How much we spent in 2021 – Full Expense Report

| Updated: |(Disclosure: Some of the links below may be affiliate links)

I keep track of all my expenses. And monthly, I publish an update with my expenses on this blog. But once a year, I also do a complete analysis of my costs for the past year. It helps me put things in perspective. And it also gives me an idea of where my expenses are going for an entire year.

It is an essential part of the way I manage my money. I do not have a budget, but I track all our expenses. And seeing expenses summed for an entire year help us realize how much we spend in some categories.

So, we will see the expenses of The Poor Swiss family for 2021. Compared to our previous years, this is now for a family of 3!

2021 Expenses

In 2021, we spent a total of 122’777 CHF. This is 30% more than last year! That sounds pretty bad, right? We are trying to reduce our expenses, but we end up spending more every year! What is happening?

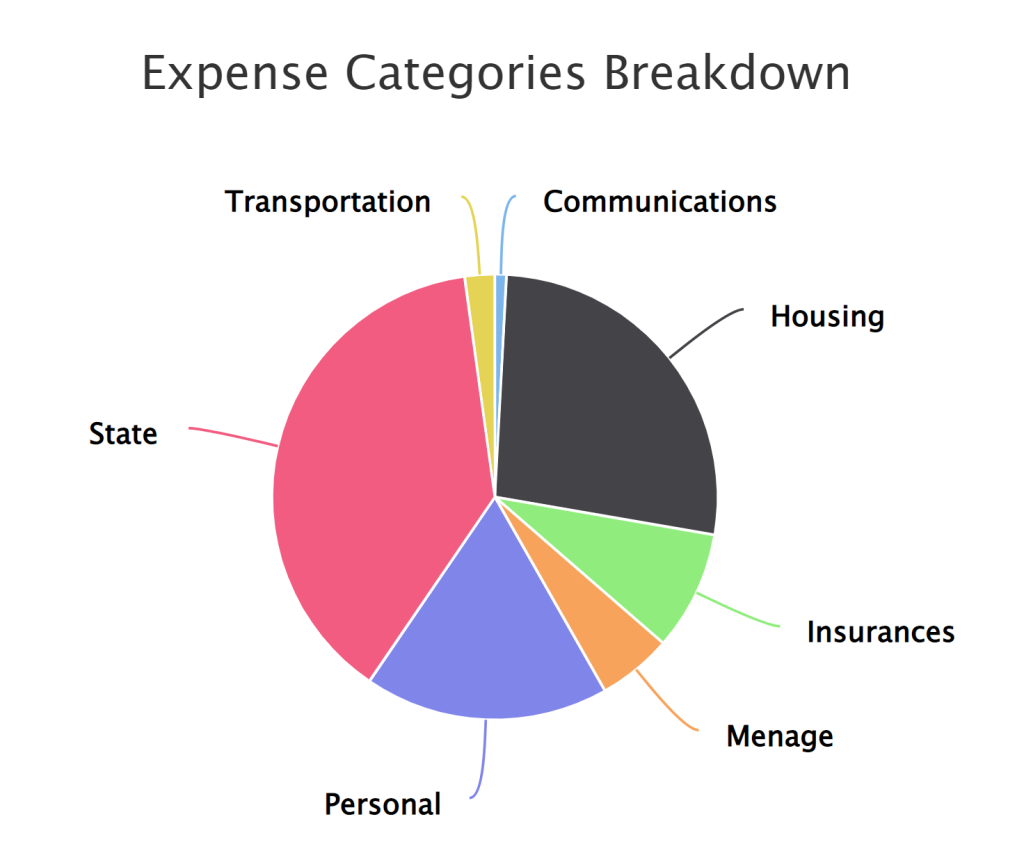

We can find out with the detail. We are using seven categories for tracking our expenses. So, here are the totals of each category for 2021 (sorted by amount):

| Category | Total CHF | Difference | What is it? |

|---|---|---|---|

| State | 47’045 | +9244 | All taxes |

| Housing | 33’008 | +16701 | Rent before, mortgage, house fees |

| Personal | 21752 | +826 | Everything else, for us, not mandatory |

| Insurances | 10631 | -411 | All our insurances, primarily health insurance |

| Food | 6636 | +1307 | Groceries and eating out |

| Transportation | 3185 | -522 | Car and public transportation |

| Communication | 1149 | -109 | Phone and internet bills |

Two categories took a big hit in 2021.

- Our taxes increased by almost 10’000 CHF. It is primarily due to not paying enough taxes in advance in 2020. It should improve in 2022 since we have paid more taxes in 2021. And our taxes should go down slightly with our son. On the other hand, our house is increasing our taxes.

- The housing category increased by more than 16’000 CHF. It is all due to a single bill from the land register of 23K CHF. Without this bill, we would have saved 7000 CHF on our housing costs. In 2022, this category will be much lower since we pay significantly less than what we did when we were renting.

The other categories mostly went up, but not that poorly. The personal category is not as bad as it looks because if we remove the blog expenses, we spent significantly less in 2021. I should add a blog category in 2022 to clean that up.

If we remove the taxes and the land register from our expenses, we spent 52’417 CHF in 2021. This is 5517 CHF less than last year! So, our personal inflation rate is -9.50%! Such a personal inflation rate is a great result. The personal inflation rate is a cool personal finance metric.

Here is a more visual breakdown of the expenses for 2021:

We can see the big bulk of the taxes on our expenses. It is a pity since this is also the most challenging category to optimize.

If you want to compare your situation with ours, here are some crucial facts. We are a married couple with a newborn (as of September 2021), we have a house (but paid 1.5 months of rent for the old apartment), and we have a single income. But generally, I do not recommend comparing too much with other people. You should try to do better than yourself!

I will also detail some of the larger expenses and what changed in 2021.

Biggest 2021 Mandatory Expenses

We can start quickly with the big mandatory expenses:

- Taxes: 47045 CHF (+9244)

- Health Insuranc:9494 CHF (-120)

- Groceries:6188 CHF (+1407)

- Mortgage: 3661.20 (new)

These expenses together are already the bulk of our total expenses. Also, we cannot get rid of them entirely.

Our taxes should go down slightly in 2022. In 2021, we paid some of the 2020 taxes. Also, in 2022, our son will lower our taxes slightly. On the other hand, our income is higher, so the base taxes will increase. So, I do not think our expenses will go down much.

Our health insurance will go up slightly because of the third policy. On the other hand, we can finally cut some complementary insurance this year. This will not play a role in 2022 but will lower our expenses in 2023.

Our groceries went up significantly this year. I am disappointed since it was a category that we were good at previously. One part of the increase is due to the baby expenses with diapers and baby products. But we also simply spent more on groceries by being less careful. I do not think we can go back much lower. But I want to keep that below 6000 CHF in 2022.

As for our mortgage, nothing should change in 2022. It will go slightly lower since we do some direct amortization, but not much.

We can also take a look at some individual expenses.

Health 4992 CHF (+32%)

Our health bills exploded this year, but there is a good reason for most of that.

Most of the bills relate to the pregnancy and the birth of the baby. This made about 85% of it. But most of it was reimbursed by our health insurance. We still have a few pending items, but overall, the reimbursement process went well.

In 2022, we will have a few health bills for me that will not be reimbursed. But hopefully, it should not go that high.

Computers 1305 CHF (+12%)

In 2021, I upgraded my monitors to three good ones instead of the old 3 I had before. This is definitely reasonable for the amount of time spent in front of them.

In 2022, I may have to refresh my configuration. And since I want to redesign my office, I will likely have a few changes to my computer. But it should stay below 2000 CHF in 2022 again.

Holidays 819 CHF (+0%)

We spent almost the same amount on our holidays this year.

In 2020, we went to Davos. We spent a few days in Thun in 2021. It was an excellent time for us, and we went there at a good time, COVID-wise. There were not that many restrictions, and the weather was great.

Internet 780 CHF (+0%)

Nothing at all changed regarding our internet bills. We still spend 65 CHF per month for Swisscom internet.

I know I could go much lower than that, but Swisscom has been working very nicely for us. We have not had any issues in many years. And I do not want to sacrifice any quality here since it is being used every day.

Gas 332 CHF (-42%)

I have worked the entire year at home, even more than in 2020. On top of that, with the restrictions and the pandemic, we did not go out much. As a result, my car has seen really low usage this year. And this translates into an even lower gas bill.

At this point, I have no idea whether that will change or not in 2022. This will depend on whether I can still work from home or not.

Phone 117 CHF (-32%)

Even though we were already spending very little on phone bills, we managed to go even lower. I am still using Coop Mobile prepaid, and I used it very little this year.

Except for many calls around the birth of my son, I did not have to charge my card a lot this year. I want to keep this amount below 200 CHF next year. It should be relatively easy.

New expenses

There were a few new expenses this year compared to before.

The house changed several of our bills. We do not pay rent anymore, but we have to pay for heating, mortgage, and water separately. All this was included before. And we have extra insurance as well.

We have a few new expenses for our son as well. This increased our grocery bills for diapers mostly. But we also bought clothes and toys, mostly second-hand.

I am also using a few new services for the blog that bump up the expenses. But as long as the blog turns a profit, I do not watch how much I spend.

But overall, not that many things changed this year!

Things we improved in 2021

Overall, 2021 was cheaper than 2020 when we do not consider the blog, taxes, and house fees. So, this is a great thing.

In the personal category (miscellaneous), we spent 3000 CHF less than the previous year. We did not lookout for this. It just happened. So, this is a good thing. And this is the category where all the clothes and baby things end up.

Our transportation budget was also great this year. But this is more due to the pandemic than us. Our communications budget is also at a great place now.

Things to improve in 2022

There are a few things we want to improve in 2022.

First, I want to lower our heating bill. This winter, we put the heating lower than last year and started doing a few more fires to heat the living places. It works great so far. We will see if this is enough.

I would also like our groceries bills to be more stable. We have some cheap and then some very expensive months. The current spending level is not bad but could be improved slightly.

We will also reduce our complementary health insurance to pay less. We have taken too many of them.

But overall, I do not think we have much to do for our expenses in 2022.

Conclusion

Overall, we spent more money in 2021 than we ever did. However, some of the big expenses will not repeat. This is the case for house expenses. And our taxes have significantly increased thanks to our income (a double-edged sword). Fribourg is a bad canton for high-income earners.

So, overall, I am happy with the level of our expenses. There are a few things we could improve but nothing big. I really wish we could improve our taxes, but short of moving there is not much we can do.

What about you? How much did you spend in 2021?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

23k bill from the land registry and 47k taxes – I am shocked! I am single, 30 y/o and even though most advice regarding finances is to buy a house, it seems like it involves so many costs (at least in Switzerland! I’m jealous of the americans who always talk about his house hacking they do)! I currently spend only Fr. 760 a month for a room in Zurich, even though I could afford much more (most of my friends spend 1000-2500). This also gives me lots of flexibility and I plan to move to a low tax canton / municipality in the near future to save almost half of the taxes and -30% on health insurance. But I totally understand that as a family, you want stability and where you live is more important (and worth paying the extra price).

Hi Eli,

The 23k is indeed because of real estate, but the 47k taxes is not related to my taxes. My taxes did go up with my house, but not by much.

But it’s true that real estate is not as great in CH as in the US.

If you can spend 760 CHF a month, it’s great indeed!

Yeah, stability is important. But I am sure that if we move out of this house, we will consider the tax factor more strongly.

I do not understand how you came up with the name of your domain, looking at the taxes you spend :-)

also impressive that we spend the double on food (groceries) only.

Hi,

I came up from the fact that everybody thinks Swiss people are rich while most Swiss people are not rich by any means. Now, it’s true that I am not poor :)

(Or at least, the tax office does not think I am poor :P)

Wow Mr .poor Swiss really impressed on the spend on holiday!, I was on holiday in Zermmat over Christmas 4 nights in a hotel with included breakfast so only ate out at dinner, and spent around 2k for the time spent there! Thanks for sharing this breakdown it has given me the inspiration to track with more detail my budget this year.

Hi Jay

Keep in mind that just because you spent more than us does not mean that you did anything wrong :)

Personally, we would not want to spend more than 1000 CHF on a 3-nights holiday. 2k for us for 4 nights would not be reasonable, but if you enjoyed your holiday and it’s reasonable for your budget, don’t worry too much about it!

47k is still the highest ticket item and accounts for around 40% of the expenses. Ever considered moving to another canton/place?

Hi,

We thought about it. But all our friends and family members (on my side at least) live near us. And I hate driving. Even 30 minutes is a long drive for me. So, for now, we have chosen convenience over cost.

But if I can work from home definitely (not very optimistic), we may consider moving a little in a few years.

Thanks for sharing. I would be interested in how you approached the topic “buying a house”, from a mortage aspect. Which portals did you use to compare the interest rates, etc. Thanks again, I really appreciate your work / blog here, as it is very interesting.

Hi Daniel,

I have a guide on mortgages and a guide on buying a house.

These should tell how I approach the topic :)

If you have further questions after reading them, let me know :)

Hi Baptiste,

I know I said it’s not a good idea to compare expenses between two different families but still I continue to do it… And I’m amazed by how low are some of your spending.

Transportation: gas, if I roughly calculate, assuming a car that consume 6-7L/100km you did about 3000km or less in the whole year. In our case our family and friends are all more than 1h away by car so we travel quite a lot but still either you drive to family or friend only 4-5 times per year or they all live within 10min drive. Or you spend a lot in public transport and didn’t mention it here. Is it only your car or the whole family? Did your wife has a car or didn’t you count the gas when she use it? I also assume you both work from home or you work from home and she is not working and stay home all day. Just to compare we drove our car 75’000km in less than 3 years. I always say to my wife that we travel quite a lot but she said that if she don’t see anyone outside me and the kid for two weekend in a raw, she get crazy. And because we leave a bit far, only a few times per year friends and family are traveling to visit us.

Holiday: again, even if you did only one holiday in the year, how can you spend so few? Even more if you went in Davos, 780frs for an hotel room is like 3-4 nights max? When we go to the sea in summer with the 3 kids for 2 weeks we spend already 2.5 times for housing, then there is food (we cook a lot on summer holiday and supermarket in Italy is cheaper than Switzerland, but you also have many ice cream and drink outside), and gas to travel there, as well as highway toll. Then you add all activities (spot on the beach is expensive, luna park and other attraction for kids,…).

And that’s just one holiday travel, usually there is at least one more if not two (a week to 10 days around April and a week around October).

You kid is still a baby but these can of expense increase drastically with kids growing up. I’m already saving for the day the kids will want to go to Disneyland Paris (and I’m not even talking about DisneyWorld/Universal, here it will be 10’000CHF at least for a week).

Phone: again I assume it’s only your bill, not the one from your wife phone. I have a similar amount but only because I have a second SIM from work that I can use for unlimited internet and occasional call. My wife phone bill is 3 times higher and I still find it reasonable when you need internet mobile, which I assume you barely use.

Internet (landline I guess): I don’t agree with you that you should stay with Swisscom because it works well. If you have FTTH in your home you really should take an offer and get 35-39CHF/month for 10Gb fiber. With FTTH whenever you use Sunrise/Yallo or Salt, at the end it’s the same infrastructure. I had Sunrise fiber 1Gb for a couple of year in Lausanne paying 29frs/month, it was working perfectly, never any cut, IP was never changing even without paying for a fixed one. Now we are stuck in country side with only cable at 74frs/month for 300/50Mb/s and they delayed FTTH for at least a year as I was suppose to start my subscription at 35frs for 10/10Gb/s end of last year but now Swisscom cannot deploy any new line due to an ongoing trial as I understood, and Swisscom provide the infrastructure for all other operators beside the local one with cable. Each time I pay the bill I cry a little bit at how much money is wasted, more than double the price for 200x less upload speed (and upload is critical when you are self-hosting stuff).

Congratulations on the baby spending, 3000frs is really not a lot, even less if it count all your and your wife personal spending in it as well. Last year I tried to track every personal spending down, but it was too much work and my wife was feeling restricted and observed. So I changed for a fixed personal spending, I had to set more to my wife as she was spending much more, while still reasonable I think. For example 3000frs/year is for my personal spending, including stuff for me alone, going out with friend and short trip without the family (usually one weekend or 3-4 days long trip per year).

Talking about personal spending I never know how to count computer equipment that are shared. Personal computer is on personal spending, like a new smartphone, GPU for gaming or a small gadget. But a NAS for example, it’s used by all the family for backup laptop and smartphone, as a cloud and for watching movies stored on it. Is is still not something that every family has, it’s kind of a hobby for me, so should it be personal? But then if we would not have it, we would pay quite a lot in cloud services like iCloud, GDrive/Amazon storage for backup, more streaming service and VOD cost. That would end up with a similar cost over the years. I bought my NAS more than 8 years ago when I was single and it was quite a large expense, now I might have to replace it eventually but it’s hard to get a budget for this.

On my wife side it’s the same. She love to cook, it’s also kind of a hobby, but kitchen appliance are very expensive and we really have a lot adding up with the years.

Finally we have a huge category, family spending. Between toys, gift for birthday parties and Christmas, clothes, going out to the pool, ice rink or short trip to a not too far theme park, one of these is about once per month or less, so it’s not like we are spending fortune every weekend (as we mostly go to see family and eat for free there, but at the expense of car gas as mentioned). This add up very fast but when we look at it in detail we feel that we are still very reasonable.

I will continue to follow the family expense but with less detail as I did in 2021, but I don’t expect to go much lower in 2022, at least I now have a good idea where the money goes and which budget we have to reserve for each category.

Hi Eluc,

We are indeed keeping some categories fairly well. But in some cases, one could argue that we keep them too low :)

That’s correct, I must have done about 3000 kilometers, maybe slightly (I don’t really keep track). The farthest member of my family is 30 minutes away and all the others are much closer. So, we are lucky for that. My wife uses my car and sometimes public transportation but I generally drive her closer to the city to reduce public transportation. We must have spent about 100 to 200 in public transportation for the year. We both don’t have to drive to work for the time being. My car is almost 10 years old and I just reached 70K :)

For holidays, 2021 was in Thun, but the one in Davos in 2020 was about the same price. And it was indeed 3 nights, with a freedreams pass. We generally have picnics at lunch and restaurant at night. And we also have a few ice creams and beers during the day.

I think we are not traveling enough, but with the pandemic we were really not motivated to travel.

We don’t have fibers to home in your village. And 10Gb is pointless. I don’t see the point of any speed higher than 100Mb. So, overall, I am quite happy with my 65 CHF per month on internet :)

We are pretty happy with the baby expenses.

In our case, Personal is really the category for everything that does not fit anyplace else. In that, we have sub categories for computers (only me), tech (only me), phones (both), … I also have a big NAS with enough space for all our movies and TV shows (which we don’t have time to watch!).

We both enjoy to cook, but never found kitchen appliances to be really worth the cost. We only have the really basic ones.

Keep in mind that we are not doing much family activities yet. Once our son will be older, this will definitely becomes an important category.

You make a good point that when looked at one by one, some expenses can seem very reasonable but when added over the entire year, they tell a different story.

I like tracking precisely our spending and my wife is mostly on board with that. We recently started adding an “allowance” each month that my wife gets and can do anything she wants with. I think it helps if she does not have to report every single expense :)

Thanks a lot for sharing your thoughts and good luck keeping 2022 budget on a good level :)

how the F word did you only spend 800 CHF on holidays?!?!?! teach me you grand master

Hi Alex,

I don’t think it’s that much of an example actually. We only did a single three nights vacation with freedreams in Thun in 2023. We went there by car and parked it in the hotel and then use free public transportation during our stay.

We generally took picnics for the lunch and had dinner in restaurants.

It was a nice vacation.

But we should have done at least one more vacation.

47k in taxes.. fucking hell.

Depends on the income! Maybe it is even only a little ;-)

Yeah, that sums it up nicely :)