May 2021 – The house strikes back!

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Overall, May 2021 was a good month, despite the crappy weather. We had some opportunities to see our friends and family again, and we feel like life is slightly going back to normal.

But from a financial point of view, it was not a great month! We had to pay a large bill for the house. So despite a good income this smooth, we did not save any money this month, and our net worth fell for the first time in a long time.

So, let’s see what happened in detail!

May 2021

May 2021 had the perfect balance for personal events. We could see friends and family. And we could even celebrate a wedding in the family. The only downside of the month was the crappy weather with mostly rain.

The big thing this month in our expenses is the enormous bill we paid for the house for the transfer of owners for the land register. We have been waiting for this bill for almost a year now. It is also the largest bill I have ever paid, at 23K CHF!

As a result of this single bill, our savings rate is zero this month. This month marks the first time in a year we have not saved money in one month. And it is the first time in a long time that our net worth decreased that much in a single month.

However, even though it is not great, I do not feel bad about this result. We were expecting this bill for a long time. At least now, the bill is paid. And there should be only one bill left for the house. Hopefully, it will come soon so that these expenses are behind us.

Expenses

Let’s see the details of our expenses in May 2021:

| Category | Total | Status | Details |

|---|---|---|---|

| Insurances | 745 | Average | Health insurance |

| Transportation | 69 | Average | One gas refill and many small bus tickets |

| Communications | 70 | Average | Internet connection and services, no phone fees this month |

| Personal | 2105 | Above Average | Many large health bills, a wedding gift, some clothes, and some various bills |

| Food | 378 | Above Average | Slightly more groceries than usual |

| Housing | 23760 | Highest ever | The big housing bill for the land register |

| Taxes | 1130 | Below Average | Only the bill from the canton |

In May 2021, we spent 28260 CHF in total! This month is by far the most expensive month we have ever had! Before that, we had one month with 15K, but May 2021 is almost twice as expensive! Without taxes, this amounts to 27129 CHF. And without taxes and the big house expense, this amounts to 3814 CHF.

As mentioned before, the big expense in the Housing category is the bill for the official transfer of owners from the land register (droits de mutation in French). This bill pays for the change of ownership in the official registries. It is quite expensive in my opinion, but there is nothing we can do about that.

When we consider our expenses without this bill, they are fairly reasonable. At 3814 CHF, we are still beating our current goal of spending less than 4500 CHF per month.

We also had some large health bills this month. But these bills will be paid back next month. So, our expenses in May 2021 are relatively good!

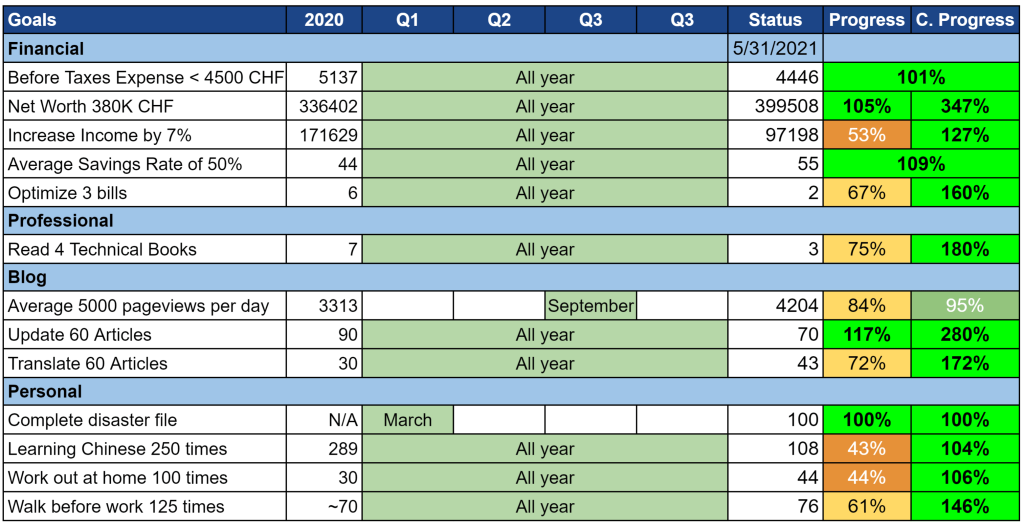

2021 Goals

Let’s take a look at the status of our 2021 goals at the end of May 2021:

Overall, our goals are doing great! Our net worth went down, but not enough that we not still on track to meet our goal. We will see once we have received the final bill we are waiting for, for the house. And our savings rate of 0% was not enough to bring our average below 50%.

The only goal that is not on track is the blog page views goal. At this point, I do not expect to meet this goal unless there is a significant shift in traffic. But I can live without that. The blog is doing okay.

So, I am pretty happy about the progress on our goals. I do not plan on doing a course correction. Everything is doing okay!

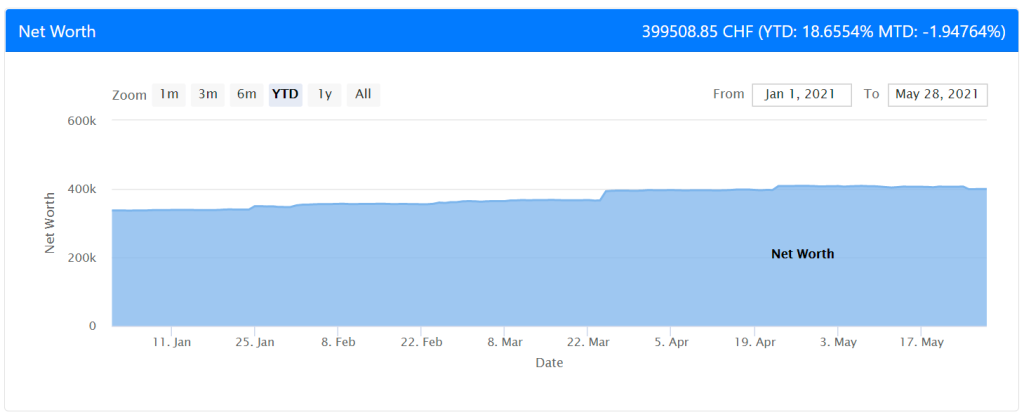

Net Worth

Let’s take a look at our net worth as of May 2021:

Our net worth at the end of May 2021 stands at 399K. We went back down below 400K but not by a long shot. Indeed, for the first time in a long time, our net worth went down.

In the previous months, many readers asked me why my net worth did not drop after purchasing the house. Here is the drop! With the huge bill, our net worth this month fell by about 10K. We are still waiting on the notary bill, so there should be another drop soon. We were expecting these bills earlier, but it seems that it takes many months for the bills to come.

Other than the big bill, nothing interesting happened on our net worth. I am still very happy about where it is.

The Blog

I do not have much to report on the blog this month. The traffic went back up a little, but this was due to one of my articles being linked in a popular Youtube video. It is great, of course, but this kind of traffic does not last.

I did not do anything special on the blog: new articles, updated articles, translated articles. This is the usual I do on the blog every month. I plan to continue working like this next month. I should probably have done a little more this month. But I was not very motivated to spend many hours on the blog honestly. We will see if I can get more motivation next month.

If you had to read only an article this month, I would recommend reading how to make money online with surveys and let me know what you think about this kind of article.

Next Month – June 2021

In June, I do not expect anything out of the ordinary. We will have a short vacation in Switzerland. That will be good to relax a little! Other than that, it will be a standard month.

As for finances, we will probably get large tax bills. They usually come in June. So this will hurt our finances again. But this is expected by now. And this should smooth out over the years.

But enough about me? How was May 2021 for you?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

I have a question, should we consider the value of the house a part of net worth?

Hi Katie,

Yes, the house net value (house total value – debt) should be taken into account in the net worth.

However, if you are using your net worth for Financial Independence, you do not want your house inside since you can’t sell it without moving elsewhere.

Thanks a lot.

That was very helpful.

How do you pay so little for taxes? Is it the municipal deposit? What marginal rate do you have, respectively taxable income? Thank you

Hi,

As indicated in the table, this is only the cantonal (state) bill. So my taxes are more than twice higher than this since I have not yet started to pay federal and communal taxes this year. My marginal tax rate is something like 35%.

P.S. There is no need to post your comments several times, I go through all comments once I get the time.

Hi thank you very much and sorry for the double comment it was my mistake. It is therefore the down payment, which is why the tax burden will be equal to

1130×3? I cannot understand how this is possible given your income. On average how much can you deduct from your income?

thanks

No, that’s not correct.

That’s the monthly bills. I get 9-10 monthly bills from the commune, 9-10 monthly bills from the canton and about 6 monthly bills from the federal level. This is the standard way of paying taxes in Switzerland.

In total, I will pay more than 30’000 CHF in taxes this year.

Thanks so much for the clarification, congratulations on your site and all the work.

Omar

Well, it might be the standard way in Fribourg. Or did you choose the monthly system?

I only pay three tax bills per year in Zurich. One for the federation, one upfront payment for the current year for commune/canton combined and the final payment with the missing difference for the commune/canton combined. If you pay more than the required amount then only two payments per year are necessary.

30k+ taxes with 35% marginal tax rate… Guess that is the price you pay when living outside of the Swiss “tax havens” and with a high income.

Here, you have the choice between paying in one bill or “monthly” (from 9 to 10 bills depending on the tax level. Currently, you get very low (0.5% I believe) interest if you pay at once, so I do not do it.

Here, the bills for the commune and canton are not combined.

Yes, Fribourg is definitely not a good place to live with a large income compared to other better tax cantons.

What I don’t really understand is why you don’t save for those bills beforehand by having virtual expenses for the last 12 months? I only pay one tax bill a year but on my budget there’s still a tax expense for each month. Otherwise you end up with months where you “save” 90% and other times you save 0%…

Simply because I want to track my real expenses, not some made-up virtual expenses. If I did not save any money during one month, I want it to show on my budget. I personally do not understand people using virtual expenses.

We had the money ready and we have still enough cash for the following house expenses, it’s not a problem.

Well you could pay your taxes for the following year in December (hence diminishing your fortune from a fiscal standpoint and sometimes getting an interest for in advance payment) and divide it by 12 or 9 or 10 in your case (Neuchâtel canton?) if you want to account monthly…

Hi Pedro,

I pay my taxes monthly (Fribourg canton) and we get 9 or 10 bills depending on the level of taxes. So, I also account for it monthly. The only year I paid entirely at once, I accounted entirely at once.

For me, it just makes sense to account for bills the same way I am paying. It’s also easier. I do not want to work to make my budget look better, it needs to be real.

I would like to add that I always thought the number of bills you receive to pay taxes are just out of convenience (4 or 9, 10). I always pay monthly ~1300.- all year round (12x) with the information from the first bill I received and don’t consider the number of bills (canton & municipal). So far I never had any issues and that in multiple cantons and municipals with this approach.

That’s true indeed, you have some liberty on these bills. In most places, you should be fine by doing what you want with them as long as the reference numbers are fine.

But I would still recommend contacting them before doing that to be sure.

I do not mind paying them only some months, but it’s true that having 12x bills would flatten my budget :)

Hi Poor Swiss, can you please elaborate on how you keep the food expenses so low (378 CHF)? Thanks!

Hi A,

I have an article where I talk about how we keep our food budget low.

Basically, we almost never go out to eat and we only shop at Lidl and sometimes go to Aligro to pile up on meat.

Hello!

I agree that the ownership tax is a very big one and wonder if you could share how it was computed.

All my best

Ioan

Hi Ioan,

Are you talking about the bill I just paid or about the rental value tax?

The bill I just paid for the change of ownership will be computed differently in each canton. The logic should be the same but the percentages will vary. In my canton, Fribourg, I had to pay 1.5% of the value of the house to the canton and 1.5% of the value of the house to the commune, so a total of 3% plus some fixed costs that are not significant compared to the 3%.

Does that answer your question?