Margin Loans – Borrow money from your broker

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Today, I want to touch on an important but controversial topic: margin loans. A margin loan is a loan with collateral that most brokers offer.

Brokers let you invest on margin, with an amount based on the value of the stocks you have with them. You can use this form of leverage to either invest with leverage or borrow money from your broker.

This article will cover everything you need to know about margin loans.

Margin Loans

A margin loan is a loan against the value of your securities. So, the more securities you have in your broker account, the higher loan you can get. You can then use this extra money either to invest more (use leverage) or to use the money for other expenses should you need up.

In Europe, margin loans are often called Lombard loans. This name comes from the Lombardy region, where it is said to have originated. But they are the same thing.

So, why am I talking about margin loans? Aren’t they very risky? Yes, they are risky, but they are also very interesting.

For me, margin loans have three significant advantages:

- They give you a substantial line of credit should you need a large amount of cash for an investment opportunity or significant expenses.

- They can allow you to take advantage of market conditions to invest more aggressively.

- The interests you pay to your broker are deductible from your taxable income.

For most people, point 1 is the more interesting of the three. Indeed, this can allow people to reduce their emergency funds since they can draw large amounts of money from their broker accounts without selling stocks.

Point 2 is also interesting, but you must be careful about this. Indeed, by investing with leverage, you are multiplying the risks.

A margin loan is still a loan, so it will not be free. But depending on the time, it can be very cheap. And for a short time, this will be much cheaper than credit card debt.

Each broker has different margin requirements and different conditions for the margin loans. So we will use two brokers as examples: Interactive Brokers and Swissquote.

It is important to note that not all brokers have the same kind of requirements, especially if they are in different countries. And some brokers allow you to be more aggressive than others.

Finally, both margin requirements and margin rates can change over time. So, if you are very close to the limit, you may be in trouble if the margin requirements change.

Interactive Brokers Margin Loans

The broker you need to buy stocks and ETFs reliably and at extremely affordable prices. Trade U.S. stocks for as little as 0.5 USD!

- Extremely affordable

- Wide range of investing instruments

Since each broker can provide different conditions for margin loans, we should take a broker as an example. We take Interactive Brokers (IB), my favorite broker, as an example and see what they offer for margin loans.

We start with their margin rates. IB uses a system where you pay different rates based on your borrowed amount. The more money you borrow, the cheaper it will get. On top of that, the rates are not the same for IBKR Pro and IBKR Lite. Since IBKR Lite is unavailable in Switzerland, I will only cover IBKR Pro here.

I also must repeat that margin rates are adapted all the time. So, I can only cite the margin rates at the time of this writing (March 2023). For instance, here are the margin rates for USD:

- Below 100’000 USD: 6.07%

- Between 100’000 and 1’000’000 USD: 5.57%

The rates can go even lower, but most investors will never borrow more than a million from IB. If you have a loan of 200’000 USD, you will pay rates per tranche: 6.07% on the first 100’000 USD and 5.57% on the second 100’000 USD.

We can see that the margin rates are currently expensive for USD. The reason is that federal banks are now increasing rates to fight inflation. Three years ago, these rates were much lower.

We can also look at the rates for CHF:

- Below 90’000 CHF: 2.281%

- Between 90’000 and 900’000 CHF: 1.781%

We can see that margin rates on CHF are significantly lower than on USD. Historically, the interest rates set by the Swiss National Bank have generally been considerably lower than those set by the Federal Bank in the US. This is good news if you need a loan in Switzerland.

We can see the margin requirements now. The margin setup at Interactive Brokers is relatively complicated. First, the default account type (cash) does not allow you margin. So, you must use a different account type. Then, Interactive Brokers has two different margin accounts:

- Margin accounts that obey Regulation T margin requirements, a rule-based system.

- Portfolio Margin accounts that obey risk-based systems.

Portfolio margin accounts have more complex rules and eligibility. Therefore, I will focus on margin accounts. But it is essential to know that portfolio margin accounts allow greater leverage. Therefore, aggressive investors will prefer it. But for some simple investors, this should matter.

So, with a margin account, you can borrow 50% of the value of the securities you own. So, if you have 100’000 CHF in securities, you can borrow 50% of that value. This 50% is known as the initial margin.

This initial margin also allows you to invest with a leverage of 2:1 (100/50). This means that if you have 10’000 CHF in cash, you can invest 20’000 CHF in stocks. It also means that if you have 10’000 CHF in securities (fully paid), you can buy an extra 10’000 CHF in stocks.

The initial margin requirement is for holding the margin overnight (while the markets are closed). A second margin requirement is the maintenance margin that works for intra-day holding.

The maintenance margin requirement is only 25%. This means you have a leverage of 4:1 (100 / 25). So, if you have 10’000 CHF in cash, you can buy 40’000 CHF of securities with it. But you have to make sure to reduce the margin before the end of the trading day.

I recommend never using the maintenance margin. Only active traders should use it. Even a margin of 50% (initial margin) is already very aggressive.

For most people, it is enough to summarize that you can withdraw up to 50% of the value of your stocks and that you can invest with a leverage of 2:1.

Swissquote Margin Loans

Everything you need to start investing in the stock market! Open an account with Swissquote and get 100 CHF in trading credits with my code MKT_THEPOORSWISS.

- Swiss broker

- Easy to use

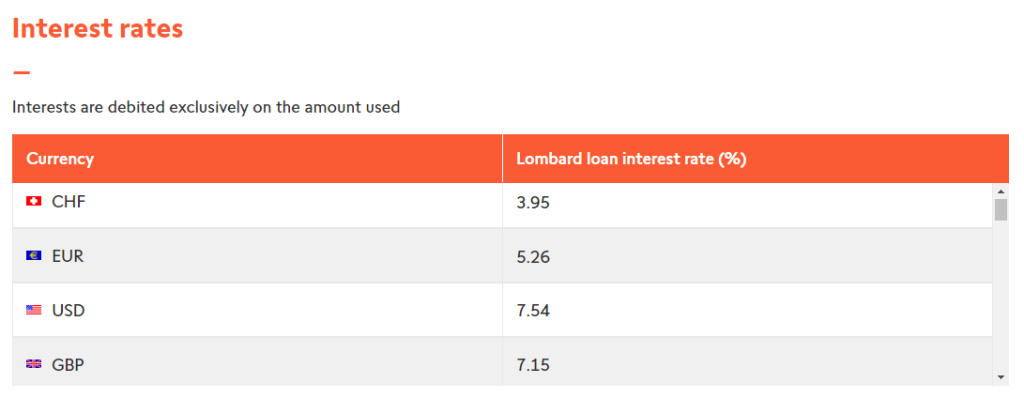

We can also take the example of a Swiss broker, Swissquote (SQ), to see how they compare. Swissquote uses the name Lombard loan instead of margin loan on their website.

Swissquote uses a straightforward system for margin rates. They only have one margin rate. It is not a tiered system. Here are the current margin rates as of this writing (March 203):

- CHF: 3.95%

- USD: 7.54%

We can see that these rates are significantly higher than those offered by Interactive Brokers. Swissquote has a much higher premium on these rates. Swissquote premium is twice higher as IB’s premium. And the premiums of IB are clearly shown on the website, while SQ does not share this information.

We should also look at their margin requirements. Unfortunately, they are not very transparent and only cite the maximum margin. For stocks, SQ will lend up to 70%. And they will lend up to 90% for bonds. But in both cases, it can depend on the quality of the stocks or bonds. So, if you buy a very stable stock or ETF, they will lend you more than if you buy a stock of a volatile company.

So, if you have 100’000 CHF of stocks, you can get an extra 70’000 CHF margin loan. You must always meet the margin requirements, so be careful not to be too close to the limit.

Getting a 70% loan is relatively high. So it is a great way to get a margin loan to get money out of the broker. However, that loan will be pretty expensive. Nevertheless, this allows significantly lower leverage than Interactive Brokers.

So, Swissquote margin loans are very straightforward. SQ allows you to be aggressive with up to 70% in loans. However, there is a hefty premium on top of the market rates. So Swissquote loans are not cheap.

Is margin risky?

It is essential to discuss the risks of margin lending. I want to discuss the risks for both cases:

- A margin loan for an expense or an opportunity.

- A margin loan to invest in securities.

Are margin loans risky?

Yes, margin loans can be risky. The main risk is that you do not fulfill the requirements, and the broker liquidates your stocks. If this happens at the wrong time, you may lose much money.

For our examples, you have 100’000 CHF in stocks and can borrow 50% of the value.

First, we will assume you are taking a margin loan to take money from your broker. You are not investing this money. It is outside the broker, and we assume it is not following market returns.

We start with a first simple example that is not too risky. You decide to borrow 10% (10’000 CHF). Then, the stock market fell by 50%, an extreme example, but one that happened in the past. At this point, your stocks are only worth 50’000 CHF, and you now have a 20% margin, twice more than what you started. Fortunately, in this case, you still meet the margin requirements and can keep your loan.

In another example, you borrow 50’000 CHF. Then, your stocks fall by 50% again. At this point, your margin is 100%, higher than what is allowed. The broker calls your margin and liquidates all your stocks to repay the loan. Your stocks have been liquidated at the worst possible time.

In this last example, if the stock market falls by more than 50%, you would be left with a negative value on your broker. If that happens, you must reinject cash into the broker to repay the debt.

So, in these cases, margin loans are already risky because your stocks can be liquidated, and you will not be able to stay in the market to recover. However, the worst you can lose is your entire portfolio, not more.

Is investing with leverage risky?

Yes, investing with leverage can be extremely risky.

If you use leverage (margin loan to invest more), your margin and stocks are at risk. You could lose more than what you have. We can take some examples again.

First, you borrow 10% (10’000 CHF) and invest in stocks. You now have 110’00 CHF in stocks and 10’000 CHF in debt. The stock market fell by 50%, you have 55’000 CHF in stocks and 10’000 CHF in debt, and your net worth is only 45’000 CHF. Your loss is more than 50% of your stocks. Since you have avoided a margin call, you may still recover.

In the second case, you borrow 50% (50’000 CHF) and invest in stocks. You have 150’000 CHF in stocks and 50’000 CHF in debt. The stock market falls by 50%. Your stocks are only worth 75’000 CHF, so you do not meet the margin requirements.

The broker will liquidate 25’000 CHF of stocks in a margin call. In that case, you are left with 50’000 CHF of stocks and 25’000 CHF of debt. Your net worth is 25’000 CHF, and you have lost 75% of your value!

If you borrow 50% and invest with a 2:1 leverage, you will have 200’000 CHF in stocks and 100’000 CHF in debt. If the stock market falls by 50%, you will get a margin call to sell all your stocks (only worth 100’000 CHF) to cover the debt. You are left with 0 CHF!

And if the market was to fail more than 50% in this case, you would have lost more than your entire portfolio and would be left with debt! The same is true if you have more than a 2:1 leverage.

In a good scenario, leverage will increase your returns. But in a bad scenario, leverage will multiply your losses! So, we can see that investing with leverage is extremely risky. And having high leverage is very risky.

Therefore, we can do a few conclusions regarding risk:

- You should not use a margin loan to invest in risky assets like stocks.

- You should not use volatile assets (like single stocks) as collateral for margin loans.

- You should not use a high margin. Staying below 20% makes it much safer.

How to use margin loans?

In most cases, I would not recommend using margin loans. Nevertheless, there are a few cases where it would be interesting to at least have them available. But I want to emphasize the risks related to margin loans first.

In any case, you must be careful about the costs of the margin loans. In 2023, margin loans are quite expensive, even in CHF. So you have to be cautious that you do not hold it for too long and that it is worth it.

A margin loan can be more expensive than the opportunity cost of selling stocks, depending on the margin rates.

And you want to select cheaper margin loans when possible. Looking at our two examples, a margin loan in CHF is much cheaper at Interactive Brokers than at Swissquote.

The first use case is to complete your emergency fund. It is much better to take a margin loan for a short time rather than sell your stocks if you need to cover a considerable expense. For instance, we have used this to pay for the land register instead of selling stocks. Knowing we have an extensive line of credit allows us to have a small emergency fund.

The second use case is more advanced, and I would not recommend it to most people. If you have a nice investment opportunity, this could be a great way to get cash available quickly without selling your stocks. I have never used that method, but that could be interesting for some aggressive investors. And you must be careful that this can quickly become risky if your investments fall in value together.

In any case, I would recommend not holding a margin loan for a long time. And I would also recommend keeping a low leverage (below 20%, ideally lower).

Conclusion

While risky, margin loans are an interesting tool. When margin rates are low, using a margin loan can be a great way to get a quick line of credit to complement your emergency fund.

On the other hand, I only recommend this to advanced investors who will first research how margin works. And I do not recommend investing with leverage because this market timing is unlikely to pay off for a long-term investor. Leverage should only be used for short and medium-term bets.

With Interactive Brokers, most people should use a cash account type, at least, to get started. If you start investing, having a margin account can be confusing.

Margin loans are also tightly linked to short-selling stocks, also using leverage. But short-selling is even more of a risky bet.

What about you? Have you ever used margin loans? What do you think about them?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Investing Fundamentals

- More articles about Investing

- My 11 Biggest Investing Mistakes – How to Avoid Them!

- Best Personal Finance Books

- Path to Independence – A Swiss Book about FIRE

Hey Poor Swiss,

I think your next article on Margin should be a ‘how to’ guide step by step. This would be really helpful! I understand how it works, but it is more opening an account borrowing the money, taking it out to pay back something etc.

I think this would be equally as useful as one of your previous articles such as “how to buy an etf on Interactive brokers”.

Merci à toi!

Hi James,

Thanks for the suggestion, I have put this on my list!

This is a good idea.

Hi Baptiste, thanks for all the infos !

I’m thinking about using a margin loan from IB near the end of this year to withdraw cash and then make a voluntary contribution to my second pillar in order to save on taxes for this year.

Would it be a good idea ?

Hi Antonio,

It depends on many factors. On paper it’s a good idea if you have higher returns on the second pillar than the interest you pay on your margin loan. These days margin loans are getting more expensive.

At current rates of the margin loan, I am not sure I would use them for a second pillar contribution.

Hi Baptiste,

I have a question regarding these loans. I currently hold stocks in an IB account. Would it be possible to convert say CHF 500,000 into USD using the margin loan and just hold it on my account paying interest on the CHF and earning more interest on the USD? I believe this is called a Carry Trade.

I realise I take the risk on the USDCHF exchange rate, but I am just wondering whether it would be possible?

I will need a large amount of USD in a few years. So I was thinking of locking in the exchange rate now, leave the USD sitting on my account earning high interest, and slowly paying off the CHF loan over the next few years at a lower rate of interest. As long as the USD remain in my account and the exchange rate doesn’t go haywire, then I shouldn’t have an issue with a margin call should I?

Thanks.

Oh, you mean taking a CHF margin loan, converting it in USD and getting a higher interest rate in USD than the margin loan in CHF? I don’t see what you would not be able to do it.

But as you mentionned, you have the risk of the currency exchange, on top of the margin loan risk.

I think you should be good with this strategy. But keep in mind that you do not know what will happent to the exchange. If the exchange rate is 20% better in a few years, you will have lost money with your strategy. It’s always dangerous to try to lock an exchange rate. You should really know what you are doing and be prepared for all the risks incurred. But this strategy is better indeed if you need the USD later than if you plan to convert it back to CHF.

Hi Baptiste,

Great article.

I have a question. Are you sure that it is possible to withdraw cash from margin loan?

I mean, is it really possible and allowed to change the account type to margin account and transfer money (making negative balance, margin loan) to my current account in another bank instead of using the margint loan to buy new securities?

So the margin loan could be function like a standard overdraft for current accounts (= it is possible to make the balance negative up to the limit)?

Just to give you an idea regarding my hypothetical plan:

– I would like to buy a real estate property but I don’t want to sell all of my securities and I don’t want to put all of my money into a single real estate property (=diversification)

– For that reason, I would like to borrow money to buy the apartment, but instead of a mortgage loan (which is quite cumbersome, slow and expensive) I would like to take easily margin loan from IBKR and get/transfer the cash (from margin loan) and for pay the apartment in cash. Could this work?

– Or we are allowed to spend the margin loan only for buying new securities in IBKR?

Thank you for your reply and keep up the good work, I’ve been reading your extremely useful blog for long time, you saved me already a lot of money (and headache) :)

Hi Thomas,

Yes, I am sure. I did that for repaying out second pillar early withdrawal :)

They don’t take as much risks as in overdraft, because they still can sell you stocks and get your money in case your don’t fit the margin requirements.

Your strategy would work, but it’s much more riskier than a mortgage and may be more expensive as well.

If you buy a 500K apartment, you will need at least 2 million in stocks. And if your stocks fall down, they may force you to sell the stocks or give you a little time to put more money into the account.

The margin loan is probably a good idea for the downpaymetn, but not for the entire house.

Hello PS,

If you take a margin loan with IB to use for a house purchase for example, can you convert it to GBP or EUR to send to the mortgage company?

Does it show in your IB as just negative cash?

How can you pay back the margin loan? Is it just a case of either selling securities or transferring money to your account?

Thanks

Hi James,

Yes, you can convert USD to GBP (or EUR) and send that converted money out. The USD will become negative then.

Keep in mind that CHF margin interest rate is lower than US.

Paying back is indeed selling securities or depositing more money.

So if I were to convert it to GBP sent it out, my negative rate would be in GBP even though my base currency is CHF?

Your negative interest is always on the balance missing.

If you have 0 CHF and buy for 1000 CHF of stocks, you have -1000 CHF.

If you have 0 USD and buy for 2000 USD of stocks, you have -2000 USD.

If you have 0 GDB and withdraw 1000 GBP, you will have -2000 GBP.

But you can also convert CHF (even if you have zero) to GBP and then withdraw the GBP, in that case, you will have negative CHF, not GBP.

Wow these Swissquote interest rates are sky high. They are really robbing their customers in broad daylight. Interactive brokers are just so much more attractive as a broker.

Yeah, they take a nice premiums in their pockets :(

You state:

“So, if you have 100’000 CHF of stocks, you can get an extra 70’000 CHF margin loan.”

That’s incorrect. If you had $100,000 and the bank applied a 30% margin to the stock you sought to buy, your maximum loan would be $10,000/0.3 -$10,000 = $23,333.

Hello,

Thank you for the nice article.

Is there a way on IB to see the interest fee you pay by trading on margin ?

Thank you,

Hi Gui,

Sure, you can generate an activity statement, and the interest will be shown in “Interest Accrued” with a negative number.

Lombard loan worked well for me in a very particular case. I knew that I would receive a one off sizable sum at the start of the next tax year that would increase my tax liability. I took a Lombard loan at the end of the previous year and used it to purchase a portion of my second pillar corporate retirement. This reduced my tax liability in the previous year at my marginal tax rate. When I received the sum at the start of the next tax year, I paid back the loan. The tax savings from the earlier year were not quite as high as the additional tax payments for the later year but it went some way to reducing the impact.

Hi GHR,

Thanks for sharing your strategy!

But, shouldn’t you have paid the pension fund contribution on the same year with the high income? In the second year, your marginal tax rate would have been higher, no?

Hi Baptiste,

I did both! Using the taxes saved in the first year, I was able to buy extra 2nd pillar contributions in the second year. Looking carefully at my marginal tax rates in both years I could make a good estimate on how much 2nd pillar to buy in each year to reduce my tax bill most effectively across the 2 years. This along with some house renovations on the second year meant I did not pay much tax for 2 years running.

Well done then! Sounds like you got a sound strategy!

Thanks, great article!

Found a typo in “you borrow 50% (10’000 CHF) and invest in stocks”, should be 50k chf.

Why do you say it is better to keep the margin loan for a short time? Once you get your margin loan, don’t you have to repay the X% of margin rate on it no matter how long you hold it?

Assuming you would have sold stocks to pay the bill, you considered it was more likely that stocks would go up by more of that X% margin rate by the time needed to reinvest the sold stocks?

Hi Alessandro,

Thanks, you are right, I fixed the typo!

In theory, you never have to repay your margin loan as long as you meet the requirements. However, as long as you keep the loan, you will pay interest on it.

You are right that mathematically as long as your average returns are higher than your interest rate, you should save money by using a margin loan. However, the longer you hold, the more you are exposed to different risks:

* The stock market could fall so much that your margin could be called.

* The stock broker could raise the margin requirements quickly, and you could end up in a margin call.

* The interest rate could rise significantly.

It’s again a balance of the risks you want to take and the returns you can get with a margin loan.

Thank you!

I still don’t have clear how often you have to pay the margin interest. Once per month for the overall sum you still have to pay back?

Hi Alessandro,

It’s paid once a month but accrues daily. It’s directly removed from your cash.

Hi Baptiste,

3: Interest are tax deductible.

But as you mention need to be very careful as the house make the rules :).

I have a margin account with IB, only use a little the margin (between 5 and 15% depending the year period).

My main etf is VUSA.SW and I recall that in June 2022 (market low) the margin requirement for this etf move from 25 to 100% in only one week.

Hi Stephane,

Have you successfully claimed interest from your taxes with a margin account? That’s interesting, and I did not think about it.

If a standard ETF can move from 25 to 100 requirements in one week, we should indeed keep our margin really low.

Hi Baptiste,

I’m located in Geneva so my answer is based on the “GeTax 2022” program.

There is a section “Etat des titres” where you enter your IB account detail, then there is two box:

1: “le compte bancaire présentes des intérêts débiteurs au 31 décembre”

2: “Le compte bancaire présente un solde débiteur au 31 décembre”

When you tic it this allow you enter both amount.

This automatically prefill the data in the “Intérêt et dette chirographaires”.

Basically it is the same rational with the mortgage interest that you pay, you are allow to deduct them in your tax declaration.

It does indeed make sense. Thanks for sharing the details.