I Will Teach You To Be Rich – Book Review

| Updated: |(Disclosure: Some of the links below may be affiliate links)

I just finished reading I Will Teach You To Be Rich, by Ramit Sethi. This book will give you a lot of advice on how to improve your finances. It may not make you a millionaire. But it is a great book, full of helpful recommendations on how to improve your finances!

This book has been great to read. It is one of the best of the personal finance books I have read so far. Like the last book I read, I have been able to buy it for a few dollars on Kindle. If you want to be lucky, look at my techniques to find cheap Kindle ebooks. It is nice and light to read. It is not too dense and still contains quite a lot of information.

I Will Teach You To Be Rich

This book will introduce you to its specific strategy for becoming rich. The strategy is based on several things. First, you will need to optimize your credit cards. Then, you will need to design a plan for your budget. This plan is your conscious spending plan. And then, you will need to automate your plan. Automation is the most important part of the book. The author encourages you to automate your money from one account to another. Investing is also covered in detail in this book.

What is unique about the book is the tone of the author. It is a light style. For instance, look at this sentence:

Listen up, crybabies: This is not your grandma’s house and I will not bake you cookies and coddle you. A lot of your financial problems are caused by one person: you

I am not used to this style, and this is the first personal finance book that is using such a style. But this makes the book enjoyable and very fast to read.

The book starts with advice on how to optimize your credit cards. The idea is to make sure you get the best credit score possible. Getting a high credit score is done with having a huge credit but no debt! Once this is done, you should make sure you have the best possible bank accounts. For this, you want high-interest and no-fees.

The author will give a helpful explanation of exactly which accounts you should have. Once you got your bank accounts, it is time to get investment accounts. For this, the author recommends a 401(k) and a Roth IRA. And if you are able, also a broker investment account. The most crucial point is that you should invest. Even little money can have high returns if you invest it smartly.

The next step is to make a strong budget. Define exactly how much you want to spend on each group each month. How much you want to invest each month should be part of your budget. If you have long-term goals, like a big wedding, a car, or a house, you should also plan for them. Once your budget and your accounts are ready, it is time to automate your plan. For this, you will need to link your accounts together and automate transfers.

After this, the author will give specific advice on how to invest in the stock market. And finally, you will also have some information on how to manage the big expenses (cars, houses, and weddings).

Real Estate is an overrated investment

real estate is the most overrated investment

renting is actually a smart decision for many people

Interestingly, the author is not as fond as other people about Real Estate. A lot of people are tricking themselves into believing that their own houses are a good investment. Once you take everything into account, it is probably not. Do not take me wrong. It can be useful to buy a house. It can be one of your goals.

But it may not be as strong a financial investment as you think. In many places, the returns after inflation are zero. And you will most likely never sell your house. Or if you sell, you will buy a bigger house. And there is a significant opportunity cost because you are not investing the down payment.

Just be aware of this when you buy a house. I think this is great to mention in the book. Because too many people are encouraging people to buy a house for the wrong reasons.

Automate your money

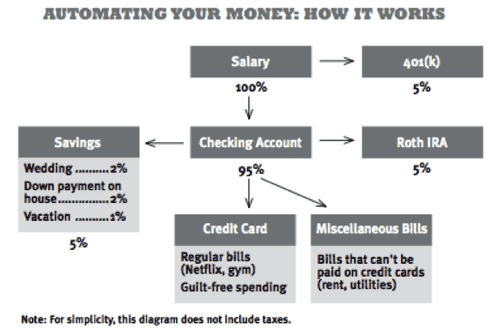

The most important part of I Will Teach You To Be Rich is the way the author recommends you to automate your money flow. Automation is the foundation of the book.

The idea is simple:

- A percentage of your salary directly goes to your 401(k)

- The rest of your salary goes into your checking account

- A percentage of your checking account goes directly into your Roth IRA

- Your checking account automatically pays your credit card

- Your checking account automatically pays your bills

- Money moves from your checking account into your different savings accounts. These transfers will fill your different goals.

This idea follows the pay yourself first strategy. You cannot forget to invest or save money each month. All your bills are paid automatically. You can set it and forget. While I do not automate a lot of things in my accounts, I think it can be useful for many people. It is a simple strategy that will probably work.

What I liked

I Will Teach You To Be Rich was pleasant to read. The style is enjoyable. It is an easy book to read. What is great about the book is that it does not contain any BS. It is full of real advice. There are actual examples. You can read the book, apply the recommendations, and improve your budget directly. It is helpful. Most of the Books are more abstract than this one.

Moreover, the money flow automation framework is well-thought. If you are struggling with your budget, this could be a way to improve. It shows you how to save for long-term goals. It also forces you to invest. Investing is important. And the advice of investment is pretty sound, with low-cost index funds.

What I did not like

There are a few things on which I do not agree with I Will Teach You To Be Rich.

First of all, the foundation of this book is to automate your finances. I think that too much money automation is a mistake. You should be careful of not automating too much. Automation will make you complacent and lazy!

Statistically speaking, being in debt is normal

It is not a good reason to be in debt. The authors encourage you to take on debt for major expenses. I agree that optimizing your credit score can be interesting if you want a mortgage later. But you should avoid taking on debt. For me, buying a car with credit is just dumb.

If you do not have much cash to put down, a used car is more attractive because the down payment is typically lower

No! If you do not have enough money for a car, simply do not buy it! Do not use credit to buy a car. Save until you can afford the car you want. I think it is never a good idea to use credit for a car. At least the author encourages you to avoid leasing and not stretch your budget for a car.

To illustrate how to allocate and diversify your portfolio, we will use David Swensen’s recommendation as a model

The primary advice of Ramit is to use lifecycle index funds. These funds will rebalance for you, and the allocation to bonds will slowly increase over the years. This is excellent advice.

If you design your portfolio yourself, Ramit suggests you follow David Swensen’s recommendation. This is not a good idea. It is too complicated and will simply confuse the readers. This portfolio is using six asset classes. A more simple three-fund portfolio would have been better as an example. I do not say it is a bad portfolio. It proved to work great over the years. But for beginners, a three-fund portfolio is more suited.

anything lower than 0.75 percent [fees] is okay

A 0.75% fee is already way too high. You should try to focus on funds that have a below 0.3% fee. This advice may be a bit dated since the book came up in 2009, and the fees may have been higher. But now, you should focus on even lower fees than this.

Finally, for me, the percentages indicated for saving are too low. The author recommends saving something like 15%-20% of income. It is a very good start, but one should aim for higher savings. Keep this in mind. But of course, as ever, it will depend on your goals. If you just to save a little for your holidays, 10% is perfectly fine. If you want to save for your early retirement, you should aim higher.

Conclusion

In summary, I Will Teach You To Be Rich is a nice book. The style is very nice to read and enjoyable. It is funny and full of real-life advice. It is based on automating your money flow between your different accounts. By setting some saving goals and automating your savings, you will reach your goals faster. I would recommend this book if you are struggling with your finances. Or also if you are interested in how to automate your accounts.

If you are interested, you can buy it on Amazon: I Will Teach You To Be Rich. If you want to read more about books, you can take a look at the best personal finance books I have read.

What do you think of I Will Teach You to Be Rich? Do you have any other personal finance book to recommend to me?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Manage your money

- More articles about Save

- Should you pay your bills early in 2024?

- How Millennials Can Get Rich Slowly Book Review

- 6 Steps towards a Solid Budget can make you Debt-Free

Hello,

I just finished reading this (right after Your Money or Your Life – also great advice when you’re starting out). Thank you for your review! You can probably tell that I’m on a mission to take control of my finances, since I’ve been asking you a few questions recently…

I’ve also been listening to Ramit Sethi’s podcast, and he has a Netflix show coming out next week!

Ramit Sethy considers 401K and Roth IRA as investments. Do you think this is true in the Swiss context of a 2nd and 3rd pillar? I am not sure whether to put them in the investment or savings category.

Certainly the 2nd pillar is more a savings account, since, as I am employed, I have zero influence over where my money is being invested – right?

My 3rd pillar is only going to yield 2.5% because it has a lot of costly insurance products built in, to protect it and my children in case anything happens to me (I am a solo parent). This was probably a bad decision I made 20 years ago, but it will be too costly to change now. So I am tempted to put this in the savings category, too, rather than investment.

What do you think?

Hi Michael,

I consider my second pillar as bonds since it’s invested but conservative.

My 3a is invested with Finpension 3a, but it all depends on how yours is invested. If you have one with a bank without investment, it’s different.

I would indeed put a life insurance 3a into savings. And be careful about expecting 2.5% yield.

Nice review PS. I agree with the author on real estate especially as it relates to one’s primary residence. It’s much more of an expense than an investment unless you live in an area that’s appreciating rapidly and only if you sell and move to another area can you take advantage. Tom

Thanks Tom :)

Yes, primary residence should be an expense not an investment.

Thanks for stopping by :)

Ah. A quite nice book. Almost leant the points from your article. Hahah.

I’m glad you learned from me :P