The Poor Swiss versus the Average Swiss Household

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Frugality and expenses are difficult to compare between two different households. It is especially true if you compare different situations like family and children.

And it is almost impossible to compare yourselves to people from another country. Therefore, it is essential to compare yourself to an average household comparable to your household.

If we compare our expenses with the FIRE community, we are not frugal. In 2018, we spent about 5330 CHF per month. Our monthly expenses are far higher than what most people trying to reach for FI are spending. I often read personal finance blogs where people claim to be living below 2000 CHF in Europe.

However, we are careful about our budget. And we are optimizing it to reduce it month after month. It is already much lower than before. And in 2019, one of our goals is to spend less than 5000 CHF per month. We will see if we can do it. However, we should also compare our spending with the average household in our country.

I do not think we are spending too much. When I compare with most people I know, we are alright. But I wanted to compare our spending with more data on the average Swiss household.

In this article, I compare our current level of expenses with the average Swiss household. I have been able to find official data from the Swiss statistics bureau. If you like data and statistics, this post is for you!

And I could compare in detail how we fare against the average Swiss household. It is fascinating to do! If you can do the same for your level of expenses and your average reference household, I would strongly encourage you to do so!

The Average Swiss Household

First, we need to establish the average Swiss household amount of expenses.

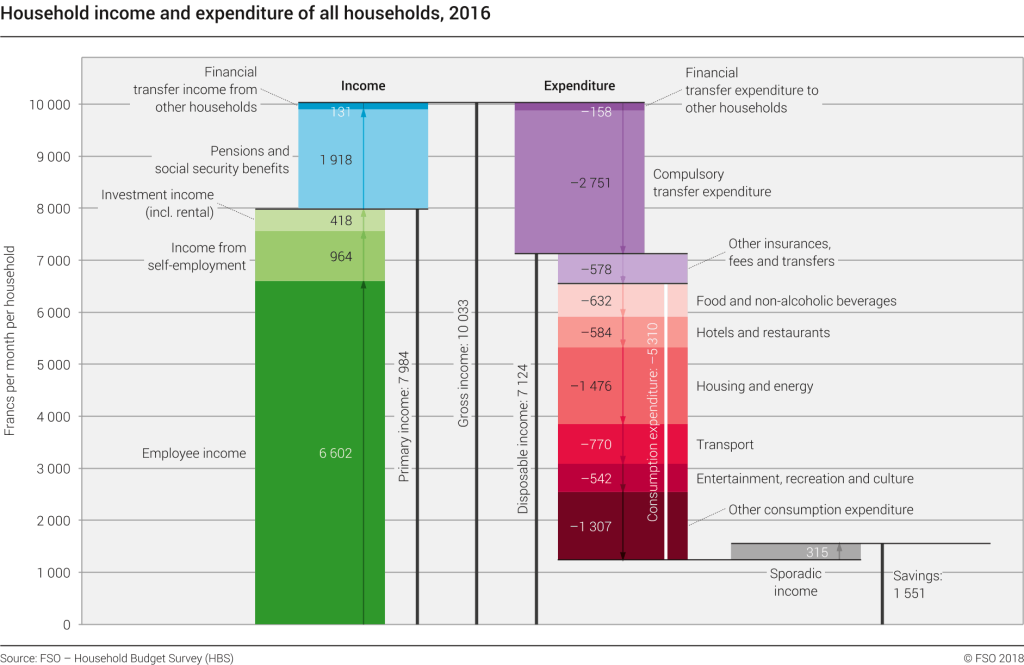

Fortunately, I found the report by the Swiss Federal Statistics Office (FSO). I could only find the Household Income And Expenditures report for 2016. And even more fortunate, this is in English.

Since we had very low inflation in Switzerland these last few years, I do not expect a lot of differences between 2016 and 2018. I found a helpful infographic for the average income and expenses of all households in Switzerland:

This infographic shows the average for all households together. That means there will be single people, couples, and families for children. But this is an excellent place to start with.

The Poor Swiss couple vs the Average Swiss Household

As a basis, I will use our 2018 expenses. I will compare each point of the average expenditure one by one.

Since the available statistics are monthly, we will compare with our monthly averages. I just took the liberty to merge some of the categories to ease the comparison and make it shorter. And I did not take social security contributions into account since we only account for the money that reaches our bank account.

- Taxes: 1153 CHF: In 2018, we spent 611 CHF on average on taxes. Our spending on taxes is much better than the average! For 2019, it should be higher, around 750 CHF per month. But this is still way lower than the average. But this will go up as my income goes up.

- Health Insurance and complementary: 767 CHF. In 2018, we only spent 467 CHF per month on health insurance. However, Mrs. The Poor Swiss was only here for seven months in 2018. In 2019. we are now paying 790 CHF per month on health insurance. Our health insurance spending is higher than the average! However, it is not too bad since my employer pays me back my health insurance.

- Other insurances: 190 CHF. I do not know how many insurances have people, but we spend much less than that. We are only spending 61 CHF per month on other insurance. Our other insurances cost us three times less than the average!

- Donations: 177 CHF. People are much more generous than I thought. With our 170 CHF donated for the whole year in 2018, we appear cheap! We are donating much less than the average.

- Food and beverages: 738 CHF. This one is quite insane! I do not understand how people would spend so much on food. Last year, we spent 300 CHF per month on food and beverages. On food and drink, we spend less than half the average!

- Hotels and restaurants: 584 CHF. Even though we went on a honeymoon and paid twice for the flights to China, we only spent about 500 CHF per month on Hotels and restaurants. And I thought we were spending too much. We are still lower than the average!

- Clothing: 210 CHF. Unfortunately, I do not have the exact number here. For many things my wife is buying, I am putting them under the Shopping category. But even if we put the clothing and shopping categories together, we are still below that. We are probably spending around 150 CHF per month. We can probably do better on that one!

- Housing and energy: 1476 CHF. On that account, we are good. But we are not much lower than the average. We are spending 1247 CHF per month for rent and about 80 CHF per month for energy. Our housing bill is about 150 CHF lower than the average.

- Furnishings and household maintenance: 234 CHF. This one is relatively difficult to estimate as well. But we are not spending that much. Since we are renting, our maintenance costs are low. And we do not buy many pieces of furniture. I would say we spend about 75 CHF per month there. Our expenses there are much lower than the average.

- Health: 244 CHF. It seems that we are quite lucky with that one! We only spent about 55 CHF per month last year on health costs. Our health bill is pretty good! Our health expenditures are four times lower than the average.

- Transport: 770 CHF. We mostly drive our car, and it seems it is doing an excellent job at keeping us under the average, with only 438 CHF per month. That is about 40% less than the average!

- Communication: 188 CHF. This average is quite close to our monthly expenses of 146 CHF. However, this year, I have reduced our internet bill by 20 CHF per month. So I may be able to reduce that amount further! We will see at the end of the year! So we are slightly under average!

- Entertainment: 542 CHF: This one is tough to estimate for us. If we put together the gym, books, concerts, what I pay for games, and my home automation gadgets altogether, we arrive at something like 200 CHF per month. We are frugal on account of entertainment!

- Other goods and services: 324 CH. Once again, it is a bit difficult to compute something so broad. But I would say that between the miscellaneous shopping, some gifts, and some fees, we should be around 200 CHF per month on that one. We are probably doing well!

Overall, the average Swiss household spends 7667 CHF per month. In 2018, we spent about 5333 CHF per month. It seems we are well below the average. Staying below the average is a good thing! Even though I think we can do better. My goal is to keep our expenses below 5000 CHF for 2019.

We can see that the average Swiss is not frugal! However, they have a nice enough income to have an average 17% savings rate. This savings rate is not as bad as I thought. I know a lot of people who do not save that much. Such a savings rate is fine if you want to retire at the official age. However, it is not enough for early retirement.

Average Swiss Couple Household

So far, we have compared all types of households together. However, the Federal Statistics Office has much more information available. All the data in the first study can be split and viewed as subparts. For instance, the data is available per:

- income range

- region of Switzerland

- kind of family (single, couple, kids, no kids)

- age

It is fascinating to look at these statistics. For instance, I have found the data for Swiss couples without children for 2014. Unfortunately, this data is unavailable in English, only in the three national Swiss languages.

On average Swiss couples without children of age, less than 34 spend 7940 CHF per month. This level of expenses is even more than the average Swiss household. On the other hand, they have an even higher income. Overall, they have about a 22% savings rate. It is significantly better than the average. Now it remains to be seen if this is real savings or if this is used for holidays. I know people who spend a lot of money on vacations every year.

Unfortunately, the data for my canton in Switzerland is not available. This data is only available for the largest cantons in Switzerland. Interestingly, the average income varies from 6000 to 9000 from one canton to another. The differences between cantons in Switzerland are large. It also means there are some good opportunities for geo-arbitrage in Switzerland.

If we look only at people in our income bracket, the average monthly expense is 7393 CHF. Once again, we are doing great! Even though we only have a single salary, we still earn more than the average. And since we are also spending less, we seem good!

What can we improve?

The fact that we are spending way less than the average Swiss household does not mean that we should not improve our budget further.

Our goal is to stay below 5000 CHF per month. However, we will need one more room once we have children. Even with higher rent, we can stay below 5000 CHF per month. Therefore, we must improve our current budget significantly if we want this to happen.

The first thing I believe we have to improve is the miscellaneous shopping that we do. Mrs. The Poor Swiss tends to buy too many clothes. And I tend to buy too many gadgets. Even though this does not account for a lot of money overall, it is still easy to reduce.

Another thing that I believe we can improve is our power bill. This one is entirely on me. I have several servers at home that are running all the time. I already improved our power consumption a lot since I have removed three servers from my installation. Moreover, I may remove one more server by the end of the year.

Other than that, we are generally quite good at power consumption. Our lamps are almost always turned off, and we fully power off the television when we do not use it. However, if we can consume less, it would be better!

This year, we have to get better at budgeting for vacations. We achieved some very frugal holidays, like when we went to Orléans in France. But, overall, we are pretty bad at budgeting for vacations. This year, I will work on that for our Summer vacation.

Conclusion

When we compare against the average in the Personal Finance community, we are spending a lot of money. However, when we compare it against the average Swiss household, we are not spending much money. We are spending much less than the average household with our income or the average household of couples without children.

It is good to know that we are not spending too much compared to the average. Your expenses will, of course, depend on where you live and where you work. So some comparisons are often made between apples to oranges. Even though one household may not be great when compared to another one in another country, it may still be doing great in its own country. It was about time to compare oranges and oranges!

Even though we are not spending much money compared to the average Swiss household, we can still improve. We have to reduce our power expenses. And we have to learn to better budget for vacations to avoid getting out of our budget. Nevertheless, after all this data, we can feel good about our level of expense!

Now, the taxes we pay will increase significantly in the coming years. So, we will probably consider our expenses without taxes for our goals.

If you want to learn more about Switzerland, I have collected many personal finance statistics about Switzerland.

What about you? How do you compare to the average household?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Personal Finance in Switzerland

- More articles about Save

- Is inflation in Switzerland really that low?

- How to Get Swiss Driving License as a Foreigner

- How to Get Swiss Marriage Visa for a Chinese

I took some time to check and compare our numbers with the average Swiss household as you did. This is for 2 adults living in Switzerland, based on the numbers of the first months of 2019:

– Taxes: approximately 580.-

– Health insurance: 460.-

– Other insurances: 120.- for the car + household insurance

– Donations and gifts: 40.-, only as gifts, no donations

– Food and beverages: 400.-

– Hotels and restaurants: 200.-, this is an average as I have included the holidays rents, some months this will be nearly 0.- and some months much more

– Clothing: 80.- at most

– Housing and energy: 970.-, with 400.- for the interests, 300.- for the « amortissement », 220.- for the PPE and 50.- for the electricity

– Furnishing and household maintenance: 50.-

– Health: 40.-, I hope that we stay as healthy as we are today, we are almost never sick.

– Transport: 400.-, with 70.- for gas and 330.- to decrease the car value each month

– Communication: 135.-

– Entertainment: 200.-

Total: 3625.- / month

Our combined take home salaries are approximately 7300.-

This is more or less what I expected, and I am happy to see that we are doing fine compared to the average household. The thing is that I don’t really feel like we are missing on anything. Of course our salaries could buy us a big german car instead of a reasonably sized one, we could live in a bigger apartment, or we could stay on fancier hotels in vacations,… but why ? Just to spend more and comply with the norm? Both of us were never used to luxury being kids and I guess we kept this mindset. You don’t miss what you never had :)

Hi Bsam,

Thanks a lot of sharing your detailed expenses!

This is very impressive for two adults! The housing costs are especially awesome! 50% savings rate on average is great :)

I think the only thing where we spend less than you is Food. And that is the thing we optimize the most.

You make a very good point about not being used to luxury as kids! I am in the same kind of situation. We never missed anything when we were kids, but we never had luxury things either. As a result, I am not so much for luxury.

Thanks for stopping and keep it up with the great expenses!

Our housing costs are lower since this year because we bought an appartement. With these low interest rates and the classic 20% downpayment we basically pay a bit more than 900.- for a flat that otherwise would cost us 1400/1500-. to rent. And on top of that, these 900.- include 300.- that goes to build our equity. I think we made a good choice to buy.

As for the budget food, I love cooking and I don’t mind spending a bit more on quality products that I buy on the local market. This budget could be a little bit lower but this is my guilty pleasure ;)

It seems very cheap indeed! Well done!

Current interest rates make us want to buy as well. However, we do not have enough cash ready for that yet. And it is difficult to find a place that suits us both :P

Guilty pleasure are very good :)

I could personally save a bit more on my Tech stuff, but I really enjoy it!

We are family of four, and we spend around 15.000€ for one year, but we have our house without debt. Our health and pension insurance is not included in budget. In my country health and pension insurance are payed from my gross salary by employer.We all have same health insurance, and it only includes state hospitals.

We have two cars, and about 17% of budget we spent on car maintenance, fuel and car insurance.

About 20% of budget we spent on kids activity(kindergarden, sports, foreign language). We have not any help frome state for kids like in Switzerland(200CHF/month for one kid). We all have same tax rate, so we are all in same tax class. Number of kids is no relative at all.

We live in emerging markets country in Balkans, and our home budget is much bigger than average.

Average net sallary in my country is 500€:)

Hi Luka,

Wow, that’s crazy low indeed! Congratulations :)

Is that considered low as well for your country?

17% on car budget is a lot, but I guess if you remove rent/mortgage, it makes sense.

Yeah, in Switzerland, there is some help for kids, but the more salary you get the less you will get. But we can’t really complain about that. Schools are really cheap for Swiss nationals. However, kindergarten is very expensive here.

Thanks for sharing your details!

You guys are doing fine I’d say! Comparing to the average FIRE person is difficult, especially living in a HCOL country like Switzerland. You see that when you compare yourself to the Swiss, you’re living on less.

If you were to compare against me, you would lose big time (my yearly spending is around 20-22k EUR). But then you would have to consider lower income and higher taxes and then the picture becomes different.

All in all I’d say you don’t have to worry, and really if you can shave off bits and pieces still you’ll be better every year!

Thanks B!

Yes, after having done, I think we are doing fine. However, there are many things on which we are still overspending for my taste. But maybe it’s my love for optimization who’s talking ;)

Haha, yes, you spend about a third of what we spend :P

I don’t really worry, but I want to optimize it further. I am pretty sure we can do better.

Thanks for stopping by and good luck with your own optimization!