How do bonds and bond funds work?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

I already have covered stocks in much detail on this blog. But I did not spend enough time on bonds. Bonds are an important part of asset allocation. But bonds are very different from stocks. And they have some strange characteristics.

So, it is important to know how they work. And it is essential to know how bond funds work because they are not as simple as stock funds.

The basics of bonds

In essence, a bond is fairly simple: it is a loan of money from one entity (the lender) to another entity (the borrower). In exchange for this money, the borrower will pay some interest to the lender. The interest rate is fixed when the bond is concluded.

A bond generally has a fixed duration until it matures. When a bond matures, the borrower will return the money to the lender. Again, the time to maturity is fixed when the bond is concluded.

Usually, a longer-term bond will have a higher interest rate. This makes sense since lending for longer is riskier. However, with interest rate fluctuations, this may change.

This is the standard definition of bonds, and it concerns many of them. There are some more complex instruments available. For instance, some complex bonds last forever and never mature unless the borrower calls them back. But these are not as interesting for the simple investors we should be.

Keep in mind that a bond is not entirely safe, like some people think. If the borrower defaults, your money is lost. This is very unlikely to happen if you hold bonds from a very safe government such as Switzerland or the United States. But some countries have defaulted on bonds in the past. For instance, Venezuela defaulted on more than 60 billion dollars of bonds in 2017.

So, a bond is only as safe as its issuer. And there are many junk bonds out there that are at least as risky as stocks. And bond funds follow the same rule. Bond funds investing in bad bonds will be risky.

Types of Bonds

There are many different types of bonds. The main bonds are treasury bonds. They are emitted by a national government like the United States or Switzerland. These bonds are extremely safe since it would take an entire government to default for them to lose their value entirely. But then, of course, some countries are riskier than others.

Then there are also some municipal bonds. They are emitted by local governments such as a municipality. Again, they are very safe but already slightly riskier than treasury bonds.

And you can also get corporate bonds. They are emitted by companies. These can be much riskier (depending on the company) since it would take a single company to go down for the bond to lose value. Also, they have few advantages over stocks since they are correlated to the stock market and will not reduce the volatility of your portfolio much.

There are also some special types, such as inflation-protected bonds, that will grow (or shrink) based on the inflation rate. And there are some sub-types as well. But for a simple bond investor, the simple types of bonds are more than enough to know.

Ratings of bonds

When we compare the risks of bonds, we generally use ratings provided by a rating agency. There are several rating agencies. The three main rating agencies are:

- Moody’s

- Standard & Poor’s

- Fitch

These agencies will give a rating to most bond issuers, and the rating should indicate the level of risk of this bond. Standard & Poor’s and Fitch are using the same grades: from AAA, AA+, AA, AA- to CCC-, CC, C, D. Moody’s is doing something slightly different with Aaa, Aa1, Aa1, As3, A1, … to Caa1, Caa2, Caa3, Ca, C.

You do not need to know about all these in detail. But you should know that A bonds are better than B bonds and that anything with a C should be considered a junk bond. For instance, bonds from Switzerland are considered the safest, while bonds from Venezuela are considered the riskiest (junk bonds). United States Bonds are extremely safe, just slightly below Switzerland (a perfect score here).

If you plan to invest in an individual bond, it is important to look at the rating of the bond. And if you want to invest in bond funds, they will provide the percentage of bonds in each grade. That should give you a good idea of the risk of the fund.

Since bonds are supposed to be the safe part of your portfolio, you should be careful about using non-investment-grade bonds. If you want more returns, you should use stocks, not bonds. Or at least you should be clear that you are using bonds for returns, not for reducing risks.

The value of bonds

There are two ways to profit from bonds. The first way is to hold the bond until maturity and collect the interest over time. This way, you will have gained the interest rate that was fixed when you bought the bond.

The second way is to buy bonds when they are cheap and resell when they are more expensive. Now, this is related to the current value of a bond. The current value of a bond can change over time if interest rates change. This is a weird characteristic of bonds that is often ignored.

When bond interests are going up, the values of existing bonds will go down. And when bond interests are going down, the values of the existing bonds will go up. For instance, we will say you have bought a 1000 USD bond from the U.S. Treasury at 2%, and there are ten years left until maturity.

If the U.S. treasury raises its interest rates to 2.5%, people will not want to buy your bond at 1000$. Its value will go down to about 950 USD. On the other hand, if they lower their interest rate to 1.5%, your bonds become more valuable. In that case, it would be worth about 1050 USD. The exact computation is not trivial because it depends on how often the bond pays outs. But you should get the gist.

Of course, if you hold your bond to maturity, this does not matter since you will receive your principal, regardless of the changes in interest rate. So generally, the current value of your bonds, as a long-term investor, should not matter much.

Bond Funds

A lot of people are owning bond funds instead of buying bonds directly. You will find bond funds for many countries and different types of bonds (the same types we saw earlier). And some funds focus on short-term bonds, while others focus on long-term bonds.

There are several advantages to choosing bond funds over bonds.

One advantage of a bond fund is that you can hold the shares forever. If you buy a bond, you must buy one again once your current bond matures. If you have a long-term investing horizon, this will be great.

Another advantage is that you will lower the impact of changes in interest rates with a bond fund. Indeed, a bond fund will buy bonds of different maturity and buy back new bonds once the old ones mature. If you buy a single bond for ten years, the interest you get can vary widely once you get a new one after ten years.

Now, bond funds do not act exactly like a bond. First, their value can vary significantly with changes in interest rates. So, the fund’s value (and its yield) will vary while you hold it. This is mitigated by the fact that a good bond fund will hold different durations. Also, sometimes managers can sell bonds before maturity. And this can make variations in the value of the fund as well as its yield. Finally, you do not get a fixed interest rate with a bond fund, unlike a bond. The yield will vary as the bonds in the fund mature. So, they are less predictable.

It is still much more practical to use a bond fund instead of investing directly in bonds. If you invest in bonds, you must buy several, ideally of different durations. And you will have to buy back bonds once they arrive at maturity. With a bond fund, you buy the fund’s shares, and you are done.

Effects of bonds in your portfolio

So, what do bonds do on your portfolio? Overall, they will reduce the volatility. But what does it mean for retirement?

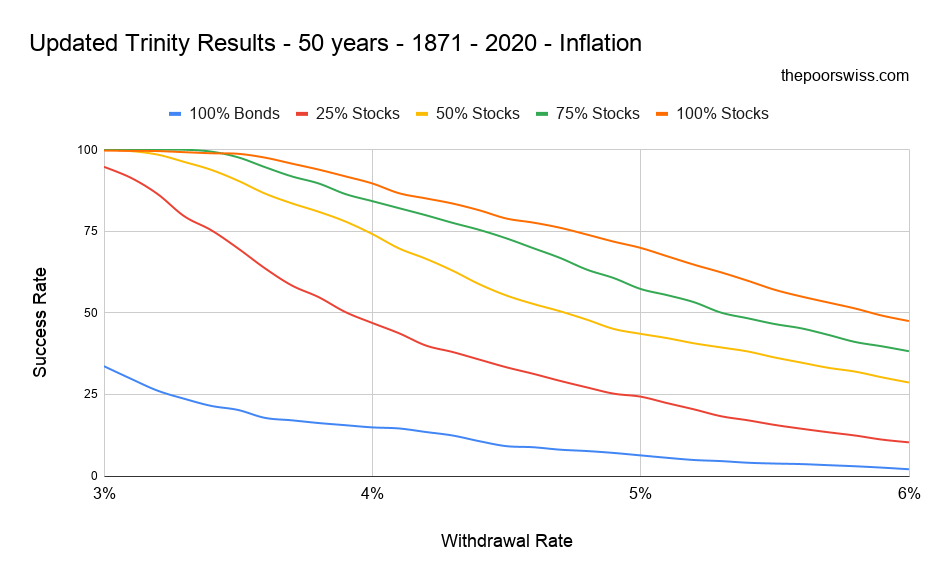

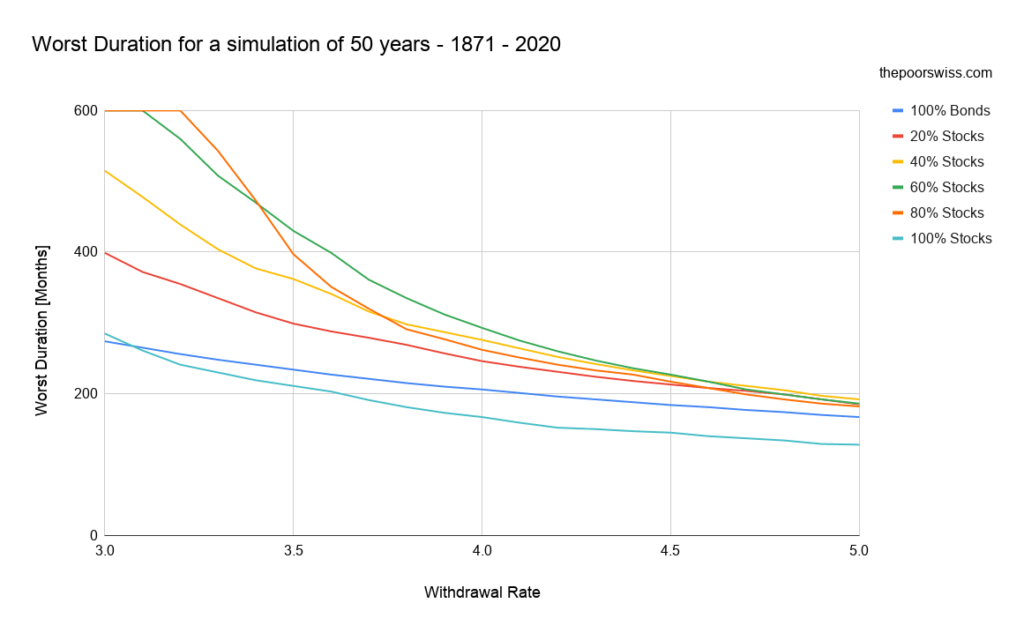

Adding a small allocation to bonds in your portfolio will increase your chances of success. Indeed, they will help your portfolio weather bad sequences of returns risks. However, this is only true for low withdrawal rates. If you use a higher withdrawal rate, stocks will be more important for the success rate because higher returns will help more than lower volatility.

Furthermore, adding bonds to your portfolio will significantly improve the worst duration of your portfolio. The worst duration is the earliest a portfolio can fail in retirement. So stock portfolios can fail much earlier than a portfolio with extra bonds.

So, you should choose your asset allocation based on your risk capacity and retirement planning. For more information, check out my article about asset allocation.

How to choose a bond fund

Now, most simple investors will invest through a bond fund rather than in individual bonds. So, we need to look at how to choose a bond fund.

First, if you live in a country with good mutual funds, you should not hesitate to use them. But if you live in a country with bad mutual funds (Switzerland, for instance), you should probably use Exchange Traded Funds (ETFs) instead. They are much more accessible than mutual funds. And choosing a bond ETF or a bond mutual fund is the same process. In that case, you will need to get a good broker.

First, you should choose the type of bond you want to invest in. I would recommend government bonds only since they are the safest and will be the best choice. And in any case, you should only invest in investment-grade bonds. If you want to invest for the long term and reduce your risks, they are the only options. Any bond that is not investment-grade is a gamble. Corporate bonds have too much correlation to the stock market and, as such, will not help enough for your volatility.

Regarding maturities, I think the best choice is to invest in all of them: short-term, medium-term, and long-term. This will give you good diversification. And some funds have all of them together. No need to have three funds! Keep it simple!

I probably do not have to tell you, but you should use an index fund, not an active fund. An index fund will have much lower fees, better diversification, and better returns in the long term.

Regarding fees, you should take the Total Expense Ratio (TER) of the fund into special consideration. You want a fund with a TER below 0.25% and ideally significantly lower than that.

Then, you should look for a fund with many bonds with large assets under management. This will give you stability and diversification.

You should not look at historical returns since they are not a good indication of future performance. However, you should look at the current yield. The current yield will help you compare different similar funds. But do not fall into the trap of junk bonds and their high returns. This is not what a bond fund is for in your portfolio.

With these criteria, you should find good bond funds for your portfolio.

Conclusion

Bonds are a great investment instrument to reduce the volatility in your portfolio. If you want to be more conservative, you can add bonds to your portfolio. This will reduce the risks and increase your chances of success in the long term.

However, you should be careful about adding too many bonds to your portfolio. Their returns are significantly lower than stocks and can drag your overall returns down. And this can also lower your chances of success if you retire from your portfolio.

If you are using bonds, it is important to know that their value can fluctuate as interest rates change. This makes them less intuitive than stocks. But a well-diversified bond portfolio should fare better since it will hold bonds of different maturity.

If you have access to good bonds, it is interesting to consider adding some to your portfolio. In some cases, cash may be a good replacement for bonds if you do not have to great bonds.

But European and Swiss bonds are currently yielding negative interest. So, in most cases, cash is better than bonds. But once this changes, I will reconsider bonds in my own portfolio, and I will talk more about them on the blog.

To learn more about bonds, you could read about yield curves, the relationship between interest rates, and the time until maturity.

Do you own bonds?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Investing Fundamentals

- More articles about Investing

- What is an Opportunity Fund? Be Ready for a Bear Market

- Dividends – Develop Passive Income

- How do stock options work?

Hi,

i was looking into the iShares Swiss Domestic Government Bond 1-3 (CH0102530786). I found that they pay the dividents twice a year around mid jan and mid July, with the ex-date and record date only a few days before the payout date. However, I don’t see a surge in ETF price before the ex-divident date and a drop after it.

I’m confused by this beceause doesnt this mean you can buy the ETF before the record day, hold it for few days and then sell it for more or less the same price and pocket all the divident?

What am I missing here?

Regards,

Jarne

Hi Jarne

I see significant drops on the last two dividends. Be careful to be looking at price only graph. If you are looking on ishares, the graph are likely to be dividend-adjusted so you will not see the drops.

Maybe I’m overlooking something, but what exactly is the case for Swiss government bonds over cash in a Swiss savings account even now when bond yields are positive?

Swiss government bonds from February 2024 yield 0.5%. Many Swiss savings accounts are currently at about 1-1.3% yield. These savings accounts are protected by the state up to CHF 100k. As long as you remain within that 100k range, what exactly is the upside of using government bonds over them?

And of course, both yields are way below inflation, but well…

Hi Paul

You can get bonds at up to 2.1% as far as I have seen, maybe higher in some banks. Generally, you will get two advantages with bonds over cash:

* Significantly higher limits (most cash accounts only give you good interest rate on the first 50K or something like that)

* Higher interest (not very significant these days)

Of course, a bond is more limited since you want a long duration to get a good interest rate.

Thanks for the reply! So it’s not the rates posted by the SNB here that are relevant, but what the banks offer to the clients? https://www.snb.ch/en/publications/financial-markets/Backoffice/ch_bonds_new

Sorry for the dumb questions, I have no clear idea how these things work on the holder’s side.

The problem is that the SNB issue many bonds at different conditions. And it’s also impossible to get the bonds directly from the SNB, so we have to use an intermediary.

Just asking a question in case someone has a suggestion.

In order to have some diversity, I am looking for low cost Bond ETF (short duration ~2 years) which offers Swiss corporate or government bonds. If not that then if Swiss corporate bonds can be bought on IBKR, then also good.

The banks like UBS offer max 1.2% interest on Fixed deposits which seem much lower to SNB interest rates.

Any suggestions would be welcome. I tried searching on Interactive brokers but I don’t find anything. Neither bonds ETfs from Swiss markets, nor individual short term bonds

Only one I see is blackrock and it’s effective yield post costs is more or less same as Fixed deposit rates

Abhiney

Hi Abhiney,

For such a short duration, I would still recommend a fixed deposit account. It won’t be great in Switzerland since bank acts as intermediary and take a hefty premium. But these bonds are not available on IB directly I think. And bond funds are not great in the short term.

What about bond etfs? I think they should be the best of both cases since us etf dividends are not taxed in switzerland while the interest from bonds is taxed as income.

Hi,

US ETFs dividends ARE taxed as income! We get lowe withholding, but we still pay income tax on it.

Thanks for the clarification, I had the wrong understanding.

In this case would 0 coupon bonds, or coupon stripped bonds be more preferable in the long time (assuming they are intended to be hold till maturity and thus no risk in the price exposure) than dividend yielding bonds?

So, in theory, if they are entirely taxed as capital gains, they could be better indeed. However, I am not sure this is is the case. It sounds like accumulating ETFs where the dividends are taxed anyway.

Which is the taxation of foreign government bond interest and capital gain?

For capital gain i assume is no taxed like stocks

If you buy bonds directly, you will only have interest, in which case it will be taxed as income. Or if you sell your bond with a gain without holding through maturity, then this should not be taxed.

If you buy through a fund, dividends will taxed as income and capital gains should not

Hi Baptiste, therefore is it correct to say that 35% withholding tax applies on domestic bond’s coupon? Can this be integrally refunded in tax declaration? Instead the US bond’s coupon shall be taxed at 15%. Is there the same taxation on interests received by a bank account (e.g. the 6% offered by IB on USD deposits)?