April 2022 – A good month

| Updated: |(Disclosure: Some of the links below may be affiliate links)

April 2022 was a good month. We had a few pleasant events with our friends and family. It was not very eventful, but we had time to work on a few late things, which is excellent since we have very little free time these days.

On the financial side, it was a great month with regular earnings and relatively low expenses. So, we managed to save a sizeable portion of our income again.

April 2022

Overall, April 2022 was a good month, very standard. We had a few friendly events, but not too many. The weather was not perfect, but we had some lovely days as well.

We were able to work on a few things on which we were very late. I would not say we are up-to-date on everything now, but we are in a better place than before.

On the sleep side, the situation is still entirely chaotic. We had a few good nights, followed by horrible nights. Overall, it was not the worst month, but still not there yet.

Financially, it was a good month. We spent a very reasonable amount of money and had an ordinary income. And once again, this is a month without taxes. It means we could save more than 70% of our income, which is excellent.

Expenses

Here are the details of our expenses in April 2022:

| Category | Total | Status | Details |

|---|---|---|---|

| Insurances | 878 | Average | Health insurance |

| Transportation | 179 | Above average | Fuel, some bus tickets, and one truck rental |

| Communications | 65 | Average | Only the Internet bill |

| Blog | 396 | Average | A few recurring bills and the first pillar |

| Personal | 1991 | Above average | Large bill for the office and many small miscellaneous bills |

| Food | 418 | Average | More small groceries than usual, but relatively standard |

| Housing | 550 | Average | Heating and Mortgage |

| Taxes | 720 | Below average | Real estate contribution to the municipality |

In total, we spent5199 CHF this month. Excluding taxes, we spent 4479 CHF. This result is good! Our goal is to be below 4500 CHF per month, not including blog expenses, which put us at 4082 CHF, a great result!

There was still a significant amount of money spent on my office project. I made a big trip to Bauhaus for wood and accessories. The bulk of the cost should now be past us.

Other than that, many small expenses piled up during the month, but nothing significant. For instance, we bought a few things to prepare the garden in May.

April should be the last month without taxes. I am expecting to see tax bills coming next month.

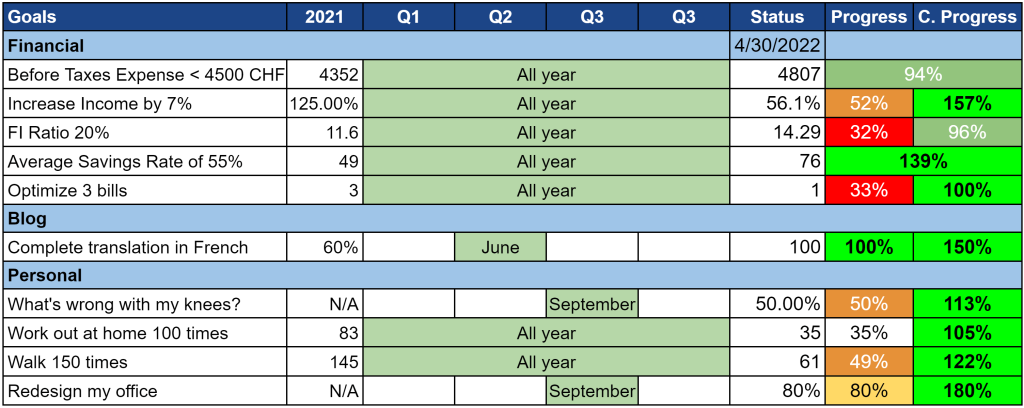

2022 Goals

Here is the status of our goals by the end of March 2022:

Overall, our goals are doing well this month. There is excellent progress on most of our goals, and many of them are ahead of schedule.

I made a minor adjustment to how I compute expenses without taxes (the first of our goals). I do not include blog expenses anymore in this category. The blog earnings are still included in the savings rate, but expenses without taxes only contain our personal expenses, no expenses related to the blog. Also, 90% of the blog expenses are first pillar contributions, a form of taxes. It does not make a big difference, but I feel it makes more sense that way.

I made excellent progress on my office project. I finished the new back wall and reorganized things around it. The only thing that remains for this first phase is to install the shelf on the back wall. Then, I will be mostly done, and only very small things will remain. So far, I am pleased about how it is turning out.

I did a good amount of walks and workouts this month, despite the weather. I started with very few walks, but I have begun to do longer walks now that our son stays awake longer when we walk around.

I also reduced one bill in April. I have increased the deductible for our household contents insurance. This will save us 100 CHF a year. And I am soon to be done with optimizing our complementary insurance, which should save us significantly more.

I finally finished the translation to French. I am ahead of schedule, but I am so tired of doing it that I feel it is long overdue. Now, I will directly translate all articles after writing them, and emails will go in both languages.

I also progressed on my quest to find what was wrong with my knees. I have done an MRI, and the result eliminated Arthrosis and several other things. However, this showed that I had a Baker’s cyst and a cruciate ligament degeneration. However, I only did an MRI of one side, so I may not have the same symptoms on both knees. I will see an orthopedist discuss what can be done later. But that will wait until June.

So, overall, I am very satisfied with our progress!

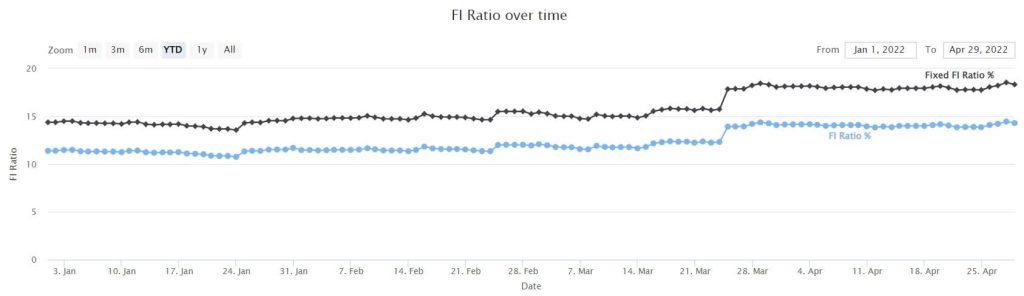

FI Ratio

Here is our progress toward Financial Independence:

Our FI ratio increased slightly this month, mostly thanks to our savings.

The stock market was not good for us this month. We still had a small net worth increase, but it was entirely due to our savings. And our net worth increase is lower than our savings, so we lost money on the stock market. On the other hand, we were able to grab shares at a lower price.

Overall, our progress towards Financial Independence is steady. There is not much we can do to go faster. We are going in the right direction already.

The Blog

Overall, the blog did okay this month. The traffic is slightly done, back to the level of February, but it is not too bad.

Except for the translation in French that is now finished, I have not done much with the blog.

I am having trouble keeping up with my schedule of one article a week. So far, I am still doing it, but it may change in the future. It is difficult to spend much time on the blog when we have so little free time.

But, overall, I would think the blog is doing well considering the time I am spending on it.

Next month – May 2022

Next month should be a fairly regular month. We have several dinners and lunches with friends and families. And I am hoping to get the office shelf finished.

As for finances, it should be a standard month. We will pay taxes again next month. And we are thinking of doing a short vacation either in May or June, that may add to the costs.

What about you? How was April 2022 for you? What do you have planned for May 2022?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Hello Bat,

thanks for the article. Now that the stock market is low and all of us have lost, have you changed your investment strategy? Did your portfolio stay the same or do you invest less money in stocks now that the stock market is low? Thank you

Hi Gabriele,

I have not changed anything. My portfolio is significantly down, all my stocks are negative, but I am still investing each month.

I see this as stocks being on sale for me. I would actually like it if I could invest more, but I don’t have available cash.

Hi PS thank you for sharing. My April expenses went through to roof because I visited friends and family in london are out a few times and the shopping was too tempting! :) bringing down by abit 10% this month :/

I have a question, when you say no taxes month what exactly do you mean? As at the moment when I calculate my total expenses of the month (using the the expense tracker you kindly shared), I also deduct the tax amount that will be due although I have not paid it in the current month so my savings %calculated is net of taxes due for that month that I will pay when I file my taxes in bulk. For example my feb expenses were double bse I took on consideration the tax that comes along with the addition al bonus payts.Is this how you go about it too?

Thank you

Hi Jay,

Visiting friends is a great reason to spend more money one month :) I hope you had fun :)

I don’t pay taxes in bulk, I pay each month. My county gives me 10 bills, my canton 9 bills and the federal level gives me 6 bills. So there are 3 months where I don’t pay taxes during the month.

I only account for bills when I pay them. If I were to pay the taxes at once, I would put 40K taxes in one month. But that would not be reasonable given the amount of taxes I pay.

Does that make sense?

Many people make an estimation and then account for 1/12 of that every month. But I prefer to have actual expenses on my tracking system. But the important thing is that your system works for you!

Hi Baptiste, I am hooked on your blog :) as a new comer to Switzerland (from EU country) and starting from zero there, your blog is very handy to learn about Swiss system. Thank you very much!

Hi,

I am glad my blog is useful! Good luck setting up here.

Baptiste,

Maybe some settings on the blog changed because the only way to see comments now is by leaving one… Personally I find it always interesting to see what others have to say on the topic.

Hi ILS,

This is because of caching I believe. It may take a while to get all the comments refreshed.

I will see what I can do.

Good job, it looks like it’s fixed :)

Hi Baptiste!

Thank you for sharing your progress! It is insightful!

I was wondering how are you able to have monthly food costs for a young family of CHF 418 in April?

I cannot get anywhere close to that figure for the month, and it is only my gf and I and we do not get / buy anything fancy, we shop organized, etc.

Any of your tips are much appreciated.

Best regards,

RS

Hi RS,

We are not doing anything fancy: shop at Lidl, meat at almost every meal, meat is mostly Pork and Chicken (only a little beef), buy in bulk in Aligro, always cook ourselves (no prepared products), go out for meals very rarely.

How much are you spending per month? What is the highest item on your budget?

Hi, thanks for this update, but I don’t understand how your net worth can increase of 16% YTD when the stock market (at least sp500) crashed of 10% YTD. Isn’t it counted in your net worth calculation, or the part of your net worth invested in stocks decreased a lot after buying the house?

Because on my side, while the saving rate looks good, the net worth is taking a hit (not that I worry, it’s a long term strategy, I’m just curious).

Hi Tim,

Our stock positions decreased significantly YTD. However, currently, our savings outweighs our loss, so our net worth grew. For instance, in January, we saved about 18K, but our net worth increased by only 8K, because of stock market losses of about 10K.

Hi Baptiste,

I’m wondering how do you work out on the “increase income by 7%” target? last year you increase by 125%, so more than double your income right? In this year you already increase by 57%.

Is it money made on the blog? with side job/consulting/coaching? Revenue from the book? Or only with salary increase at work?

This year I got a salary increase of 1.5%, which is ridiculous, my boss was so happy to announce me that I got a raise, I was doing a grim and tell him that’s is not even beating inflation… Ok we got a good bonus last year which bring more than this in increase overall, but pretty sure it will not be the same this year, so I head right into a decrease for 2022 I guess.

I tried to find a new job by it looks like I’m already quite well paid for my job as many offer were slightly if not significantly lower than my current wage, and for a job in an area which is much more expensive (housing + tax + insurance).

Last year I made about the equivalent of this rise just by selling some of our old stuff online, of course it’s not something sustainable, I will not buy more to sell more obviously at loss, and there will be a limit when I will have nothing valuable to sell anymore.

Beside that I don’t see how to bring significantly more income without completely sacrificing all my time with family and the rare free time I get for myself (my blog, follow from time to time an online course, a bit of video games…).

Any tips in this regard? Or just a reality check that I have to compromise more and work much more to reach higher wages?

Hi Eluc,

Sorry, my metrics are not very clear. When I say 125%, it’s not +125%, it’s 125% of the previous year, so “only” a 25% increase. I did not double my income last year :)

This should reassure you already!

Last year, the increase was mostly due to the income at work, but the blog is indeed starting to pick up and helped drive the income significantly.

This year, I got slightly more than 4% increase, I am very happy about that.

My strategy for this year is simple: aim for a promotion. This will be the next milestone on how to reach higher. Other increases will be small incremental improvements.

I would not recommend working much more or hustling. I personally don’t have much of that hustling mentality. The blog is a hobby and the fact that it gets income now is mostly because of luck, I never pushed monetization. My income strategy is for my main job, just by being as good as I can and delivering with velocity and quality. These days, I try to spend as little time as possible on the blog while still keeping it alive.

How is that possible that you monthly spend only 400 CHF for food? Amazing :)

Hi,

I have an article where we detail our strategy for food. Our average is now slightly higher than 400 CHF, but basically, we always cook at home, we don’t buy prepared products, we mostly shop at Lidl and buy meat in bulk at Aligro.