January 2024 – A good start of the year

| Updated: |(Disclosure: Some of the links below may be affiliate links)

Happy New Year!

The first month of the year is already over! It was a good month, with few events planned. We did a few things, the three of us, which was great.

Financially, it was a good month despite the usual yearly expenses. We managed to save almost half of our income.

I also have created a forum for the blog (more details below).

January 2024

After an eventful month of December, January was very quiet. Nothing changes every year just because we are in a new year. I did not even wait for midnight on New Year’s Eve. I was already asleep!

We did not celebrate New Year’s except for some small firecrackers for our son. We had only a few events this month, which was good for recharge.

So far, we have not been able to restore our son’s sleep schedule to before the holidays. He almost gave up on naps already, and it takes a while to put him to sleep. Our sleep quality went back down (although we are still far from the worst).

Financially, it was a good month. Since we are done paying the federal taxes, we paid only canton and municipality taxes this month. This is good because in January we have to pay several yearly bills. So, we managed to save a significant amount of money this month.

We start the year with a 49% savings rate, which is great!

Expenses

Here are the details of our expenses in January 2024:

| Category | Total | Status | Details |

|---|---|---|---|

| Insurances | 776 | ||

| Transportation | 531 | Higher than average | Yearly license fee, fuel, bus, and trains. |

| Communications | 354 | Well above average | Serafe! |

| Personal | 1379 | Higher than average | Many small bills piling up |

| Food | 572 | Below average | Usual groceries, a few small snacks out |

| Housing | 1208 | Above average | Water, heating, mortgage, and wood |

| Taxes | 3577 | Below average | Only municipality and canton |

In total, we spent 8401 CHF. Without the taxes, it comes down to 4823 CHF. This is an excellent result to start the year because we aim lower than 5000 CHF.

Since we were running slightly short on firewood, we bought four more cubic meters. This is good because one of my family members has forests near us, so we know where the wood comes from, and the money stays in the family.

In January, we usually have some yearly expenses that happen. This month, we had to pay:

- The car license

- The stupid Serafe bill

- The water bill (bi-yearly)

In addition, I bought quite a few second-hand books for my son and a second-hand indoor bicycle. When the weather was nice, we did a few things together.

As mentioned before, we paid less in taxes than usual. The federal taxes were paid with only six bills, so we are now done with them. Next month, we will only have the municipality taxes to pay. Finally, in March, we will not have any taxes to pay.

Overall, it was a slightly expensive month, but much was due to things we only pay once or twice a year. So, I would say this is a reasonable level of expenses to start the year.

2024 Goals

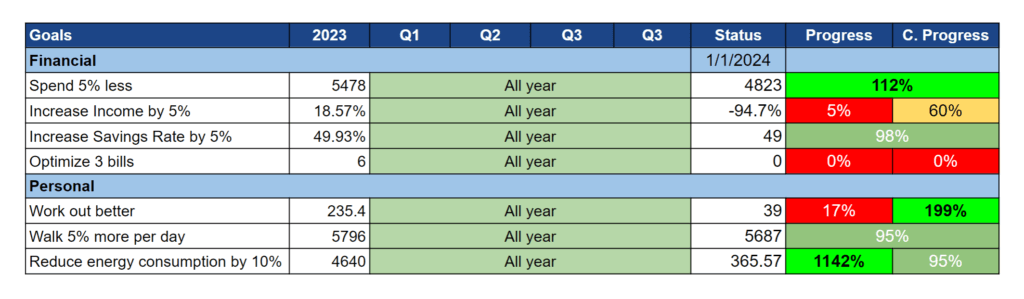

Here is the status of our goals by the end of January 2024:

Overall, our goals are going well. We spent significantly less this month than our average, so we are starting on a good note despite paying some yearly bills this month.

We are low on income goal, but this is expected for the first two months because my income varies significantly, and March will be a major contributing month because of the bonus. Also, we only extract a regular monthly salary from the blog, which will lower our average income this year.

On the other hand, our savings rate is slightly below our objective but still a very decent 49%!

I did well on my workouts this month. I only missed a day when I had to go to the office and did three circuits on each workout. On top of that, I managed to start some indoor bicycle workouts. I still struggle to get time for them, but I did them multiple times this month already.

On the other hand, I am not entirely satisfied with my steps this month. There were many days with a very low number of steps. Because of the cold, we did not go out much with our son during the weekend. And even though I continued my daily morning walk, I cut it out a few times for the weather. I hope I will get more motivation next month.

Finally, our energy consumption went up slightly this month. It is only 3%, so it is difficult to know why. The number is still way below January 2023, but we are slightly short of our goal.

Overall, I am happy with these results.

FI Ratio

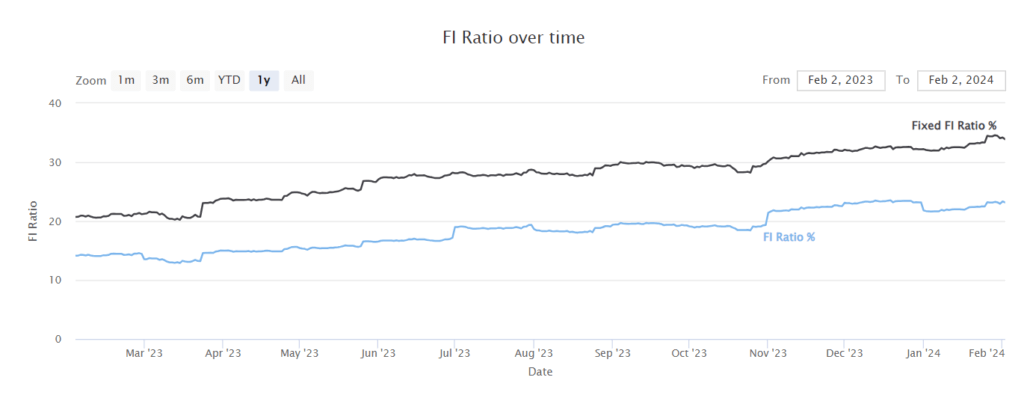

Here is the progress of our FI Ratio as of January 2024:

Our FI Ratio increased nicely this month to 23.32%. Our expenses remained almost flat, so our target did not move much. We also saved a nice amount of money this month.

More importantly, our net worth increased significantly this month. The USD appreciated very slightly, and our stocks appreciated as well. For once, our savings contribution to our net worth growth is below 30%.

So, I am pleased about the beginning of the year for our FI Ratio.

The Blog and Forum!

Since I had several articles written in advance in December, I could focus on other things on the blog this month.

I was able to update many articles with updates to services. I am always trying to keep up with updates of other services in my reviews, for instance. This takes a lot of time, and I cannot always do it as quickly as I would like. I also updated my Updated Trinity Study article for 2024. This is something I do every year.

Another thing I did was create a forum for the blog: The Poor Swiss Forums. Multiple people asked about this, and I was wondering about it as well. So, we now have a forum for Personal Finance discussions.

At this stage, I consider this a test. If this works well, we can continue the forums. Otherwise, I will call it quits after a few months. But I will continue if this can help more people with their money in Switzerland. Of course, I cannot guarantee that I will answer every question. The goal of the forums is to bring people together to discuss and help each other.

Let me know what you think about the forum.

Next Month – February 2024

We do not have much planned for next month, just a few events with family and friends. This will be good enough.

Financially, it should be a good month because we will only pay one set of taxes instead of three. I also expect some shares to vest from my company, so we should have an excellent savings rate.

What about you? How was January 2024 for you?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Hi Baptiste

If you say “We start the year with a 49% savings” is this percentage referring to the amount of money you have at your disposal after you paid taxes? Or taxes are included?

If taxes are included, then this system of measuring your progress would be quite hard on yourself, because you cannot do much more about changing the taxes (yes you can do 3pillar, top up 2nd pillar and so on, but are usually already doing this). Well a game changer could be having one more kid maybe :P

Cheers

Maciej

Hi Maciej,

I always include taxes in my savings rate. I also compute my savings rate after taxes, but I don’t generally follow it or publish it.

I both agree and disagree with you :)

You are right that it makes it much harder to push for a high savings rate given the amount of taxes we pay (more than 35% of our expenses are taxes). But it also reminds me that optimizing taxes is important. And it’s the best indicator for howe long it will take us to reach FI.

I don’t really get how you arrive at the percentage values in your goals/progress table:

– Goal 1: Spend 5% less: Your status is at 4823 compared to last year’s 5478, that’s a reduction of over 11%. In terms of your goal (5%) you have met it over 200%, not 112?

– Goal 3: Increase savings rate by 5%: Your status is at 49% compared to last year’s 49.93% and your progress is 98% towards the goal even though you haven’t increased anything yet?

Also, what is C. Progress vs. Progress and why do some goals have both columns but some only have one combined?

Hi barbara

I have not really touched the progress tabs actually. I should address that.

For goal 1, the progress is not correct indeed. It shows that we spent 12% than last year, but indeed has nothing to do with our goals of 5.

For goal 3, the progress is the same, comparison between this year and last year.

C. Progress is current progress, meaning based on the current month and not based on 12 months. This makes sense for income for instance between we cannot increase our income in one month.

I’ve been willing to comment for a while on those monthly updates, as I think I would do the comparison to average differently.

One-off events (like serafe, federal tax, buying wood for the house, paying for the server, etc) always bring your category above/below average. But in the end they are expenses you pay once for the whole year and are part of your “normal” rythm. So for me, it would make more sense for the mental accounting that they end up in something neutral (maybe not “average” but “as expected”).

I guess it depends if you want to track mentally the amount you saved for the month or how well you did in controlling your spending.

Hi Daniel,

This is a good point. One-off events will stretch the average. This is especially true when paying for the boiler. Smaller expenses like Serafe a okay because they won’t impact our high expenses that much.

But it’s a good idea to think about expectations rather than average. Paying for the boiler was expected even though it was higher than average month. On the other hand, too much shopping is not expected, so it reflects more the effort.

I may try that idea next month! Thanks.

Thanks for your nice post, as always!

Do you have a template of your excel ‘Goals’ spreadsheet available for us ?

Thanks, Nico!

I do, it’s available on this page: https://thepoorswiss.com/kpis-goals-spreadsheet/