May 2020 – The revenge of the taxes!

| Updated: |(Disclosure: Some of the links below may be affiliate links)

May 2020 is over! One more month that we spent at home. Restrictions have started to get eased in Switzerland. But we still spent most of the time in our apartment.

We managed to spend very little money this month. However, we now have to pay the taxes for 2019! Given my significant increase in income last year, I did not pay enough taxes in 2019! So now, it is time for the taxes to take their revenge!

So, while our pre-tax expenses are quite good this month, our savings rate is down to zero! It has been almost three years now since the last time it happened. A zero savings rate is never great news. But we knew it would happen.

So, for the first time in almost three years, we are back to a month with zero savings. Our net worth went down this month.

May 2020

May 2020 was pretty much uneventful. We had a few meals with friends but only with five people or less (the current maximum in Switzerland). We went for walks in the forest and to the river. But aside from this, we only went to groceries.

This situation is fine by me, but I wish we could start again having parties with more friends and families than five at a time. And Mrs. The Poor Swiss would be glad to get out of the house and out of our village.

Regarding our financial situation, this month was okay for the pre-tax expenses. We managed to spend little money once again. Our level of expenses is reasonable. I feel like we are going to keep our goal of having our expenses below 4000 CHF on average per month.

But when we include taxes, May 2020 is a terrible month for our finances. We had to pay a ton of extra taxes this month. I knew it was coming. But it still sucks to have to pay such amounts of money.

After taxes, our savings is a beautiful little zero. We have not saved any money this month. And we had to use our savings to pay out the taxes. It will happen again next year but in a much smaller proportion.

On top of that, paying an extra 600 CHF for my knees is starting to piss me off. I still have no clue as to what is wrong, and I have already paid a significant amount of money. If doing physiotherapy does not help, I do not want to go back to doctors and continue paying for nothing.

Except that, this was a very simple month. The weather was good most of the time. So we have enjoyed our backyard a lot.

Still working at home

I have spent this entire month working at home. And I am still enjoying it.

I have built myself a nice routine for my day, with a walk in the early morning and a coffee pot pause later on in the backyard. I feel this routine is more healthy than when I was working in the office.

I hope that the COVID situation gets resolved quite soon. But I hope that the work-from-home situation keeps longer. Hopefully, my company will relax its rules for working from home in the future. But I am not very hopeful about that.

Now that I am always at home, I realize that I need to invest in a good ergonomic chair. The one I am having now is not made for working all day on it. It is quickly becoming uncomfortable. For now, I am waiting to see if my company makes the remote work option longer or not. Then, I will see if I buy a new one or not.

Unfortunately, work has been crappy these last few months. We have not been doing anything interesting recently. It is starting to wear on me. I used to love my job. But I now realize that I do not enjoy it that much anymore.

Still searching for a house

Regarding our search for a house, not much has happened here. We are starting to realize that my income is simply not high enough for us to buy the house we want. We will need to reduce our requirements otherwise we will never get a loan for the house we want.

On top of that, there is also the fact that banks do not want to take my bonus into account since I have not worked for three years at the same company. I feel like this system is pretty dumb. Financially responsible people cannot get a mortgage. And at the same time, financially irresponsible people can get all the consumer loans and leasing they want.

It is a bit disappointing that Switzerland is a country where you cannot afford a nice house with a gross income of almost 160’000 CHF per year and a savings rate of 50%. I have to say that this sucks. I was not expecting that. Maybe, we are Poor Swiss in the end!

All the houses we are seriously interested in cost between 950K and 1M. But we cannot properly afford anything higher than 850K without bringing in more than 20% in cash. But doing so does not make any sense financially.

We will continue looking, of course. But we may have to settle for something less than what we want.

Expenses

Let’s see the details of our expenses in May 2020:

- Insurances: 1235 CHF: Health insurance and home insurance.

- Transportation: 89 CHF: Parking place and one half gas refill.

- Communications: 82 CHF. Internet and bill for my phone plan.

- Personal: 1045 CHF. Mostly bills for my knees and a service fee for the blog.

- Food: 251 CHF. Normal grocery bills.

- Apartment: 1247 CHF. Only the rent bill.

- Taxes: 11062 CHF. I have already talked enough about these bills!

Looking back in the past, I have never spent that much money in a month in my life. Let’s hope this is a record we are not going to beat any time soon.

Not taking the taxes into account, we are meeting our goals of spending less than 4’000 CHF per month. Now, we are very close to this limit. So we spent a bit more than I thought. And the main issue is the large bills for my knees (still without any solution). I paid more than 600 CHF this month again.

Aside from this, we had to pay the house insurance bill, which is once a year. Our gas budget for the entire month is 29 CHF. And last month, we spent 0 CHF on gas!. Low transportation fees are one of the significant advantages of working from home and social isolation.

So, I am not too unhappy about these expenses. There is not much we could have done better this month.

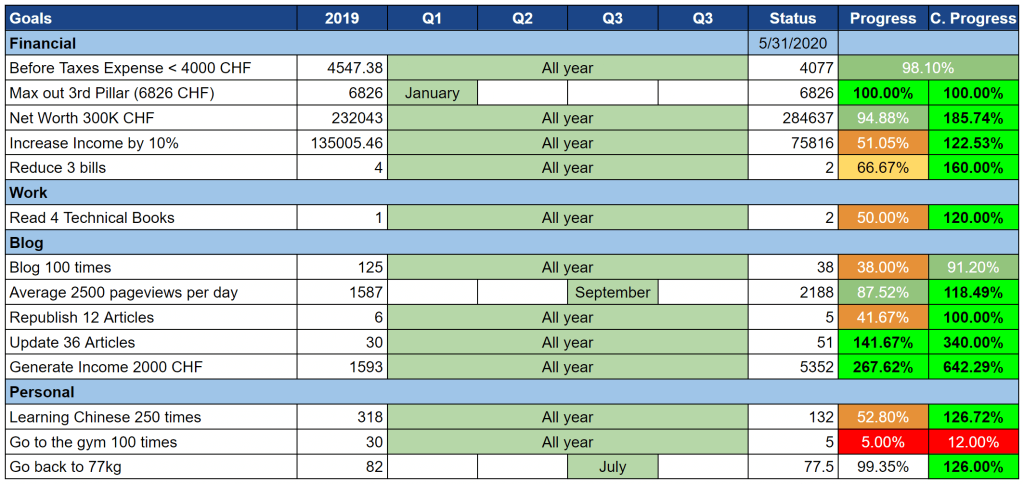

2020 Goals

Let’s take a look at how our goals are doing at the end of May 2020:

Overall, our goals are still doing great. We did not make much progress this month on some of our goals since our net worth went down. But there is nothing terrible either about them.

I even managed to lose weight during isolation. I am still not sure how this happens. Maybe that my morning walks help a little here. But I am not sure this is the case. I am pretty sure that some of the lost weight must be muscles, unfortunately.

As for the gym, this goal has been destroyed by COVID. Gyms are slowly restarting now. But I do not think I will do 15 minutes in the car just to go to the gym if it is not on my way to work. So until I am working at home, I will not go to the gym.

I realize that I have to start exercising at home. I am now trying to find a gym bench to do my exercises. I do not need much. And I already have a few dumbbells at home that will be more than enough for that. The problem is that we do not know where to put it since we have little free space.

One goal is going backward. The page views on the blog are decreasing month after month. I am still on track for this month. But if this continues decreasing, I will not reach this goal. And I am running out of ideas to make it work.

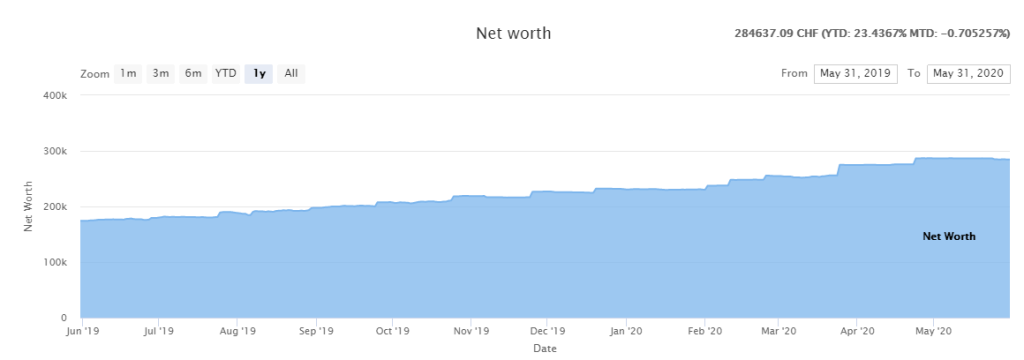

Net Worth

Let’s see how net worth evolved during May 2020:

We can see that this month our net worth almost did not move. Fortunately, even though we spent a ton of money this month, our net worth only decreased by less than 2000 CHF. And we did not have any special income this month.

The reason is not the stock market growth since almost all our assets are out of the market for a house. But my second pillar is not counted in our income and continues to grow. Also, the dollar appreciated slightly compared to the last time I checked it. So, it is not so bad. It should go back to growing next month.

Overall, our net worth is still going nicely. We are still on track to reach 300’000 CHF by the end of the year. But of course, this will highly depend on whether or not we find a house.

The Blog

Once again, the blog did not do well in terms of traffic. It went down again for the third month in a row. I do not see what to do to get out of this plateau.

I am keeping up with my routine of publishing two posts a week. Going back to three could improve my traffic. But I feel like two articles a week is a reasonable rate for me and the blog. And I am continuing to update some older content. But this seems to no avail.

I have a few ongoing things to improve the blog that will come next month. But no dramatic changes. I will not make any more changes to make the blog faster. All my effort on this side did not affect traffic. But hopefully, visitors can see that the blog is fast.

I have a few ideas that could improve the traffic, but they require a lot of time. For instance, I am sure that translating some of the posts to French could bring in a significant amount of traffic. But I do not have the time or the motivation to do that now, to be honest.

And I think that adding videos to some of the articles would also help. But again, I do not have to continue producing content and doing videos at the same time. But this could be something I do once I am done with the ongoing improvements to the blog.

Do you have an idea of what I should do to increase traffic?

Hopefully, some of the posts I have planned for next month will bring a little more traffic. But I have been wrong before on that. So, we will just wait and see.

On the other hand, I still get many comments and emails from readers. And many people are expressing their thanks for the blog. So it seems that the blog is doing a good job of being helpful. I should work on being content with that.

As usual, here are the top three posts in terms of traffic for May 2020:

Unfortunately, the new articles of May 2020 did pretty poorly this month. So, fortunately, some of my older articles are still bringing in some traffic.

What about you? What was your favorite article this month?

Next Month – June 2020

I do not expect much will change in June 2020. Normally, the next restrictions of isolation should be removed. It means we will be able to organize small parties with friends again. It is honestly the only thing that I missed in isolation.

Normally, I will still be working from home the entire month of June. But this could change. Hopefully, I will not have to go back to the office for a while.

There may still be some extra taxes coming in next month. I have not yet received the report for the municipality taxes. And I know I did not pay enough last year. It should be lower than this month. But it could still be bad. Except that, I do not see anything unusual. But as usual, I could have overlooked something.

What about you? How was May 2020 for you?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Thanks for the amazing blog. It really is very helpful!

Have you already written about how you track your goals? I found the spreadsheet you showed very impressive and would be interested on a deep dive on how did you come up with it and how are you feeding the data.

Thanks,

Hi CLS,

I have not written in detail about that. I have a small section about in my post about my 2020 Goals, but that’s about it. This should cover how I come up with my goals.

But for the feeding, it’s mostly manual. Each month, I update the data in the spreadsheet, for instance, the number of books. It just takes some dedication at working the habit. For me, it’s really natural to track that way. Most of the financial data comes from my money system. But I have not done any smart import, only copying data once per month.

I hope this answers your question.

Hi,

if you are relying on SEO as a main source of traffic I think you should work more on the link building part.

Also enhancing social media amplification via share buttons / social media page can help.

Lastly, your e-mail subscriber list is another asset to leverage.

Hi D,

Thanks for the suggestions :)

I know I need more backlinks. But I do not enjoy guest posting and I truly hate link outreach.

I found out that almost nobody was using my share buttons. I may put them back later.

What do you think I should do to leverage my mailing list more? It’s well visible on the blog and I am actively sending messages.

Thanks for stopping by!

Well I would start by understanding what’s the “deal”: why someone would subscribe to your list? Why someone is visiting your website in first place? What is generating value for those audiences? How did they find you? What are they looking for?

There are reasons why people are taking action. Uncovering the why would definitely help in understanding what’s valuable here.

For instance. I guess you have a cluster of people who are interested in “budgeting”. Another cluster interested in “moving to switzerland”. And so on and so forth.

How can you serve them better? Where can you reach them?

Feel free to reach my via e-mail if you have any question :) I guess is too long to explain in a comment!

Hi D,

These are good points. And you are right, not everybody in my audience is interested in everything. Some people are here for the frugal tips, while others are just here for the investing. And some are mostly following monthly updates.

I need to try to serve them all better :)

Thanks for sharing! This is helpful!

He TPS,

I honestly don’t understand how you can pay so little for taxes. I have a B permit so it’s detracted from my salary directly, and being in Geneve it’s ~18%

You pay in one single instance 11k, which means you pay less than 1k per month (unless I’m missing something)

If you were in Geneva it means your gross salary would be ~5500k and I really doubt.

I hope I’m not asking too many personal questions, but I’m really confused on how you can achieve this

Hi Daniel,

You are missing something :)

The 11k I paid this month is basically just what I did not pay last year because I did not pay enough in advance. This is not the total of taxes for the year :) I am not paying my taxes all at once, there is too little advantage for doing that.

For this year, I should be at around 2K per month on average. My gross salary is about 11K per month.

Do not worry about asking too many questions, I am trying to be transparent :)

Hi there,

I’m still amazed at how you can keep your monthly spending below 4k per month. We pay more rent and garage than you but still it’s a very huge difference. Maybe you can write something about things you spend on and things you don’t spend on. And also for grocery shopping, two of us need CHF600 per month plus coffee. And we shop in discounter supermarkets. Our insurance is lower than yours though.

It could be interesting to read how you allocate your money and maybe there are ways or approaches that people haven’t thought about yet.

By the way, we are also looking for apartments or houses, passively. The income constraint (Tragbarkeit) is a barrier. Do the banks use 4,5% instead of 5% now?

Cheers

Yasi

Hi Yasi,

Keep in mind that the 4K per month is without taxes.

Maybe you can share how much you spend and I’ll tell you if I think something is high (you can use the contact page if you want to do it privately).

I have a post describing the expenses of 2019. Hopefully, this should help you :) If you find something that is puzzling about our numbers, let me know and I’ll try to explain what we are doing :)

Also, our average is currently slightly higher at 4100 CHF. Some months are higher than others.

Some banks use 4.5% now indeed while others use 5.0%. Bun on top of that, they will add the amortization and the maintenance of the house, so it’s more like 6% in total… It’s definitely a barrier for us as well.

Thanks for stopping by!

I like this post. Perhaps include a few pictures one in a while. 😉 otherwise content is great. I just read that the swiss national assembly decided that employees working in switzerland could contribute more than 6826 Fr. to pillar 3a in the near future. Perhaps you could elaborate more on that in a future post. Keep going. ;)

Hi Hung,

Thanks for your kind words. I try to include pictures when something is picture-worthy, but these days we haven’t done many picture-worthy things :P I’ll try to include a few on next month’s update. That’s a good point!

Yes, I have seen that as well. While this was accepted, it still remains to be put in place. I will be sure to talk about this once this actually possible and once we know the exact details.

Thanks for stopping by!

We’re in the same boat as you in terms of owing extra taxes. Even though I haven’t tracked our household expenses for years now, I kind of know that our savings rate is around 50% or more. But this month, it is definitely below 0.

And I’m sorry about your mortgage situation. Do you not have 20% downpayment for a 1m chf house or you don’t wish to take out this much?

I also really enjoy reading your blog so keep it up!! :) (Also, my traffic is still down too so I don’t have much advice there.)

Hi Mama Bear,

Yes, this sucks. But we knew it would happen :)

It’s a bit sad to have a month at 0% after two months with 75%. But we will live with it!

Apparently, I was not clear :) We have more than enough downpayment even on a 1M house. But the banks will not lend us that much money because our income is not high enough:

* They are considering my bonus (15% of my base income) since they want to have proof of payment of three bonuses and I only received two so far.

* They are using a theoretical interest rate of 4.5% for their calculations and this 4.5% plus amortization and plus maintenance should be less than 34% of our income.

So together, we would probably be able to get a 900K mortgage but that’s really the upper bound.

Now, we need to consider our options.

I am going to keep it up :) I just paid for 3 years hosting ;)

Good luck for your own traffic too then!

Thanks for stopping by!