Buying a house in Switzerland: The Complete Guide

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Buying a house in Switzerland is not an easy matter. There will be many steps involved in the process. You will have to fill in many forms and learn about many things.

This guide is here to help you through the process of buying a house in Switzerland. I go over all the necessary steps in the process.

Buying a house in Switzerland

We recently went through the process of buying a house in Switzerland. After many months of research, we finally found the house we wanted. And in the end, we got it!

However, we made several mistakes along the way. And we learned a ton of things about buying a house in Switzerland. It is not a straightforward process.

With this guide, hopefully, you will be able to enjoy a smoother process than we did. And this will help you avoid some of the mistakes we made!

I will mostly talk about houses in this article. Indeed, we are buying a house ourselves. But most of what I am talking about is the same if you want to buy an apartment.

Keep in mind that I am not a real estate expert. But we just went through the process of buying a house in Switzerland. So I want to share all the information I have on the subject.

If you already have a house, you must sell your previous house (or rent it out). I will not cover this. But in that case, you have already been through buying a house, so it should be easier. And all the buying processes should be mostly the same.

1. Research how much you can afford

Before looking at houses or apartments, you must know how much you can afford. If you think of buying a house, you need to know exactly what house you can buy.

Many people do not research that enough, and once they find a house they like, they realize they cannot afford it. It is disheartening when it happens.

We made that error when we started looking. We only considered the down payment and current interest rates. And we realized we were a little short on money for the houses we were looking for. So, this must be your first step!

Make sure you have enough cash

When buying a house, you will need at least a 20% downpayment in general. Out of this, at least half must be in cash, and the rest can come from your retirement assets. So, if you do not have at least 20% of the house ready, you should try to lower your expectations.

In general, you will need an extra 5% in cash. This extra cash will cover all the fees you will have to pay. But this may be quite far in the future. So you may be able to save this money while searching for a house.

Make sure you have enough income

Secondly, when buying a house, you must also have enough income for the bank to mortgage you.

Banks currently use a 4.5% interest rate to check if you can afford the mortgage, regardless of current interest rates. It is essential to know. On top of that, they will count about 1% amortization and 0.7% maintenance costs. It gives a cost of 6.2% based on the mortgage value (generally 80% of the house’s value).

All these fees must represent less than 33% of your income. Keep in mind that they will take your net income into account. On top of that, there are some restrictions for taking a bonus into account, for instance. But these may need to be considered for each bank in particular.

Based on this information, one can compute how much he could afford. People can afford a house value of (Net Income / 3) * (1 / 0.062) * (1/0.8). For instance, an 80’000 CHF net income would allow a house with a value of 537’000 CHF at most.

If your income is insufficient and you still want to buy the house, you will need to reduce the amount of the debt. For this, you will have to put more cash into the house. But you should consider increasing your income or limiting your expectations if you cannot afford it.

For more information on this step, I recommend you read my complete guide on mortgages in Switzerland. You can also check how much owning a house costs in Switzerland, where we recorded our costs for a year of owning.

2. Think about where you want a mortgage

Even though it is very early in the process, it may already be a good time to make some comparisons.

When buying a house, you will need a bank to provide you with a loan. Theoretically, you could buy entirely in cash, but there is a minimal incentive, and nobody would have enough cash.

That step is to prepare for when you must make an offer to sellers. It sometimes takes some time to get a relationship going with a bank. So if you did not research banks before visiting houses, you would be disadvantaged.

At this point, you may already know what mortgage you want. You do not have to decide, but having some ideas could help. So from that, you can compare the banks providing the mortgages.

The only good and neutral mortgage comparator I know is the mortgage comparator from moneyland. This comparator should give you a good idea of which banks are interesting. You should note the two or three cheapest banks on the list.

If you already have a good banking relationship with a bank that offers mortgages, you should also consider them. It helps if you are already a client with them.

If you already have a relationship with insurance that offers mortgages, you could also put them on the list. Insurance companies sometimes offer very interesting conditions, but there are limitations, of course.

With this done, you should have a list of potential banks that would be interesting for you.

3. (Optional) First contact with banks

Now that you know how much mortgage you can afford and which banks are interesting, you may want to confirm this with the bank.

This step is optional because, at this point, you do not have a house to present to the bank. So, unfortunately, most banks will not take you very seriously. If you already have a relationship with a bank, you could have an advantage here.

However, you have a nice advantage at this stage: time! When you want to make an offer for a house, you may be pressed for time. But before that, you have a lot of time. So, it does not hurt to have first contact with the banks from your list.

Remember that at this point, you should not sign anything with the bank. And if the bank advisor is too pushy, you should avoid them. You want an honest contact that will help you, not somebody that will try to sell you expensive options.

With the banker, you should discuss how much you can afford. You could already start to discuss the different options for mortgages. And you should ask how long it will take them to give you an answer once you have found a house. Some banks are much slower than others.

4. Define what you want

At this stage, you may already know what you want. But most people will not have a precise idea of what they want.

Before you start researching everything, I believe it is essential to define exactly what you want to buy. And if you are buying a house with a partner, you should already consider something that would go for both.

You should decide on a few critical things:

- Do you want to buy a house or an apartment?

- Do you want to buy a single house or a twin house?

- Where do you want to buy it?

- How many rooms do you want?

- What commodities do you want?

- How many parking or garage do you need?

- Etc.

Now, you have decided on what you want and need. You should try to stick to these. Of course, if you find a house slightly higher or below your standards, it is perfectly fine. But starting to go higher and higher is a perilous act.

5. Search for your house

Now that you know what you want, it is time to start researching houses or apartments. Before buying a house, you will need to find it!

You need to know that this could take time. If you have specific needs or are looking into a small market, it may take a while before you find a property that you want.

There are three main ways to find houses:

- Real Estate Portals

- Real Estate Agency Portals

- Real Estate Agents

The one you want to use will depend on you and your needs. We only used the real estate portals, and we did not get any issues with that.

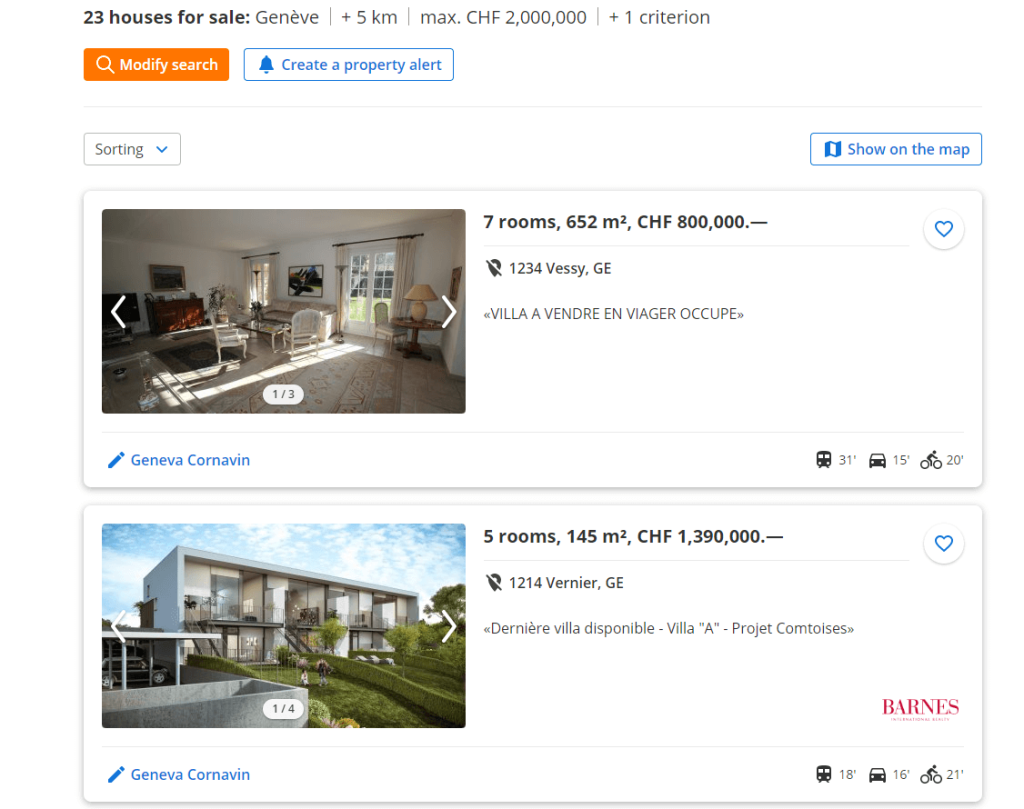

Real Estate Portals

My favorite way of looking for houses is to use Real Estate Portals. There are a ton of them in Switzerland. But there is one great thing about these portals: they are all synchronized together.

Another good thing is that these portals allow you to filter precisely what you want. That way, you will significantly reduce the number of properties you must look at. Of course, you still want some margin not to miss some great thing that is slightly out of your standards.

If you want, you can use a single portal to get all the information. I still prefer to use two to make sure that synchronization works well. My favorite way is simply to register an email alert with my filters with these two real estate portals:

If you follow this method, you will able to get information very quickly on new properties.

If you want even more portals, you can take a look at these:

- anibis (good but not in English)

- homegate

- immostreet

- home.ch

But it is unlikely that you need many portals to find all the information. After all, they are all getting information from the other ones.

Real Estate Agency Portals

Another option is to get information from the real estate agencies themselves. Many of them have newsletters and portals of their own. I do not recommend using their portals. Big real estate agencies have their portals directly replicated into comparis, anibis, and immoscout24.

There are many agencies, so I will not make a list. And the problem with that is they are local. So you will have to look at the agencies working in the area you are considering buying a house. Then, you can check if they have newsletters on their website and register with them.

Real Estate Agents

The last option is to find a real estate agent directly.

You can find a neutral real estate agent that will look for houses widely. But this will likely cost you money for the research of the agent. However, this will liberate you from a lot of work.

Another option is to go through an agency that sells houses. The problem with that is that many of them will only work with their properties. So, you may limit yourself to some properties.

I believe most people will not need to use this to find a house. However, if you are looking for something specific or high-end, this can be a great way to find an offer that may not even be on the internet (although this gets unlikely these days).

6. Visit the house

Once you have found a house you want to buy, it is time to visit it. You can contact the agent responsible for the property (or the owner) and organize a visit.

As soon as you see the offer, you should contact them to make an appointment. Then, you should try to get an appointment as soon as possible. Sometimes, there will be many people visiting the same house. And maybe people already visited before you even called.

Unfortunately, when buying a house, the fastest people are often the ones that get the best options. So, you need to be reactive. It is a bit dumb, but sometimes waiting a day before calling could make the difference between buying a house and not buying it.

There are a few things you need to be aware of before visiting the house. First of all, do not trust the pictures, one way or the other. Sometimes the pictures are made by experts at marketing. They are capable of making the pictures much better than the real thing. And they use angles so that rooms look bigger than they are.

Sometimes, the contrary is true, as well. Some people cannot take good pictures. So a house can look much better than its pictures.

Before you go to visit the house, you need to plan the questions you want to ask. If something bothers you about the house, note it and ask. You need to ask all the questions you have. Even if a question sounds insignificant, you need to ask it. And if you feel like the agent does not answer your questions well or is reluctant to answer, you may consider not doing business with them. Buying a house is a huge purchase. You do not want to take such a decision lightly. And you do not want to do business with unprofessional people.

If you are not inspired, do not despair, there are quite a few lists of questions on the internet. For the Swiss market, home gate has a nice list of questions that could ask during the visit. Some of these questions, you can directly answer with the classified ad itself. But a lot of them, you should try to ask the owners or the agent.

Now, there are two more essential things when viewing houses.

The first thing is that you should never tell the agent (or the owner) how much you can afford. If you can afford more than the price, they will try to squeeze more out of you. It is good to have some margin for negotiation, but you should not let the other party know about your margin. The good answer is simply to say that you have enough for this price and already talked with your bank.

The second thing is that you should not appear too enthusiastic. It is not an easy thing to do if you are enthusiastic about the house. But this is showing a weakness that some agents will try to use. So, try to refrain from showing your emotions and be a little detached.

Ideally, you should visit several houses, not only one. It is much better to have several houses on your radar and be able to compare them. Now, it is not always easy. Some houses stay on the market for less than a week. In these delays, you may not have that long.

7. Make an offer

When you have found a property that you are interested in, you will need to make an offer.

An offer is a letter with the amount you are prepared to pay to buy a house. In some cases, you will have to write a motivation letter, but in many cases, you will simply have to write down the offer. Your offer can be higher or lower than the price asked, based on what you think is best.

You can make offers for several properties at the same time. You are allowed to rescind an offer you made. If you go further down the process, it will become much more binding. But now, you still have some margin for changing your mind. And the seller can also change its mind. So even if the seller accepts your offer, he can change his mind and stop selling the house or accept another offer.

Generally, the sellers will ask for a letter from the bank saying that they are prepared to loan you this amount. Without this letter, most people will not accept your offer.

So, at this point, you will have to contact your bank again. You do not have to decide on anything or sign anything now. However, I would recommend that you already choose your bank at this time. It is better than if you have to change things later.

If you already have a bank (or insurance company) in mind, you can continue with them directly. Otherwise, you will have to speak to several banks with your property. At this point, banks should pay much more attention to you since you have a property in mind.

It could take some time to get a confirmation from the bank since they will have to evaluate the house. But if it is a standard property, it should not take more than a few days.

Once you have all the documents, you can send the offer to the sellers. At this point, you will have to wait for them to decide if they will accept or not. Some sellers may be using a bidding process. This process means that they will do several rounds of offers. In the second round, you will have the choice to keep your offer or increase it (or drop it).

If your offer is not accepted, or if the house is sold before that, you will have to restart the process with another house.

8. Sign the reservation contract

Once your offer is accepted, in most cases, you will have to sign a reservation contract. This contract binds both parties to execute the sale of the property. When buying a house, this step is the first one where you have a good guarantee that the house will be yours.

With this contract, the sellers agree to sell the house, and the buyers (you) agree to buy it. In case somebody breaches this contract, they will have to pay penalties. This contract ensures that people will not bail before the contract in front of the notary. However, this reservation contract can be breached much more easily than the notarized sale contract.

In many cases, you will have to pay an advance payment for this contract. Generally, the account will be opened by the real estate agency. This advance payment will be deposited in an account. And it still belongs to you. This money will count towards the downpayment in cash of the house. In case of a breach from your side, penalties will be taken from this account.

In most cases, the amount will be between 5’000 CHF and 30’000 CHF. But it could go up to 50’000 CHF. If you are buying a luxury house, you may have to go even higher than that.

At this stage, you will also have to decide on a date for the signature of the notary contract. Generally, the buyer can choose the notary. If you do not know one, the real estate agent will probably find one.

9. Study the notary contract project

Generally, the notary will send you the draft of the sale contract before the meeting. This contract will specify the details of buying a house.

You should study this information before the meeting. By doing so, you will also save time in the meeting if you can fill in the blanks or fix errors.

You should pay a lot of attention to all the contract details. You need to remember that this is an extremely important contract. You should not take it lightly.

If you do not understand the contract’s language, you should do your research or ask the notary directly. It is essential to know what goes on in the contract. It should not happen, but you need to know if there is a clause that is too detrimental to you.

When you buy a house, you must pay a certain amount in cash (the downpayment. In some cases, the notary (or the sellers) will make you pay this already before the signature of the notary contract.

You must check this in the contract and ensure you transfer the money on time. You should wire the money to the bank account of the notary. And the notary will be responsible for dispatching the funds after the purchase.

10. Sign the notary contract

When buying a house, the notary contract is what matters the most. Once signed and notarized, this contract will be binding for both parties.

For the signature, all the parties will need to be there in person. And they need to be identified by the notary (with a valid ID).

During the meeting, the notary will generally read the contract entirely. It is pretty long, but you must pay attention to the reading.

If the notary or one of the parties finds something amiss in the contract, the notary will edit it directly. This process will continue until the contract is final and it is time to sign.

So, in the end, all the parties will sign the entire document. After this, the contract will be binding.

The notary may ask for some information from you after the signature. For instance, in our case, they asked for residency confirmation for my wife since she is not Swiss.

11. Finalize the financing details

After the signature, you must finalize some details with the bank.

The first thing you will have to do is sign the contract for the mortgage. Make sure you read the whole thing to check that it is what you agreed before. If there is something you do not understand, just ask the banker about it.

At the same time, you will have to plan to transfer your retirement funds. For this, you will have to contact the managers of your second pillar and your third pillar. Generally, there are forms you can download online and fill out to send to them. These forms will instruct them to send the money to the bank. The bank should have already contacted them in advance.

You can expect this step to take time. But it should not be much of an issue. And the bank will help you with the process of moving the funds.

If you have not already paid the 10% cash necessary for buying a house, it is also time to move your cash into the account of bank for the downpayment. In most cases, you will have to do that at least a few days before the actual payment date.

You do not have to worry about the actual payment of the house. The bank will take care of that if you have filled in all the documents and transferred all the funds.

12. Check the house insurance details

When buying a house, the house insurance of the previous owner (if you are not buying a new house) will automatically fall into your hands.

Here, I am talking about property insurance. This insurance is tied to the property and not to the people taking the insurance.

So, you need to check the details of this contract if you want to change it. You will have 30 days after you start living in the house. So, if you wish to cancel, it is better to cancel directly before you even take the house.

At this point, I would recommend researching the best options for house insurance for this house. If this insurance is already the best one, you can keep it, and you will not have to do anything. Otherwise, you must cancel the inherited one and sign a new insurance policy for the house.

13. Cancel your lease

If you were renting before buying a house, you have to take care of canceling your lease.

If you are lucky, you can cancel your lease on time. You must check your lease contract to see the delays under which you can cancel the lease.

If you are not lucky, you must cancel the lease out of delays. It means you must find a new tenant for the apartment (or the house). Then, you must send the information to the owner to validate this new tenant. Once the owner accepts a new tenant, you will be released from your lease contract.

I think that the lease system in Switzerland pretty much sucks. So, on top of all the things you have to do when buying a house, you will also have to care about finding a new tenant. Or you will have to pay the rent for several months for a property you are not using.

To learn more, read my guide about renting in Switzerland.

14. Plan your move to the new house

After doing all the administrative stuff, you must plan the move to the new house.

First, you need to plan the actual move. You will have to decide if you want to make the move by yourself or hire professionals to do it. In our case, we have always done it by ourselves. For this, you need to choose a date, rent a truck, and find a few friends that will help you. It is not a big deal if you are well-organized. But if you want to save time and trouble, hire professionals!

Between now and the time you move into the new house, you will have to prepare and pack all the things you want to move to the new place. It is an excellent time to get rid of things you do not need. More space is no excuse for having more things you do not need.

You will probably also buy a few things for the new house. If you have planned new rooms, you will need furniture. So you must plan for the essentials to be ready when you move. If you are ready to buy a house, you should be ready to spend some money to furnish it properly.

But you will have to do quite a few other things as well:

- Move your internet subscription to the new house.

- Let the municipality know about the move. If you are moving to a new municipality, you must inform both the new one and the previous one.

- Let the power company know about the change.

- Let the post office know about the change. And you will probably want to direct your previous address to the new one.

- Let other services know about the new address. Tons of services need your address. If you redirect your old address, you have a long time to do that.

It is difficult to think of all these things in advance. So, the best course of action is to as many as you can think of early. And then, you can rely on postal redirection to get old mail to the new house. And when you see the wrong address, you change it.

15. Take ownership of the house

Before you can move in, you must take ownership of the house.

After you have signed the notary contract, the changes in the land register will make you the house owner. But you will only be able to take ownership of the house at a set date.

In the notary contract, there will be a day for this ownership transfer. On this day, you will meet the owners and probably the real estate agent. You will tour the house to check for defects, and they will give you all the keys that they have of the house.

Depending on what you are buying, you should be careful about what you see on this day. If something is amiss based on the contract, you should note it and inform the owners and the agent. Usually, they should at least give you the house empty and clean.

If there are new defects from the time of your first visit and this day, you should check them out. But depending on your contract, if you are buying a house that is not new, you may not be able to do anything. Indeed, many sale contracts have clauses that protect the owners from defects that would come from normal use.

Make sure the owners do not try to hide something from you. Later, it will be too late.

If you are worried that the owners kept some keys from you or made extra copies, you can change the cylinders of the house after you move. It is not very expensive, and you can even do it yourself. Some extra sense of security could be worth the cost. Some people always change their locks after buying a house.

16. Move to your new house

It is time for the last step when buying a house: moving into your new home.

I do not think there is much to tell about this. You will already have planned the day. Just execute your plan and do not stress too much about it. Unless you have a ton of stuff, it should take more than a day to move all your stuff.

After the move, you can treat your friends to a good dinner. Or you can treat yourself to a good dinner if you have hired professionals.

After this, all you have to do is enjoy the house you just bought! Congratulations!

Conclusion

As you can see, buying a house in Switzerland involves many steps. The task of buying a house can be daunting. But if you are organized and dedicated, you should not have too many issues during the process.

Hopefully, this guide will help if you consider buying a house in Switzerland. I certainly wish there was such a complete guide for us. I think many things could be simplified in this process. But this is out of my control.

If you are unclear on mortgages, I recommend reading my guide on mortgages in Switzerland. Before buying a house, it is essential to understand how mortgages work. And if you are not set on buying a house, you may rent to read about renting vs buying in Switzerland.

What about you? Do you have any tips for buying a house?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Good morning Baptiste,

Will have your list in mind. I am at the step of talking to mortgage advisor and compare options for financing. I paid reservation and are in process of organizing tenant for my current place.

I love your list, it is clear and helpful. From my perspective, I will add that cost of maintenance between house and apartment differs. From my perspective from other countries, houses are more expensive and require more work. Apartments are easier.

Also, I advice to apartment hunters to look outside preferred neighborhoods. Zug, Zurich, and Rheine Valley are expensive but other cantons/regions are more affordable. Proximity to lakes and lake views also add a lot to a final price tag and I will say this is not worth it. For me railway station with good connections are deal breakers. For example, prices in Chur and Bad Ragaz are different. The same remains true for Atlstaetten and Au in canton ST Gallen.

My search was combination of google map (to track train line) and using comparis. I felt proud from myself, where Swiss colleagues told me I made a smart search. I am not the expert of the real estate market, but during my crash course I learned that despite cliches it is possible to more affordable properties in Switzerland, but this require staying away from the hottest spots like Zurich, lakes, etc. Living 10km from a lake still allows to enjoy it, but saves a lot of money. Hour commute by train can be used to learn German, reading, learning a new skill by on-line tutorials or sleeping.

As for affordability, my advice is to go way below what is max budget. For example if based on income max budget is 600k then property should be below 400k. I think this can save a lot of issues in a future. Choose old build versus new build. Average appliances cs high end…

Hi margaretha

Thanks for your kind words :)

You are correct that apartments are generally easier to maintain. However, you have to be careful that you generally have PPE costs with apartments because of the common parts of the property.

And obviously, you pay a large premium to go into some neighborhoods. If you want a lakeside house, you will pay a huge premium.

Thanks for sharing your thought process, it seems you are putting it a lot of thoughts into this.

Good afternoon,

True, there are monthly costs of apartments in every country. I’ve lived in apartments whole my life and true monthly costs are higher, but there are no huge costs for roof repairs. But again it all depends on a personal preferences. Mine is to have own property, not only rent. I want to grow up into a community, improve a language and be a positive addition to a community.

I am very flexible when it comes to neighborhood. For me it needs to be clean, safe, and well connected which is true for the vast majority of a country. It took me a lot to think about what I need, and realize having own property is more important than central living. Smaller place is fine as long as there are trains. My first years I spend in Zurich, love a city, but prefer apartment in small town to rental in Zurich.

It’s very well done to realize what is really important for you!

Dear Baptiste! Thank you for your amazing work with the blog, sharing so many valuable insights. I am reading your blog regularly. Can you please advise what is the best way to save cash for the initial payment for buying a home if I want to buy home hopefully in few years? Investing into the stock markets makes sense long term only. Keeping in the bank on saving account with the inflation rate means losing money. Do you suggest to invest into 3a pillar and do buy-backs of 2nd pillar now and withdrawing it later for buying the home? Are the tax benefits at the point of deposit worth the taxes to be paid at the point of withdrawal? What strategy did you use yourself?

Many thanks in advance for the advice.

With best regards!

Hi Marco

I have an article about short-term investing: The 5 Best Short-Term Investments

You don’t have many options and stocks are indeed too volatile for saving for a house in a few years. I would it in fixed term deposits.

You could put it in the 3a since it’s not locked in, but be careful if the 3a is invested. Be very careful about the second pillar since contributions are locked for 3 years. Whether it’s worth it depends on your income and tax rate.

Personally, we kept it entirely in cash because at that time, fixed deposits where returning 0%. These days, I would keep in fixed deposits.

Hey!

I appreciate your guide so much! We are foreigners and currently buying our first home and this has been our bible!

Can I ask, when do you actually pay the 10 percent cash to the bank? ASAP or when you get the keys to the property (I.e completion of sale)?

We haven’t yet signed the reservation agreement but this will happen very soon (we really aren’t sure how long things take here). We discovered that our third pillar with VIAC cannot be pledged but needs to be moved to ubs or we take w mortgage with WIR which seems complicated with their own WIR franc.

We want to avoid using third pillar all together and we think we have enough cash to pledge with just second pillar. If we do that this month we will be broke with just 10 k left to our names. If however the 10 percent is paid in may where we get the keys that’s a totally different story. Hence my question about timing :)

Hi Marty

Thanks for your kind words.

This can vary from contract to contract. But generally, you will need to pay before signing the final contract at the notary. So, it could be anytime between the reservation contract and the final notary signature. It should definitely be before the keys.

Hello Poor Swiss,

Blog is awesome.

I am looking to buy an apartment in a new building, what are your thoughts on the possibility of negotiating the price with the agency? or for example negotiate to get the parking spot within the apartment price?

Hi Mac,

It’s always possible to negotiate, but it will of course depend on how many buyers there is. If it’s a buyer’s market, you are good, but if it’s a seller market, you may not have much margin.

When you buy something, you have to make an offer, backed by your bank. You are free to make an offer lower, but be careful about not lowballing them too much and it’s of course if you know the market better.

Hi Ivo,

thank you for the very informative article!

I have a question regarding the size of a cash down-payment. You mention that it should be at least 20% (half of it in cash). What are your thoughts about the upper limit of the cash financing. For instance if one has more than 20% cash savings in the bank, up to which % it is beneficial to use these savings to finance the property purchase and reduce the mortgage?

Thank you in advance

Hi Geo,

From an optimization point of view, you want to put as little as possible into the mortgage to avoid the opportunity cost. Leverage is the main advantage of real estate.

The only advantage of putting more into the mortgage is to help keep it in retirement to meet the bank’s requirements.

Hello, thank you for the very detailed information regarding buying a house in Switzerland. I currently reside in Finland. My husband and I bought a house in Switzerland while we were living there. He said he doesn’t have the purchase contract.

I’m not sure if I really own the house. I would very much appreciate it if you could give me some information on who to contact in Switzerland in order to find out if I own our house. Any information you can provide would be greatly appreciated. Thank you in advance.

Hi B.

I would see two ways to check.

1) If you went to the notary and signed the contract, you should be on the contract, so the house should be in your name (and your husband’s).

2) You can consult the land register to see who owns the plot. You will have to check the one from your canton.

Hello ,If I want to buy parcel of land with small house in Ticino is it a nightmare to add a garage for example ?

Regards

Alan

Hi Alan,

I don’t know about Ticino, but getting something built in Switzerland is quite administrative. You will need to get a building permit and deal with possible opposition from the neighbors and you need to make sure the land is buildable.

It’s probably not a nightmare, but it’s not trivial either.

What are your thoughts of condominium ownership. We found a great flat in the area where we want to live in and the price also seems a bit cheaper than the rest in the region. The catch is – condominium ownership. What are the downsides of that?

Hi Yan,

I have no thoughts about that, I have never researched the subject and I am far from being an expert in real estate.

Greetings and thank you for the very informative article.

We have been considering buying a house/apartment with our B residence permits. Being non-Swiss we always have in the back of our minds the possibility that for whatever reason we might decide to leave the country at some point.

You mentioned there might be penalties up to 50k for selling before the mortgage expires and is my assumption correct by saying that the 5% fees paid by the buyer in the buying stage are also lost. Assuming a house cost of 1mil, selling early might cost us 100k plus all the maintenance work done during this period? Looking at the house market, house prices do not seem to be rather stable and unlikely to go higher up.

Hi Yan,

If you indeed think that you are going to leave the country sooner rather than later, you should probably avoid buying a property.

All the original fees are lost (notary fees, real estate transfer, …). And you will also lose the real estate agent seller fee (unless you sell without an agent) on top of that. It’s possible that some maintenance work is compensated in the selling price. But, it’s difficult to predict housing prices, so this may not even be true.

The market is already inflated, so it could burst but it could go significantly higher, nobody knows.

Hallo Mr. Poor Swiss,

in your list, you do not mention a technical check of the house by professionals. This is typical step in the property buing process in other countries, I wonder how it is in Sweitzerland?

Hi Ivo,

That’s something you can do, but unless you buy an older house, it shoud generaly be fine since houses are built under strict code in Switzerland.

However if you buy somethng older or that had many works by the owners, it’s definitely worse doing it.