April 2024 – Another expensive month

| Updated: |(Disclosure: Some of the links below may be affiliate links)

In April 2024, not much changed or happened. I felt it was a month between two months. It was neither bad nor good.

Financially, it was an expensive month again, with some old taxes to pay and some extraordinary expenses (and some splurging).

Despite these expenses, we were still about to save about a quarter of our expenses.

April 2024

In April, we had a few events with our family, but not much. It was a pretty quiet month. The weather was also weird, with a few days at 25 degrees (we even went playing near the river) and days with snow.

On the sleep side, we have seen issues rise again, and we are back at around one wake-up per night on average. We saw a specialist again, but I do not expect much to happen. Our son also started sleeping less, which may be normal for his age, but is still a little concerning (especially on top of the tantrums we get each day). He often wakes up at 6am these days.

As for my back pain, it got significantly worse. I saw a doctor and have started physio. I am now doing more walking and some daily back stability exercises. Hopefully, it will turn around.

Last month, I hinted at something that could happen that would change a lot. This did not happen in the end. So, not much changed, but we were in the waiting for most of the month. This was a possible job for Mrs. The Poor Swiss.

Financially, it was expensive because we had to pay some taxes after we finally received our tax statement for 2022. With a standard income, we were still able to save about 25% of our income.

Expenses

Here are the details of our expenses in March 2024:

| Category | Total | Status | Details |

|---|---|---|---|

| Insurances | 776 | Expected | Health insurance |

| Transportation | 111 | Expected | Buses, parking and one fuel tank |

| Communications | 20 | Expected | One phone plan |

| Personal | 2639 | Higher than expected | Kindergarten, a chainsaw, a new watch and too many small things |

| Food | 1378 | Expected | A quarter of beef and usual groceries |

| Housing | 470 | Expected | |

| Taxes | 7190 | Expected | Late taxes for 2022 |

In total, we spent 13949 CHF this month. Without taxes and without the blog, this amounts to 5396 CHF. This is still below what we spent on average in 2023, so this is not so bad. But we probably still spent a little too much this month.

I mention the blog because we received one more bill for 2022, so before the LLC was created. We had to pay 1362 CHF for the first pillar. This should be the last for this year, but we may have to pay one more next year.

We have finally received our tax statement for 2022. Fribourg was extremely late for that. We already submitted our tax declaration a few months ago for 2023, but we were still waiting for 2022. As expected, we had to pay about 6400 CHF in back taxes. We knew this would happen because of our income increasing.

We also had to pay the real estate contribution for municipality, of 720 CHF.

Our Food budget is quite high this month because we bought a quarter of beef. We bought again from a family member of mine. This was great to get some more beef on the menu. Even though this is expensive, it is still worth it in my opinion. We have reserved again a full pig from him.

Other than that, there were many expenses that piled up during the month. I had to cut a part of our hedge entirely, so I bought a chainsaw. Then, I bought a new watch for my birthday. We had many health bills, for dentist and vaccines. And I bought a few more things for my espresso machine.

Overall, our level of expenses is still decent. But I should be more careful about what I buy.

2024 Goals

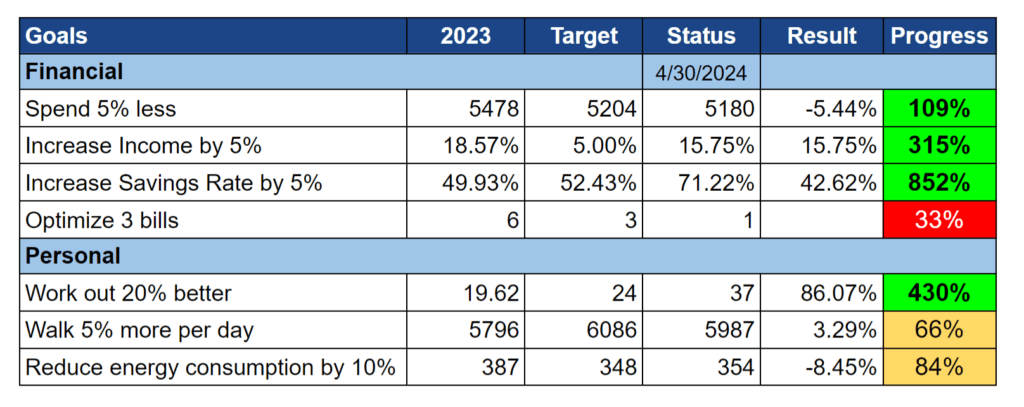

Here is the status of our goals by the end of April 2024:

Overall, our financial goals are going really well. Our personal goals are slightly falling behind, but not much since we are already better than last year and only slightly below our targets.

Even though we spent too much this month, our expenses are still slightly below our target. Currently, our income is above our target, but this will soon average out because the weight of the bonus month is currently high. Our savings rate average is excellent at this point, but will good down again since the best months of the year are gone.

Finally, I decided to do a contribution to my second pillar already this year. We still had a considerable amount of cash after last month’s bonus, so I split it between second pillar and stocks. With that, we sent 10’000 CHF to my second pillar. This should reduce our taxes next year. And this means it is the first expense I could optimize this year.

On the personal side, my workout goal is going really well. I have switched from three circuits to four circuits at the end of the month. I hope to stick to four circuits next month. Furthermore, I have added a little weight training at the end of my session (not adding to the goal). So, I am doing much better than last year so far.

My walking goal is slightly below target, but I managed to walk quite a lot this month. And at the end of the month (only one week), I added a treadmill to my desk. I feel like I should have tried this a long time ago to avoid sitting or standing statically for too long. I do not know whether I will turn this into a routine, but I hope to.

Finally, our energy consumption is quite decent, 8% less than last year so far. I am not sure what else we can do to reduce further, but we will try.

Overall, our goals are doing well.

FI Ratio

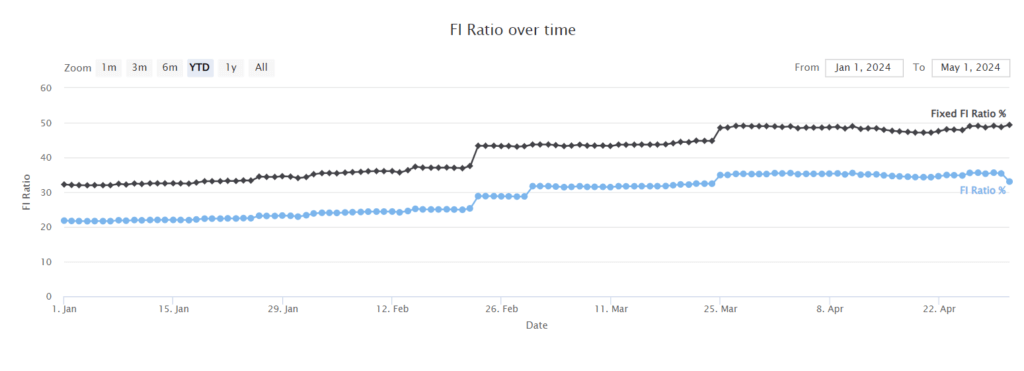

Here is the progress of our FI Ratio as of April 2024:

Our FI ratio went back down significantly this month. This is because of two different reasons.

First, our net worth went down slightly. This is because our savings were not enough to counter the stock market losses. This is really not a big deal since we are in it for the long term.

Second, our expenses this month were significantly higher than last year at the same time, resulting in an increased average. And since our FI ratio is based on our average expenses, an increase in expenses means a lowering in FI ratio.

Overall, this is not a bad result. We still saved some money. And our expenses will stabilize over time, resulting in smoother progress in our FI ratio.

The Blog

Not much happened on the blog this month. I did not have time to do anything besides writing a few articles, answering the comments and the emails.

As for the forum, it has not been very active. I plan to use it a little more to announce some important news there because I can do it easily. But I do not have a big plan to animate the forum, I was hoping the community would pick up, but it is currently not the case.

Next Month – May 2024

May 2024 should be a fairly quiet month. We have a few things planned with family and friends, but nothing major.

Financially, it should be back to a standard month because we will once again pay the standard (although higher) taxes.

What about you? How was May 2024?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Hi Baptiste

I was looking at your monthly update together with my wife, and she was wondering what phone plan you and your wife are using that is this cheap?

Thanks

Clemens

Hi Clemens

My wife has the Lidl Connect plan. And for the time being, I have the Coop Mobile Prepaid. I plan to switch to Migros Mobile and charge that to the blog.

Thanks for sharing your financial challenges and personal matters in April. It seems we both had an expensive month! We’re in the middle of renovations, and I had to invest in new tools and furniture. To top it off, I injured myself, and our gray dachshund needed treatment for his anal glands—I’m definitely not looking forward to that bill. Oh well, what can you do. It’s impressive how you managed to maintain a solid savings rate despite unexpected expenses. Wishing you a speedy recovery for your health issues and continued success in budgeting!

Thanks for sharing!

As you said, what can we do! Shit happens. Sometimes, plenty of things happen at the same time. Hopefully, an emergency fund should cover these.

I am considering getting dogs in retirement, but these beasts are very expensive.