How Much We Spent in 2019 – Detailed Expenses Report

| Updated: |(Disclosure: Some of the links below may be affiliate links)

It is time for a full expenses report for the entire year 2019. I am already doing an expense report every month. But having a yearly view helps put things in perspective.

I think it is essential to do this. It shows that some expenses that you feel are small can quickly pile up. 400 CHF per month may not seem much, but this 4800 CHF per year! And this sounds like a lot of money!

Another advantage of doing that is to clean up all your expenses. In my budget tool, once I aggregate all our expenses together, I often see some small mistakes in my accounting. Once fixed, it makes the entire year nicer.

So, let’s see how much the Poor Swiss Family spent in 2019!

Expenses 2019

In total, during 2019, we spent 64’752 CHF. For reference, in 2018, we spent 64’113 CHF. It means we spent 639 CHF more than last year. Since we wanted to reduce our expenses, this does not look so good for us!

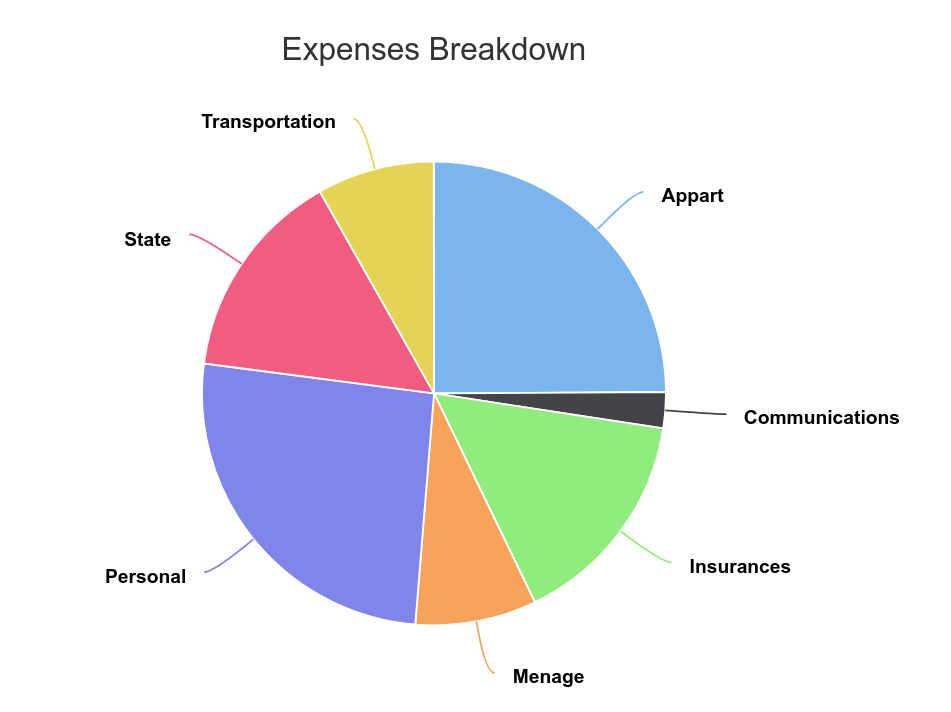

For tracking our expenses, we are using seven categories. So, here are the totals of each category for 2019 (sorted by amount):

| Category | Total CHF | Difference | What is it? |

|---|---|---|---|

| Personal | 16684 | -4981 | Everything for us, not mandatory |

| Apartment | 16140 | -113 | Our rent and power bill |

| Insurances | 9995 | +3354 | All our insurances, mostly health insurance |

| State | 9544 | +2200 | All taxes |

| Food | 5472 | -27 | Groceries and eating out |

| Transportation | 5305 | +33 | Car and public transportation |

| Communication | 1609 | -55 | Phone and internet bills |

We can see that we improved our expenses a lot for some of the categories. But we also completely blew it in some of the others.

However, when looking at this, there is something good. The main non-mandatory category (Personal) is where we were able to reduce the most. There is not much we can do about the Apartment, Insurances, and Taxes.

And for a more visual view, here is the breakdown of the expenses for 2019:

We can directly see that some of the categories overweight others. Personal expenses and apartment expenses already make for 50% of our costs.

Keep in mind that some of the expenses may not be comparable. For instance, I recently changed the way I am paying my car insurance from twice a year to once a year. It makes it more challenging to compare it.

Now, we can take a look at more details at some of our expenses for 2019. I am not going to look at every single expense. Even when aggregated over the entire year, some expenses are too tiny to get into details.

For instance, do you need to know we spent 46.75 CHF on fireworks for August 1st? Or that I spent 1.50 CHF on bullets for the mandatory yearly shooting test for the army?

But if you want to know something specific that I did not outline here, feel free to ask in the comments below!

The biggest mandatory expenses

We can go over some of the mandatory expenses first. Here are the four biggest mandatory expenses of 2019:

- Rent: 14’964 CHF

- Taxes: 9’544 CHF

- Health Insurance: 9’485 CHF

- Groceries: 4’411 CHF

For our rent, there is not much we can do. We can hope for a reduction in the reference interest rate. But this will probably not happen soon. As for taxes, it will increase even more next year. And since we are planning on buying a house next year, we are not going to contribute to the second pillar next year.

I plan to reduce the price of our health insurance next year. We can cut down our supplementary coverage.

Some may argue that the rent is not mandatory. But you need a place to live. And if you own a house, you still pay rent in the form of interest to your bank.

Groceries – 4411 CHF (+20%)

Our grocery expenses significantly increased compared to last year. There are several reasons for this:

- Last year, Mrs. The Poor Swiss was only here for seven months. This year she was here for twelve.

- Last year, we went more regularly to Aligro to get meat in bulk. But this year, Mrs. The Poor Swiss does not want us to freeze food for too long. So most of our meat is fresh.

- We invited more people into our home. It makes for some big groceries every time. For us, we never buy alcohol. But we drink alcohol when we receive people.

Nevertheless, even with these reasons, I think we are spending too much. We are now paying 367 CHF per month. I also believe that we were less careful with some of our groceries this year. We will have to work on that next year.

I think we should get back to below 350 CHF per month on Groceries. I do not know precisely how, but we are going to have to find that out!

Holidays – 3334 CHF (-44%)

Even though it is not cheap, I think we have been quite reasonable with our holidays in 2019. We spent 44% less than in 2018.

The main difference is that in 2018 we went on our honeymoon. It cost us a lot of money. So, it makes sense that we spent less this year.

This year, we went to China at the beginning of the year. Then, we did a one week vacation in Switzerland. And then a one week vacation to Spain. Finally, we also purchased the flight tickets for next year’s Chinese new year.

In 2020, I think that this will be a bit lower. We plan on doing only one big vacation. But this may change.

French Courses – 2097 CHF

One significant expense that we had this year was the French courses of Mrs. The Poor Swiss. She took classes at Migros School Club. I think that the quality of the classes was excellent. But it is a bit expensive.

It is a great thing that she took so many courses. Her French is getting better and better. But I think that the offer in our part of Switzerland is not suitable for higher levels. Now she does not find courses anymore for higher levels of French.

For now, we do not plan on spending money on French courses for 2020. But if we find an excellent course, we will probably take the opportunity.

Computers – 1367.25 CHF

In 2019, I had to replace my computer. The motherboard completely died. It was already four years old. To save money, I could have replaced the motherboard with an old one.

Instead, I decided to replace it with a recent one. It means I had to change my processor, memory, and GPU. Hopefully, this will last for a long time.

This price is not so bad since the last one lasted for four years. I hope my current configuration will last even longer. And the case remains the same.

For 2020, I do not expect any significant expenses like this. But of course, if something breaks, it may prove me wrong!

Gas – 1185.14 CHF (-8%)

In 2019, we spent less on gas than in 2018. I do not know exactly what caused this difference. This reduction is not a huge difference. But this is good!

One difference is that we do not drive only for Mrs. Poor Swiss driving lesson. We only drive when we need it now. And we probably have been away less this year.

I think this is a pretty reasonable level of expenses for gas for us. Next year, we are going to try to stay below 100 CHF per month as well.

Health – 1278 CHF (+102%)

Our health bill went nuts this year! We spent twice more on health than last year.

Mrs. The Poor Swiss needed to remove one tooth and fix two others. She had to go three times to the dentist for that. These three visits cost us 840 CHF in total. Fortunately, our secondary coverage insurance did cover 300 CHF of that, at least.

Aside from this, the expenses were somewhat normal. I went once to the dental hygienist. I also needed to take some medicine for my iron deficiency and problems with my knees.

Eating out – 836 CHF (-37%)

We have been much better at frugality with eating out than last year. We only spent about 70 CHF per month eating this during the year.

We had several dinners and lunches with friends this year. And we also went several times with only me and Mrs. The Poor Swiss. I think this is a reasonable amount for the year.

We may want to reduce that slightly for next year. But this is not catastrophic.

Ski – 828 CHF

In 2019, we spent more than 800 CHF on ski! This is quite expensive!

However, about 480 CHF was for the ski equipment for Mrs. The Poor Swiss. Half of this is for clothes for skiing. The rest was for renting the equipment itself. So this means, we already have some part ready if we were to ski again.

The rest of the money is for paying the ski cards. Ski cards are insanely expensive in Switzerland. For our first weekend of skiing, we spent 80 CHF for two people because we used points cards. But for the second weekend of skiing, we had to pay about 100 CHF per day for two people.

We will probably not ski in 2020. Mrs. The Poor Swiss is not really motivated to start again. And my knees are getting painful. I would rather spare them for one year. But we will probably start again later on.

When we ski again, we will use some of our tips to save money on skiing.

Internet – 803 CHF (-17%)

In 2019, we spent about 800 CHF on our internet plan. This significantly lower than what we paid in 2018 (963 CHF). We were able to reduce our bill by 17%!

To reduce this, we switch to a slower plan. And we did not notice any difference.

I know I could get it even cheaper at some other providers than Swisscom. But I refuse to do that. We are using the internet at home every day, me and Mrs. The Poor Swiss. And I have never had any issue with Swisscom. Compared to what I hear with other providers, I am not ready to change that!

So, unless Swisscom proposed a cheaper plan in 2020, we should be at the same level.

Furniture – 521.75 CHF

In 2019, we had to buy several pieces of furniture:

- A standing desk for me

- A new sofa for the living room

- A new desk chair

- Pillows and bedsheets

Hopefully, we will not have to buy many pieces of furniture in 2020. However, if we find a house to buy, we may have to purchase a few things.

Games – 331 (+89%)

In 2019, I went a bit overboard with what I spent on games. I spent almost twice what I spent in 2018!

I will need to reduce this in 2019. I think I can easily bring that down to about 100 CHF in 2020.

Clothes – 312 CHF (-31%)

In 2019, we were able to cut down our expenses for clothing.

I personally rarely buy clothes. I already have too many to my taste. And I do not enjoy clothes.

But Mrs. The Poor Swiss likes clothes. But in 2019, she was reasonable about buying new clothes. She already has a ton of them.

Natel – 244 CHF (-15%)

In 2019, I was able to switch to a cheaper phone plan. So, we saved about 15% on our phone bill during the year.

I have been a bit lazy because I already found a better mobile plan for me. Changing to a new phone plan is something I will do early in 2020. Hopefully, I can cut about 30% out of my phone bill.

Things we improved in 2019

Even though we spent more than last year, there are a few things we improved this year.

I was able to cut my internet bill and my phone bill. It does not make a massive difference for the year. Indeed, I did not change at the beginning of the year. But this will make a significant difference in the long-term.

I was able to cut our coffee bill significantly. Last year, we were drinking Nespresso coffee. This year, we switched entirely to Lidl coffee. Even though Nespresso is indubitably better, I do not miss it. Lidl is entirely acceptable. And it is about three times cheaper.

We have been able to lower our power bill. It is excellent and not only for money reasons. We want to try to save even more next year. My computers are probably what is using the most power in our household.

Overall, many of our bills have gone down. But several new bills such as ski, french courses, and a new computer were added to our expenses. We also need to work on trying to avoid some of these extra expenses.

Things to improve in 2020

There are several things we should improve in our budget in 2020.

We need to improve our grocery bill. I think that there are some things where we could spend less. We have been less careful than usual this year.

We have to reconsider our health insurance coverage for 2020. Unfortunately, it will not make a difference for 2020 per se, only for 2021. But we should do it in 2020.

I will also spend less on online gaming in 2020. I did not count accurately this year and ended up spending twice more than last year.

One other thing we need to improve is to try to cut spendings on some small things that accumulate. This problem is mostly on me. But I bought several small things for our home. For instance, I still spend money to simplify our home automation system. But honestly, it would have been better to get rid of it. Also, we spent a bit too much on pieces of furniture. We need to work on that for 2020.

Conclusion

Overall, we spent slightly more in 2019 than in 2018. However, we spent more mostly on mandatory expenses. On the other hand, we were able to reduce non-mandatory expenses compared to 2018.

But there are still many things we can do to improve our expenses in 2020. For instance, we are going to try to reduce our food budget. We are mostly going to focus on reducing some of the unexpected small expenses that add up during the year. Some of them are not necessary for us.

Working on these small expenses was mostly our conclusion upon doing that. We have too many small expenses that should not have been necessary during the year. We need to consolidate to have fewer of them for 2020. We need to refocus our expenses on things that matter.

What about you? How much did you spend in 2019?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Do you experience that the Lidl capsule damages your machine? We had a machine before and used other branded capsules and after awhile the machine did not function well. We had a buy a new one then we stick to Nespresso capsules.

Hi Yasi,

I did not experience any such thing no. But it is true that the Lidl capsules do not fit really well and I feel that they do not go as well in the machine as Nespresso capsules.

In general, I have had a bad experience with Nespresso machines, they do not last more than 2-3 years for me. It could be that the machine was simply broken, not because of the capsules.

Recently, I switched to more Italian Moka Pot, it’s significantly cheaper and it makes me take a longer pause which is great for Working At Home.

Thanks for stopping by!

I pay only 24 CHF/month for 100 Mbit internet in Geneva. But this is only because my apartment is wired with Naxoo, a company who partnets with UPC and 30 CHFD per month from my rent or fees or whatever is then reduced from my internet bill. Guys, check this thing out if you rent new apartment. I was not aware but by pure luck got this knowledge – it is like 360 CHF free each year. And 100 Mbit on download and 10 mbit on upload is more than I need.

Hi small_potato,

I did not know about Naxoo, seems like it’s fairly priced.

However, I knew that sometimes the cable is already priced in the rent. So it’s good for people who are going to use it. But it’s not good for people who are not going to use it since they pay for nothing. Sometimes, it’s possible to block the connector and avoid the fee, but not always.

Thanks for sharing!

There is no reason to fight chocolate. It gives you endorphines that make you happy. Much better than being addicted to alcohol or even coffee.

As per the low tax. Please be aware that you’ll get hit twice as hard for the next period. Since one usually has to pay the last year and the predicted tax for the coming year, both payments will go up as you didn’t increase your downpayment for the actual year. (you’ll have to pay the missing amount, to the actual amount owned, plus the newly estimated amount.)

Lastly, I am quite a generous person myself. But I pay about 700 per year for 1Gb Internet plus Mobile Phone. Sticking with the unreliable swisscom and paying 1000 extra per year, seems quite lavish, especially for a frugal person.

Also I dont go ski for a couple of reasons:

1. it’s much riskier to get hurt than one might thinks (getting injured and then having to pay lots of bills)

2. it costs a sh*tload!

Really enjoy reading your articles Mr. Great job!

Hi Mr. Chocolatier,

It’s much better than to be addicted to some other things indeed. But it is not good being addicted to anything.

Do not worry, I am well aware of how much taxes I will have to pay this yes :)

I do not pay 1000 more per year. I have reduced my internet plan to 65 CHF per month. And for me, Swisscom has been extremely reliable.

You may get hurt crossing the road, that’s no reason not to cross the road. Ski is a lot of fun, that’s enough motivation to do it. But yes, in Switzerland, it cost a ton of money.

Thanks for stopping by!

I was comparing your total communication costs 1600 vs. 700. I spend less than 65 and the cellphone is included as well.

But I noticed I made the mistake to calculate for only 1 phone contract, when you as a couple obviously need 2.

You’ve built an amazing place here. Wish you a great week!

Actually, this is only for one phone plan. Mrs. The Poor Swiss still has her Chinese phone plan that is dirt cheap compared to Swiss plans. And we want to keep her Chinese phone number for now.

And something is missing from the article: 1600 is indeed the total of 2019. But since that point, I changed my internet plan to a cheaper one and my phone too. Also, my communications category also includes the dumb Serafe bill, some bills for domains, my newsgroup subscription and some small online subscriptions. Internet plans accounted for 803.20 CHF of that and my mobile plan accounted for 243.95 CHF of that. I should have made that clearer in the article.

Thanks for stopping by!

Wow! Good job for keeping your grocery bill so low! I think even before we had our baby, we paid about 600 CHF for both of us. With the baby I’m pretty sure we pay closer to 1,000 CHF since we buy all of the diapers and wipes in the supermarket as well. We are big spenders comparing to you guys!!

Just a question though, your taxes also seem really low to me in relation to your salary. Is it because you live in a low tax canton? Did you write a post about income tax in Switzerland?

Overall, well done on keeping your overall spending so low despite having some unforeseen expenses. :)

Hi Mama Bear,

Maybe we are cheap eaters after all :P

As for the taxes, it’s only because in 2019 I am paying the taxes for 2018 and I was only half the year with a good income. It will at least double in 2020.

I have an article about taxes yes.

It’s not so bad overall, but there are some things we can do to improve!

Thanks!

Thank you! Will def check out this post :)

And yeah, I think our weakness when it comes to spending is good. My husband love eating snacks and I love swiss chocolate! (Our excuse is that we won’t have anymore swiss chocolate like this once we move back to US – which we’re still here for the past 6-7 years!) I’m sure 20% of our grocery bill goes to junk food, which is really really bad!

I think I’m gonna have to start tracking our detailed household expenses like you do to keep our grocery splurges under control! ;)

I really like tracking my expenses. Now I have data on my spending al the way since 2013. I just wish I had earlier data :)

6 years of chocolate snacks won’t be good for your budget or your weight:=)

But Swiss Chocolate is great! I understand the snacking. When we have snacks at home, I also eat regularly. But when we do not, I do not miss it, so it’s a good thing!

Good luck fighting Swiss Chocolate ;)

Sorry, I meant our weakness is “food,” not good. And thanks, it’s not easy to fight Swiss chocolate!

Good summary!

Quick question if you don’t mind. How do you pay so little taxes? You must have approx 120k salary and 9k in tax (including social AHV) seems little. Can you shed some light?

Keep it up!

Hi Sergio,

This is a good question. In fact, the taxes I paid in 2019 were for the year 2018. And in 2018, I only worked half a year at my new job. The other half was with my much smaller Ph.D. student salary. In 2020, I will probably pay at least twice more taxes.

Unfortunately, I do not have a trick to pay smaller taxes :(

Thanks for stopping by!

yes, I had the same question, how can you pay 9k in taxes? I live in Geneva, ca 130 000 gross income, I am single, no kids – I did buy cotisations of 10k in 2nd pillar and went max for 3rd one and I calculated my tax bill will be ca 21k! Last year without 2nd and 3rd pillar it was ca 25k. I am sick of it. I am sure I calcualted my tax well, did all the deductions, health costs etc, still, over 20k tax kills me :o

Hi small_potato,

As I said, this is because the taxes I paid in 2019 are the taxes due for 2018 and in 2018 my income was much lower! I will pay around 22K in 2020, not counting the fact that I did not pay enough in 2019, so probably around 30K.

Thanks for stopping by!

Even though we tried to spend less but in total still seems a bit more than expected.

Hopes 2020 we will have no unexpected expense.

But overall, thanks for your efforts.

And thank you that even though we try to save more but We could still get what we needed.

2020 be less stressful and more relax.

Thanks :)

Yes, we have to do better. But as you said, it’s not a bad situation! I need to relax :P

Thanks for stopping by!

If you want swisscom internet but not pay swisscom prices just switch to m-budget internet. Even though it has the migros label it is swisscom.

Hi Mark,

I especially want to keep access to Swisscom support. I always had a great experience with their customer service.

I could indeed save 15 CHF/month with M-Budget internet. But for now and given that activation fees are not free, I do not think it is worth it.

Thanks for the suggestion :)

“We are now paying 367 CHF per month”.

Me and my girlfriend spent around 500/month and we shop mostly in Lidl and Aldi.

How can you spend so little?

Even if you search through MP forum we’ll see that you are spending less than the average “frugal” guys.

Hi ajPT,

Keep in mind that this is only for groceries, no going out is included. But we do not go out a lot.

I do not know why we spend little. We are eating mostly Asian food. We eat meat at almost all meals. But we are generally eating chicken and pork, very little beef. But we almost never buy Swiss chicken, mostly foreign chicken at Lidl. The pork is generally Swiss. We rarely buy anything that is already prepared. We try to cook everything ourselves. We are mostly eating rice with most of our dishes but also some Asian noodles. We eat very little cheese and milk products except for about 4-5 yogurts every week and maybe one liter of milk every week.

I hope this helps a little.

Thanks for stopping by!

I fully agree that if you cook from basic ingredients then grocery bills and a lot cheaper and the food is a lot healthier to boot as well. Also, I used to buy and freeze reduced items from coop & Migros so more often than not my chicken, fish and pork was 50% off. I could never resist cake that was marked down 50%!

Hi Lakshman,

Yes, being able to buy 50% off meat and freeze it can save a ton of money.

I was always able to resist cake, but it’s more difficult to resist 50% off meat :P

Thanks for stopping by!