Our 2020 Goals – Path to Financial Independence

| Updated: |(Disclosure: Some of the links below may be affiliate links)

2019 is now well over! It means it is time to set ourselves new goals for 2020. I liked having yearly goals since we started. So, it is now time to set our 2020 Goals.

Earlier, we reviewed our 2019 Goals. We checked every goal to see what could be improved. Some of the goals were not perfect. But some of the goals were great. On some of the goals, we did not do enough to reach them.

Our 2019 goals were already much better than our 2018 goals. I am going to try to make our 2020 goals even better. Of course, I will not know how good they are until the end of the year. But I am confident this is the best set of goals yet.

So, we are going to build on that to make even better goals for 2020. Without further ado, let’s go over all the goals we set ourselves for 2020.

2020 Goals

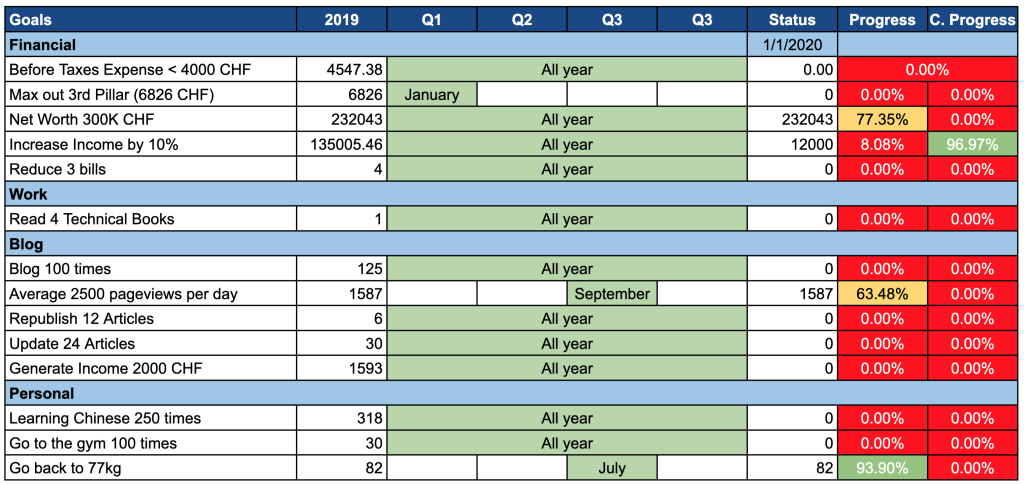

To track my goals, I am going to reuse the same spreadsheet as last year. It worked well for me. I track both the overall status and the current status. The current status is just tracking how much I should have accomplished up to the current month. In general, I should achieve 8.25% of each goal each month.

So, here is my (empty) table for our 2020 Goals:

I think this simple table is a very effective way to track my goals. It is straightforward yet quite effective. It worked well last year. So I did not make any change to the format for 2020.

Since my goals were not all very good, I did some research on setting goals. As a result of this research, I have published a guide on how to set goals. I hope that this will be helpful.

For reference, you may want to take a look at the review of our 2019 goals.

Financial 2020 Goals

Our main 2020 Goals are financial. It is logical since this is a financial blog! So, for 2020, I have five financial goals.

1. Average Before Taxes Expense < 4000 CHF

In 2019, we had a goal to get our average monthly expenses below 5000 CHF. Unfortunately, we failed to do that. The first of our 2020 goals is going to try to address that.

I still want to keep a goal like that. I think it is essential that we lower our expenses without reducing our quality of life. Since our taxes will significantly increase this year, I am going to have a goal of average expenses without taxes. The idea is that I count all our other costs but not our taxes. And I am going to make this goal 4000 CHF. Considering what we paid in taxes in 2019, our 2020 goal is harder!

In 2020, we will spend less than 4000 CHF per month, excluding our taxes.

2. Max Out Third Pillar (6826 CHF)

In Switzerland, contributing to the third pillar is a great way to lower taxes. It is a good way for high-income employees to save money.

Even though this is a straightforward goal, I need to max out my third pillar every year. Therefore, I will keep this goal.

In 2020, we will max out our third pillar account in January.

3. Net Worth 300K CHF

To become Financially Independent, we have to increase our net worth significantly. For this, we try to save as much money as possible every month. And we invest this money to generate some extra income.

So, in 2020, we want to increase our net worth to the next level. Doing this will put our Financial Independence Ratio (FI Ratio) much higher. For this, we need to work on reducing our expenses and increasing our income.

You may think this is simple since we increased our net worth more than that in 2019. However, we are planning to purchase a house in 2020. Doing so will reduce our net worth and our savings capacity. So, it is going to be hard. But I think it is possible. But this should not be impossible!

In 2020, our net worth will reach at least 300’000 CHF.

4. Increase Income by 10%

So far, we have not been outstanding to decrease our expenses. On the other hand, we have been quite good at increasing our income.

In 2020, I want to go further and increase it even more compared to this year. I am considering our income as all our earnings. I think this is the best way we can use to reach Financial Independence faster.

At some point, it will become difficult to reduce our expenses faster. But income has a higher ceiling. Especially in technology, it is possible to increase revenue very significantly.

In 2020, we will increase our income by at least 10%.

5. Reduce 3 bills

In 2019, I set myself a goal of reducing 3 of our recurring bills. It was a great goal. At the beginning of the year, I only had one idea to do it. But I was able to reduce four bills during the year.

I want to keep a goal like this for this year. Again, I only have one idea on a bill to reduce. And I have absolutely no idea for the other two. But I will review all our bills and try to optimize them all!

Recurring bills are essential because they can quickly pile up. If you think of a bill like your phone bill, you will probably pay it for the rest of your life.

Of course, this should not be an excuse to only focus on three recurring bills. We need to lower our expenses. So we are also going to try to eliminate other things. And we are going to try to reduce more than three bills!

In 2020, I will reduce at least 3 bills by the end of the year.

If you want to learn more, I found a nice guide about financial goals.

Work 2020 Goals

For this year, I only have one work goal that I want to track here. I have several objectives at work that are managed within my company. But other than that, I will only track one.

1. Read 4 Technical Books

I used to read a ton of technical books. But since I finished my Ph.D., I only read one technical book. I am a bit disappointed about that.

So, in 2020, I want to read at least four technical books by the end of the year. In software engineering and in the specific domain of the company I work for, there are some great books. I want to increase my value to work on my career. I think that growing my career income is the best way for us to reach Financial Independence.

Of course, reading books will not directly increase my income. But this is extra education. And I am confident this will make me more efficient at my job. And I will focus on books on topics where I am weak at.

In 2020, I will read at least four technical books related to my job.

Blog 2020 Goals

For 2020, I have several important goals for the blog. In 2019, I wrote a lot on the blog, and I achieved excellent results. The traffic on the blog increased very significantly.

For 2020, I want to continue to write new content, but I also want to improve the existing content. I did some updating during 2019. But I want to do more during 2020.

My main goal for the blog is still to increase traffic. The revenue from the blog is not a big goal for me.

So considering all that, I will have five blog goals for 2020.

1. Average 2500 page views per day

I said that my main goal was to grow the audience of the blog. For this, I want to increase coming to my blog from the different sources.

For this blog, most of the traffic comes from organic search. And I plan to keep it like that. I will still work on increasing my social media audience. But I need to focus on Google organic search first.

Some of the other blog goals will also contribute to this goal. But, I plan to do some guest blogging to increase my website authority. And I will probably try to increase site speed further for SEO. I have plenty of ideas to improve this blog. But since this is only a hobby, I am limited by the time I have!

In 2020, the blog will average at least 2500 page views per day by the end of September.

2. Blog 100 Times

Since my blog is still quite young, I still want to produce a lot of content. I plan to keep on a schedule of two posts per week. When I am on holiday, I schedule my posts ahead of time.

So, as part of my 2020 goals, I want to publish at least 100 articles. Doing this will help to increase the traffic to the blog. For now, I still have plenty of ideas for articles in 2020. Now, I also plan to republish some articles. For simplicity, these will also count towards this goal.

In 2020, I will publish at least 100 articles by the end of the year.

3. Republish 12 Articles

I already have more than 250 articles on this blog. And many of them have never read by many of my new readers. So I want to republish some of them to spread them. I worked a long time on some of these posts. So I want to increase their potential. I have already started doing that in the last few months of 2019.

But, I am not only going to republish them. I am going to update them to make sure these articles are as good as they can be. Several of my older posts need a good refresh before I could republish. With this strategy, the overall quality of my blog posts is increasing over time. And it gives them a second life.

In 2020, I will republish at least 12 articles by the end of the year.

4. Update 36 articles

As I said, I have plenty of articles already on the blog. And I want to keep them up to date. Some of them need a small refresh, while some others require significant updates. But I do not want to spam my readers with older articles.

So I am going to update some older articles without republishing them. The difference is that they will not show up on the feeds, and I will not send an email about it.

In 2020, I will update at least 36 articles by the end of the year.

5. Generate income of 2000 CHF

Even though income is not a big goal for me for this blog, it is still a nice bonus. I spend many hours on this blog every week. And it is great to have some small side hustle.

In 2019, the blog generated 1593 CHF. I want to increase a bit over that. But again, it is not a big goal of mine. I do not plan to use ads, and I do not plan on recommending any service I do not believe in. I am curious to see how much I can generate next year!

In 2020, the blog will generate at least 2000 CHF of income.

Personal 2020 Goals

For our 2020 Goals, I have decided on only three Personal Goals. They are related to things I already talked on the blog, mostly on my monthly updates. But they are not related to money, the blog, or my work.

1. Learning Chinese 250 times

A bit more than one year ago, I have started learning Chinese with FluentU. It is an online platform based on videos. Until now, I have set my daily goal to 15 minutes. For 2020, I will bump up my daily goal to 30 minutes.

I want to do 30 minutes of Chinese every day for 2020. In 2019, I set the goal to 300 times, and I was able to reach it. But since I was doing it for a shorter, I will only set my goals for this year for 250 times. When we are on vacation, I do not plan on doing the courses.

I am also going to try to talk a bit more with Mrs. The Poor Swiss in Chinese. And when I am in China, I have to force myself to speak more in Chinese with my in-laws.

In 2020, I will reach my daily goals on FluentU at least 250 times.

2. Go to the gym 100 times

In the first few months of 2019, I stopped going to the gym. At that time, my previous gym did not have good opening hours. So, for several months, I just stopped. By the middle of 2019, I found another gym and started regularly going again.

Generally, I am trying to go three times a week to the gym before work. However, it is often that case that I cannot go three times. So, my minimum is twice a week for the entire year.

I need to work on my health. Being a software engineer (and a geek), I mostly sit on a chair all day. It is not healthy for the long-term. I am already starting to have some knee and back pains. At some point, I want to retire, and I want to retire healthy!

In 2020, I will go to the gym at least 100 times.

3. Lower my weight to 77kg

Since I got married, I put on quite a few kilos. At my best, I weighed 76 kilograms. At the end of 2019, I weighed 82kg.

Now, I want to get my weight back down to a better place. I am not obese by any means. I am just developing a pouch. And if I continue on this, I am afraid I will get really fat.

Losing some weight will go hand in hand with going to the gym. But I also need to watch my diet. Since my wife is an excellent cook, it is sometimes difficult for me to not overeat. And this also goes by keeping in good health.

In 2020, I will bring back my weight to 77kg by the end of July and keep it there.

Other Goals

We have a few other goals that we did not include in our tracking for various reasons.

First, we are planning to buy a house in 2020. We did not want to put this as a goal because if we do not find something interesting in 2020, we do not want to feel pressured by a goal! We should take our time until we find a house that we really want.

Second, we want to try to be a bit more environment-friendly in 2020. We want to reduce the amount of trash that we produce. And we also want to try to reduce the energy that we consume. This one was not included as a goal because it is too difficult to quantify. Also, we do not have a set plan for it.

I also want to improve my health. It does not only mean losing weight and going to the gym more. I also want to improve my sleep and improve the quality of the food I date. I am starting to think I have neglected my health. Hopefully, it is not too late now to work on improving it. I am beginning to have some issues with my knees and back. I want to take care of these issues. And I want to take care of my iron deficiency.

For the blog, I plan on doing a full content audit for my blog. Now that I have more than 250 articles, I need to make sure the quality of them is consistent. I am pretty sure some could be consolidated or even deleted. And I have a few experiments I want to run on the blog in 2020.

And of course, we have some other small goals during the year. But the goals in this article are the most important for us for this year.

Conclusion

And that is it for our 2020 Goals! I think this is the best set of goals I have ever set. Last year’s goals were good but had a few defaults. Now, I think I have fixed them.

That is not to say that our 2020 goals are perfect! They are not! I am pretty sure that by the end of the year, I will realize that some of my goals are not good. Some may be too ambitious, and some may be too easy. But that is by setting goals consistently that I will get better at it.

I think that setting goals and working to reach them is improving my personal finances. It helps to have a clear view of where I am going.

For me, yearly goals are enough. But some people prefer quarterly or monthly goals. And this is perfectly fine. It is a bit difficult to imagine what will happen in a year. It is easier for a shorter period. But for me, yearly goals make more sense.

Some people also have a few yearly goals and define quarterly goals that go with the yearly goals. I think this makes a lot of sense. And I may try this once.

If you do not set goals yourself, I encourage you to try. You can read this guide on setting goals to get started.

What about you? Did you set goals for 2020?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Financial Independence and Retire Early

- More articles about Retirement

- 5 Great Ways to Reach Financial Independence

- 7 Best Blogs on FIRE

- Should you rebalance your portfolio in retirement?

Congrats for achieving successfully your yearly target.

Your net worth has grown increadibly in the past year, is it thanks to the high income or due to investment ?

I just wonder if you have any break-down on the growth of the investment ?

Thanks for sharing your experience, I would love to follow your footsteps.

Hi Ben,

This is a good question. Unfortunately, I do not have a precise breakdown (but I should!).

But it’s mostly due to income now. We made about 13K in investment returns on our investment portfolio. This is pretty good but nothing out of this world.

Thanks for stopping by!

Hi. I find the articles on your blog very interesting. If I may add some ideas to your goal setting, from someone who went FIRE 6 years ago.

-invest wisely in property in a great location, when you have the salary to attract the banks to lend you money at a favourable rate. Stay mostly with LIBOR. Never buy a nice property in the wrong location. Optimise renovation works (not improvements) to lower taxes.

-pay as much as you can afford into extra 2nd pillar contributions, to reduce taxes. Obviously maxing 3rd pillar also with high portion of stocks in several tranches.

-don’t get divorced (assuming you are married). Marry well !

-“it’s only a matter of time before you get made redundant”. Prepare for this by having a company set up to pay you so you don’t pay AHV on your total wealth, you appear commercially active & you can offset costs as a consultant.

-if you do get made redundant, put the 2nd pillar into 2 funds (not one) and pay in extra before your last day at work (not allowed after). Very tax efficient if you get a nice lump sum.

-invest in ETFs, don’t try and game the market or currencies.

-have fun.

Hi Captain,

Thanks for sharing your ideas. And congratulations on going FIRE!

* It is a great idea to take location into account for a property. It will make a world of differences.

* I am not so sure about second pillar. It is a good thing to reduce taxes, this is true. However, in the long-term, it is not that great of an investment. Don’t you think?

* Is it legal to employ yourself? I guess you still have to do business, no?

* I understand maxing before you leave, but why 2 funds?

* Completely agree on the ETFs and the fun :)

Thanks for stopping by!

2nd pillar: (mostly) every franc you pay into a company pension is matched by your employer usually, so that’s free money. It’s also tax deductible; handy if you have a good salary. You can pay in extra whilst working (perhaps part of your bonus), which isn’t matched by employer, but its still tax deductible. If you leave an employer you can transfer this money to another pension scheme or stash it in a 2nd pillar with insurance company or bank. I have two in 40% shares with pictet which has done well. You are allowed to open 1 or 2 accounts with an institution. Opening two allows you to take the money out in separate tax years and pay a lower withdrawal tax, once you reach 59 as a woman or 60 as a man. The tax rate is progressive, thats why smaller amounts are better. In my Gemeinde, the max withdrawal tax is about 7.5%. So, if I do the maths on tax savings, employer contributions, annual return, no wealth tax and low withdrawal tax, I think 2nd pillar is pretty good as part of a balanced investment portfolio.

company: Yes you need to work and show you are commercially active with more than one client, but there’s no reason why a company owned by yourself or a family member cannot pay you a salary. You have to remember that in Switzerland, if you don’t work during the period up until you are 65 (64 for a woman), then you are still liable to pay AHV based on your net worth and this can be over 30,000/yr.

Hi CaptainTelf,

Thanks for sharing your thoughts!

I completely agree that matching is great, no doubt about that. And it’s good indeed once in a vested benefits account, you can have better investments. However, when in a pension fund, it’s really too conservative for me.

I guess I should try to turn my blog into a business before I retire to employ myself. I never thought of that before.

Thanks for stopping by!

I was thinking that myself, for you. You can set up a GmbH easily (we did it online with a lawyer) with 20,000 and then book the revenue from your blog and offset the costs. You just need to produce a simple P&L and balance sheet every year. Chances are you won’t pay much tax, probably only a little on the capital retained. Good luck