What should you do with a life insurance 3a?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Recently, I have talked about life insurance 3a policies and how bad they were. We have established that they have almost only disadvantages compared to an invested 3a.

So, people should not take new life insurance 3a. But what should you do if you already have one?

There are a few options about what to do with life insurance 3a. We will explore them all in this article and compare them. By the end of this article, you should know what to do about your life insurance 3a.

Life Insurance 3a

We have already established that life insurance 3a has significant disadvantages:

- Their returns are low.

- Their fees are high.

- They are very inflexible for deposits, locking you into this monthly expense.

- They are very inflexible for withdrawals, making you lose money in taxes.

- They are not transparent.

- They are heavily advertised.

The only advantage they have over an invested 3a (like finpension 3a) is that they have a guaranteed amount of money. However, life insurance 3a only guarantees a 0% interest rate, and the guaranteed amount is less than what you paid. If you want guaranteed 3a, you should take a bank 3a.

Life insurance 3a also has insurance in case of disability and death. This extra insurance may sound like a significant advantage. However, most people will not need insurance. On top of that, you can get pure risk life insurance for a fraction of the fees of life insurance 3a.

If you need more convincing, I have an entire article explaining why nobody should fall into the trap of life insurance 3a.

What to do with existing life insurance 3a?

It is essential to know that life insurance 3a is a terrible instrument. But what should you do if you already have one?

First, you should not feel bad about it. Many people in Switzerland are falling for life insurance 3a. I have a life insurance 3a. I am not proud of it, but I consider it a learning opportunity.

Why did I take life insurance 3a? An insurance advisor convinced me, and I did not know any better. Most people in Switzerland do not have the necessary financial education to understand how bad these products are. And most people in Switzerland trust advisors, banks, and insurance companies.

Banks, advisors, and insurance companies push these products because life insurance 3a is very lucrative. But life insurance 3a is not lucrative for its users.

We now go to the main question: What should we do with life insurance 3a?

There are three main ways to deal with life insurance 3a:

- Do nothing

- Reduce or stop the payments

- Cease the contract

We will see these three ways in detail in this article.

1. Do nothing

The first and simplest option is to do nothing. You continue contributing your monthly premiums, which stay in your life insurance 3a until your retirement age.

While this option is the simplest, it is also the most costly. Indeed, we have seen that life insurance 3a has abysmal returns and is very expensive. These low returns and high fees result in low performance for life insurance 3a in the long term.

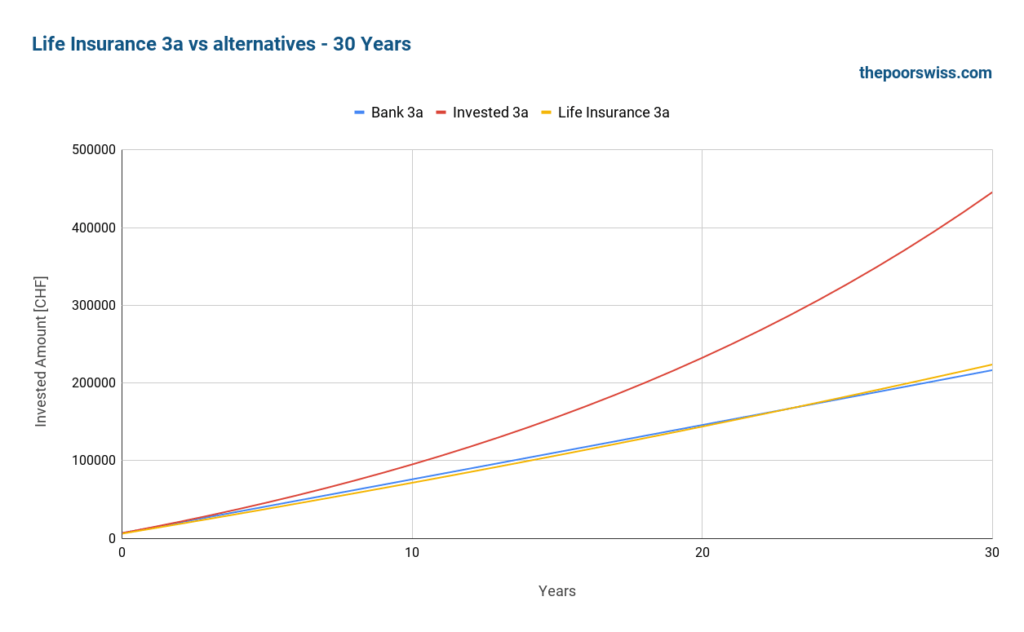

In the previous article, I ran a comparison and got these results after 30 years:

We can see that doing nothing can be extremely costly. Over 30 years, investing in a good 3a could easily yield twice more money by the time you retire.

Overall, I would strongly advise against doing nothing!

2. Release the premiums

The second option is to stop paying the premiums either fully or partially. Most life insurance 3a allows you to be released from the premiums. Once you release the premiums, you will not have to contribute anymore, and the money will stay with the life insurance until the original policy termination date.

From what I know, all life insurance 3a include such a clause in their conditions. So, it is generally not a huge deal to do that.

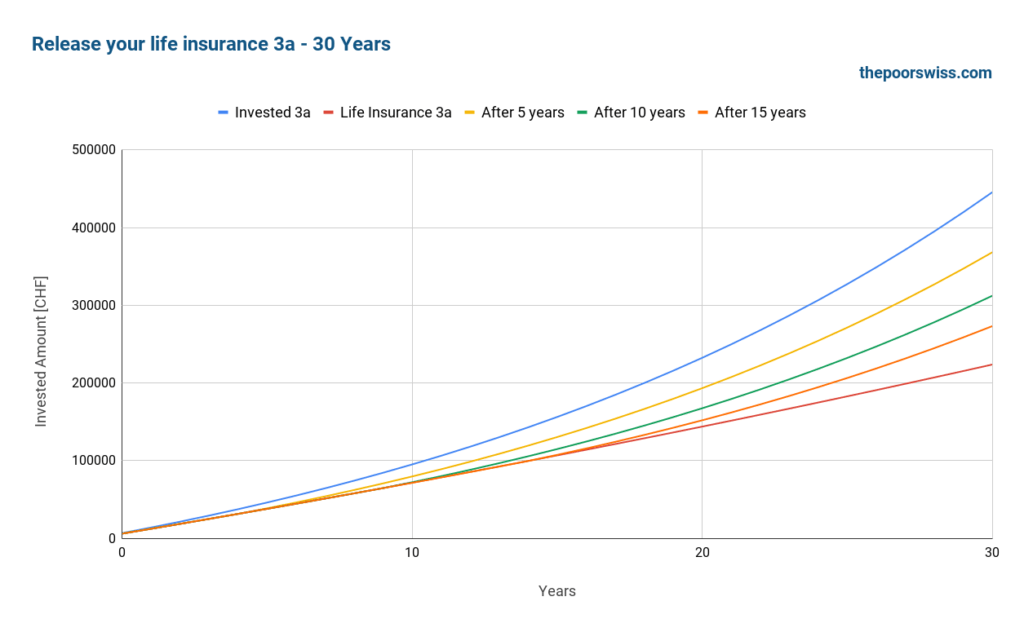

Here is what would happen to the money by stopping paying the premiums, simulated for 30 years.

We can see that the earlier we stop, the better results we get. It is logical since we get better compounding in the invested 3a, with much better returns. The part invested in the life insurance 3a will continue growing slowly over the years, but you could see it as bonds in your portfolio since this money (minus the fees) is guaranteed.

If you stop the premiums very early, in the first few years of the life insurance 3a, you may incur a penalty. Indeed, in the first few years, the life insurance company takes more in premiums for the risk premiums than in the following years. However, the earlier you stop, the better you will end up in retirement.

This strategy always makes sense unless you are extremely close to retirement. Even a few years without fees could help.

You must remember that the stock market returns are great in the long term but not necessarily in the short term. So, if you are close to retirement, below five years, you could stop the premiums and switch to a bank 3a instead. Or, you could be more conservative, depending on your asset allocation.

It is probably worth mentioning that doing that may prevent you from taking on another life insurance 3a. But that is probably a good thing.

3. Break the contract

The third option is to go a little further and entirely break the contract. With that, you stop paying, and you get back the money from the insurance company.

With this option, you will get back the buyback value. This value is based on the current value minus some cancelation fees. Usually, this value is zero in the first few years of the contract. You have no choice but to transfer this value to another 3a account.

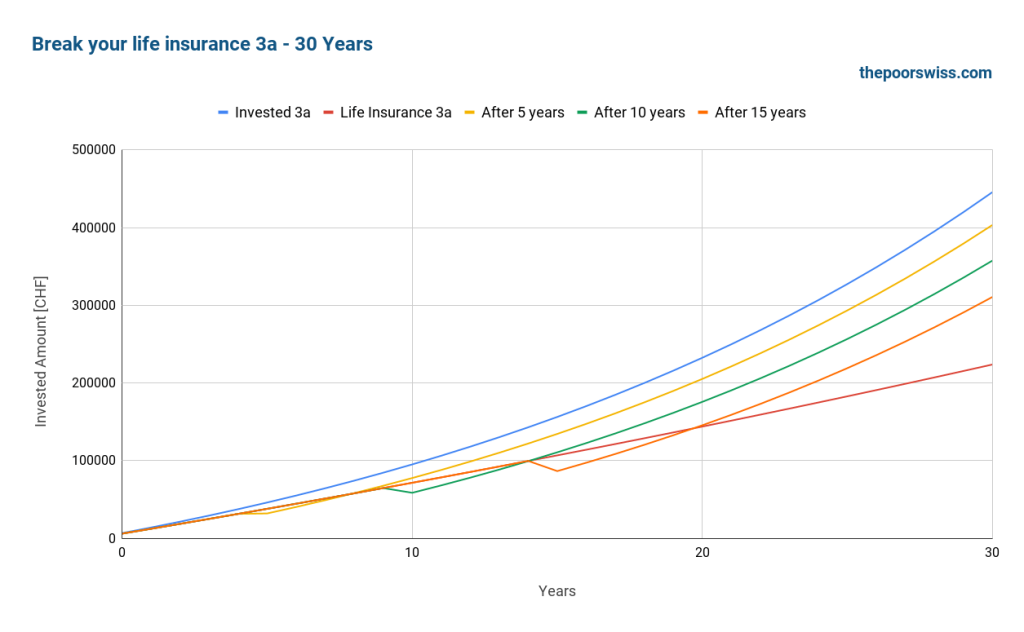

Once again, we can simulate this. I will assume that by canceling the contract, you will lose an extra 20% of the value compared to what you would have in life insurance 3a. This assumption is not precise since, in theory, you would lose more during the first few years and less during the following years. However, this allows us to make a simple simulation.

You may lose more than 20% or less than that based on your life insurance company. Unfortunately, they are not very transparent about these fees.

Here is what would happen if we were to break the contract after 5, 10, and 15 years.

We can see that the penalties can make a significant dent, but the returns of a good 3a easily recover this.

Again, the earlier you break the contract, the better the results will be in retirement. This effect is due to the compounding of the invested 3a.

I should repeat the disclaimer for the previous strategy: if you have only a few years, the stock market’s returns may not be great, depending on the timing. Therefore, breaking your contract a few years before retirement is not a great idea.

Comparing the three strategy

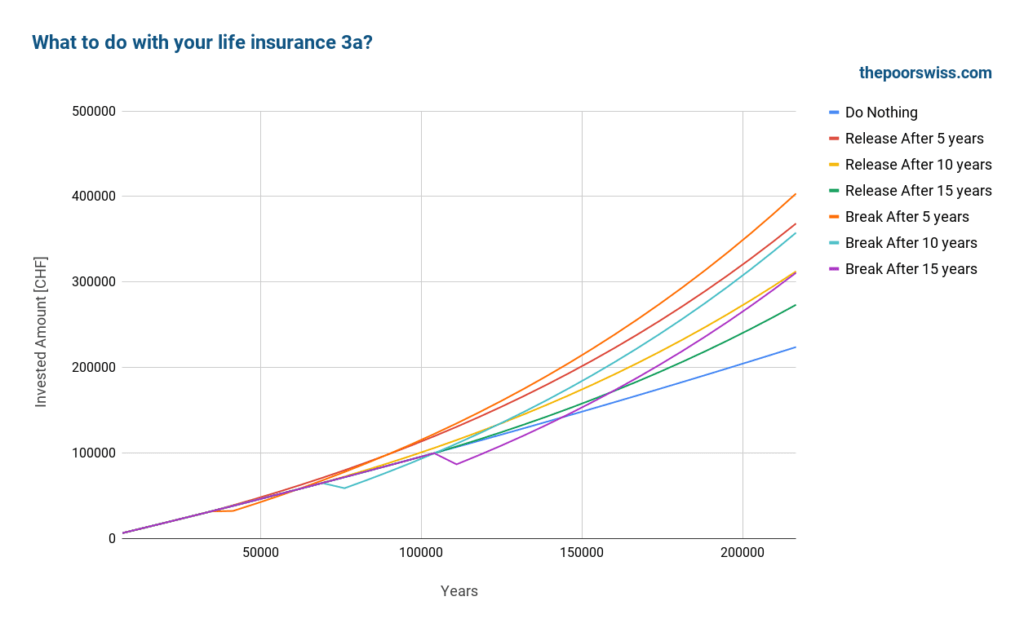

Here are all three strategies together on our graph to summarize them.

The difference between the worst and best strategies is almost 200’000 CHF! Such an amount of money can make a very significant difference in your life in retirement.

Unless you are very close to retirement, you should do something about your life insurance 3a. And doing something means either releasing your premiums or entirely breaking the contract.

The earlier you can do something, the better your returns will be in the long term. And generally, it should only take a few years to recover the loss from breaking the contract.

So, what makes the most sense is to break the contract and move the little money you get back into a good 3a and then invest regularly into that 3a. Releasing the premiums is also an excellent strategy that can make a lot of difference.

Life insurance 3a and mortgage

If you have tied your life insurance 3a with a mortgage for indirect optimization, you may be unable to change your life insurance.

Indeed, if you are using it for indirect amortization, your life insurance 3a policy belongs to the bank. Therefore, you will not be able to make any changes to the contract without changing the mortgage contract.

In these cases, the best option is to wait until the next contractual deadline for your mortgage. Then, you can either switch to direct amortization or use another third pillar for indirect amortization.

Of course, you can also ask your bank to see if there is a quicker way out.

What will I do with our life insurance 3a?

By now, you may know that I also have a life insurance 3a. And if you have read my previous article on life insurance third pillar, you will know that my life insurance policy is really bad.

Before writing these two articles, I thought I would keep them as a reminder of my error. Then, I was thinking of lowering the premium from 300 CHF per month to 100 CHF since it seemed possible. Since I had to wait a few more years because of my mortgage, I wrote these articles to support my evidence.

At this point, I have realized that my life insurance 3a needs to stop. Before, I did not know it was possible to stop paying the premiums completely.

Finpension 3a is the best third pillar in Switzerland.

Use the FEYKV5 code to get a fee credit of 25 CHF*!

*(if you deposit 1000 CHF in the first 12 months)

- Invest 99% in stocks

So, I plan to break the contract in 2024, when I can renegotiate my mortgage. At this point, I will remove the life insurance 3a from my mortgage, switch to direct amortization, and start to invest in finpension 3a fully.

I will then move the leftover money from the contract into Finpension 3a. At first, I was thinking of keeping it and considering it a bond. However, life insurance 3a is much more than a bond. Therefore, it does not make sense to keep some money with these people.

Conclusion

If you are trapped with a bad life insurance 3a, I strongly encourage you to do something about it. At least you should learn more about how they deliver very poor returns, have high fees, and are not transparent.

The results of this article show that doing nothing may cost you a lot of money in retirement. Before doing this analysis, I considered doing nothing. However, I now realize it does not make sense.

Once I can renegotiate my mortgage, I will free my life insurance 3a from the bank. Then, I will break the contract and invest everything in finpension 3a.

If you need to find a good 3a after reading this article, you should read about the best third pillars in Switzerland.

What about you? What will you do with your life insurance 3a?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Retire in Switzerland

- More articles about Retirement

- Third Pillar: All you need to know to retire in Switzerland

- What is a 1e pension plan (pillar 1e)?

- Vested benefits accounts: All you need to know!

Thank you for your advice. I was conned by my Home Mortgage advisors in Zurich into opting for a 3A life Insurance. My wife and I have been paying into it since 2017 (i.e. 5 years now). I have now written to the 3A company to release us from any further premiums going forward in 2023. Let us see what they have to reply.

Hi,

Congratulations on acting on it! Keep in mind that if the life insurance is tied to your mortgage, you will not be able to stop paying since this represents indirect amortization for your mortgage.

Hi Baptiste,

Thanks for the article. Just would like to share my experience on the matter. Last year I was in the same situation like you with a life insurance 3a that cumulated to around 40k. I work in the banking field and asked myself how not convenient for me was such a product (and of course how convenient was for the insurer), so I decided to close it and transferred all in the finpension 3a, as I also believe is currently the best player out there. I paid a penalty of some thousands, but I believe in the long run is a proper choice (beside the suffering of this year..).

On the side, I opened a full risk life insurance where I can customize my specific insurance needs and I believe this is the setup that fill the majority of people (3a invested + full risk insurance). Btw the 3a insurance broker is a good friend of mine but as you mentioned the problem is in the industry itself.

Thank you for your article and kind regards,

Brian

Hi Brian,

Thanks a lot for sharing your story!

And congratulations for getting out of this situation. It’s not easy to pay the penalty even when considering the future.

I wish this industry would stop costing a lot of money for future retirees.

Great and extremely useful blog, a big thanks. Are you aware of any tax penalties for breaking a life insurance 3a?

Hi TBG,

No, I am not aware of any such penalty regarding taxes.

Hey Baptiste

Great article as always! I read a lot about 3a Insurances and how they are bad for most people. I do also have a 3a Pillar with an insurance (Pax) for some years now and have been considering switching to Finpension or Viac (or at least open a separate one along with the existing one). However I haven’t seen any articles addressing the topic of “Premium exemption” (not sure of the exact translation in english, in German it’s called Prämienbefreiung). Essentially, if you become disabled at one point, the insurance will keep investing for you in your 3a fund as long as you recieve money from the invalid insurance. This, because you are legally not allowed to further invest in your 3a fund once you receive that money. I think this matters more than the life insurance per se. What are your thoughts about this? Is this something you have considered in your decision making as well or can this be achieved in another way without having to miss out on returns of the 3a pillar?

Hi Carlos,

That’s correct, life insurance 3a will continue paying for you if you become disabled. That’s indeed an interesting feature that most brokers will push you to get.

However, what brokers won’t’ tell you is that pure risk life insurance can have the same feature. The example in my article about life insurance 3a has this “Premium Exemption” feature as well.

So, with pure risk life insurance on the side, you have this advantage, and you don’t have the disadvantages of 3a life insurance.

very useful info

however i see that the returns of 3a with Swisslife are very good

which one would you recommend for 3b ?

Hi Yasin,

I am not sure I understand. Are you talking about the Swisslife funds or life insurance? I would be interested in figures showing that 3a swisslife life insurance is good.

I don’t recommend a 3b life insurance either.

Hello there, I started a 3a with AXA (90% investing, 10% insurance) last year with a monthly payment of 300,-

If I stop now, they will give back just 1’100,-

:\\\

What do you think? Is it worth then losing 2k now for a better return during time, isn’t it?

Hi M,

Yes, it’s worth it. It sucks to lose money, but at least you only lost “a year”, not several like me. So, unless you are very close to retirement, I would recommend closing it or at the very least stop contributing to it.

Thanks Baptiste for the follow-up.

It’s decided, I’m going to take action on my contract as well. Your information will help me choose the right exit strategy.

Well done! Good luck :)

Thank you very much for all this information. Most of us reading this are probably already in the trap, but it is better to become aware (sooner or later) rather than never. I have to write to my broker, he is such a nice guy and I was trusting him blindly…

It’s indeed better to know.

I am not blaming my broker that much, but the industry in general sucks. And it’s my fault anyway to have not done the math. And now I know to trust no advisor :)

I think that many people who read this are already in this trap… Hopefully it will get to many others who might be able to avoid it!

Thank you for all the research, it is less painful to break the contract when you see the figures as clear as here.

Hi Adrian,

Yes, it’s likely that there are many people like me in this trap. Hopefully, these two articles will avoid some more people falling.

Hey Baptiste,

Thank you for the great article. After reading the last one you wrote I went to do a little research and it would seem to be possible to transfer the funds that were already paid in this type of life insurance to another of 3rd Pillar account, such as Finpension 3a while terminating further contributions. As you did not write about it, I was wondering if this is indeed the case. Thank you very much and have a great week.

Gonçalo

Hi,

I am not sure I understand. What you describe is option #2 in the article. You break the contract and then transfer the money to another 3a.