June 2018 – Insurance month!

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Fewer things happened in June 2018 than the crazy previous month!

Although it is a good month for savings, it is not as good as I planned. This month is the first month I received my new salary :) But it was a very expensive month :( We had to pay many insurance fees. And several other relatively big expenses. But it is still not too bad :)

Read on if you want to know what happened to use in June 2018!

June 2018

At the beginning of the month, I started a new job. I have a better salary and several new advantages. My new net income is now about 9000 CHF per month. And this month we have sold a few things online for a bit of extra income. Nevertheless, even with all this income, we managed to have a lower savings rate than I was expecting. We saved 37% of our income this month! Of course, it is not bad. A lot of people do not save that much. I probably had too high expectations.

You may remember last month I was saying that we may have to pay a lot for insurances this month. This turned out really true! I was thinking we could get the cost down this month, but once again I was wrong :(

Last month, I made a comparison of credit cards in Switzerland. Since then, I have ordered my Cumulus Mastercard. The card has not yet arrived. I have also ordered a Revolut card to reduce foreign exchange fees. This should save me some money each year :)

Last month, we started our own vegetable garden. It is now bearing its first fruits (if I can say so ;) ). We just got our first salad :)

It was also the first time we built our own furniture. We really enjoyed our first DIY project. And the result looks really great :)

We did not plan for it to look exactly like the wall! It is just a nice bonus!

Insurance Hell

Every people in Switzerland need to have health insurance. And foreigners that set up in Switzerland are no exceptions. So my wife needs a health insurance now. We had a pretty bad experience with the insurance for her. I am already at Assura for health insurance. So I decided to simply go with Assura for my wife this year. We signed the contract in mid-May. We asked for the beginning of insurance in June 1st.

Until last mid-June, we did not get any news from the insurance. And suddenly I received all the bills. We did not receive any communication because now it is done online. But they never contacted us to say that our online account was ready. What did they expect? That I would go there every day and check if the account was ready.

And they made us take the insurance from the first day of my wife’s arrival in Switzerland. Since apparently, it is the law… All this without any communication. The first communication was the bills. Ultimately, we had to pay about 1000 CHF in one month for Assura. I did not like this communication system.

Expenses

We also had some other big expenses this month. We had to pay my house insurance (assurance ménage) and civil responsibility insurance (RC). Plus, we also had to pay almost 300 CHF for the gym for Mrs. The Poor Swiss. We also took some tickets for a concert in November. And we went to my cousin’s wedding and offered some gift. Finally, I also paid for the new hosting of the blog. All this and many small expenses and this makes for a very high expenses month.

Here is the final breakdown of all our expenses for June 2018:

- Insurances: 1’396.55 CHF: Well above average. We had to pay a lot for Mrs. The Poor Swiss and the house insurance.

- Transportation:766.20: Well above average. I pay to pay my semester car insurance.

- Communications: 88.00 CHF: Average

- Personal: 1’037.84 CHF: Above average. We just spent too much this month.

- Food: 477.80 CHF: Average month. A few going out, but nothing fancy here.

- Apartment: 1’429.55 CHF. Slightly higher than usual, because we had to pay the power bill.

- Taxes: 746.20 CHF. This will be the average for the year. It is municipality and canton taxes.

2018 Goals

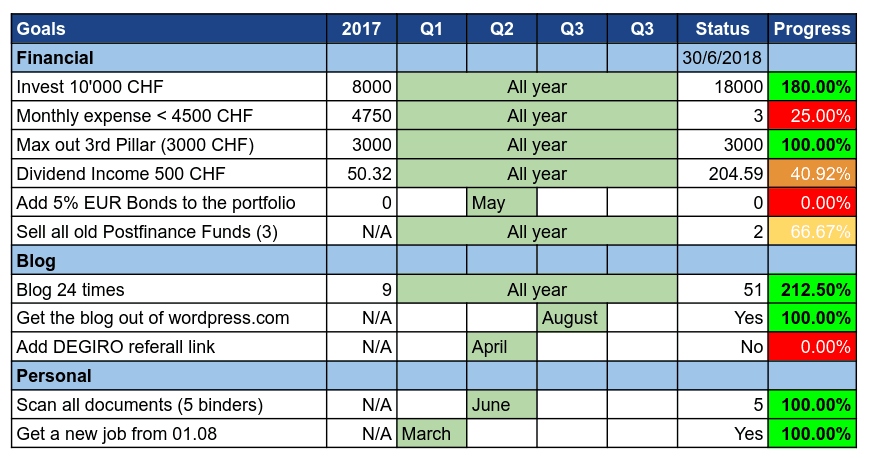

Let’s take a look at the status of my goals for this year as of the end of June 2018:

Once again, I did not reach my goal of staying below 4500 CHF of monthly expenses :( Next year, I will use an average instead of an absolute. And I am starting to believe that 4500 CHF is not doable anymore now that we are two. But we will still try to skim our budget a bit more. Next month should be under 4500 CHF normally.

As for the other goals, I have finally got a nice dividend from my Vanguard Total World ETF, about 137 CHF. Finally, the dividend income of 500 CHF this year does not seem impossible anymore. I am still waiting to be able to get rid of my last PostFinance fund. It is going down every month a bit more :S I also wish I could get rid of my Bitcoin ETN, but it is also going more and more down :(

The last goal that is not yet done is the DEGIRO referral. I have given up hope on this one.

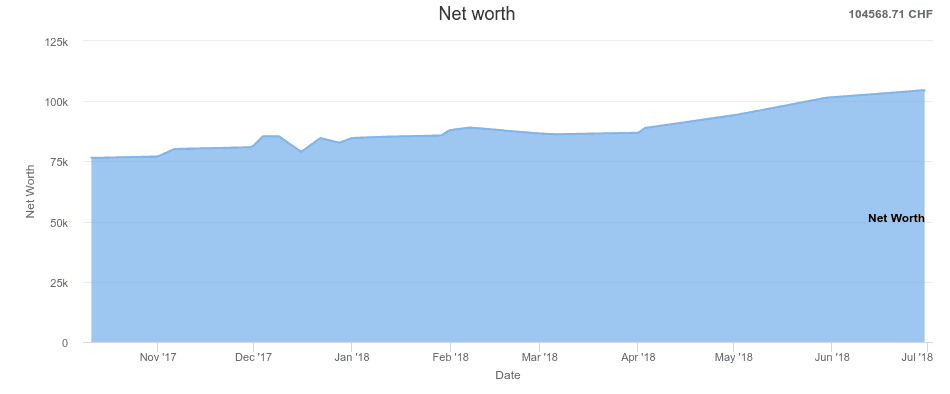

Net Worth

Let’s look at my net worth at the end of June 2018 Last month, I reached over 100K of net worth. This month, there was not so nice of an increase, but it still increased to 104’568 CHF:

This represents a Year-To-Date increase of 23.59%. This is only due to adding money to my accounts. Unfortunately, the market is still very unstable. It is only going up and down without a clear direction. It has been 5 months now that the market has not been doing well. I hope it goes into a clear direction at some point. I would even prefer it going well down and not staying like this. A flat market means no returns and no opportunities for buying more shares. We will see what happens in the future. My estimation is that we will reach 110K in August. We will see how it goes :)

The blog

As for the blog, I have again been able to write many articles. And I have now transferred from Bluehost to SiteGround. After all the problems with Bluehost, it was necessary for me to migrate. This took some time and made me a bit slower to write new posts. Nevertheless, it is now behind me.

As for the audience, no change since a decreasing audience. The huge peak last month that was because of the feature on Rockstar Finance did not last. I am again at numbers that were there before this post. And actually even below now ;) The more I post and the fewer people read ;)

It is now been two months since I started using Pinterest. Already last month I had a lot of doubts. And now it is confirmed. I had around 20 visits from Pinterest. This is less than Twitter even if Twitter is already low (in the 50s). And I do not spend much time on Twitter. I will not chase the audience anymore. I am giving up on having a big audience. Instead, I will keep writing for my pleasure, whether people are reading or not.

Next Month

Next month I do not see any big expenses coming. But I am not very good at estimating next month’s expenses. So I can be wrong ;) We will see next month how it goes. The only expense I know about is the Billag bill. This is the tax I hate the most about Switzerland. It is a completely useless and unfair tax. But we have to pay for it. At least next year, we will pay less, but it will still be useless…

We will be more careful with our expenses. We will limit expenses as much as we can. One thing I will do is change my internet connection. I will move from a 100Mbs connection to a 40Mbps connection. This will save us 20 CHF per month. It is not a lot, but it is a start.

What about you? How were your finances in June 2018?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

“I had around 20 visits from Pinterest. This is less than Twitter even if Twitter is already low (in the 50s). And I do not spend much time on Twitter. I am not going to chase the audience anymore.”

– 24 tweets in the last 24 hrs and they are all just links to your blog (and links to old posts at that). I followed for a few days, but it’s too much. It’s basically the twitter version of SPAM. Turn it off and just post a link when a new story goes up or when something of interest happens. At the moment it’s no-wonder it’s not performing for you.

Thanks for letting me know, I will consider that.

I was planning on switching my health care provider from Groupe Mutuel to Assura for myself and my family (wife+kid) by the end of the year. According to Comparis Assura is the cheapest.

However, after reading your post and your experiences with Assura, I’m having second thoughts. I’m actually quite happy with GM other than that I feel I could reduce my expenses by going to a different health care provider. What I really about GM is that you can send the bills electronically. Just scan the ‘Rueckforderungsbeleg’ and send it to them through their portal. I hear with Assura it’s still the old school by sending a snail mail to them every time you get a bill, and then you will have to wait for several weeks until you get money back.

I might consider just moving my wife and myself to Assura and keep my daughter with GM (as she requires more visits to the doctor, hospital, pharmacy, etc.) and I like the service that GM provides overall. Actually the difference in costs for my daughter is negligible when switching to a cheaper provider, therefore it’s not worth the hassle. For myself and my wife it’s a different situation, as we could save quite a bit by moving. We barely ever require medical attention (fingers crossed it stays that way :)) and I wouldn’t mind sending a snail mail with our bills every now and then when we have exceeded our 2500.- deductible per person.

I’d be interested to know which health care provider you are considering for the switch.

Hello RB,

Maybe it’s only me that had a bad experience with them. But they do have a reputation of very bad management. This is the cost of cheap insurance I guess. If you really save significantly for you and your wife, I would still consider moving to Assura. For the snail mail, I don’t really care. I never exceeded 2500 deductible. Therefore, I’ve never been reimbursed for anything :S

For myself, I’m considering switching to Helsana since my company has a partnership with them. And since my company is paying my insurance bills, I’m planning on reducing the deductible to 300.

For my wife, I don’t know yet. But it may also be Helsana. It’s almost the same price as Assura and they have a better reputation. This will be on a deductible of 2500.

Of course, it also depends on the option you use. Personally, we use the model with family doctor. Since we don’t have a Sun Store pharmacy close by, we can’t use the Pharmed model that could result in cheaper price. If you are able to get Pharmed from Assura, I think it’s still the best option.

In the end, Assura is not a good insurance, but since the basic insurance all have to provide the same service, it’s not so bad.

I hope that helps ;)

Let me know the choice you make eventually ;)

I happen to work at a major (swiss) health insurance company (not Assura btw… ;-) ) in the Finance/Litigation IT developers team…

I agree with you, and sure, we/they are for profit businesses! Certainly on the complementary insurance side, but the boundary with the compulsory side is sometimes vague… And yes, with my insider’s view, I know many things could be greatly improved.

By the way, you’d be surprised about how awfully many people are concerned with litigation, meaning they are struggling with their personal finances. And we go after them adding more stress… well, not the part of the job I’m proud about… I guess we should rather provide pointers about how to get more financial education. By reading blogs for instance! ;-)

Hi JB :)

Thanks for sharing your insider point view! I’m not that surprised by the fact that there are many. I’m surprised they don’t react faster. I completely agree with you that we don’t have a good financial education. People are trained to spend more as they earn more. And there is so much pressure to get new things and always more expensive. Sound financial education at school would be great. But I’m sure the industry would be against that.

Thanks for stopping by :)

Never trust insurance providers. They are a for profit business. You have to be in top of things. After all the expenses, 35% is a good saving rate :-) Congrats!

Yeah, they are really in for profit, but I’m still hoping some of them are actually good insurance. But they are probably like all property manager companies in Switzerland, highly incompetent and only after maximum profit!

You’re right, 35% is already good and I’m happy about it (even if I don’t write like it :P).

Thanks for stopping by!

Don’t be too hard on yourself, your saving rate is a very decent one. I guess you still need to adapt to your new situation . You will be able to draw conclusions after a few quarters and try to remember that you are already moving in the right direction :)

I do understand that you would like to get a bigger audience and somehow monetize your blog. It makes sense since you are chasing an early retirement, but it will take some time I guess… Enjoy the process and let’s see where you end up ;)

Haha, thanks :) Yes, I’m a bit hard on myself. Most of the result is coming from the huge insurance bills that I can’t do anything against. But there is still a lot of room for improvement!

As for the blog, I’m not thinking of monetizing it anymore. I’ve lowered my expectations ;) As long as I enjoy writing, I’ll continue like this :)

Thanks for stopping by. Good luck with your how finances ;)

Sorry to hear about your terrible experience with insurance companies. As a few-times expat I learnt that insurance coverage starting country entry date is typically the case in Europe and it has a pretty good intention – not to leave a person without health insurance within the first three months, but it can get surprisingly costly when you are not aware of it.

Thanks AverageSwiss! I should have known better and get information. My main point of distrust of Assura is the lack of communication. They have been terrible at that. When the first communication you receive is the bill without even getting the insurance policy, it’s a bad move. But the health insurance system in Switzerland is really not good and is getting worse every year. We have less and less coverage and it is more and more expensive.

Thanks for stopping by :)

Still nice to see that your saving rate is above 35% and the increase in NW is also nice!

I reached a saving rate from 42% last month (high expenses because of vacation from April). By the way thanks for mentioning the dividends – I missed that part! I got 125 USD – now you can already prepare to blog about taxing so that we receive the other 15% :-)!

Regarding your blog – I was not really interested in the credit card comparison because I use the Visa from Coop (Supercard) for years now. In addition the hosting topic was also something which I completely ignored. I like the investment series (despite the fact that I know already a lot) and this monthly updates in particular.

Hi Mascap :)

Congratulations, 42% is already great! I will talk about reclaiming dividends later, probably around the end of the year. This time I may have to do it since my dividends are starting to get interesting.

Yeah, I guess that for credit cards, most people were already more aware than me :P I am a bit late to the game. As for hosting, it was just to share something that could be useful. Of course, a lot of my posts won’t talk to everyone ;) I’m glad you like the Investing series and the monthly updates!

Thanks for stopping by!

Mrs. The Poor Swiss is costing a lot of expense!

I hope everything will be good next month!

Haha, yes, but she’s worth it ;)