July 2019 – New computer

| Updated: |(Disclosure: Some of the links below may be affiliate links)

July 2019 was a very simple month for us. Not a lot of things happened. It was a good month from our point of view. We did not do much but we had several outings with our friends and family!

From a financial point of view. There were many unexpected expenses. However, there was also some extra income this month. Put together, it makes higher savings than usual.

Finally, July 2019 was a good month. However, I could not help to think that it could have been a great month! We had too many unexpected expenses that reduced significantly our savings rate. If we did not have the extra income from my company, this would have been a poor month.

In this post, you will find all that happened to us during July 2019!

July 2019

July was a pretty standard month. We did not do anything really special this month. We went one day with my grandmother to Geneva because she wanted to go back there for a while. It was really nice!

I finally found a good standing desk. This was part of my health plan for the year. I have been looking for that for too long already. In the end, I found a second-hand one, almost new, for 50% of its price. I bought it on the Anibis website, one of the best websites for selling second-hand things.

I plan to stand at least one hour a day at home. Hopefully, I will be able to increase that later on. We will see how it goes. For now, I cannot tell you if it makes a real difference. But so far I like it.

In the end, this gives us a savings rate of 56%. This is obviously great. But this is still almost 6000 CHF in expenses. And this is too much.

New computer

The biggest issue this month was with my gaming computer. It started crashing repeatedly. The computer is already five years old. But it was still running my favorite game without issue.

Since the graphics card was too hot, I figured it was overheating and stopped the computer. So I purchased a new graphics card to fix this. But it turned out it was not the graphics card. So I had to purchase a new motherboard, processor, and memory to fix it. And of course, all this does not work anymore with Windows 7, so I had to buy Windows 10. It makes a very big hole in our budget.

But, I think I should have planned for this. Five years old for a gaming PC is already starting to get old. And I have a few ideas for improving it. I should allocate some money regularly to take care of it. I would rather avoid having to change all in five years again.

Now, there are some things that I can sell. But since it is already quite old. I do not think it will be worth a lot.

Considering moving

We are trying to move to a new apartment. We are having tons of issue with our building managers. By the way, you should really avoid RFSA as building managers. I have never seen such a bunch of incompetent and unprofessional people…

However, it is more difficult to convince Mrs. The Poor Swiss than I would have thought. She thinks it is too much work to move to a new apartment. And our tastes in apartments are very different. We find a great one at a low price, but finally, we did not do take it.

I moved twice myself and it went like a breeze. I must actually be one of the few people that enjoy the process of moving. So I am having a hard time figuring out the issue with moving. But, to try to make it more easy to move, I am sorting through several things at home. I would like to reduce our clutter.

Expenses

Here is the detail of our expenses this month:

- Insurances: 790.05 CHF: Average.

- Transportation: 264.15 CHF: Above average. We had a trip to Geneva.

- Communications: 89.53 CHF. Average. Nothing special.

- Personal: 1796.55 CHF. Well above average. I had to buy a new computer.

- Food: 650.45 CHF. Well above average. We invited many people over and had lunch in a restaurant in Geneva.

- Apartment: 1474.80 CHF. Above average. The horrible building managers made us pay a bill for curating the sewage system. The entire building is against them.

- Taxes: 763.25 CHF. Average. Normal taxes.

Overall, we spent 5828.78 CHF. This is way too much. We really have to work on handling our expenses better. This brings our average expenses to 5356 CHF.

I am especially disappointed in our Food budget. The average for this year is significantly higher than last year. And it does not seem we changed a lot of habits. Next month, I am going to check all our grocery bills to see what is more expensive than usual. This is normally something we have been able to handle quite well.

2019 Goals

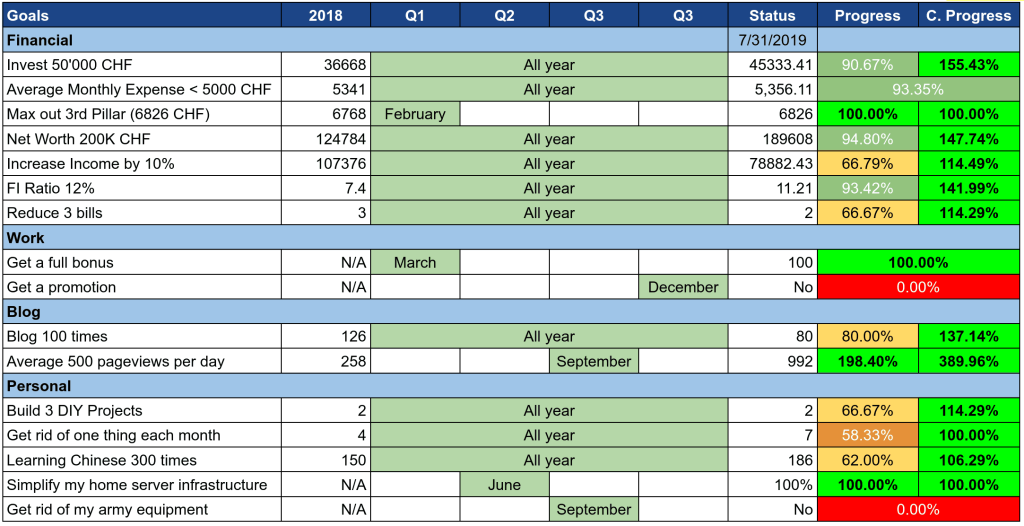

Here is the status of our 2019 Goals at the end of the month:

Overall, the goals are going great. I just do not think that I would be able to get rid of my army stuff this year. It was not a good goal anyway since it does not depend on me but on the military administration. A goal should not solely depend on other people.

Our average expenses are also not great. For now, they are sitting at 5356 CHF. I really thought we could pull this off. But it seems it will not be possible.

This month, I did a comparison of Swiss mobile phone plans. I found out I could save about 10 CHF each month by changing my mobile phone plan from M-Budget to Mucho. I have not yet done that. But I plan to do that in August.

This month, I got rid of a big bag of books and a big bag of DVDs. I am trying to reduce our stuff to convince Mrs. The Poor Swiss that it will not be too much work.

Net Worth

Let’s see how our net worth evolved during the month:

Currently, our net worth sits at 189’287 CHF! We almost made it to 190’000! This is a really good result. Some of our funds increased in value and we had a nice bump from my company shares vesting.

I think that next month we should reach 200’000 CHF. My ESPP shares will vest at the beginning of the month. And normally, we should be able to keep our expenses reasonable next month.

Moreover, we will probably reach 100’000 USD on Interactive Brokers. This is the amount at which the custody fees are waived. This is what makes Interactive Brokers the cheapest broker once you reach that amount.

The Blog

Overall, this month was a great month for the blog! The traffic on the blog increased by 30%. I am pretty happy about this result. I know it will not increase that much next month. But this is still great!

My post about DCA got featured on The Sunday Best post by The Physician of FIRE. This brought a lot of traffic. This is already the second time I got featured. I am really glad about that.

During this month, I was able to continue my rhythm of three posts a week. I think I will be able to do the same for August 2019 as well. But I am not so sure I will be able to do it in September. And there are still some things I want to do on the blog that will require time. So maybe I will go back to the routine of twice a week. We will see about that!

I also got a new logo for the blog. It is really simple. But I am really happy about it. I had it made on Fiverr. It cost me about 12 dollars with a tip. I think it makes a nice difference on the blog.

What do you think of my new logo?

I also optimized the page speed slightly more on the blog. I have cut one more request. It is probably not very noticeable. But it still helps if you have a bad connection. Later, I am going to try to find a way to optimize the fonts on the blog.

Here are the three most popular posts of July 2019:

- Wise vs Revolut: Which is best? This post is really doing great.

- Dollar Cost Averaging may not be as good as you think I am glad that for once one new post makes the cut to the top three.

- Revolut has a Swiss IBAN This is my best performing Revolut post.

Which was your favorite post this month?

Next Month – August 2019

We do not have anything special planned for August 2019. I will have two long four-days week-end. So I am going to have some time finally!

From a financial point of view, it should see a nice bump in the net worth since my ESPP shares will vest early August. Of course, this will also depend on the performance of my company shares. But overall, it is performing well.

But we are going to have some large expense as well. We are planning for a vacation in September. There will probably be a lot to pay upfront. And my car will soon need a checkup. I will do it either in August or in September. Moreover, we have to plan for the next French course for Mrs. The Poor Swiss. With this, I am pretty sure we are going to blow our budget once again.

What about you? How was July? Anything good planned for August?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Hi The poor Swiss,

I’ve been reading and learning alot from your posts.

Do you have the break-down of the networth increase thanks to Investment and Pillar 3A ?

Thank you.

Ben.

Hi Ben,

Most of the increase was due to my RSU shares vesting, like 3000 CHF. And then about 1000 CHF for the investments and about 500 for the Pillar 3a.

I am glad you are learning from my blog. Let me know if something is missing :)

Thanks for stopping by!

Hi there,

Great progress. What do you use to track your net worth? (The blue bar graph image) it looks a nice simple way.

Also, what do you have included in that figure?

Hi Andi,

Thanks!

I have included everything in my net worth: savings, investment, my second pillar, my third pillar, and some P2P lending.

I am using a special tool called budgetwarrior. It’s a bit geeky though!

Thanks for stopping by!

Hi Mr. The Poor Swiss

Recently went through quite a few of your posts. Liked ones on “math up” savings rate and FI blog affiliate income as behind the scenes income source.

What are your plans for the vacation if I may ask?

Lastly, did you mean twice a week?

“So maybe I will go back to the routine of twice a day.”

Cheers,

Janis

Hi Janis,

I am glad you liked my posts :)

We are planning to go to the island of Santorini, in Greece. What you about, any vacation plan?

Yes, I meant twice a week! Thanks, I will fix that in the article.

Thanks for stopping by!

Great, never been there, looks good in pics :)

I am on a paternity leave, so more of a family visiting.

BTW I like the logo, not sure though it would fit the current banner nicely.

Yes, it goes look great in pics, we’ll see if that true once there :)

Congratulations on your child!

The image below the logo is not meant to be used. The banner logo will stay as it is (it’s the same logo, just different background).