August 2021 – A good simple month

| Updated: |(Disclosure: Some of the links below may be affiliate links)

August 2021 was a good and simple month for us. We had many events during the weekend with our friends and families. This month was the perfect mix of events and time at home.

Financially, it was also a great month with good income and record low expenses (not counting taxes). So, we managed to save more than half of our income. This puts us back on track to save more than half of our income during the entire year.

August 2021

As I said in the introduction, August 2021 was a good month for us. It was simple and quiet, but this is not a bad thing. Overall, the weather was acceptable so that we could be outside regularly, and we were lucky with our family and friend events since the weather was clement on these days.

Financially, it was also a very simple month. I am actually amazed by how little we spent this month. It is our record spending month, when not counting taxes. We spent less than 3000 CHF before taxes. We know we cannot do this every month, but it is great to be at this level, two months in a row. And we even had some unexpected spending this month. So, we are extremely happy about being able to reach that level.

This is great to have such a month because we expect next month to be more hectic. Although financially, September should be just fine.

Expenses

Let’s see the details of our expenses in August 2021:

| Category | Total | Status | Details |

|---|---|---|---|

| Insurances | 745 | Average | Our health insurance premiums. |

| Transportation | 44 | Average | Just put gas once. |

| Communications | 70 | Average | Internet and online services. |

| Personal | 842 | Below average | Some things for the blog, a few books, some good beers, and fixing the dishwasher. |

| Food | 500 | Above average | We went once to Aligro to refill our freezer |

| Housing | 445 | Average | Interests and heating |

| Taxes | 3845 | New average | Taxes at the three levels |

In total, we spent 6489 CHF in August 2021. Overall, this is a great result for us. We only spent 2643 CHF without taxes, which is our best result since the beginning of the year. It is actually probably our best result ever! I did not think we would spend so little. But it just happened.

Overall, our expenses are quite good this month. There was not much special this month. I ordered some special kinds of beer that I was missing for a long time and splurged on them (about 200 CHF). We also had to fix our dishwasher adding almost 150 CHF to the expenses. And we went back to Aligro to refill our meat freezer! But other than that, we only had some small expenses here and there.

Overall, this brought us to a savings rate of 61% this month, a great result!

Normally, our taxes will now stay at this level, more or less. They will likely rise a little yearly, but we won’t have months with 20K taxes like we had this year. I still wish there was something to do to optimize our taxes. But short of moving (which I won’t), I do not see much to do.

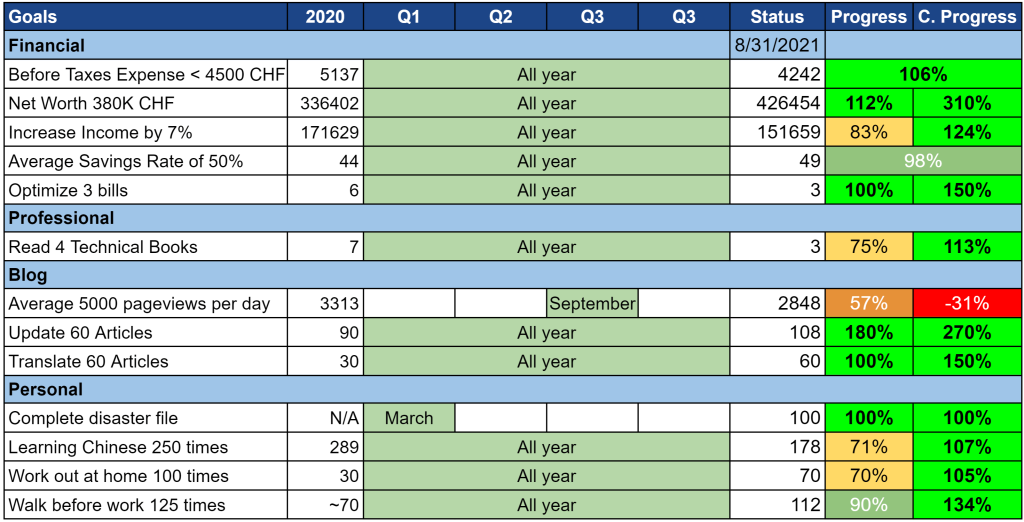

2021 Goals

Let’s take a look at our goals by the end of August 2021:

Overall, my goals are doing great. Except for the blog traffic goal that I do not want to talk about, all the other goals are well on track for the end of the year. I am not entirely certain we will reach a 50% average savings rate by the end of the year, but we will be close and at a good level anyway.

It is the same for the taxes before expense. We are very close to the goal which is great since it was a stretch already. Currently, we are even lower than our goal, which is amazing. If we manage to do a few more months like this one, we will be in a great place by the end of the year!

All the other goals should be completed by the end of the year, and we should even complete some in advance. I thought that my goals were more ambitious this year than last year, but it seems I need to aim higher!

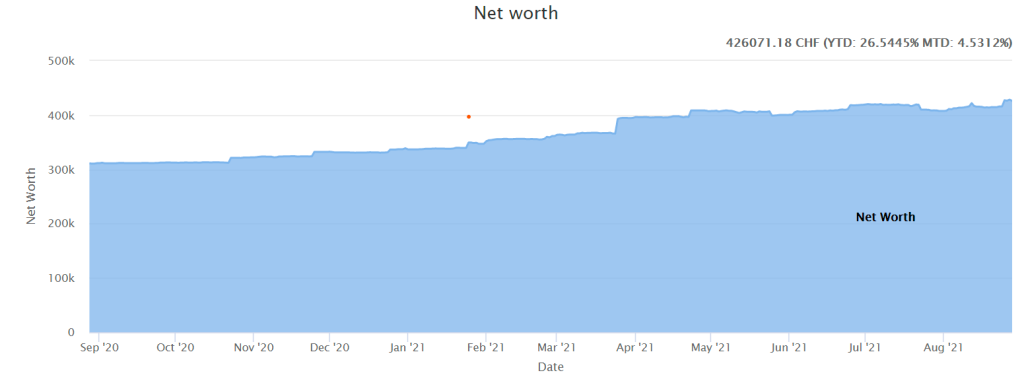

Net Worth

Let’s take a look at our net worth as of August 2021:

Overall, this month was great for our net worth. We reached 426K CHF. The markets had some up and down this month, but overall my portfolio is up. And we had nice savings this month as well.

Also, my ESPP was paid off this month with a nice profit of about 3000 CHF. Since these profits are taxed, I have decided to count them as income this year. I do not count capital gains as income since they are not taxed. But while these profits are some kind of capital gains they are taxed as income, so I prefer to include them now as income starting this year. This avoids surprises when filing tax declaration and having 10K more income than on my budget numbers!

Nothing changed as to my investments. I have started moving my portfolios from VIAC to Finpension 3a. I will do it slowly, one portfolio at a time. By the end of the year, my three portfolios will be at Finpension. And I will open a fourth portfolio next year and a fifth the year after.

Now that we are almost fully invested again, we can see that the market is starting to influence our net worth more significantly than before.

The Blog

There is not much to report on the blog. The traffic is continuing to decrease. For the first time in several years, I changed my schedule to one article a week. I do no think this hurts the blog and I feel better doing one article per week, considering the traffic on the blog. I do not think it hurt the traffic at all, the decline is continuing more or less the same as before.

I have continued updating articles on the blog, but significantly fewer than the previous month. I have only translated three articles this month. I will try to translate a few more articles next month.

What do you think about the new posting schedule?

Next Month – September 2021

Overall, September 2021 should be another simple month, but with some important changes coming. I won’t spoil you the news, you will have to wait until next month.

Financially, it should be fairly normal, on the same level as August I believe.

What about you? How was August 2021 for you?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Hi, those tax bills are indeed the worst! Do you take your net income (minus AHV, pension fund etc.) for the calculations of the saving rate?

Hi Leandra,

Amen to that!

Yes, I take net income (what hits my bank account). For me, taking a higher income (like adding pension fund) is a bit dumb and is just a way to inflate saving rate for showing off.

Hi Mr The Poor Swiss!

I’m still impressed with the progression / streamlining of your portfolio. Let’s say that starting next year you can no longer buy the Vanguard Total World Stock ETF (VT) in USD and TER 0.08% … what would be your alternative? Would you consider the new Vanguard ESG Global All Cap UCITS ETF (V3AA / V3AL), which is traded in CHF and is a subset of the VT (OK, 3x as expensive in ongoing charges – i.e. TER 0.24%)? It is still very young – but cheap. Surely the value could more than double in a few years? I would be really interested in your opinion. Thanks, Hans-Peter

Hi Hans-Peter,

I would not buy this ETF no since I do not invest in ESG ETFs currently and it’s a little small right.

But if you want to invest sustainably, this is a good ETF, no doubt.

If I had to switch away, I would probably invest in VWRL. But my mind is not yet set.

Thanks for your answer! Of course the VWRL – the European variant of the VT. How could I forget that :-)

You are welcome :)

You mentioned you have a number of 3a portfolios. I know it’s better for tax savings when cashing out but I could not find what is the point from which I should consider opening a second portfolio.

Hi Trixxie,

Unfortunately, this point depends on your canton. In Fribourg, you should have 5 while in some cantons, it’s 3 or even 2.

And the exact threshold can also change based on the canton. What I recommend is do a rotation each year (example for 5):

* Year 1 on portfolio 1

* Year 2 on portfolio 2

* Year 3 on portfolio 3

* Year 4 on portfolio 4

* Year 5 on portfolio 5

* Year 6 on portfolio 1

* and so on

If you want to know the exact threshold, you will have to check the taxes on withdrawal for your canton. And you have to keep in mind that amounts can grow over time. So a simple balancing strategy is simplest.

“But short of moving (which I won’t), I do not see much to do.”

Earn less or deduct more.

Earn less by receiving fewer dividends and focusing more on growth and capital gains.

Deduct more by moving money past the great chinese wall for example… the separation between taxable and non taxable wealth and income… your pension capital. With nearly 4K a month and a high marginal tax rate this seems a good way to save money assuming your pension fund is stable enough. It’s already worthwhile for me with 30% marginal tax rate in Zurich (lower taxes).

With 1e and 3a plans you can invest too.

Makes more sense though the older you are.

Hi Capmac,

Thanks for your tips :)

Unfortunately, 99% of my taxes come from my direct income, almost nothing from dividends at this point. And my taxable wealth is currently negative because of our house :)

Our 3a is already maxed and I have no access to 1e unfortunately :(

But these are great tips for FIRE people!

Hi, I am a bit lost in what you are proposing – could you articulate a bit more?

Are you suggesting to put money into voluntary payments into your pillar 1 ?

Or something else?

Thanks!

Hey!

Thanks a lot for all the work you do on your blog. I have never seen someone be so transparent about their expenses, their income etc so I feel less alone in my adult journey when reading your blog.

Even if I count as only 1 page view, know that behind that page view is someone who learnt something today, so you made a difference in someone’s path.

Now that I got all the emotional stuff out :D I was thinking: How do you translate the articles?

Some unsolicited advice about translations: even if I know French well enough to write a full email from scratch, I am not the fastest at writing in French, especially for official communication with authorities.

I still count on English as my “best spoken foreign language where I make the least amount of mistakes”.

So what I sometimes do is: quickly write the message in English, pass it through Google Translate to get it in French and then check the French text for big mistakes or parts that GT didn’t translate correctly.

It makes the whole process so much faster.

Since you already have the text in English, I guess it would just be a matter of checking the French translation and you’re done.

Would that work for you?

Hi Maya,

Thanks for your kind words :) And I greatly appreciate your page views!

I am a native French speaker and my English is bilingual (although my written English is not always great). But I actually use the strategy you are mentioning. I start with my English article, pass it to Google Translate and then read it once to fix everything that does not make sense.

It’s the fastest way for my to get my article in English. The articles that take the longest time are the articles with graphs, I have to redo all images :)

Hi,

What is an ESPP?

Also what elements made you decide to leave VIAC for finpension?

Thanks a lot for your blog, I found valuable and accessible informations in here and I’m very grateful for all the work it must have meant on your part!

Cheers from Geneva

Hi,

An ESPP is an Employee Share Purchase Plan (ESPP), it’s a benefit that some companies (mostly large ones) provide to their employees. I have an article about ESPP strategies, this should help.

As for VIAC and Finpension, I have an entire article comparing the two great third pillars.

But basically, Finpension lets me invest more aggressively which I believe will be better for my long-term returns.

Hi Mr TPS,

I have one question regarding your housing expenses since you only report about interests regarding your home acquiring. Is this because of the credit plan you are using to buy your house, delay the payment of the principal?

All the best,

Luis Sismeiro

Hi Luis,

I do not think I understand the question. I only report the interest as an expense since this money is lost. But I also amortize my mortgage every month. However, I do not report this as an expense since this reduce my debt, this is simply a transfer from my liquid assets to my debt.

Does that make sense?

Hi again,

Yes it makes sense to consider interest as an expense and the debt reduction like a money transfer like you do.

I suppose you also have a life insurance and a house insurance for the bank to lent you money, also more expenses… At least in my country (Portugal) this insurances are needed.

Regards,

Luis Sismeiro

You do not need life insurance to get a house here. But you need house insurance indeed.