2023 Goals and 2022 Goals Review

| Updated: |(Disclosure: Some of the links below may be affiliate links)

At the end of each year, I review my goals and plan for the following year. And to keep myself accountable, I publish them on this blog and follow them month after month.

So, in this article, I will review my 2022 goals and their progress, what went well, and what did not go well. And then, I will show and explain my 2023 goals.

2022 Goals Review

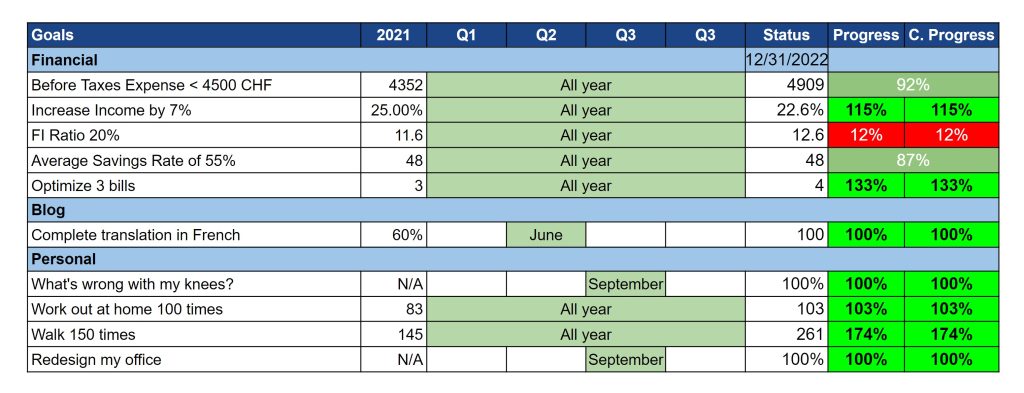

As a reminder, here is the status of our goals at the end of 2022:

Overall, our progress towards these goals went well. We failed some goals, some because of me, and others were poor goals. Overall our goals were better than last year, but they could still be better.

So, we will go over the details of each goal and how it went, category by category.

Financial Goals

Overall, we did not do very well on our financial goals. But at least one of the goals was not good. I failed three out of five goals.

Our first goal was to spend less than 4500 CHF per month, not including taxes. We failed that goal, unfortunately. We spent 4909 CHF per month on average. Considering our goal, it is not a good result. But because we are now a family of three and added a day of kindergarten per week at the end of the year, I think less than 5000 CHF is a great result. This goal was too optimistic.

I am amazed about how high we could get our income this year. I wanted to grow it by 7%, but we increased it by 22%. This result is quite insane. The bonus this year was very high, and I started getting higher RSUs. Also, the blog had slightly higher revenue this year, helping the result. So, we passed this goal.

Our FI ratio goal is a disaster. We wanted to be 20% financially independent. However, we are only at 12.6%. Retrospectively, this was a dumb ago because it is highly dependent on the stock market. 2022 was a bad year for the stocks, making our net worth stagnate. I am not disappointed we missed that goal.

I wanted to reach a 55% savings rate, but we only managed to get 48%. I am a bit disappointed because it means that our savings rate is lower than in 2021. The reason is multiple. Our base expenses significantly increased that year, and so did our taxes. And our taxes will also rise again next year. Currently, I do not think that we can reach 55%. However, 50% still seems doable for next year.

Keep in mind that I am using a strict savings rate calculation. If you want to compare it against others, keep in mind that many people use calculations that plays in their favor for savings rate.

Finally, I wanted to optimize three bills and managed to optimize four. So, we passed that goal. I have been using that goal for several years now and like it. This goal pushes to find optimization each year.

Blog Goals

I only had a single blog goal for 2022, and I passed it.

I wanted to complete the translation of the blog in French by the end of June. In the end, I managed to reach that goal several months early. Interestingly, I also finished the translation in German at the end of the year.

Personal Goals

I passed all four personal goals in 2022.

I have had knee pains since 2020 and wanted to know what was wrong with it. It took a while and some money, but this is just a sedentary issue because I sit too much at my desk. I need to walk more and not sit too much. The second part will be difficult since I am a developer and enjoy computers. Ideally, I should run or cycle, but I hate both. It is not the best result, but at least nothing is wrong.

I passed my workout goal but only barely. I managed to reach 100 workouts, but I had to force myself. I have not managed to make it into a habit. In 2023, I need to continue workouts.

I entirely passed my walk goal. I could do many more walks than I thought. It was much easier during summer than during winter.

I redesigned my office to my wishes in the first few months of the year. I passed that goal. It was challenging to find the time to do it and very stressful to do it within the little time I could steal. Nevertheless, I am thrilled with the result.

Overall, I did well with my personal goals.

2023 Goals

For 2023, I have two objectives for my goals:

- Simple objectives. My time is horribly limited, so I cannot commit to a strong goal. However, I still want them to be challenging, not easy.

- Only depending on us. Too many of my past goals depended on somebody else or the market. I need goals that only depend on us.

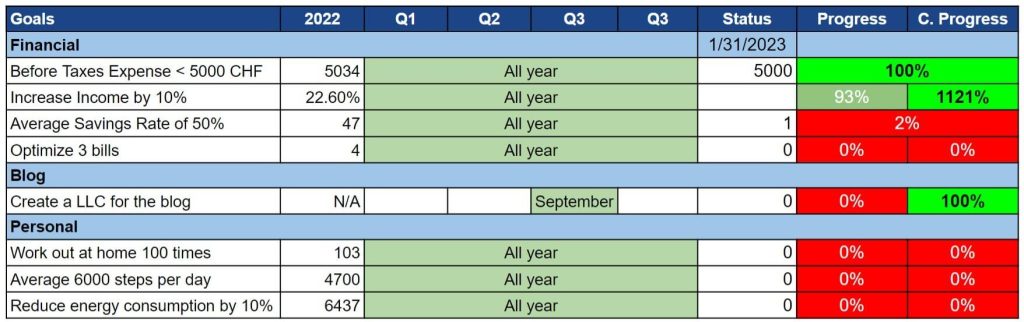

So, here are my 2023 goals:

These 2023 goals are relatively simple. They are not our best goals, but I think they are reasonable.

So, we will detail these goals.

Financial Goals

I mainly kept the same financial goals for my 2023 goals. I think these goals are working well for us. But I got rid of the FI ratio since that goal mainly depended on the market rather than our financials.

In 2023, we want to spend less than 5000 CHF per month, not counting taxes and blog expenses. Since we have our son and some kindergarten, our last goal of 4500 CHF is not reasonable anymore. We have systemically failed that goal every year, so we will see what happens this year.

In 2023, we want to save at least 50% of our income. Last year, we were close to 50% but failed at that goal, primarily because of large expenses. I believe 50% is doable, but we need to stabilize our expenses.

In 2023, we want to increase our income by at least 10%. Last year, the goal was at 7%, and we managed to increase by 22%, which is fantastic. I do not see us increasing by that much this year, but 10% should be doable.

In 2023, we want to optimize three bills. I like this goal because I have no idea what to optimize every year, but every year I optimize bills anyway. This is an interesting goal.

Overall, our financial goals are meant to push our income and expenses. The idea is to save as much money as possible and invest it in the stock market for our future financial independence.

Blog Goals

In 2023, I do not want to start a big new project for the blog. I do not think I will have any time for that. I will be happy if I can meet my only goal and the day-to-day activities.

In 2023, we want to create an LLC for the blog. Until now, I have been operating under a sole proprietorship. For various reasons, I want to switch to an LLC. Once I have the 20K CHF to lock into the LLC, I will start the necessary steps to create the LLC.

Once the switch is entirely done, this will remove some earnings and expenses from our budget, which may change our financials slightly. The taxes themselves will not change until 2024.

Personal Goals

I do not have any significant personal project I could take on this year. Therefore, my goals are minor improvements.

In 2023, I want to work out at home 100 times. This goal is the same as I had in 2022. I managed to pass that goal in 2022, but I could not get it into a habit. I had to force myself to do it. I hope I can get into the habit properly in 2023. I will follow the same workout routine as before.

In 2023, I want to walk an average of 6000 steps per day. You may think this is a very low average (and it is), but I am far from this goal (less than a 4000 average in the last two months). I think steps are a better goal than walks. I also have to consider that my step counter does not record any step whenever I push the stroller. And the same happens when I have my son on my shoulders.

In 2023, we want to reduce our energy consumption by 10%. We already made some effort in 2022 but want to get it further. 10% seems like a good start. I do not know whether that will be a reasonable goal. From May 2021 to May 2022, we used 6437 kWh. I will check our counters each month to see our progress. There are a few things we have already implemented, but we will go further later.

Conclusion

Overall, we did relatively well for our 2022 goals. We failed some of them because they were bad, and others because we did not do enough to achieve them.

I think our 2022 goals were already much better than our 2021 goals. Hopefully, the 2023 goals themselves will be better. I wish I had more time and energy to plan some more ambitious goals, but at this point, I do not think very optimistic about that. Therefore, I kept my 2023 goals very simple.

What about you? What are your goals for 2023? Do you have any suggestions for cool goals?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Dear Baptiste,

Thank you for publishing your goals, it’s very interesting to read! If you’re looking to expand your blog, may I suggest as a topic how to optimize a small business. As you can see from these comments, there’s a lot of interest in how to best manage and optimize a small business. What is the optimal legal form? How to manage banking and accounting easily (and for free if possible)? And so on… I also have a sole proprietorship in Switzerland and I struggle to find advice similar to what you offer for personal finances. Just an idea :-) or if you have a link where to find this kind of advice that would be great! Thank you for the great work, it has helped us a lot!!!

Hi Minna,

That’s a good topic indeed! This won’t’ cater to my entire audience but I know indeed that many people would be interested. And when I looked for information, it was not easy to find.

If I learn something interesting, I will definitely try to share it on the blog!

Thanks for the suggestion!

Hi Baptiste

Thanks for the update. I have two follow up questions.

First, how are you planning to increase your income by 10%, if you don’t mind me asking? Do you see that much potential with the blog?

Second, you said you wanted to choose goals that are just dependent on you. Don’t you think energy consumption is too dependent on the weather? Or are you only looking at electricity?

Hi,

Please ask any questions :)

I am expecting the blog income to grow if I can work enough on it. My thinking is that this will account for half of the increase.

I also plan to do a very good job at work and increase my main income there.

I also got a promotion last September that will account for some of the increase this year.

Good question about energy consumption. It will be slightly dependent on the weaht. But our electricity counters do not account for our centralized heating that comes with another bill. We are also tracking our heating on a monthly basis and obviously trying to reduce it but it’s indeed very dependent on weather.

Hi Baptiste

In the last few weeks I binge read your blog, you’ve come a long way!

I’m in a eerily similar situation to yours, just a year or so behind your schedule. So it’s always interesting to read your updates.

The one thing that made me stick to my exercise is this: Do something every day, and do it first thing in the morning. I alternate between rowing and strength training. I used to do one big workout on saturdays and couldn’t stick to it, tried to do it every other evening, couldn’t stick to it either. Doing it every morning is easy though, since motivation is highest then.

Hope this helps, keep up the good work!

Hi Bruno,

Thanks for your kind words, we are quite happy about our progress.

Doing something every morning could be a great idea. I could do some stretching or jogging during the other days!

Be careful with the LLC, legally you are not allowed to work more than 100%, and you are obliged to have at least 1 employee in the LLC (even without income), so you may be forced to lower your activity rate a bit to not exceed 100%.

Also beware of the administrative work of the LLC, which takes a lot of time and brings no added value. I took this step 2 years ago and I feel like I’m doing 5x more than before, for nothing more.

Congrats on everything else and your motivation!

Hi Seb,

Thanks, Seb, that’s a good point. We are considering that already. I am thinking of employing my wife who already does several things for the blog, and that works less than 100%. Also, normally, you should be able to work 50 hours a week, so I have 10 hours “free” ;)

What more did you have to do? I already have a sole proprietorship, I already have to deal with AVS, a proper compatibility, salary declarations.

Hi Baptiste,

Good point, that’s what I was going to advise you to do ;)

Otherwise what is the most time consuming in my opinion is the accounting (be well organized and make sure you have a receipt for each line of your bank statement), the LPP (mandatory if you have an employee, your wife or you), the professional and non-professional accident insurance (also mandatory if you have an employee).

Otherwise that’s all. A last advice: put the maximum of charges on your company so that it lowers its profit to the maximum and will make you pay less taxes ;)

Hi Seb

I have never dealt with LPP and accident insurance indeed, that may not be fun :)

And thanks for the advice, I definitely need to do better with receipts than now!

Hey Baptiste,

Great update. I’m as well interested in the switch to LLC (GmbH). How do you manage that as a full-time employee? Isn’t it affecting your legal maximum workable weekly hours?

Or do you figure out as a shareholder, and that’s it? If so, how do you take gains from your legal entity?

I guess you already did lots of research 😂

Hi The_Shadow,

I already got permission from my employer to have the LLC. So, as long as this does not impact my work, it’s fine. I won’t’ work more with an LLC than with the blog now.

As explained below, it’s mostly for separation concerns. In the beginning, I will mostly be a shareholder without revenue.

Curious to know why you want to change to LLC. What are the advantages? Tax improvements?

Hi Ralph,

I want a little more control over how I manage my income. I will likely let some of the income inside the company and not give myself a salary in the first years. This will mostly give me better separation.

But overall, there should not be any tax improvements except that I plan to delay some of the taxes (which I could also do with a sole proprietorship).

Thanks Baptiste and I will closely follow your path to LLC. I can see many interesting comments already.

The reason I am asking is that my wife plans to continue her online business she is building up at the moment (we are still in the US) and choosing the right form LLC vs sole proprietorship once back in Switzerland will be important.

I need to learn a lot about it and what helps optimise taxes etc. I guess as long as you make none to little profit the sole proprietorship makes sense. But as soon as you start having a good profit, which increases your personal income, it impacts your taxes. It gets taxes higher as it’s income vs in a LLC.

self employed in the US is super simple and with all the startup costs we always had higher expenses than income. Nice effect was it lowered our taxable income. IRS will of course start getting suspicious if it continues to run at a loss over several years. :-)

You can get a very large business as a sole proprietorship. The tax implications are complex to estimate exactly what makes the most sense.

I hope my experience will be useful. Once I start the process, I will start sharing what I learned. But you will indeed have to research your situation.

Thank you for your transparency, Baptiste.

And bravo for the 2022 and 2023 projects.

You do the most important part, the thinking process ( what do I want to achieve) and the review process ( where am I).

I am a firm believer in increasing income and not just the saving part. And for you, the year 2022 has been exceptional in that respect…

Bravo

Hi Dror,

Thanks :)

Yes, 2022 has been quite impressive in terms of income, and I am also a firm believer in the income part.

What are your 2023 goals?

Thanks Baptiste for asking :)

I can categorize them into 3 categories.

–Family

Doing my utmost to be the best husband and dad I can be.

–Personal

keep myself in shape. 3 runs a week, plus a daily 7 min workout.

Continue to learn German and chess.

–Professional

Develop my coaching business.

Financial independence has allowed me to discover a new passion and career. Coaching.

I take great pleasure in developing myself and helping the people who work with me to do so.

Thanks for sharing your goals! Good luck reaching them!

Your first goal is definitely something everybody should try to attain!