance, for my example, we can see a monthly investment of 1000 USD in VT. Over one year, this will cost me 12’000 USD.

You should double-check all this data. Once you have checked everything, press “Save Investment,” and your recurring investment will become active.

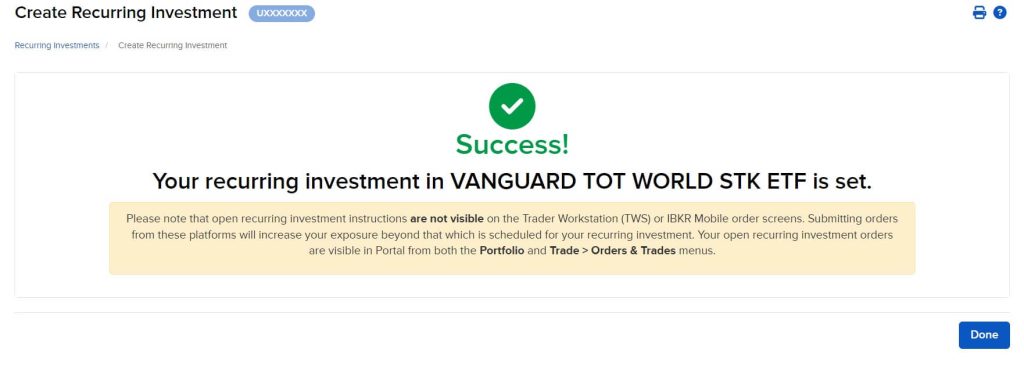

Your recurring investment is now active! By this time, you have successfully automated your investments on IB! On the next screen, you can see the new active recurring investment.

From here, you can update your recurring investments if you want. And you can start adding more if your portfolio has more than one position.

And this is already the end of the process. The process is very simple and was made to help you automate your investments in the simplest way possible.

Automate your deposits with IB

If you want to automate your investments, you must also automate your deposits. Fortunately, automating your deposits with IB for a long time has been possible.

First, you can access the proper view from the menu Transfer & Pay and then Transfer Funds.

Then, you can choose “Make a Deposit”, as you would normally do a standard (non-recurring) deposit.

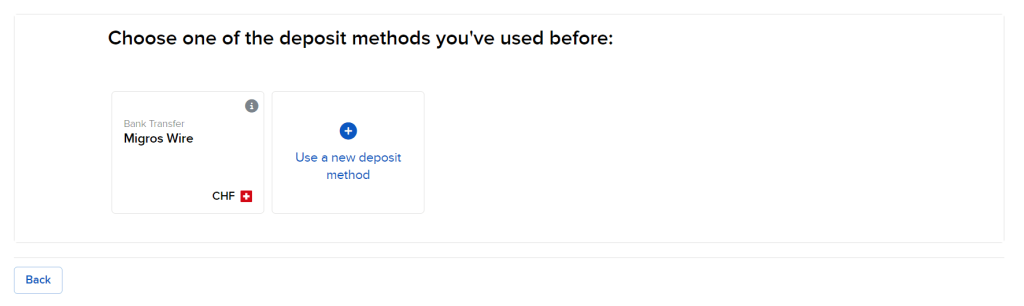

Then, you will need to choose a deposit method. Here, I only have my Migros bank account as a source. If you have not set up one, read my guide on investing with IB. It will help you.

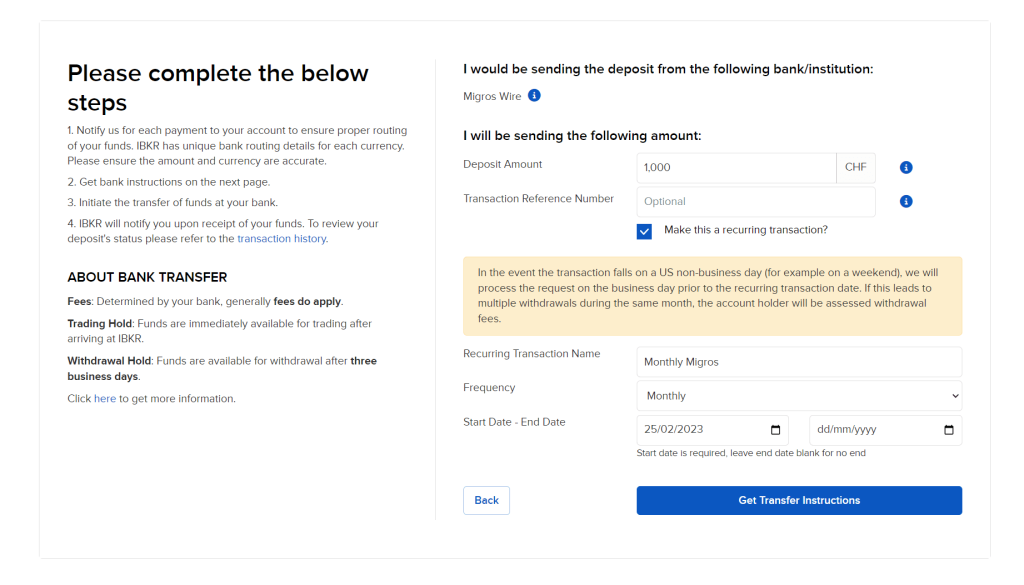

Finally, this view is where you can set up the deposit as recurring. Just check the box “Make this a recurring transaction?” and your deposit will be set to recurring. You can then choose the frequency, start date, and end date, similar to automated investments.

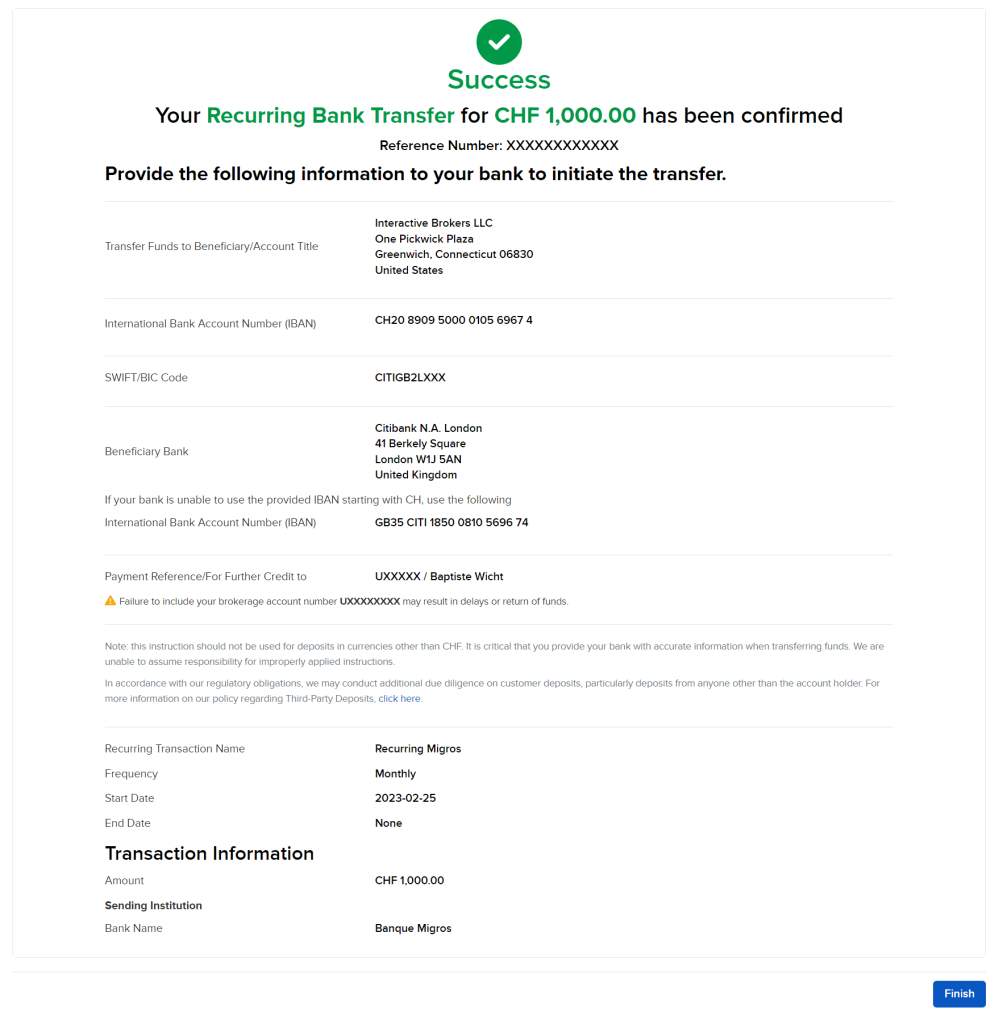

Once you have configured everything, you can click on “Get Transfer Instructions” and this will take you to a confirmation page.

You must confirm your recurring deposit with your password and second authentication factor. Make sure you double-check the information before your click on Save.

Congratulations, you have now successfully set up an automated deposit on IB. You only have to automate it on your bank side, ensuring you are using the proper information in the message so that IB can identify you.

With these two parts (automated investments and recurring deposits), you can fully automate your investments!

Conclusion

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

It is now possible to automate your investments with Interactive Brokers! Many investors will be very happy with this feature. I have often been asked whether automated investments were possible, and now I can finally answer yes!

I do not plan on automating my investments. I do not think this is useful since this makes people too complacent. Nevertheless, it is much better to automate your investments than not invest! And I know that many people disagree with me. Therefore, if this feature helps you invest, it is a great feature!

What about you? What do you think about this feature?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best Brokers

- More articles about Investing

- DEGIRO vs eToro: Which Is Better For You in 2024?

- Swissquote vs Interactive Brokers 2024

- Yuh Review 2024: One app to pay, save and invest

I got confirmation from my contact at IB that this was temporary, an update is rolling out. Several Swiss investors already got US ETFs back.

Bad bad news for us investors from Switzerland. IBKR won’t let me buy US etf’s anymore. Today I got the KID restriction. I’m really really sad because my whole strategy has gone down the drain!

Can you provide more info? What were you buying and why were you restricted?

Hi,

Currently, it’s not very clear whether this is intended or it’s a mistake. I am waiting for IB’s official stance before making any changes. If this turns out to be the case, I will write an article on our options. But it’s true that this will hurt Swiss investors!

I’m having the same problem. All US ETFs now can’t be bought and come with the following disclaimer:

This product requires a KID in a language approved for your

country. Retail clients can trade packaged retail products only if

an appropriate KID is available. More information is available in

https://ibkr.info/article/4718.

Hi Paul,

I wrote to IBKR support since I have been having same issues starting Saturday, April 29th.

They replied:

“The warnings, order cancellations or rejections for instruments without Key Information Documents (KIDs) are related to a temporary technical issue on our side which will be resolved soon. We are sorry for any inconvenience.

We have started to make products without KIDs subject to the European Union’s PRIIPs regulation available again to our clients resided in Switzerland. Temporarily restricted products should be automatically available for you again as soon as the update is rolled over for your account. The rollover process has started and is currently ongoing, no further actions are needed from your side.

As the update will be fully implemented, as a Swiss resident you will be able to place opening orders for products (e.g. ETFs) without KIDs again. You will be also able to resubmit your canceled orders if you would like to.”

So hopefully this will be resolved quickly.

Cheers,

Jana

Hello! Do you think it makes sense to buy stocks at local minima (whenever it is possible)? Or it would not make much difference because the long-term trend is anyway going upwards? Thank you!

Hi Pavel,

How would you know when is the local minima? If you knew, you could indeed save money, but nobody can know that with enough precision to make a difference.

First of all thank you for shining a light on this feature. I was waiting for it for a long time.

I have tried it this week already. I had only CHF on my account and since I don’t have a margin account, IBKR automatically exchanged CHF for USD. However, for this exchange there is not commission listed, where normally it’s 2 CHF if you do it manually! To be honest I’m not sure I understand why and whether there is not something I’m missing.

Hi Aurea,

You are welcome!

Thanks for sharing your experience. It’s indeed surprising that you did not get a commission. This should not be too expensive for IB since they will group all conversions and may net them against each other. So maybe, they are doing the conversion free of charge. Have you checked the activity statement to double-check if the charge is not here?

I checked in the report and there is indeed 0 commission there. And this is the case on 2 recurring trades already. The only difference is that there is an “L” to mark it as a liquidation. So it looks like you can indeed save some money with this feature.

Very interesting, thanks for sharing!

Hi

I plan to invest only 500-800 CHF a month. Is it worth it to do using automated investing or should I go to something else like True wealth?

I would say it’s always cheaper to use IB rather than TW if you are willing to manage your portfolio yourself. Once you have set up your portfolio in IB, you can use automated investing or invest manually.

I think the value of a robo-advisor is more in the setting up than in the investment later.

Can you give an update once you have seen the executions regarding fees on the trade and currency conversion?

Unfortunately, no, since I am not automating anything on my end. But I do not expect any surprises. Are you thinking the fees would be different or the execution worse?

It would be great if people shared their experiences here.

Ciao Baptiste.

Thank you very much for your guides, with your help i was able to make my first few investments!

But i have a questions for those recurring transfers / conversions. So what is the difference between submitting USD from my bank (USB) account to Interactive vs. submitting CHF and the exchange it in Interactive to USD? Isn’t the second option always comming with (small amount) 2CHF fees?

What is the most cost-effective way for me to recurringly buy US ETFs (eg. VOO) from my InteractiveBrokers Account?

Thanks in advance!

Regards, Diemo

Hi Diemo,

If you have USD in your bank account and you can send it for free to IB, then this is the cheapest option.

If you have CHF in your bank account, you should send CHF and convert it for 2 USD at IB. This will give you a much better exchange rate than you bank.

If you can transfer USD for free from an account in Switzerland to IB, please share your method. The last time I did it from a USD Postfinance account, it cost 14 USD (on the IB side as I understood).

In contrast, transfer in CHF to IB’s IBAN in CHF is 100% free.

I don’t have a method, but maybe Diemo has one or has an US bank account, not a CH bank account.

Can I automate currency conversions as well? I have monthly deposits in CHF and always have to manually convert them to USD before I buy the ETFs that I want. Thanks!

You can, but you don’t have to. If you don’t have the currency for a recurring investment, the conversion will be done automatically by IB.

If you want to automate, you can use the Forex pairs. For instance, if you buy USD.CHF, you will USD with CHF.

Awesome, thanks Baptiste!

It would be great if you could set the recurring investment amount in CHF, so the recurring purchase would be for example whatever amount of USD you get for 1500 CHF on that particular day. That way you wouldn’t have any spare uninvested cash in the account.

Maybe something for them to implement in the future…

Hi Andreas,

You are right that if you want to ensure your trades go through, you need some margin so that USD/CHF does not block your trade for a few missing USD.

On the other hand, having a little cash uninvested is not the end of the world. I often have 1000 CHF on my account that sits idle.

Do you know how fractional shares are treated by the swiss tax authorities?

As far as I know, there is no difference, you would declare a 0.X share, but I have never owned any fractional share, so no expert here.

This is correct.

Wow, thanks for this post. Do you know if IB is smart enough to auto-buy as soon as the money arrives? Otherwise, I have to make sure that money arrives first and auto-buy kicks in a few days later.

The rules are rather strict for the day. So, if the money is not here, I believe the order will not be made and you would have to wait until the next period.

I would personally do the recurring deposit on Day X and the trade on X+2 to be sure.