What is the best third pillar in Switzerland for 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

In Switzerland, contributing to your third pillar is one of the easiest ways to save on taxes. I recommend everybody to contribute to their third pillar.

But contributing to your third pillar is not enough. You should invest the money in your third pillar. That means you have to pick the best third pillar for your money. Since there are many options, choosing the best third pillar for your needs may be difficult.

So, this article is here to help you! We see how to choose the best third pillar!

What makes the best third pillar?

First, we must consider what makes the best third pillar. We must decide which factors will drive the choice.

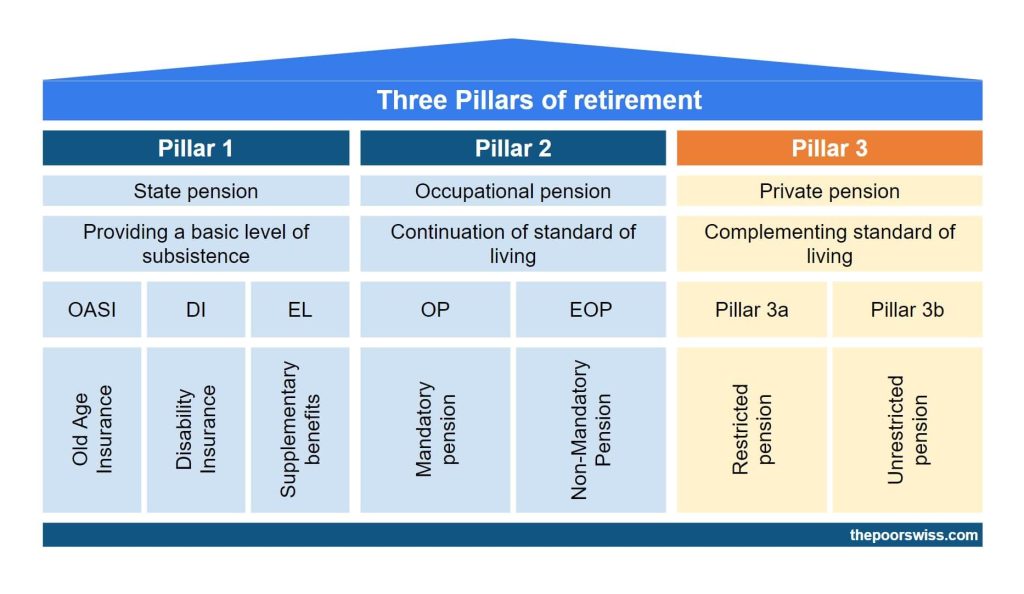

I assume you already know about the third pillar and are contributing to it. If you do not, you should learn why you should contribute to the third pillar.

We only consider bank third pillars, not insurance third pillars. Indeed, in almost every case, a bank third pillar is much better than an insurance third pillar.

The goal of your third pillar is to provide you with enough money to retire comfortably. Therefore, you want your invested money to grow as much as possible while not taking too much risk. So, the best third pillar must support this goal!

There are three critical factors in choosing the best third pillar:

- A large allocation to stocks will increase your returns in the long term.

- A diversified stock allocation reduces the volatility of your portfolio.

- Low management fees to avoid wasting your returns in fees.

Since we are counting on the long term, there are also some things we can ignore:

- How good the app looks does not matter. You will spend less than an hour every year.

- The interest on the cash part is irrelevant unless you do not want to invest.

We will now delve more into the details of the three critical factors.

Allocation to stocks

The best third pillar has a significant allocation to stocks.

It will depend on your situation, of course. You need to choose yourself your asset allocation. Recently, Swiss bonds have had negative interest rates for about ten years. When this is the case, what is not in stocks should be invested in cash.

I want to allocate as much of my third pillar to stocks as possible. I already have bonds in my second pillar, and my current allocation to bonds is more than enough. Ideally, a third pillar will have a 100% allocation to stocks.

Diversification

The best third pillar has a diversified stock allocation.

Switzerland is too small of a country to only invest in its stocks. We need to have global stocks (stocks outside of Switzerland). Ideally, the allocation should be the same as a world stocks fund. Since the Swiss stock market represents about 3% of the entire stock market, we should avoid investing much more than that.

Unfortunately, this is not possible in Switzerland. The law states that the third pillar must have at least 40% allocated to Swiss stocks. So, an ideal third pillar should have 60% of international stocks and 40% of high-quality Swiss shares.

As we will see later, there is a way against this limit, making some third pillar providers significantly better than others.

Fees

And last but not least, the best third pillar has fees as low as possible.

I want my third pillar to have zero load fees. I do not want to pay to get money inside the fund. The absence of load fees is essential. You should never use any fund with load fees.

Moreover, the yearly fees must be low, and the TER must be as low as possible. Most third-pillar accounts in Switzerland have higher than 1% TER.

When you are investing for the long term, it is essential to minimize investing fees. The difference in returns in the long term is significant.

Third Pillar from a Bank

Most people in Switzerland will invest in a third pillar their banks provide. And they have a ton of options. Historically, they have been the only option available for third pillars.

I will not go over all the possible offers here. Indeed, there are too many of them. And most of them are terrible options. But I will go over some interesting options from some popular Swiss banks.

We will use the third pillar accounts from banks as examples. These are not the best third pillars.

Migros Bank Fund 85 V

My current bank is Migros, so I wanted to check their offer.

They have several retirement funds. The most interesting is Migros Bank Fund 85V. It has 85% in stocks and the rest in bonds and money market. The TER is 0.94% per year.

The allocation to stocks is slightly low but not too bad. The TER is not that bad for a Swiss bank. But I would not recommend this fund.

LUKB Expert Fund 75

Many people recommend the Luzerner Kantonal Bank’s LUKB funds. Let’s take a look at their LUKB Expert Fund 75.

This fund has 75% of stocks, which is alright but not great. 40% is invested in Swiss stocks, 35% in global stocks, 15% in Swiss bonds, 4% in international bonds, and the rest in liquidities and real estate. The diversification is not too bad when compared with other options.

It has a TER of 0.8%. For third pillar accounts in Switzerland, this is a good TER. However, it has a load fee of 0.4%. The TER is okay, but the load fee makes it highly undesirable.

PostFinance Pension 100

Many people are using retirement funds from PostFinance. So, we can take a look at the PostFinance Pension 100 fund.

This fund invests 100% in stocks. 72% is invested in Swiss companies, while 28% is invited globally. And the TER is 1.01% per year.

The allocation to stocks of this fund is quite reasonable. 100% allocated to stocks is the best you can do in your third pillar. However, more than a 1% yearly fee is already significant. And this fund is not well globally diversified since only 28% of the stocks are international. This is significantly lower than we would like.

Raiffeisen Pension Invest Futura Equity

Since many Raiffeisen banks have a good reputation, it is a good idea to look at their retirement funds, and more specifically, the Pension Invest Futura Equity fund, a mouthful.

This fund has between 80% and 100% in stocks. I do not know why it is not fixed. But the last invested value I saw was 95% in stocks, which is good. 47% is invested in Switzerland, which is not great but not the worst.

The TER of the fund is 1.42%, which is very bad. While it is not the most expensive fund in Switzerland, it is the most expensive that I will mention today. And it is way too expensive for people to consider.

Swisscanto Fund 95 Passiv VT

Swisscanto provides many Swiss funds, and many banks use them. We can examine the Swisscanto Fund 95 Passiv VT.

This fund invests 95% in stocks, which is excellent. The diversification is also good, with 65% invested in foreign equities. However, they hedge most of the equities, with 72% in CHF for the entire fund. This is not great for currency diversification.

On the fee side, this is an excellent example of how banks are trying to make it complicated for people to know how expensive it is. The flat fee for the fund is only 0.38% per year. At first sight, it sounds great. But if you look in detail, we can see that this is a fund of other funds, so there is an extra 0.33% in fees for the sub-funds. But they never show the full fee of 0.71%. On top of that, they are adding a 0.1% issuance fee and a 0.09% redemption.

It is the most complicated fee system I have seen during my research. They use several small fees not to scare customers away, but when you add up all the costs, this does not make them very attractive. And just because of this lack of transparency, I would not invest in their funds.

Independent providers

As we saw, offers from banks are not that great. Fortunately, recently, many independent providers have started in this market. And they are offering much better conditions than banks.

We have seen that banks have high fees, sub-par diversification, and not aggressive enough portfolios. Independent providers are fixing all these issues. So, to find the best third pillar, we need to look at these independent providers. Note that they are not all good. There are also some bad options.

There is no disadvantage to having your money in a third pillar from these companies instead of at a bank. They only have advantages.

There are many, but I will only mention two main providers in this article: Switzerland’s two best third pillar providers.

Finpension 3a – Best Third Pillar

Finpension 3a is the best third pillar in Switzerland.

Use the FEYKV5 code to get a fee credit of 25 CHF*!

*(if you deposit 1000 CHF in the first 12 months)

- Invest 99% in stocks

For most long-term investors, Finpension 3a will be the best third pillar available in Switzerland.

Indeed, they have some powerful advantages going for them:

- You can invest up to 99% in stocks

- The fees for an aggressive portfolio are extremely low, at 0.39% per year.

- They have a mobile application and a web application.

- You can make custom portfolios with a lot of liberty.

Finpension 3a is the best third pillar for long-term returns, with a high stock allocation and low fees. This is a great way to ensure your money is well invested until retirement.

Interestingly, Finpension also runs an excellent vested benefits account. They are experienced in the pension industry and provide great products.

Finpension 3a is the best third pillar available for aggressive long-term investors. So, in 2021, I started investing my third pillar in Finpension 3a. As for 2023, I am still using them and have five portfolios with them.

For more information, you can read my review of Finpension 3a.

VIAC – Good Conservative Third Pillar

In some cases, VIAC is an interesting alternative as well.

VIAC is a little more mature than Finpension 3a. They also offer an excellent third pillar. In general, they have several disadvantages over Finpension:

- Their custom strategies for investing are more limited.

- The fees are slightly higher.

- You are limited in your maximum foreign currency exposure.

However, they have some advantages for conservative investors who would not invest fully in stocks:

- They allow you to invest in cash or bonds.

- The fees are lower if you invest in stocks and cash. Indeed, you only pay fees on the invested part.

So, if you are a conservative investor (or a short-term investor) and do not want bonds, VIAC may be better.

But this is only true if you do not use bonds. If you use stocks and bonds, Finpension 3a is cheaper.

VIAC used to be the best third pillar until Finpension 3a came along. But it is only interesting in a few cases now.

For more information, you can read my complete review of VIAC.

Conclusion

Finpension 3a is the best third pillar in Switzerland.

Use the FEYKV5 code to get a fee credit of 25 CHF*!

*(if you deposit 1000 CHF in the first 12 months)

- Invest 99% in stocks

Overall, the best third pillar available in Switzerland is Finpension 3a. They offer the highest allocation to stocks and the lowest fees. On top of that, you can create custom portfolios with a high degree of liberty. This makes them an excellent option!

For these reasons, in 2021, I invested in Finpension 3a instead of VIAC, and I recommend that all aggressive investors do the same. I have five portfolios with Finpension 3a.

If you open a Finpension 3a account, please use my code FEYKV5, this will help the blog and give you a 25 CHF fee credit (if you deposit 1000 CHF in the first 12 months).

If you need more information on these two third pillars, I have an article on VIAC vs Finpension. This article goes more in-depth into the comparison.

What about you? Which is your favorite third pillar?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best retirement accounts

- More articles about Retirement

- VIAC vs Finpension 3a – Which is the best third pillar for 2024?

- VIAC 3a Review 2024 – Pros & Cons

- Yuh 3a Review 2024 – Pros & Cons

Hallo Baptiste,

vielen Dank für deine ehrliche, praktische und authentische Art mit diesem Thema umzugehen und zu publizieren. Ich denke, das ist ziemlich einmalig in CH.

Eine Frage: Hattest du schon mal vorgehabt die Säule 3a oder allgemein die Anlageprodukte von Vermögenszentrum VZ zu vergleichen? Soweit ich weiss, sind viele in der Schweiz darin investiert.

Besten Dank!

Alex

Hi Alex

Thanks for your kind words about my articles. I will answer in English since I prefer to have English comments on the English articles.

I did not really plan to review them in detail. With a 0.68% fee without counting product fees, this is already significantly more expensive than other alternatives. They also do not share much on their website about their strategies, which makes it difficult to really evaluate.

But if enough people are interested, I could review their services.

Salut Baptiste, thank you for this wonderful blog and interesting articles.

Since we’re talking about our long-term money, how do you know that indipendent providers will still be around at the time of our retirement? I’m a bit skeptical about their ability to give money back if they have some kind of financial problem in, let’s say, 20 years.

Is it better to find a bank and pay a few fees?

Is it even better better to find a government-owned bank? (To avoid a Credit Suisse situation…)

Thanks a lot and en guten Rutsch!

Hi Andrew

By this logic, how do you know UBS or ZKB will still be around in 20 years?

Independent providers are more likely to not to be around, but not much more in my opinion.

That being said, I think it does not matter much. The 3a foundation is separated from the provider and so are the funds. If FP or VIAC went away, the foundation would have to find a new manager for the money. And the money should be safe in custody accounts.

Dear Baptiste,

I checked Moneyland for the cheapest 3a and found “CEA compte 3e pilier” offers zero fees and a savings rate of 1.6% on the deposited money year on year. Have you ever checked that out? I am interested in a more steady return that I can count on rather than turbolent stock market returns, so that seems to me the best possible choice, please let me know what you think:

Various costs in detail

Initial deposit:

CHF 0

+ Deposits:

CHF 91,728.00

+ Interest earned:

CHF 9343.75

– Account management costs:

CHF 0

Final capital:

CHF 101,071.75

Account management:

No account management fees.

Regular account closure:

Free of charge.

Advance withdrawal – disability or death:

Free of charge.

Advance withdrawal – change of provider:

Free of charge.

Advance withdrawal – self-employment:

Free of charge.

Advance withdrawal – property:

Free of charge.

Advance withdrawal – emigration:

Free of charge.

I have never really researched cash 3a because there are too many of them and they are mostly the same. In general, only the interest rate different between and sometimes some special conditions like exit in the first year.

I don’t have any thoughts on CEA.

Just be careful that interest can change quickly. So you should not assume you will get 1.6% your entire retirement.

Hi “Mr poor swiss” Baptiste,

For 3rd pillar I’ve been proposed passive funds of UBS (link to fact sheet below) that in their “UBS Vitainvest Passive 100 Sustainable Q” fact sheet they claim a TER of 0.24%; what’s your take on that?

BTW thanks a lot for all the valuable information you continuously provide!

https://www.ubs.com/2/e/files/RET/FS_RET_CH1110134157_CH_EN.pdf

Hi Andrea

This fund is good, but the problem is that there is an extra fee for the custody 3a account:

“In the case of the UBS Vitainvest Passive fund, an annual management fee of 0.65% is charged. This fee is debited from the account balance. ”

So, they are charging you more for using a cheaper fund…

Hi!

I invested now in VIAC for 3 years in a row. Can I just open a new one on Finpension for 2024 and ‘save’ there and leave VIAC’s money in VIAC?

Thank you for your answer.

Hi Michaela

Yes, that’s not an issue, you can have 3a accounts with different providers.

Hello, how come you don’t mention 3rd pillars B? Are there any interesting B’s that can be usefull to detax long term, if we have some extra earnings? Thank you!

Hi W,

I don’t mention them because they are not interesting.

I have an article about them if you want to learn more: The truth about 3b pillar accounts

Hi

I understand that one can contribute to the 3rd pillar with a B permit. I am not sure if this helps to save on taxes. Do u know perhaps?

Thank you.

Hi Maria,

The 3rd pillar only helps if you fill a full tax declaration, not if you are taxed at source.

So, if you are paying tax at source, it does not help, but you should not ignore your retirement either.

Hi,

Can you please explain that in more details. I am a B permit holder, and I taxed at source, but still every year I need to submit mu tax declaration form. So in my case if it’s worth opening 3a pillar?

Kind regards,

Damian

Hi Damian,

Normally, if you pay tax at source (removed from your salary), you should not have to fill a full tax declaration, no?

If you can deduct your 3a inside the tax declaration, then you should be good.

Hi Baptiste

You can still voluntarily do a tax declaration if taxed at source (if the regular tax by your Gemeinde is lower than the source tax, which is an average of the whole canton).

And you HAVE TO do a tax declaration even if taxed at source with a B permit if you earn 120k or more.

Best

Barbara

Hi Barbara,

I am aware of these rules, but if you opt for the tax declaration, you will not be taxed at source anymore, right?

yes, you are. You are taxed at source as long as you have a B permit. Even when you come into the country with a contract of over 120k, the still deduct tax at source and then make you do a tax declaration.

So, you fill a tax declaration and then this is reflected into your taxes deducted from your salary, every month? I was thinking it was switching from the same bills as a Swiss citizen.

Thanks for sharing!

Dear Baptiste

No. Source tax doesn’t change in the amount. There is a set percentage for every salary that you can google. Then you do a tax declaration and they determine how you should be taxed by Swiss normal standards. Then they compare how much source tax has already been deducted for the year. If it exceeds what you should pay regularly (i.e. you either live in a tax-cheap Gemeinde or you have a lot of deductions) then you get a return. If it was less than is determined in the tax declaration, you get a bill for the rest the same way Swiss people to as a final tax bill for a specific year. But then the following year you pay the same source tax again. Endless cycle.

On B permit you are handing in retrospectively how the tax for you should actually be compared to what they deducted for you (this is comparable to how it works for everyone in Germany for example) while the Swiss get a proactive bill for the year.

Thanks for the explanations! My understanding was definitely incomplete!

Have you looked at Tellco third pillar option? It seems to me there is a way to pay 0% fees if investing only in their Tellco Classic funds and also they have one of the highest current interest rates on the cash portion: 1.35%.

I have never looked into them.

Their conditions are not very clear. Because under some conditions it looks like there is indeed no charge to invest. However, they mention that they may charge an initial fee of 1% as compensiation and also that distribution partners may also set a consulting fee per year. From their website, it does not seem transparent enoguh for me to even look at it.

Hi Again Baptiste,

Do you know if the third Pillar at Credit Suisse is any good? I am in between Credit Suisse because I anyway have an account there or open one at FinPension.

At Credit Suisse I was told that there is 0 fee monthly, and also when I deposit money there are no fee and I would receive an interest rate of currently 0.80%. And ofc they also have investment groups and a lot of different ways to invest your money…

Do you have any thoughts?

Appreciate!

Hi Jimmy,

I storngly doubt there is a 0% fee if you invest. But if you don’t invest, many accounts are free and up to 1% interest rate these days.

If you want to invest, Finpension is going to be superior to CS, but if you only want little risk and small interest rate, CS will be just fine.

Hi Baptiste,

What do you think about Liberty foundation kanton schwyz, I was recommended by a broker to do it there a third pilar, because you are more free to invest where you want vs other places…

Other question is, does one need a broker to do a third pilar? Because what I understand they will get a fee monthly I guess by doing it correct?

Just wanted to know your thoughts.

Much Appreciated.

Best Regards

Jimmy

Hi Jimmy,

I have never done any review of this service, I don’t really have an opinion about them.

I am not sure I understand I understand how you would be more free. There are some very customizable 3a out there and they all have to obey to rather strict rules.

You definitely don’t need a broker to do a third pillar. You can use something Finpension and they will do everything for you. In that case, the fees will be deducted from your account.

Got it, thank you very much! I will check Finpension.

I have another question, maybe a bit off topic but, for the second pillar, my broker had me and my employees register with NEST Sammelstiftung for some years now for our pensions funds, but are there better options that you know of, that I would profit more than Nest Sammelstiftung? The interest rate there is 1% in the year. I have about 40K in it.

Best Regards

Hi Jimmy

You are talking about a pension fund for a company, right? Unfortunately, I have no experience there. I have never researched the best options for that.

If you have a small company, you have fewer opportunities because some of the best pension funds will want some minimum employees and salary to get in.