March 2024 – A weird month

| Updated: |(Disclosure: Some of the links below may be affiliate links)

In March 2024, we did not do much, only a few things nearby.

However, March was a special month for the financial side of things. Indeed, March is always a month with very high income, thanks to my bonus. This allowed us to save over 80% of our income despite splurging a little.

Keep reading to learn everything that happened to us and the blog during March 2024.

March 2024

March is usually the month with the highest income in our household. In March, I always receive my bonus, and this makes a massive difference to our income since my bonus is (this year) about twice my monthly salary.

It is also often a more expensive month since I allow myself to splurge a little. I bought a new coffee grinder and a proper portafilter espresso machine this year. I wanted these for a while and waited for my bonus to arrive.

I am still learning to dial espresso, but I could already drink nice ones. I expect it will take a while to master it. The next step will be to learn how to steam milk and make lattes for my wife.

This month, we did not do much. We had very little planned except for the Easter weekend. I felt like we were on the low side of events.

On the personal side, it was a month where it was difficult to find the proper balance between everything. I am still juggling my different roles and finding a good balance.

We are currently awaiting something that may change the balance of things. Depending on what comes out next month, this will also compromise the existence of the blog. This currently weighs on me since I do not handle change well, but we will see what happens.

Other than that, it was a fairly eventless month.

Expenses

Here are the details of our expenses in March 2024:

| Category | Total | Status | Details |

|---|---|---|---|

| Insurances | 776 | Expected | Health insurance only |

| Transportation | 90 | Expected | One fuel refill and buses |

| Communications | 20 | Expected | One phone plan |

| Personal | 4375 | Higher than expected | A big espresso machine, some health bills, some shopping |

| Food | 905 | Much higher than expected | Expensive groceries, one lunch out |

| Housing | 1200 | Expected | Mortgage, power, heating, and ECAB |

| Taxes | 0 | Expected | No taxes in March |

In total, we spent 7369 CHF during this month. This is a big failure compared to our goal of spending less than last year per month. However, I am okay with this result since this includes expected splurges.

As usual, in March, we do not have any tax bills. This is ill-timed since it is also the month with the highest income. Together, these two things will make our savings insane in March.

We also had some extraordinary expenses this month. The main expenses are because I bought an espresso machine and an espresso grinder. On top of that, we had a few health bills and some French and English courses for my wife.

In addition, I had to go to the dentist and a specialist for my teeth, which added to the expenses. And I even bought some clothes (which is very rare for me).

We spent a little too much this month. However, since most of our expenses this month are for my espresso machine, I am happy with this level of expenses.

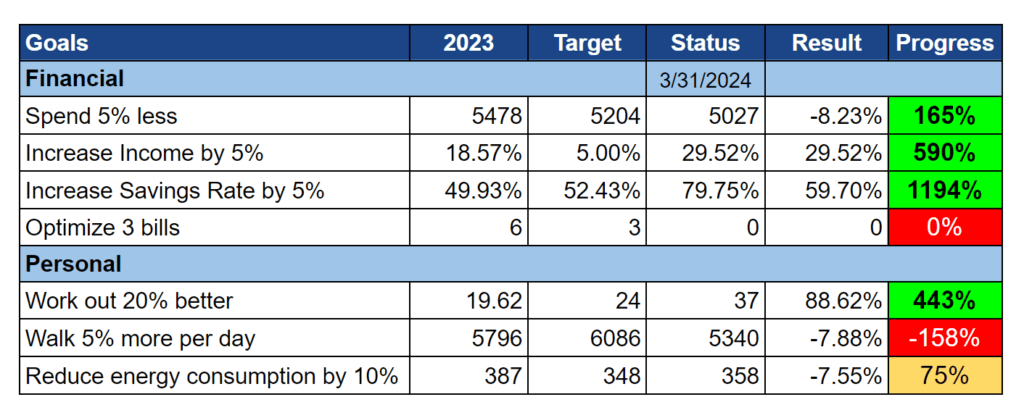

2024 Goals

Here is the status of our goals by the end of March 2024:

Overall, our goals are going well.

Our financial goals are going well. Some of these goals will go down because we have now passed some of the months with the highest income. So future months should be more average.

The only financial goal that is not going well is my bill optimization goal. I have not thought of a bill to optimize and did not take much time to do that.

On the other hand, I am still not very happy about my health goals. My workouts are doing okay; I only missed two days (one sick and one without time). But my daily steps are still too low.

My overall health has declined this month. In particular, my back pain is back and worse than ever before. My knees are fine, but I have traded one problem for another. And the problem is the same as for everything else: time.

Currently, we are on a good track for our energy consumption. We should try to find extra measures to reduce it further, but it is already nice.

Our goals are going well, but I need to focus on my health.

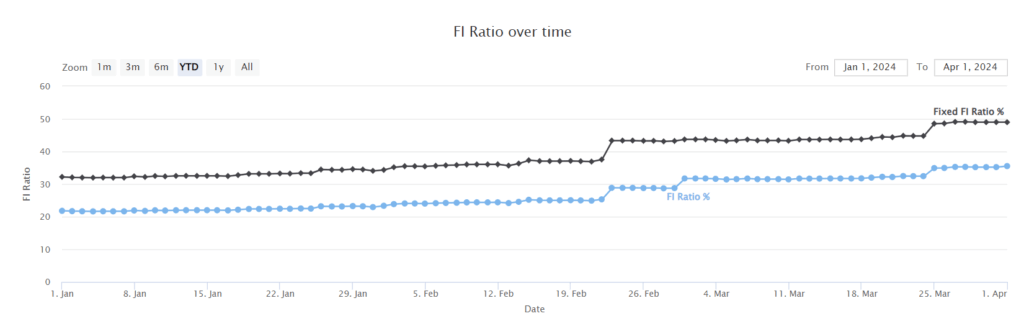

FI Ratio

Here is the progress of our FI Ratio as of March 2024:

We have now reached 35% FI Ratio, which is nice! We have passed the 1/3 line.

We significantly increased our FI ratio thanks to the bonus and high savings this month. So far, this is the best start to the year we have ever seen. The next few months should be more standard with slower increases.

We finally reimbursed the withdrawal from our second pillar. This month, we transferred the 20,000 CHF remaining to the pension fund. We aim to start making voluntary contributions by the end of the year or early next year.

This year, this will not save us any taxes, but we can get back the withdrawal taxes we paid when buying the house.

Other than that, nothing special happened to our finances. Given the high increase in the USD value and the high value of my bonus, this gave us a nice increase in our FI net worth.

So, I am pleased about our progress towards Financial Independence.

The Blog

March 2024 was relatively standard for the blog. In the first half of the month, I finally had time (and motivation) to work on two projects I had wanted to do for a long time.

I created a new calculator: The Advanced Fire Calculator. This is a new version of the FIRE calculator (still available) with many more options, such as glidepath and Social Security. This includes all the features I have implemented in my simulator for articles. I am keeping both versions because the advanced version has many options and can be intimidating.

I also created a new spreadsheet: The Advanced Budget Spreadsheet. This has many more features than the old spreadsheet. Again, I am keeping both versions because the advanced version may be less straightforward. Thanks to Douglas, who motivated me to do so!

I am glad I could complete these two small projects, which had been on my list of tasks for a while. I had very little time for the blog in the second half of the month.

This month, the forum has been losing a lot of steam. I plan to keep this experiment going for a few months. But if activity does not pick up, I will need to find a way to reduce costs by stopping it or self-hosting it myself.

For next month, I have nothing special planned for the blog.

Next Month – April 2024

We have very little planned for April 2024. We will try to do something with my family, but nothing is set yet.

Financially, April 2024 should be a standard month, with nothing special for our finances.

What about you? How was March 2024 for you?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Hi Baptiste,

Thanks for your post, a lot of food for thought as usual.

I am surprised to hear that you are reimbursing the withdrawal from the second pillar for the following reasons:

1) you will not get any tax advantage on the money you are using to pay back the withdrawn money

2) I don’t know your marginal tax rate but assuming something around 25-30%, a return of 5% per year from stock market and of 1% per year for the second pillar it would be more advantageous to invest in stocks if your time horizon is at least 5-7 years (and your money would be more accessible to you in case of need)

The only reasons I see to reimburse the withdrawal from the second pillar are the following:

1) You are planning to buy a house in 4-6 years (I am not sure if money can be withdrawn from the second pillar to buy a second house)

2) You are planning to retire in 4-6 years (or become an entrepreneur) and then switch your second pillar to a vested benefits account

Maybe there are other good reasons I cannot figure out myself.

Best,

Marco

Hi Marco

Excellent questions. In many cases, I agree that there are better things to do with money than to put it in the second pillar.

A few important points in our situation:

* Our marginal tax rate is actually significantly higher, at around 40% (living in Fribourg is not great for that).

* My second pillar has decent returns. It averaged more than 2% these last few years. It’s obviously not as good as stocks, but better than average in Switzeralnd.

* I hope to retire in the next 12 years

With these points, I think it is good to invest in our second pillar.

What do you think?

More than 2% as average return on the second pillar….kudos to your employer for the choice of the second pillar!!!

40% marginal tax rate….aaaarrghhhh!!!!

These numbers are definitively some game changers and your strategy makes much more sense but still….not having any tax benefit on the money invested to reimburse the withdrawal from the second pillar a huge voluntary contribution should occur after reimbursement completion to compensate the difference from the expected stock market return and the second pillar return.

I don’t want to speculate further not knowing all details but it seems that we would need some of your coding and a specific blog post to deeply investigate the second pillar reimbursement controversial topic ;-)

P.s. regardless the dilemma between reimbursement and stock market investment to optimize a reimbursement strategy I would consider the following:

1) reimburse the withdrawal toward at the end of the year to earn some additional dividends prior reimbursement

2) reimburse the withdrawal at the very end of the year getting a margin loan (in this case the discussion would become even more controversial and complicated…topic for another blog post)

3) reimburse the withdrawal closer to the expected (early) retirement date so that a substantial net worth would allow to reimburse and do voluntary contribution in one go killing the tax bill when the marginal tax rate is, likely, at its maximum

Hi Marco

Yes, I agree that putting back the 50K itself is a big decision because it has little benefits (I still get back withdrawal taxes, but it’s low).

That’s a good point. I have an article about contributing to the second pillar, but no article about reimbursing (or not) the second pillar withdrawal. I will put this on the list.

Hi Baptiste

I’ve been following your blog for some time now as well, and regarding your backpains: My wife is an occupational health doctor, and according to her for most people having backpain with your occupation (i.e. sitting in front of a screen all day) this is because of a bad workplace setup.

There’s a guide from the SUVA on how to setup your desk, chair etc here, maybe that will help? It did help with my problems (I’m a software developer as well) when my hands used to hurt all day long, this simply vanished since then.

https://www.suva.ch/de-ch/download/dokument/bildschirmarbeit–informationen-zur-ergonomie—publikation/standard-variante–44034.D

Anyway, thanks for your informative blog as well!

Hi Clemens

Thanks for sharing. I think it’s realated to my occupation but not because of bad position more because of the lack of exercise that weakened my back over the years.

I pay attention to ergonomics and I have an excellent chair with good lumbar support.

Thanks for sharing this document, it looks very complete, I will go through it.

Hi Baptiste,

even though I regularly visit yout blog (been doing so for about 3 years or so now) I somehow completely missed the forum. Just checked that out now and I think that it is a really useful feature. I am not aware of anything similar elsewhere. I am not sure what the pain/cost of running it is but I believe it would be pity to shut it down. It might need some time to get full traction. Perhaps not many people are aware of it…

Keep up the good work!

Hi T

I sent an email to all my subscribers about the forum and talked about it in the previous monthly updates, that’s about all I can do about it :) There is also a link on the top bar. But I am sure many of my readers don’t yet know about the forum.

Let’s see what happens :)

hello Baptiste; well done for this great month!

I hope the next big event is on the positive side.

Back pain : I am not a doctor, I do not know the source of your issue; still I can share what made me lower/cancel my back pain : simples flex physio exercices and basic reinforcements (superman, plank…). Free. Every day 5 to 10 min. Also being a data guy, spending also too much time sat down playing with excel and IBKR, at 44 this is now a must for me … aging is not good. If it helps …

Keep on the crazy good work you are doing since years; you bring tons of added value and should receive an federal award.

I re-discovered NEON (opened nearly at the beginning) after reading one of your article. Your highlight of it, at the NEON app itself, are VERY powerful to track records, budget and save. And this highlight of yours is only a very small fraction of your added value! So cheers up ! Well done !

Hi JS

Thanks for sharing!

I am trying some reinforcement exercises currently and trying to avoid some pain triggers, but it’s not obvious whether that helps! I will soon soon a doctor about it.

Thanks for your kind words, I am glad you find value in my content!