November 2021 – Not so frugal

| Updated: |(Disclosure: Some of the links below may be affiliate links)

I cannot believe it is already December. These last few months are flying by us very quickly. It is crazy how a child can change everything.

We are still slowly adapting to life with our son. He is growing nicely and changing very quickly. It was an interesting month to follow his growth.

Financially, we bought quite a few unusual things but did not go overboard either. So, we managed to save a sizeable portion of our income again.

November 2021

Overall, November 2021 was a good month. We had a few family events again with our close family. This made a big difference in our moods. We are still careful especially seeing the current number of cases in Switzerland, but being fully isolated would be worse.

We are still not sleeping much. Most of the digestive issues during the night went away. But this was replaced by a cold already lasting more than two weeks. So, our son wakes up in the middle of the night because of a blocked nose, and we have to unblock it. It takes a parent to know that a cold can be bad for babies. I would never have thought that before.

On the other hand, our son is growing well and is in good health. This is what matters most. He is now smiling very regularly and playing around with small things. He is also trying a little to move while on the belly. This is great to see.

As for our finances, this was a good month. We had a good income, although not exceptional, and we had good savings too. We had a few extra expenses this month, but nothing really bad. In total, we saved more than half of our income, which is great!

Expenses

Let’s see the details of our expenses in November 2021:

| Category | Total | Status | Details |

|---|---|---|---|

| Insurances | 834 | Average | The health insurance for us three. |

| Transportation | 137 | Above average | Switching to winter tires and twice refining the tank. |

| Communications | 75 | Average | Internet and reloading my prepaid once. |

| Personal | 1954 | Above average | I bought wood for the winter, some chimney accessories, a gift, some tech stuff, some shopping, and a few health bills. |

| Food | 584 | Above average | I went once to Aligro to restock and a few unusual buys at Lidl. |

| Housing | 550 | Average | Mortgage interests and heating. |

| Taxes | 3782 | Average | Standard taxes. |

Overall, we spent 7918 CHF during the month. Without taxes, we spent 4136 CHF. This is a good result, below our goal of 4500 CHF per month.

Most of our categories are well managed. But the food budget and the personal budget were higher than usual.

For food, we went back to Aligro to restock many kilograms of meat. We were running really low on some pieces. And we had several good deals at Lidl with Lidl Plus, so we restocked some of our reserves.

In our personal budget, we bought three cubic meters of wood, seeing that our reserves were going low. We now have more than enough pine wood for at least two winters. And we should have enough hardwood for this winter already. But I am expecting one more load of hardwood next month. So, we are covered for a long time.

We also bought a few accessories for the fire, like a thermodynamic fan for the wood stove and an ash vacuum cleaner. These are things we should not have to change for many years.

We also had a few health bills for my wife and son. And we to repair our dishwasher. And finally, there were a few miscellaneous bills. But overall, nothing too bad. We can definitely afford this kind of spending.

Overall, I am quite happy with these expenses. Even though we bought many things we wanted, we still saved more than half of our income and stayed below our goal of 4500 CHF spent per month.

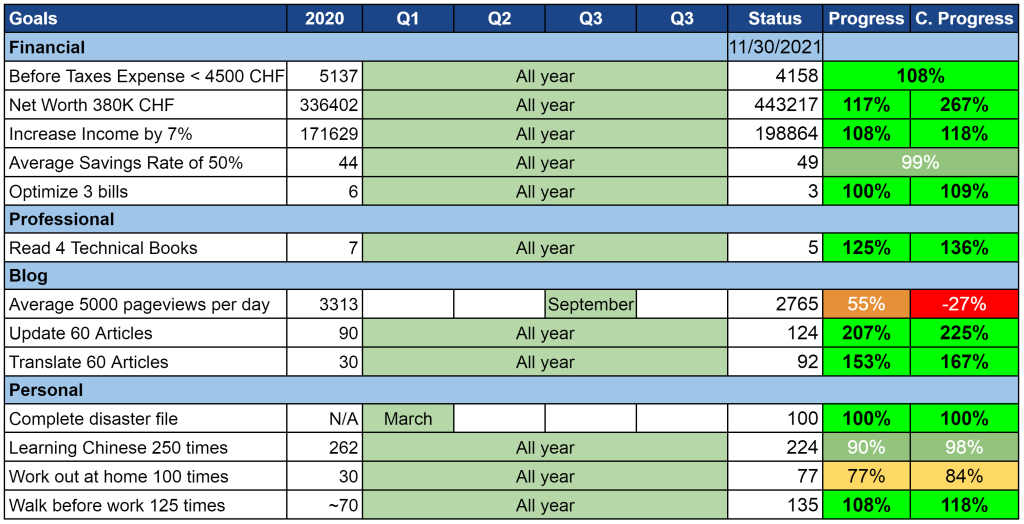

2021 Goals

Let’s take a look at our goals by the end of November 2021:

Overall, our goals are doing well. At least, all the most important goals are doing good. And we have an unwritten goal to have a healthy baby, so we meet that hidden goal!

I was able to start a few workouts again in November. This was not nearly as many as I wanted, but this is already better than zero. I hope to get back to doing that at least twice a week soon. But this goal is already failed for this year.

I finished my fifth technical book of the year. The book’s content was pretty good, but it was horribly translated into English. That made it very hard to read.

I also talked very little Chinese this month. Fortunately, my wife has started talking Chinese with our son. So hopefully, I will learn by listening to them. But at this point, I expect that I will fail this goal.

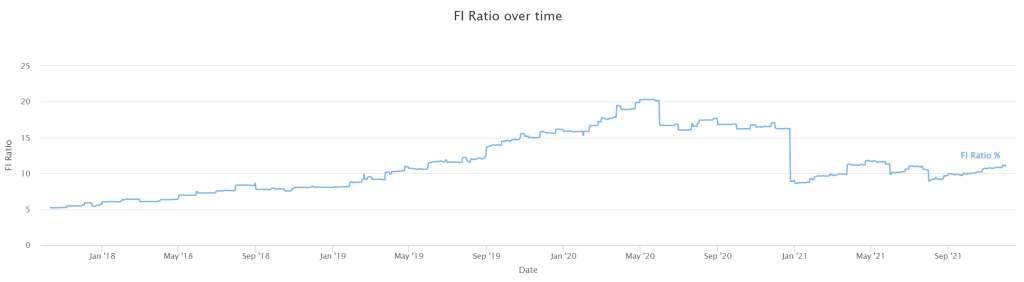

FI Ratio

Let’s take a look at our progress towards Financial Independence:

Overall, our progress to Financial Independence is really not impressive. We just went over 11%. Our monthly expenses are still not very stable. Hopefully, we will lower our average monthly expenses.

Our FI Net Worth itself went up but not by a lot. We could save a nice amount, but the stock market was going down at the end of the month. This may be a nice buying opportunity for next month, but it is not great for our FI Net Worth. We will see how it goes over the long term.

At least, our net worth is now going in the proper direction. And we should not have huge downwards movements anymore.

The Blog

Overall, not much happened on the blog this month. I made some minor changes to the blog that I believe improved it significantly. And I also have plans for more changes, but I have no idea when I will have the time to implement them.

As usual, the traffic on the blog continues to decline. This month, I lost about 5% of readers. I am starting to wonder how low this can go. At least, if I get zero readers, I will not have much left to do :)

This month was really hectic in terms of the time available for me. I was planning to advance significantly towards the French translation. But I got very little done in that matter. At this point, all my blog projects are either late or on hold.

Next month, I will still try to work on the French translation and update a few outdated articles (Investart changed their fees, for instance). But there will be little progress towards the blog. I plan to finish my current projects by the end of the year. And next year, I plan to focus on content for a while. I do not want to spend too much time on the blog.

Next Month – December 2021

December should be a simple month. We will have a few (very few this year) meals with our family and friends. This will be nice, and we will take it easy over Christmas.

As for our finances, we will have a few usual end-of-year bills. But we do not expect any large expenses or earnings to come in December. So, it should be a fairly good month.

What about you? How was November 2021 for you?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Hi Baptiste, your dollar exposure is very high (VT). Are you worried about US inflation and possible dollar weakness, or how are you handling the projections? Based on your recommendation, I switched to IB this year, which was my best financial decision in 2021. Thanks for that! In general, I’ve become a huge fan of Vanguard! Best regards, Hans-Peter

Hi Hans-Peter,

Congratulations on moving to IB!

I am not particularly worried about that. Over the long term, I believe these will be smoothed out. Currency variations matter in the short term, but not much in the long term. Also, I am still investing. So if the dollar goes down, I get more for my CHF and can invest and this will compensate for some of the variations. Once in retirement, if am afraid about that, I could switch more of my money to CHF or hedge some of the stocks.

In any case, if you can’t stand this risk, you should either reduce your allocation to USD or hedge to CHF.

Thanks for the monthly update! It always really motivates me to review my own situation in the previous month. One question, do you calculate the taxes you will likely have to pay based on your income or are these actual tax bills you received (based on last year’s income)?

Because of Corona and ruined travel plans I ended up unemployed more than half of last year so my tax bills this year have been really low. I switched jobs and have a high income and currently a saving rate of around 75% but I know this is inflated because it doesn’t account for the much higher taxes I will need to pay next year on this year’s income. Do I correct this now based on average estimates or just wait till I actually receive and pay the high tax bills next year?

Hi Natalie,

Thanks :) I am glad my article motivates you!

The taxes are actual tax bills. And indeed, currently, they are based on last year’s income.

Sorry to hear about your unemployment and glad to hear about your which income!

None of these options are wrong. You could virtually correct now or wait until the tax bill. I would do the second option since I want my budget to reflect real expenses and earnings, not anything virtual. Another option would be to do extra payments (you can ask the tax office for further bills, but it’s a bit late now).

The same can be seen on my expenses over time.

Actually, in my canton (Vaud) I just change the amount of the payment slips that were sent : I never had any problem doing so. I assume it only works if you want to pay more ;)

To estimate my taxes, I use the official app from my canton and enter roughly the values and I know if I’m far or not.

Baptiste have you thought about the change in your tax rate change as your are father now ? You will definitively pay less.

That’s a good point, I could estimate my taxes in advance and adapt the payment slips. But I prefer following their numbers :) Over the years, the estimation gets better since my income does not move that much.

Yes, I will pay less. I can deduce 7000 CHF from my taxable income for my son. And I can deduce 1040 for his health insurance. So, that’s a total of 8040 CHF.

On the other hand, child allocations are taxable as well (which is a huge shame). So, this adds 3180 CHF to my income. In the first year, this will add an extra 1500 CHF for the birth allocation.

Starting from this year, I will deduce 4860 CHF from my income, which should remove about 2000 CHF from my taxes, at about a 40% marginal tax rate. So, it’s not bad :)

I really appreciate the time you spend updating the blog, specially keeping fees updated for the different services, it’s super super helpful!

And congrats on your ‘hidden’ goal :-)