How do bonds and bond funds work?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

I already have covered stocks in much detail on this blog. But I did not spend enough time on bonds. Bonds are an important part of asset allocation. But bonds are very different from stocks. And they have some strange characteristics.

So, it is important to know how they work. And it is essential to know how bond funds work because they are not as simple as stock funds.

The basics of bonds

In essence, a bond is fairly simple: it is a loan of money from one entity (the lender) to another entity (the borrower). In exchange for this money, the borrower will pay some interest to the lender. The interest rate is fixed when the bond is concluded.

A bond generally has a fixed duration until it matures. When a bond matures, the borrower will return the money to the lender. Again, the time to maturity is fixed when the bond is concluded.

Usually, a longer-term bond will have a higher interest rate. This makes sense since lending for longer is riskier. However, with interest rate fluctuations, this may change.

This is the standard definition of bonds, and it concerns many of them. There are some more complex instruments available. For instance, some complex bonds last forever and never mature unless the borrower calls them back. But these are not as interesting for the simple investors we should be.

Keep in mind that a bond is not entirely safe, like some people think. If the borrower defaults, your money is lost. This is very unlikely to happen if you hold bonds from a very safe government such as Switzerland or the United States. But some countries have defaulted on bonds in the past. For instance, Venezuela defaulted on more than 60 billion dollars of bonds in 2017.

So, a bond is only as safe as its issuer. And there are many junk bonds out there that are at least as risky as stocks. And bond funds follow the same rule. Bond funds investing in bad bonds will be risky.

Types of Bonds

There are many different types of bonds. The main bonds are treasury bonds. They are emitted by a national government like the United States or Switzerland. These bonds are extremely safe since it would take an entire government to default for them to lose their value entirely. But then, of course, some countries are riskier than others.

Then there are also some municipal bonds. They are emitted by local governments such as a municipality. Again, they are very safe but already slightly riskier than treasury bonds.

And you can also get corporate bonds. They are emitted by companies. These can be much riskier (depending on the company) since it would take a single company to go down for the bond to lose value. Also, they have few advantages over stocks since they are correlated to the stock market and will not reduce the volatility of your portfolio much.

There are also some special types, such as inflation-protected bonds, that will grow (or shrink) based on the inflation rate. And there are some sub-types as well. But for a simple bond investor, the simple types of bonds are more than enough to know.

Ratings of bonds

When we compare the risks of bonds, we generally use ratings provided by a rating agency. There are several rating agencies. The three main rating agencies are:

- Moody’s

- Standard & Poor’s

- Fitch

These agencies will give a rating to most bond issuers, and the rating should indicate the level of risk of this bond. Standard & Poor’s and Fitch are using the same grades: from AAA, AA+, AA, AA- to CCC-, CC, C, D. Moody’s is doing something slightly different with Aaa, Aa1, Aa1, As3, A1, … to Caa1, Caa2, Caa3, Ca, C.

You do not need to know about all these in detail. But you should know that A bonds are better than B bonds and that anything with a C should be considered a junk bond. For instance, bonds from Switzerland are considered the safest, while bonds from Venezuela are considered the riskiest (junk bonds). United States Bonds are extremely safe, just slightly below Switzerland (a perfect score here).

If you plan to invest in an individual bond, it is important to look at the rating of the bond. And if you want to invest in bond funds, they will provide the percentage of bonds in each grade. That should give you a good idea of the risk of the fund.

Since bonds are supposed to be the safe part of your portfolio, you should be careful about using non-investment-grade bonds. If you want more returns, you should use stocks, not bonds. Or at least you should be clear that you are using bonds for returns, not for reducing risks.

The value of bonds

There are two ways to profit from bonds. The first way is to hold the bond until maturity and collect the interest over time. This way, you will have gained the interest rate that was fixed when you bought the bond.

The second way is to buy bonds when they are cheap and resell when they are more expensive. Now, this is related to the current value of a bond. The current value of a bond can change over time if interest rates change. This is a weird characteristic of bonds that is often ignored.

When bond interests are going up, the values of existing bonds will go down. And when bond interests are going down, the values of the existing bonds will go up. For instance, we will say you have bought a 1000 USD bond from the U.S. Treasury at 2%, and there are ten years left until maturity.

If the U.S. treasury raises its interest rates to 2.5%, people will not want to buy your bond at 1000$. Its value will go down to about 950 USD. On the other hand, if they lower their interest rate to 1.5%, your bonds become more valuable. In that case, it would be worth about 1050 USD. The exact computation is not trivial because it depends on how often the bond pays outs. But you should get the gist.

Of course, if you hold your bond to maturity, this does not matter since you will receive your principal, regardless of the changes in interest rate. So generally, the current value of your bonds, as a long-term investor, should not matter much.

Bond Funds

A lot of people are owning bond funds instead of buying bonds directly. You will find bond funds for many countries and different types of bonds (the same types we saw earlier). And some funds focus on short-term bonds, while others focus on long-term bonds.

There are several advantages to choosing bond funds over bonds.

One advantage of a bond fund is that you can hold the shares forever. If you buy a bond, you must buy one again once your current bond matures. If you have a long-term investing horizon, this will be great.

Another advantage is that you will lower the impact of changes in interest rates with a bond fund. Indeed, a bond fund will buy bonds of different maturity and buy back new bonds once the old ones mature. If you buy a single bond for ten years, the interest you get can vary widely once you get a new one after ten years.

Now, bond funds do not act exactly like a bond. First, their value can vary significantly with changes in interest rates. So, the fund’s value (and its yield) will vary while you hold it. This is mitigated by the fact that a good bond fund will hold different durations. Also, sometimes managers can sell bonds before maturity. And this can make variations in the value of the fund as well as its yield. Finally, you do not get a fixed interest rate with a bond fund, unlike a bond. The yield will vary as the bonds in the fund mature. So, they are less predictable.

It is still much more practical to use a bond fund instead of investing directly in bonds. If you invest in bonds, you must buy several, ideally of different durations. And you will have to buy back bonds once they arrive at maturity. With a bond fund, you buy the fund’s shares, and you are done.

Effects of bonds in your portfolio

So, what do bonds do on your portfolio? Overall, they will reduce the volatility. But what does it mean for retirement?

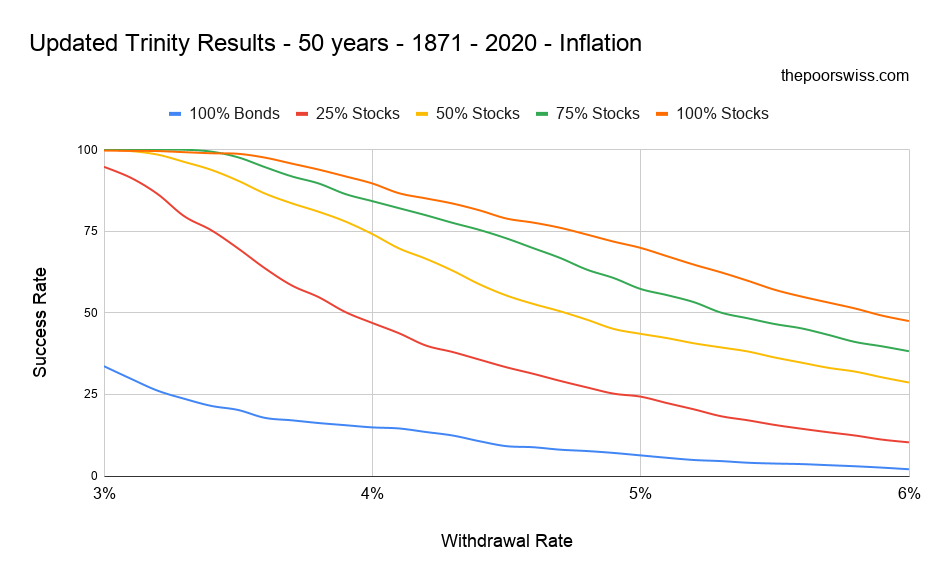

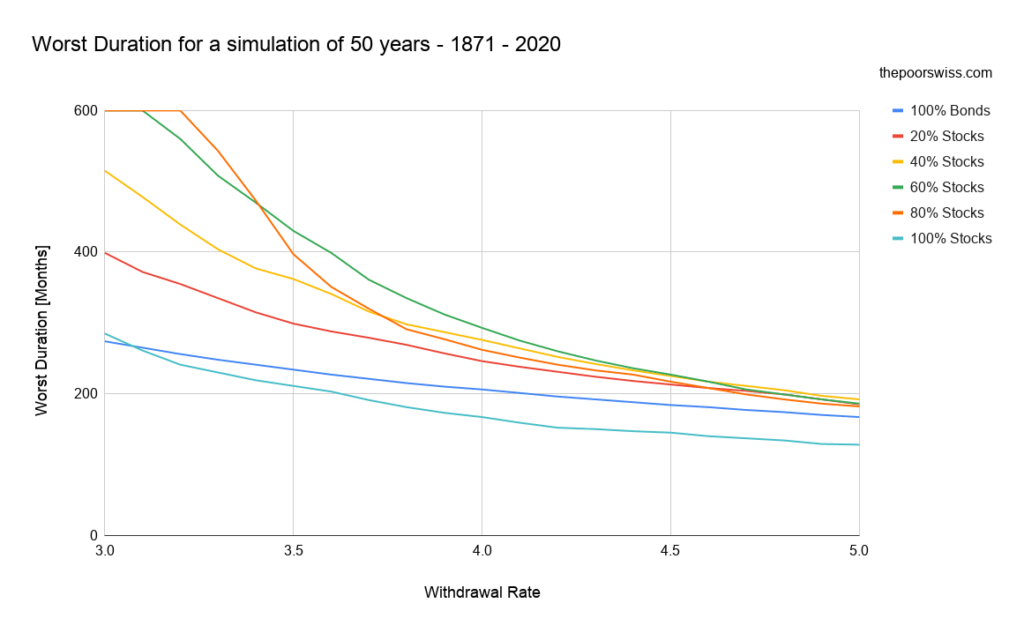

Adding a small allocation to bonds in your portfolio will increase your chances of success. Indeed, they will help your portfolio weather bad sequences of returns risks. However, this is only true for low withdrawal rates. If you use a higher withdrawal rate, stocks will be more important for the success rate because higher returns will help more than lower volatility.

Furthermore, adding bonds to your portfolio will significantly improve the worst duration of your portfolio. The worst duration is the earliest a portfolio can fail in retirement. So stock portfolios can fail much earlier than a portfolio with extra bonds.

So, you should choose your asset allocation based on your risk capacity and retirement planning. For more information, check out my article about asset allocation.

How to choose a bond fund

Now, most simple investors will invest through a bond fund rather than in individual bonds. So, we need to look at how to choose a bond fund.

First, if you live in a country with good mutual funds, you should not hesitate to use them. But if you live in a country with bad mutual funds (Switzerland, for instance), you should probably use Exchange Traded Funds (ETFs) instead. They are much more accessible than mutual funds. And choosing a bond ETF or a bond mutual fund is the same process. In that case, you will need to get a good broker.

First, you should choose the type of bond you want to invest in. I would recommend government bonds only since they are the safest and will be the best choice. And in any case, you should only invest in investment-grade bonds. If you want to invest for the long term and reduce your risks, they are the only options. Any bond that is not investment-grade is a gamble. Corporate bonds have too much correlation to the stock market and, as such, will not help enough for your volatility.

Regarding maturities, I think the best choice is to invest in all of them: short-term, medium-term, and long-term. This will give you good diversification. And some funds have all of them together. No need to have three funds! Keep it simple!

I probably do not have to tell you, but you should use an index fund, not an active fund. An index fund will have much lower fees, better diversification, and better returns in the long term.

Regarding fees, you should take the Total Expense Ratio (TER) of the fund into special consideration. You want a fund with a TER below 0.25% and ideally significantly lower than that.

Then, you should look for a fund with many bonds with large assets under management. This will give you stability and diversification.

You should not look at historical returns since they are not a good indication of future performance. However, you should look at the current yield. The current yield will help you compare different similar funds. But do not fall into the trap of junk bonds and their high returns. This is not what a bond fund is for in your portfolio.

With these criteria, you should find good bond funds for your portfolio.

Conclusion

Bonds are a great investment instrument to reduce the volatility in your portfolio. If you want to be more conservative, you can add bonds to your portfolio. This will reduce the risks and increase your chances of success in the long term.

However, you should be careful about adding too many bonds to your portfolio. Their returns are significantly lower than stocks and can drag your overall returns down. And this can also lower your chances of success if you retire from your portfolio.

If you are using bonds, it is important to know that their value can fluctuate as interest rates change. This makes them less intuitive than stocks. But a well-diversified bond portfolio should fare better since it will hold bonds of different maturity.

If you have access to good bonds, it is interesting to consider adding some to your portfolio. In some cases, cash may be a good replacement for bonds if you do not have to great bonds.

But European and Swiss bonds are currently yielding negative interest. So, in most cases, cash is better than bonds. But once this changes, I will reconsider bonds in my own portfolio, and I will talk more about them on the blog.

To learn more about bonds, you could read about yield curves, the relationship between interest rates, and the time until maturity.

Do you own bonds?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Investing Fundamentals

- More articles about Investing

- The truth about Capital Gains and Taxes in Switzerland

- How much time does investing take?

- What Makes Vanguard Unique?

Hi Baptiste,

Thanks again for all the great articles!

I was wondering if you know/could explain how to buy (if possible) CODs of Swiss Bonds on Interactive Brokers? And if you think it makes sense?

A quick summary of my portfolio to give you the context:

My portfolio is almost entirely composed of ETFs:

– 40% VT

– 35% VOO

– 15% CHSPI

– 10% cash CHF

I wanted to invest the remaining 10% cash with minimum volatility exposure since the rest of the portfolio already is.

As you said in many articles, buying Treasuries doesn’t make sense due to FOREX risk exposure…

But with the recent surge of Swiss bonds’ interest, I thought it could be a good investment alternative. I intend to keep the bonds up to maturity to secure the 1.45% of return and thus, I don’t think an ETF makes sense here…

Let me know what you think!

Thanks again and keep up the good work!

David

Hi David,

I do not know whether it’s possible. I would personally buy CODs in a Swiss bank directly.

If you intend to hold through maturity, I recommend going through a bank directly.

Depending on your overall asset allocation, it may make total sense to use Swiss bonds. Don’t forget to also count your second pillar in your asset allocation. This may represent a large sum that is low volatility. I view my second pillar as bonds and I can invest into it with voluntary contributions to increase my “bond allocation”.

Good morning. Very good article. I have a basic question. What is the cheapest way to buy Swiss government bonds directly? I could not find any place which is selling bonds itself. Are they sold via brokerages or some other website? I use Interactive brokers.

And a bit of technical question.

Lets say average maturity of a bond fund ETF dealing with Swiss government bonds is 2 years. And lets say expense ratio is 0 (just for simplicity).

If I buy the ETF (lets say 5000 CHF) and hold for two years, would the total returns and final value would be same as if I bought a Swiss government bond (lets say 5000 CHF) with 2 years maturity ?

Hi Abhiney,

As far as I know, we can’t buy Swiss bonds directly from the SNB. Banks and financial institutions are buying them.

We can buy Certificates of Deposits at banks, which are similar.

No, the total returns would not be the same. The reason is that the fund will continue to buy bonds as old bonds mature and these new bonds may have higher or lower interest rate, changing the average. Also, if there is a large outflow of funds, the fund may have to sell (through arbitrage) before maturity.

@Baptiste Wicht: “I would personally prefer using CODs or bonds directly and hold them until maturity rather than bond funds.”

Indeed. I wish to buy 1Y bonds and hold to maturity. I don’t want exposure to longer duration bonds at present. I am happy to “lock in” > 1% pa (before 35% withholding tax).

I will look into CODs from my bank.

I recently noticed the 2-10 yield curve inversion on Swiss Government Bonds (SGBs).

1Y bonds yield 1.4% at par.

Then I tried to find out how to buy some directly and it seems to be neither easy nor cheap to directly buy SGBs. I don’t have an active brokerage account at the moment. My current bank have trading fees, to quote Frank Zappa “somewhere between usury and science fiction.”

Maybe I misunderstand, but it seems a bond fund is a good idea now for otherwise spare cash, because these funds have been losing money due to the negative rates for what, 10 years, and now interest rates are picking up, at least for the shorter durations. Also the toilet paper that I must pay my taxes with is converted to securities that remain mine in the case of a bank failure followed by a “bail in”/ haircut.

The Swiss banks are going to be very slow to raise the interest on their private and savings account.

Hi Adam,

Generally, people don’t buy Swiss government bonds directly, but CODs from their banks. But you could also use a Swiss Bond fund, these are becoming more interesting again. But keep in mind that if bond yields rise, the value of bonds falls, which is something most people ignore.

I would personally prefer using CODs or bonds directly and hold them until maturity rather than bond funds.

Thank you very much for the article. As it looks like there may be a recession next year and interest rates are rising, I am considering buying US government bonds that mature in 6-12 months. Living in Switzerland and not being a US citizen, is it possible to buy this bond or a related product (ETF index fund) at Interactive Brokers?

In early 2024, when the worst of the recession is over, I would start investing with the DCA strategy in a stock index like Vanguard Total World (VT) or VOO (Vanguard S&P 500).

Hi Sergio,

You can definitely buy US bonds ETFs on IB.

However, you have to think about a few things:

* US Bonds are likely a bad idea because of the currency exchange risk of the USD. They won’t give you as much safety as you think. You should use CH bonds.

* It’s impossible to know whether there is going to be a recession and whether it’s going to be over in 2024 if there is one.

Great Article! Congrats for the blog.

How are corporate bonds (in usd, an Apple bond for example) taxed here in switzerland? Do we have to consider the coupon as income or capital gains?

Thanks

Hi Will,

The monthly returns (if you have a monthly bond) are taxed as income. When you get back the principal, it’s not taxed.

Thanks!

So bond funds are more efficent because both the coupons and capital gains inside the fund are treated as capital gains if you sell the fund, and therefore are not taxed. Am I right?

No, bond funds will generally distribute the interest payments as dividends.

If you choose a distribution class, but you can buy the accumulation class which will reinvest the coupons. I believe its a better choice!

In Switzerland, you pay the same taxes on distributing and accumulating funds.

Hi Mr. PoorSwiss,

you write that European/Swiss bonds are currently yielding a negative interest and you will consider bonds only when the situation changes. But why not just buy i.e. US bonds then, i.e. Vanguard Extended Duration Treasury ETF (EDV)?

Hi Kuba,

If I buy bonds, it’s for reducing the volatility of a portfolio. U.S. bonds will return some yield (also low right now) but then you will get the volatility of the currency exchange between USD and CHF. With that, they will not decrease the volatility of your portfolio.

I see what you mean, but I think it still decreases volatility of the portfolio. If you invest in US Equity ETFs, then you have double volatility from Stocks and from currency exchange. With U.S. bonds you reduce the volatility coming from the stocks.

I am not convinced it has enough value. If you want to be sure, you can compute the volatility of a portfolio by using historical volatility data for stocks, bonds and currency exchanges.

Thanks for a very insightful article, as always. I will have a question regarding buying swiss bonds (even though interest rates are below zero here and IMO for now it does not make much sense to buy bonds for now at least). Is it possible to buy inflation-protected bonds issued by Swiss Gov for retailers not in the form of ETF? Does Swiss National Bank offer some bonds for retail investors? Cheers, Szymon

Hi,

No, there is no inflation-protected Swiss Government bond.

As for retail investors, we have to go through banks to get access to these bonds, we can’t get them directly. The government takes a loan and the SNB arbitrages this by allowing many people (banks and institutional investors) to participate in the auction of bonds.

Excellent article as usual.

I would love a follow up article on currency risk & bonds and maybe some bond etfs you might consider, if the interests rate would be better.

Hi Zueritram,

Thanks :)

That’s a good idea. I should definitely talk more about currency risk.

I would suggest something simple like “iShares Swiss Domestic Government Bond 7-15 ETF” or maybe slightly shorter.

But I would have to think about it. Maybe in a few years, we will have better bonds :)

Hi Mr.PoorSwiss,

I think you did finish the paragraph about values of bonds. If the bonds interest goes up, isn’t the bonds more valuable as it will give you more return? You wrote the opposite.

If you are correct, I don’t understand why people would sell less a bond that is making them more money than before.

Otherwise thanks for the article, always interesting. I guess I was sleeping in economy classes in high school or I really don’t know what they did learn to us because I don’t remember more than “bond = money lend to governments”.

Hi Eluc,

Thanks, there were still two big TODO on my article :(

I am talking about what happen when the current bond interest changes, not the interest of your bond (this should never change).

For instance, you buy a bond from the U.S. Treasury giving you a 2% return per year. One year later, the U.S. Treasury yield increases its yield to 3%. Your bond does not change, only new bonds. Your bond will lose value (on the market) because people prefer the new bonds at 3% then your bond at 2%.

Does that make sense?