February 2020 – Quarantine and Quarter of a Million!

| Updated: |(Disclosure: Some of the links below may be affiliate links)

It is time for the second update of the year. February 2020 is already done.

Last month, we went to China amid the coronavirus outbreak. When we come back, my company put me on quarantine for two weeks. I had to work from home for about ten days.

Aside from this, it was a very uneventful month. From a financial point of view, it was not a bad month. We spent a bit too much on food. But I received my ESPP shares, which made a nice bump on our net worth. So overall, it was a good financial month. We managed to save 63% of our income this month.

We are still looking for a house. But we have not been very successful. I am starting to believe that it is not going to happen with the needs of both of us and our financial situation.

So, let’s see in detail what happened to us in February 2020.

February 2020

In January 2020, we went to China. I am sure you already heard about the coronavirus outbreak by now. Fortunately, we did not catch the virus, and we are in good health. And so is my family in law. It is the most important thing.

However, when we came back, my company was afraid that we could still be incubating the virus. So, I had to work from home for two weeks. And to avoid too much contact, we canceled several dinners we had planned. We preferred not to take risks with our family and friends.

It was not that bad to work at home for about ten days. I can sleep longer in the morning, and I save time on the commute. I managed to be very productive, even at home. And it is very enjoyable to be able to have lunch with my wife. And a freshly cooked meal is always better than a microwaved one!

We still managed to do something nice for Valentine’s Day! At this point, it was already the end of our isolation. So, we kept with our plan. We went to bed and breakfast in a vineyard. We had a delicious dinner with wine matching. In the morning, we bought some wine, and we had a nice walk in the vineyard.

Then, we went to visit the nice town of Rolles and walk next to the lake. Finally, we ended up with some shopping at Ikea for me and at an Outlet for Mrs. The Poor Swiss. We had a nice weekend!

We are still looking for a house. And the search is not going great. We had one great opportunity. But it was sold before we could even visit. And for the rest, we cannot find something that suits both of us and our budget. I am not optimistic that we will find something.

Unfortunately, my knee and my back did not improve. They are both getting worse. It is getting limiting for me. I cannot stand for long periods, and long walks are getting bad.

I am still trying to understand what happened. But it is likely to be some form of Arthritis. I am just hoping this is not the case. But we will see. I have an appointment in April with a specialist.

From a financial point of view, it is a good month. We saved 63.7% of our income this month. This is helped a bit by the fact that we paid fewer taxes this month. But still, we managed to keep our expenses low. I am quite happy about that.

Expenses

Here are the details of our expenses in February 2020:

- Insurances: 795 CHF. Average. Our health insurance bill.

- Transportation: 142 CHF. Average. Gas and parking.

- Communications: 109 CHF. Average. Internet and mobile bills.

- Personal: 496. Average. Some furniture and clothes and a trip to the dentist.

- Food: 997 CHF. Way above average! We redid our stock of meat, did dumplings, and had to restock several other things.

- Apartment: 1247 CHF. Average. Our rent.

- Taxes: 418 CHF. Below average. We only paid municipality taxes this month.

In total, we spent 4206 CHF during the month. Overall, this is not bad at all. It was quite reasonable. Even what we spent on wine is perfectly fine since this is probably going to be the only time in the year when we buy Swiss wine. Since we only paid municipality taxes this month, we had a very nice savings rate.

However, we completely blew up our food budget this month. We almost spent three times our average food budget. This is a terrible result. I was not expecting to spend so much. When we came back from China, we had nothing at home, so we had to do big groceries. We went to Aligro to buy a lot of meat to freeze. We also did dumplings and once cooked a starter for a friend’s party. e also invited a couple of friends to our home.

And once the coronavirus started in Switzerland, Mrs. The Poor Swiss was afraid of the lockdown. So, we restocked everything. I bought more than 35 kilograms of meat in a day! At least we will not have to do too many groceries next month. And if something happens, we can stay at home for more than two weeks.

I am going to be extra careful about that next month.

2020 Goals

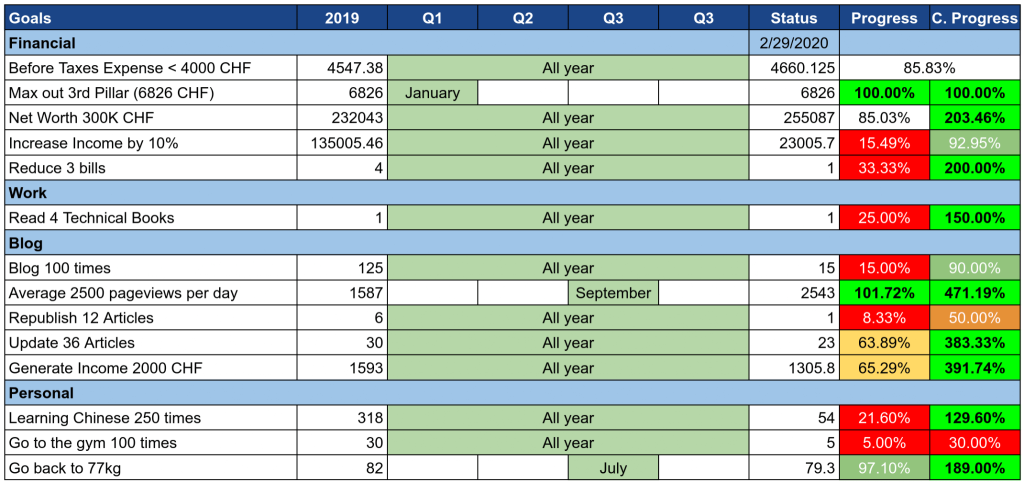

We can take a look at our 2020 Goals as of February 2020:

Overall, our goals are doing well. We are up to date with almost all of our goals. And there is still plenty of time to correct the ones that are not doing well.

Since we spent little money this month, our average has gone way down. But we are still not below 4000 CHF expenses. Hopefully, we will be able to keep next month cheap as well.

I wired the money to my VIAC third pillar. So I am done with my third pillar for the year. I should have done in January. But with going to China, I was too late. In the grand scheme of things, it should not matter.

I managed to reduce one bill. I am going to switch from M-Budget Mobile to Coop Mobile Prepaid. This change should save me about 10 CHF per month. It is not much savings, but this is still a small win. Since I have two months’ notice on my mobile plan, this will only take effect in April.

My gym goal is not doing well. With my knees and back in such a bad shape, I froze my gym membership for two months. It is unlikely that I go back to the gym before that time. We will see how it is going after I see the specialist.

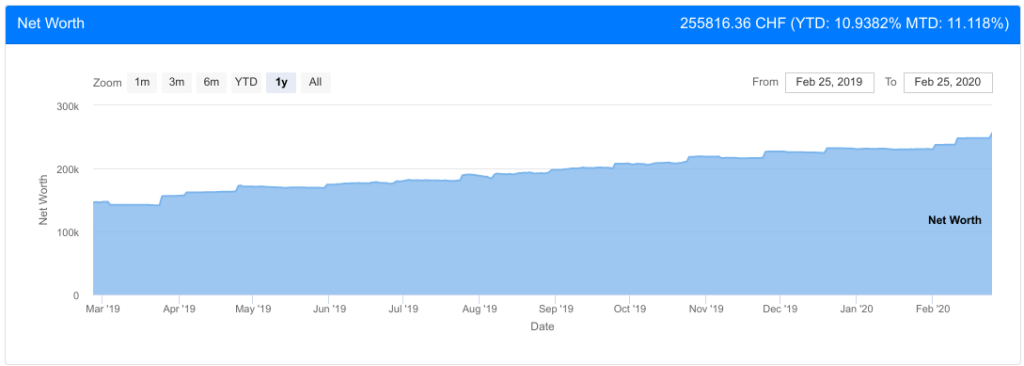

Net Worth

Let’s take a look at our net worth at the end of the month:

We finally reached our next milestone! We are now at over 250’000 CHF. It is a significant milestone. Our net worth already increased by 10% this year.

My ESPP shares vested this month. The sale generated about 10’000 CHF of profit. This is excellent returns over six months. I really cannot complain about that. It helps push our net worth in the correct direction.

The rest of the growth is merely coming from the savings of the month. Most of our money is still uninvested since we are looking for a house. We have been missing out on some good returns.

Next month we should see some great growth as well. I will receive a bonus. We should go over 270K already.

The Blog

The blog did well in February 2020. However, this is not standard growth. This is due to two events.

First, my post about N26 vs Revolut got featured into Google Chrome Content For You. This is the first time it was the case. And it brought me almost 3000 users in a day. Since my usual average is closer to 1000 users, this is a big deal for me!

And secondly, my guide to taxes in Switzerland generated a ton of traffic from Facebook. This is also the first time a post went nuts on Facebook. It generated about 2000 views on this article.

I am pleased about these two events. It never happened to the blog. It is good to see something new. However, this means that the traffic for this month is going to be challenging to recover next month.

I also appeared on a podcast for the second time: Financial Independence Europe Podcast Episode 088. It was a cool experience to do it again.

I was less productive than I should have this month. I should have pushed some things further. So I am now behind schedule. Since we have several things planned for the coming weekends, I am not sure I will be able to keep up with my schedule.

It is also interesting to note that I am starting to have more mobile and tablet users than desktop users. It is important since my website is mostly optimized for desktops. I will make some improvements for mobile users next month.

What do you feel I should change on the blog?

Here are the three most-viewed posts of February:

- Wise vs Revolut: Which is best for you? This post always has a lot of views. But it did a little worse this month.

- N26 vs Revolut. This new post did well this month.

- Guide for taxes in Switzerland. This post did well during this tax season.

What about you? Which was your favorite article this month?

Next Month – March 2020

Next month, we have a few things planned with my family and my friends. But we have nothing out of the ordinary. We are still going to try to look for a house. We are probably going to expand the area of our search. But I am pessimistic about that.

From a financial point of view, next month should be great. I will receive my bonus next month. Also, in March, we do not pay any taxes. So I am expecting a very large savings rate. On the other hand, we just received our federal taxes bill for extra taxes for 2019. We did not pay enough in 2019. This will impact our savings rate. But it will significantly less than our bonus.

What about you? How was February 2020 for you?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Hi The Poor Swiss,

I want to purchase a house in around 6-8 years. I plan to have the capital to get good interest on credit in cash and the rest in stocks. But that will allow me only a pretty conservative 40% in stocks and 60% in bonds which will delay FI.

If I correctly understand, you have 90% in stocks and will delay buying a house in a bear market.

Could you explain your strategy?

Thanks and regards,

CE

Hi CE,

My strategy is not to delay during a bear market. Currently, we simply do not find a house that we really like and that we can also afford.

Do you mean that because you are buying a house in the next 6-8 years, you can only have 40% of stocks? Or after buying a house, you will have to do that?

Why is that?

My strategy for a house was very simple: We invested everything in stocks (all our portfolio was in stocks, rest considered as bonds) and when we started looking for a house, we sold everything.

Thanks for stopping by!

I just started investing in January. If I invest everything from now on (like you) and I want to buy in 7 years and there is a crash, I have to sell with a minus, which I want to avoid.

My question is if I should save in cash or invest. My plan now is to save in cash in order to have 150k € in 6 years for the, house. The rest I invest in stocks. I have now 90k in cash, 30k in stocks, and can save 25k per year. This will result in 6 years into 60% cash/40% stocks.

But if I don’t buy then I miss the return on stocks which will delay FI.

I live in Austria and saving accounts have only 0.8% interest rate if you lock the money for several years.

Hi CE,

Ok, now I get it.

If you want to buy in 7 years, you have indeed two choices:

* Be extra safe and not invest in the stock market all the cash you need

* Take some risks and invest in the stock market. The risk is that you will a) sell at a loss or b) delay the purchase of your house.

You could also go hybrid, save half the cash (75K) and invest the rest. It’s still a risk that you will not be able to buy a house when you need.

For 7 years, I would take risks with the stock market. But that is only my position. If you are not comfortable with that, there is not much you can do.

Why buy in 7 years though? It seems you would have enough cash in one year, no? 7 years is long-term enough for the stock market in my opinion, but it could delay your plans.

Thanks for stopping by!

Hi,

thanks for your answer. I see also only these possibilities. 7 years is not that less but also not more than 10 years. If I would need the money in 10 years, I would feel more risk averse. So, it is best to take some calculated risks but not 100% stocks.

It is true, that I would have enough but now the rent is quite cheap and family planning will start just in 6-8 years and therefore no house is needed now.

Thanks,

Regards CE

Hi CE,

Given the current low rates, you may still consider a house to reduce your budget. On the long-term, this could compensate. Of course, this depends on what kind of house you want and how low your rent price is now.

As you said, it’s very important to have a good amount of risks. There is no point going 100% stocks if you are not comfortable with this. This will make you miserable or worse will make you sell at the worst time. If YOU are comfortable with with 40-60% stocks, this is a good number.

Thanks for stopping by!

Congrats on the progress! Thanks for sharing.

Few questions:

1a. How do you shop at Aligro? I thought it’s only for businesses.

1b. How much cheaper is Aligro than Lidl/Aldi or a trip to Germany?

2a. How did you get from 232k to 255k networth in 2 month with a 135k salary?

2b. Is your wife not working?

3a. Could you share your ideas on buying a house as you only pay 1400chf of rent at the moment? I imagine it would cost significantly more to buy/maintain a house.

Hi Peter,

1a. Everybody can shop at Aligro, you just need to register. Prodega, on the other hand, is for businesses.

1b. It depends for what. Several pieces of meat are cheaper than at Lidl, I would say by about 10 to 20%. This is mostly some pieces of beef and pork. Some drinks are also available at good prices. But a lot of things are not worth it. You have to compare many things.

2a. More than 12k are from returns on my ESPP, the rest is from normal savings.

2b. No.

3a. I think it is a good time regarding interest rate. However, the prices are pretty dumb right now. If people can find something at a fair price, I would say it is a good opportunity. However, we are not considering buying a house as an investment. We want to live inside.

Thanks for stopping by!

Thanks for the quick response.

Regarding the house… It would be highly appreciated if you could do a post about buying houses in CH and what the advantages/disadvantages are and when it would make most sense, compared to renting. I really don’t get the whole system and only really like the idea of it as a long term investment / retirement place.

Also, I guess it makes no sense to buy and rent out in CH… this is something Im looking at with my american gf, if we ever get married we want to invest in real estate in the US and rent out.

Hi Peter,

I am planning to do such an article, but I do not yet know when I will do that.

I think there are some cases when it makes to buy and rent in CH, for diversification. But I would not make that a priority. In the United States, it’s another story, it’s a great investment.

Thanks for stopping by!

Hi The Poor Swiss,

At which point are your gonna change your name ? 500K, 1M ? ;-)

Very good job anyway, you are on the right track.

I’m always surprised by the low taxes that you pay per month (even with 3rd pillar and so on). If I’m not wrong, you are in the state of Fribourg, right ? Do you mind telling me what is the rate of your village ?

Hi DivHunter,

That’s a good question. I will consider buying the domain once we reach 500K :)

Yes, I am in the state of Fribourg. My village is actually average, 0.80. However, keep in mind that I have increased my income two-fold in the last two years. This has not yet reached my taxes. They will significantly increase starting this year.

Thanks for stopping by :)

What a great month! I think you may be getting too used to good months so you’re getting bored of them haha. The problem with success I guess?

Anyway, what you spent on grocery in Feb is what we spent on average every month. I took your advice to try not buying swiss chocolates and I failed. This is in part due to Easter so all these chocolates are unavoidable when you enter a supermarket!

Also, I enjoyed reading the post about taxes. Thanks!

Hi Mama Bear,

Yes, you may be right :P I am getting spoiled.

Our average is below 400 CHF, so spending almost 1000 CHF is really a lot for us. But at least, now we have some stocks.

Haha, yes, easter is difficult without chocolate. We only bought one chocolate bunny so far, not bad!

Thanks for stopping by!

Congratulations on reaching a milestone! A quarter million has a nice ring to it.

Thanks Mark! Yes, it does sound good :)

Congrats on the 250k milestone. I must have missed previous posts about your decision to buy a house, is this an economic decision or a personal one (or combination)?

Thanks Francinvesting,

I did not write in detail, only small comments in my monthly updates.

It’s mainly personal decisions. We want to live in a house and there are no houses to rent where we live. So, we are considering buying. Also, the low mortgage rates are encouraging for buying even though the market prices are highly inflated.

Thanks for stopping by!