Spending less will not make you rich

| Updated: |(Disclosure: Some of the links below may be affiliate links)

I want to touch on an important subject today, the biggest lie of personal finance. You will often read success stories from people getting rich by tracking their expenses and having a budget or doing simple things.

However, these stories often miss some critical context. In practice, you will not get rich simply by spending less. You may save more money, but this is quickly limited, especially in such an expensive country as Switzerland.

So, I want to discuss the problems with this biggest lie in personal finance.

Success stories

If you are reading personal finance blogs and news, you have probably read these kinds of stories:

- 38-year-old retiree: America, stop wasting your money on these seven things – if you want to retire early

- Live by these five rules and become rich

- Our six steps to retire by 40

There are many stories like that on websites like CNBC, Forbes, and Marketwatch. But this does not mean these stories are good for the readers.

They all discuss how everybody can get rich easily by following simple rules. The simple rules or habits generally are tracking your expense, budgeting, focusing on your financial freedom, and cutting down on spending. They often suggest cutting down your daily coffee will save you so much money.

The problem is that most of these stories miss the main point: people do not retire very early by spending less – people retire very early by saving a huge portion of their income.

We have seen before that your savings rate is the driving factor for the time it will take you to retire. And there are two ways to get a very high savings rate:

- A very high income

- A very low level of expenses

Many early retirees in the United States live in a trailer or have 300K USD or more in income when they retire. Neither of those things is something that everybody can do.

So, why do these blogs and news outlets share these stories? Simply because they sell! People want to hear that things are easy and they can get rich without doing much. If you tell people that it is hard to retire at 35, they will not like it. And websites only want to write about things that make their readers happy.

Income is a crucial factor

Many people do not want to read this: Income is an essential factor in reaching financial goals.

Optimizing your expenses is excellent, no doubt about this. But you quickly reach a point where you cannot spend less without living in an RV or in the woods. Many people do not want or cannot live like that.

So, if you want to increase your savings rate without decreasing your expenses, you only have one choice: increase your income.

Unfortunately, increasing income is not as simple as reducing expenses. And some jobs indeed have more opportunities than others. That is not to say that people cannot increase their income. However, increasing income is easier in some careers than in others.

There are many ways to increase your income:

- Focus on your career

- Develop a side hustle

- Invest in bonds, stocks, or other assets

Ultimately, it mostly boils down to building your human capital and investing in income-generating assets.

Most people do not have money to save

Another problem with saying people can become rich by spending less is that most households save very little. Sure, they could cut their expenses a little, but the capacity to lower their expenses is extremely limited.

I looked at savings statistics from The Federal Statistics Office (FSO). I am using data from 2015 to 2017, the latest available for the data I am looking for.

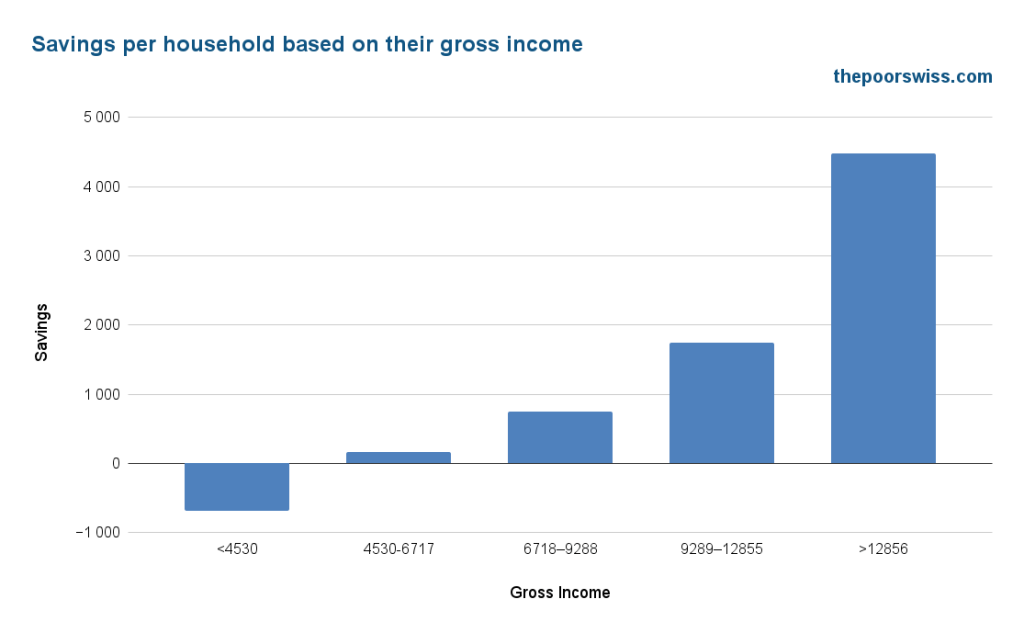

This graph shows how much each 20% of households save, based on their gross income. We can see that 20% of the population does not save money in a month. And the next 20% save less than 200 CHF per month. 60% of the households in Switzerland save less than 1000 CHF.

Asking a household with less than 4500 CHF in Switzerland to accumulate 1.5 million CHF by age 40 to retire early is unreasonable. To retire early, such a household would need to spend extremely little. They would need to spend so little that they could not live in Switzerland.

But people will argue that people are not careful with their money. And it is entirely accurate. Most people are unaware of how much they save and how much more they could save.

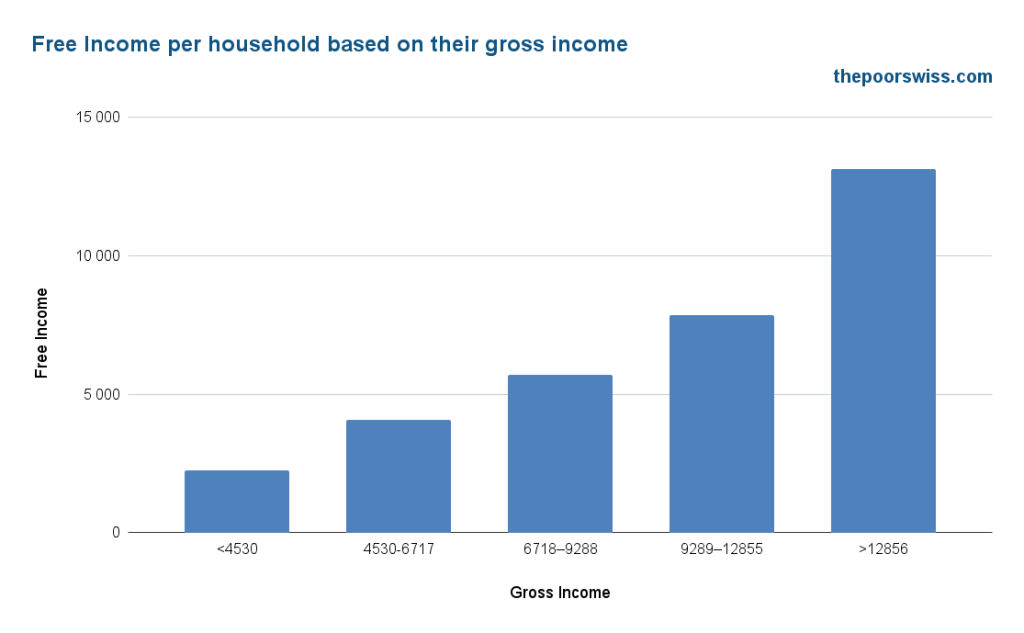

But we can look at another statistic, the free income of these same households. The free income is how much you have left after mandatory deductions, taxes, and health insurance.

We can see that most households have a significant amount of free income. But at this point, they have no places to live, nothing to eat, and nothing to wear. At the very least, you will need 1500 CHF to live in Switzerland, which is very low. We are talking about the bare minimum to survive, not live.

So, the 20% of households that earn less than 4530 CHF, with a free income of 2249 CHF on average, removing 1500 CHF to survive, would have about 750 CHF left. So, the best savings rate they could achieve is about 24%. Based on the 4% rule, this would take about 32 years to achieve “early retirement”.

And again, that is with barely surviving and not counting any insurance, health costs, no leisure, and no transportation. This is an unrealistic lifestyle.

Even the next bracket would only save about 44% by barely surviving. But if we take what they spend (based on the statistics), remove everything unnecessary, and remove 20% of that total (assuming they can save more), they would only get about a 27% savings rate.

Even doing the exercise for the third bracket would give a 32% savings rate. This is not necessarily the best they can achieve. Some people can save more than that. But again, it depends on the lifestyle you want. And we are talking here bout necessities. I have not included leisure, going out, or even communication as a necessity.

Also, I have considered that people can cut their expenses by 20%. For most households, this is already difficult.

We can take our expenses as an example. We are not big spenders but also not minimalists. Without taxes, we spend an average of 4500 CHF to 5000 CHF monthly. Considering such a lifestyle, you would need at least 10’000 CHF of net income after taxes to retire in less than 17 years. And this is with a perfect track record.

Having such an income generally means a few years of study. So, starting work at 25, having an average savings rate of 50%, would take you a retirement of around 42. It is not bad, but not early enough to be on the news. And once again, this is with consistent savings and investing over 17 years, something most people can’t achieve.

These results show that you need a significant income to become financially independent (or rich) early. And this also shows that extremely early retirement needs a very high income or surviving on nothing (living with your parents or in an RV helps).

Getting rich is pointless

It is also essential to realize that getting rich is pointless. Having a million dollars will not change your life in one day. Many people think that becoming rich is what they want. But most people can have a great life without being rich. And being rich will not make people happy.

What matters with money is that you have enough money to not worry too much about it and live the life you want.

I want to achieve financial freedom to be independent of my day job. This would bring me security. But achieving this goal will not change my life entirely.

If you are living a sad life now, becoming financially free will not make you happy suddenly. Many people have discovered after early retirement that they were happier before. And many people have burned out on their trip to financial independence because they focused too much on their end goal and not enough on their current life.

Conclusion

It is essential to realize that early retirement or getting rich is difficult. And in fact, it may not even be possible for many people. This is not great, but this is how things are.

Too many online articles perpetuate the lie that early retirement results from a few good spending habits or a good budget. But in fact, it all boils down to having a huge income, which many people will not have, or having an absurdly low level of expenses (think living in the woods), which many people would not like.

There are no secrets to becoming rich! What matters most is building your human capital and investing in income-generating assets. Reducing your expenses is less important.

I am probably guilty of making several articles too optimistic about early retirement. Please let me know if you feel like this, and I will try to amend these articles. I have never considered early retirement easy. Early retirement is simple but far from easy.

I also do not want this article to be too negative. Most people spend too much and do not realize it. Cutting your expenses will help your financial goals. Depending on your goals, it may even be enough. But do not leave income out of the equation.

The term “Biggest lie in personal finance” was coined by Nick Maggiuli, a famous blogger. I recommend reading his article on the subject if you want to know more.

What do you think about this issue?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Manage your money

- More articles about Save

- 8 Good Habits of Financially Successful People

- How Millennials Can Get Rich Slowly Book Review

- 11 Personal Finance Myths You should ignore

Hi

Great article again, it gives a very realistic view of how hard it is to reach fire. Even when cutting cost you should still not forget to invest, just saving won’t do it.

More importantly, what is rich. I don’t think it’s a number. I believe it’s a feeling that is different for everyone. It can be the feeling that you have enough in savings, that even when losing all your income you still have enough to live off for a year. Having a job that makes you happy. Having time enough to spend with your family. Stand on top of a mountain or the shore of a lake and enjoy the beauty of this country.

My wife and I have been on the fire journey for 5 years now and progressing steadily. Nevertheless, we consciously decided to reduce working hours and switch to a less stressful companies/jobs, meaning less income but have more time to spend with our 3 young children and our personal hobbies. We save (invest 😉) less but I feel so much better. I guess I could say I am rich already.

Hi Joost

Yes, rich means very different things to different people. Even I and my wife don’t have the same view here :)

It makes a lot of sense to spend more time with your children, this is very rich and will pay back dividends for them! Well done!

THANK YOU BAPTISTE for this brillant read. It makes a lot of sense. Talking on income and savings, lifestyle in Geneva, Switzerland (do I want to live in a RV?), and about those articles who are here to make us “happy” actually end up misleading us in some way.

I am very relieved you wrote this article, I think it helps me manage my expectations and that it’s OK, I am doing whatever I can, but I can’t do more. It’s a great reminder to focus on our current life (being rich will not bring you the happiness you expect it to).

At the end of the day, there is joy and serenity in just being realistic in your own shoes, while saving and investing as much as one can.

Much needed gentle reminder for me today, thank you very much for your very poignant and spot-on words 🙏🏽🙏🏽🌸🌸

P.S. I never felt negative while reading your previous articles nor this one. I enjoy reading you because you’re very practical, hands on and insightful as well as meaningful in a spiritual way, if I may add !

I am glad you like it! Thank you for your nice words. I am happy my articles can have such impact!

These articles are indeed very misleading, giving people what they want (shortcuts) instead of what they need. Being realistic and ready to put in hard work is what we need!

Hello,

Thank you for this very interesting article.

What’s the definition of being rich?at least in Switzerland. Is about net worth?income?both?how much?

Thanks a lot

Best regards

Hi Matraca

Good question. I would saya rich means multi-millions and not caring about expenses anymore.

This article was mostly triggered by stupid articles claiming you can get rich by doing small things and ignoring all the context.

“We are not big spenders but also not minimalists. Without taxes, we are spending an average of 4500 CHF to 5000 CHF per month.”

This is just crazy to me. Just housing and health insurance is half of that for our 3 person houshold in Lucerne.

Hi

We may live in a cheaper place. Housing is about 525 per month and health insurance is about 800 CHF, so less than a third of our average expenses.

What do you do about setting aside the recommended 1% of house value for maintenance?

We could add to our emergency fund, but we decided that for now these maintenance should be planned ahead. if something really unexpected arises, we have several ways to get the money, including credit card and margin loan.

I agree with you. Rent in Geneva is around 3k per month if you have kids and health insurance is minimum 1k more, so you need roughly double that only to make hands meet. 8k or 9k net in expenses is the bare minimum unless you don’t want to eat or clothe yourself. And this cutting out everything else, of course, considering a Spritz in a bar here is 14 CHF!

Wow, it seems like Geneva is on another planet for expenses.

…and a bad place for spritz!

Yes I confirm: Geneva is terrible in that way!

I checked the OFS figures for rent and taxes: highest taxes AND highest rent (higher than in Zug and Zurich).

Even though I have a good salary, being single and no kids, I pay more in tax than on my rent (and my rent is chf 1700 for a 47m2).

Anyway, it’s what it is in Geneva, I grew up here and like my hometown enough to work and live here, with my friends and family, and its glorious Jet d’Eau on the Lake of Geneva (hmm Lake Leman ;))