August 2022 Update – An expensive month

| Updated: |(Disclosure: Some of the links below may be affiliate links)

August 2022 was a good month with many events for us. We also had many things to organize and take care of. While good, it was a tiring month.

Financially, it was significantly more expensive than usual because of one considerable expense. But we still managed to save about a third of our income, which is excellent.

So, we will delve into the details of what happened in August 2022.

August 2022

August 2022 was a good month, but it was packed with events and things to do. These days, I do not want to do too many things. I simply do not have the energy for many activities.

Adding to that a bit more work than usual, it was a very tiring month. But at this point, we are used to being tired.

We had several family and friend gatherings this month. And we also had a few nice events.

Financially, it turned out to be an expensive month because we paid for a course for my wife. This is a real course in Fribourg, not an online course. But this is a reasonable expense. On top of that, we had standard expenses. But this means we are only saving about 34% of our income this month. While this is a good result, this is significantly lower than we aim for.

With the course starting next month, we are looking for solutions for our son once a week. If everything goes well, we will have a place in a kindergarten, but it is very late, so we will see how that goes. Kindergarten will make a big dent in our budget. But it is also great for our son to see more other children.

Expenses

Here are the details of our expenses in August 2022:

| Category | Total | Status | Details |

|---|---|---|---|

| Insurances | 878 | Average | Health Insurance |

| Transportation | 100 | Average | Parking a few times and once fuel |

| Communications | 85 | Average | Internet and one phone plan |

| Blog | 304 | Average | A few monthly bills and one yearly bill |

| Personal | 4043 | Well Above Average | Many small shopping bills and a course |

| Food | 504 | Above Average | Many groceries, one night out, and many sausages |

| Housing | 550 | Average | Heating and mortgage |

| Taxes | 5210 | Average | Taxes at all levels |

In total, we spent 11676 CHF this month. This amounts to 6161 CHF without taxes and blog.

If we exclude the 3400 CHF for the course for my wife, the month has been very cheap. We would have been even lower than last month, which was already our best month. So, I am pretty happy about this result.

Our food budget is also slightly higher than average. But we bought 100 CHF of smoked sausages, so we cannot complain. We found the best smoked sausages ever, so we bought a bunch of them. It is entirely worth it!

You may have noticed that our taxes are higher than last month. This is because we are now paying federal taxes. These taxes are paid with six bills and started only in August this year.

Other than that, it was a very standard month. All our expenses are pretty average.

Next month, we should not have any significant unexpected expenses and be back to normal.

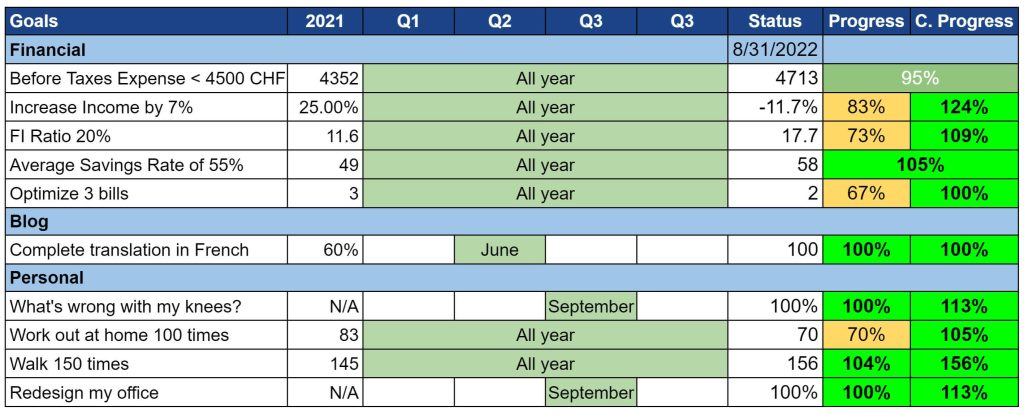

2022 Goals

Here is the status of our goals by the end of August 2022:

With the extra expenses of the month, it is now unlikely that we will meet our expenses goal. We had too many expensive months for that. But I am okay with failing at that goal.

I think we will still meet our savings rate goal if we do not have many months with this level of expense.

I made good progress on both walks and workouts this month. I am pretty happy about this. I should strengthen my workout goal for next year.

I also was able to reduce one bill! We changed all our complementary insurance for next year. With that, we will save 166 CHF per month. This saving is a great result.

Ideally, I would not keep my insurance policies for a while, but since the prices vary wildly, we may also have to change base in the future. You can read my health insurance guide if you want to reduce costs.

I will know next month if we have succeeded in reducing one bill. And I have a plan to reduce one bill, but I will have to wait until November. So, I should be able to meet that goal.

Overall, I am pleased about the status of our goals.

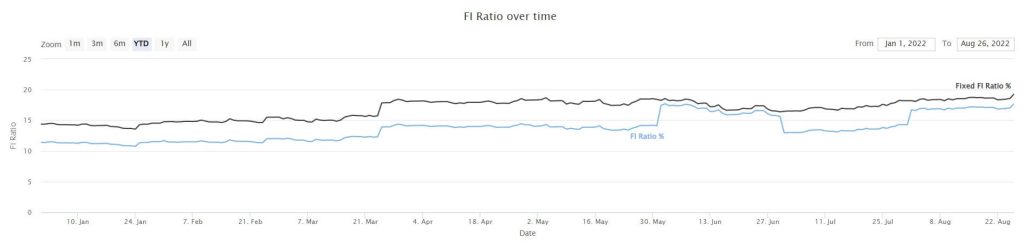

FI Ratio

Here is our FI Ratio until the end of August 2022:

Once again, our FI ratio has been going wild. This is because the blue line is using a 12-months average of our expenses, which are not stable. On the other hand, the black line uses fixed costs of 100’000 CHF per year.

Since we have very far from retirement, our current FI ratio does not matter much. But we would like to increase the speed at which this metric improves.

The stock market recovered a lot during the first half of the month and then lost some of its gains again. But overall, it was a good month for the net worth. I would prefer if the market took a clear direction, but for now, I have no problems either way.

Our progress next month will highly depend on the stock market’s performance. Our net worth should move up as usual by our savings, but if the stock market goes down again, it will go lower.

If you want to compute yours, you can read my article on how to compute your FI ratio.

The Blog

The traffic on the blog went up by a few percentage points this month. This is a good result since the traffic is generally decreasing.

I did more on the blog than most months this year. I could update quite a few articles, both for quality and for fixing outdated content. It is good because this was delayed too long.

My wife is now taking care of the translations. This is good for me because this is something I do not enjoy doing, mostly because I do not like dealing with the crappy translation plugin.

I could follow my schedule of an article a week, but I am very close to not being to follow next month. I was almost burned out while writing one of the articles for September, so we will have to see whether I will write the others or not.

In September, I will participate in an event organized by Selma: The No Bullshit Event. This is the first time I have participated in a personal finance event, which will be interesting.

Overall, it was an okay month for the blog. I do not foresee any significant changes for next month.

Next month – September 2022

Next month will be pretty hectic. We are planning a party for our son’s first birthday and went slightly overboard, in my opinion. Then, my wife will start her course. We will see how everybody gets accustomed to the changes.

I also have many things to do next month. For instance, I have to attend and judge several bachelor presentations. I also have quite a few organization meetings. And we are looking for a kindergarten. But this should then slow down in October.

Financially, it should be a slightly expensive month, but nothing particular.

What about you? How was August 2022?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Hi Baptiste, my monthly fixed costs are a bit higher than yours. I am currently at 9,500 USD per month (living in Singapore with my family of two kids). My current monthly passive income though is at about 12,000 USD, so we are still okay (I don’t work full-time). I am working on building out my All-Weather Portfolio, like to reach 1 Mio USD in the coming six months. Many (not so good) things happened in the digital asset space – let’s see where we go from here. Anyways, keep up sharing such good articles! Cheers from Singapore, Noah

Hi Noah,

Thanks for sharing your numbers! is that with or without taxes?

Is that 12’000 entirely passive or do you count your part-time income in it?

Hi Baptiste,

Thanks Baptiste for this clear update, I understand about the translation pluggin, I also have trouble and I know we have the same. :)

And like you, I would have preferred markets that continue on the momentum of July to make up for the declines of this year. But neither you nor I can do anything about it…We just need to wait.

And take some time for yourself, even if you miss an article in September. I’m sure readers will agree with me. :)

Enjoy September.

Hi Dror,

Yes, the choice I made with this plugin is not helping :(

I am pretty sure people won’t mind a single article missing indeed, thanks :)

September should be fine since I have some articles written in advance, October may be harder for the schedule.

Hello,

Your blog name does not represent the information you write in your posts. As a Swiss, I can confirm that you are not poor at all.

Maybe I should write a blog about a real poor Swiss…

Anyway, I love your posts as always.

BR

From a real poor Swiss

Hi RPS,

I am not poor, agreed, but I am not rich either.

It’s funny, we discussed my blog name yesterday and people actually liked it. I will keep that name :)

Thanks for sharing!

Hi Mr PoorSwiss,

that’s interesting figures but you don’t clearly mention the income. From your information, you saved 34% and spend 11676.-, I end up around 17’700.- of income this month. Assuming it’s stable on 13 paycheck, that’s close to 230’000.- ! It looks like your wife is not working so congratulations for earning that much, you find a very good job.

Then when I compare to our family, I must admit that we spend less with more kids. Thus we earn 100’000 less so it makes our saving rate very low. Well we should work on improving our income, maybe I will change for an IT job, I’m not so far from my education, I could change my career. Do you recommend that?

Hi Joe,

That’s correct, I don’t share my income directly since I have put it on my real name. However, as you saw, it’s very easy to find out.

My income is actually not very stable. My salary is stable, but the blog part varies wildly from one month to another. But, yes, I indeed have a high-paying job, and I am lucky about that. It’s important to note that it took me many years to get there (bachelor, master and PhD) and that I work quite hard and have developed many programming projects on the side to improve myself.

If you spend less with more kids, that’s actually great, no? And even at around 130’000 CHF per year, you are not in a bad position I would say.

As for changing to IT, I would not recommend it to everyone. Sure, it can pay, but switching careers may take a lot of time, and it’s important to have a job that you like. And it’s likely easier in the US because in Switzerland, they really like diploma. So, to switch to a software developer (or another IT job), you would likely need at least a bachelor.

Hi Mr The Poor Swiss,

Just to comment that the monthly updates are my favorite blog posts and when the month starts I come here almost every day to check if I have a new one to read. Your monthly numbers impress me since I’m used to Euros in a not so expensive country.

Lately I’m not very organized with the expense control so I cannot comment on that to tell how August was. Regarding investing, I “just keep buying” and hope that the markets start on the up move soon. If not no problem either, I will keep buying at “discount”.

Regards,

Luis Sismeiro

Hi Luis,

Thanks for your feedback. This is great to know because some people don’t like my updates! I am glad to know there are still interesting :)

FYI, it will always come up on the first Tuesday of the month, and if you subscribe to the mailing list, you will receive a notification.

Good for you to keep buying on these days! This is exactly what I am doing and telling myself that everything is cheaper to buy :)