How much we spent in 2023 – Full Expense Report

| Updated: |(Disclosure: Some of the links below may be affiliate links)

We keep track of all our expenses. I usually publish a monthly update on this blog. Once a year, I also analyze all the costs for the entire year. This helps me have a global view of what we spend.

We do not really budget, but we track expenses in multiple categories. While monthly expenses are interesting, a yearly overview gives a better picture of what is going on.

So, in this article, I detail the expenses of our family of three for 2023, in the canton of Fribourg. This is the first year we have paid for daycare the entire year.

2023 Expenses

Before we get started, you can take a look at our 2022 expense report, if you want a baseline.

To give a bit of context, we are a married couple in the canton of Fribourg, with a two-year-old and two incomes (one full-time, one part-time). Be careful that you do not compare too much against others. It is better to try to improve yourself, rather than compare with others.

Here are the totals of our expenses for 2023:

| Category | Total CHF | Difference | What is it? |

|---|---|---|---|

| State | 48’316 | -5387 | All taxes |

| Personal | 31’394 | +3322 | Everything else, for us, is not mandatory |

| Housing | 23’004 | +415 | Mortgage, house fees, new windows, new boiler |

| Food | 12’185 | +3139 | Groceries and eating out |

| Insurances | 9’514 | -1974 | All our insurance, primarily health insurance |

| Blog | 8’119 | +1207 | Blog expenses, AVS mostly |

| Transportation | 2’442 | -1233 | Car and public transportation |

| Communication | 1’175 | +125 | Phone and internet bills |

In total, we spent 136’152 CHF in 2023. This is 545 CHF less than in 2022 (a 0.39% decrease). Without taxes, we spent 87’836 CHF, 4840 CHF more than in 2022 (a 5.83% increase).

If you are wondering how we spent less in 2023 but more without taxes, this is a good question. And in fact, this comes down to the fact that we still have not received our full tax summary. I am sure there is a tax bill coming for us.

So, while it is great to have spent slightly less, I think the number without taxes is more interesting for us. So, this would give us a personal inflation of 5.83%.

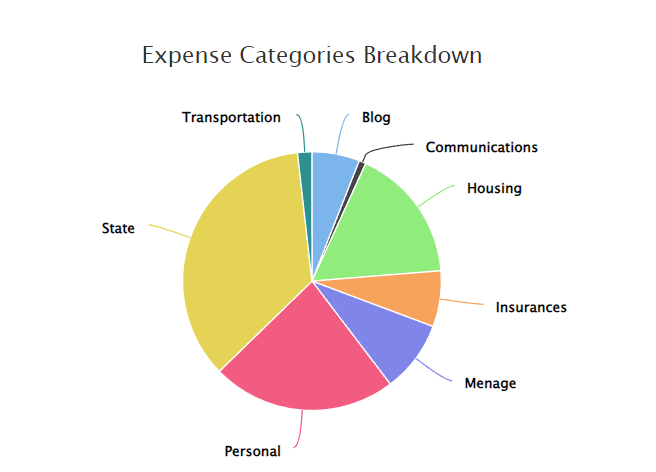

Here is a breakdown of our expenses per category for 2023:

We can easily see that some of the main categories are making a huge part of our budget.

- Taxes are 35% of our budget

- Personal expenses are 23% of our budget

- Housing is 17% of our budget

There is not much we can do about taxes, although this should go down in 2025. On the other hand, we have control of our personal expenses, and this represents almost a fourth of our expenses. This is something we will need to improve in 2024.

I can now detail some of the larger expenses of 2023.

Biggest 2023 Mandatory Expenses

We can start quickly with the big mandatory expenses:

- Taxes: 48’316 CHF (-5387 CHF)

- Health Insurance: 9183 CHF (-1163 CHF)

- Groceries: 7897 CHF (+939 CHF)

- Kindergarten: 4698 CHF (+2923 CHF)

- Mortgage: 3661 CHF (No difference)

Together, these expenses make up a large part of our entire expenses. We cannot get rid entirely of any of them. In theory, we could stop daycare, but we feel one day at daycare is necessary for our son and for us as well. This will continue in 2024 and will slightly increase because our daycare facility has increased its fees significantly.

As mentioned before, our taxes are lower because of two factors. First, in 2022, we had to pay large extra tax bills because we did not pay enough in 2021. Also, in 2023, we have not yet received our tax summary. So we are likely to pay again more in 2024.

We are paying less for health insurance because we reduced our complementary insurance. In 2024, our premiums will go up significantly even when changing health insurance. We will reduce again the coverage on complementary insurance by mid-2025.

We can then take a look at some individual expenses.

Holidays 5319 CHF

In 2023, we had one main family holiday. We went to Santorini for about a week. It was rather nice, with very nice views. Our son had a lot of fun despite the heat, and it was a good test for him to fly.

However, we did not plan this vacation well and ordered everything quite late. As a result, it was very expensive for such a short vacation. Of course, Santorini itself is already very expensive, but when you order late, prices are starting to be quite insane. We will be more careful about the next vacation.

Mrs. The Poor Swiss also went to Malaga for a few days with our son while I stayed home. It was a much cheaper vacation, although it was quite nice for my wife and son.

In 2024, we will likely go back to China, so this number may be even higher, but our expenses per night should be much lower.

Health 2553 CHF

In 2023, we spent more than 2500 CHF for health. This was for three people.

This was a combination of many small expenses. I did a checkup this year. And we had regular checkups for my son and gynecologist appointments for my wife. On top of that, we also have the usual dentist appointments.

There was nothing really out of the ordinary with these expenses, but they quickly piled up. However, we still spent significantly less than in 2023, so it is still a good result.

In 2024, I hope to spend a little less on that, but we are not entirely in control of our health, of course.

Fuel 960 CHF

In 2023, we spent 960 CHF on fuel. This is more than the 838 CHF from 2022.

We traveled a little more within Switzerland than before and also went to Annecy by car. But we still use our car much less than the average Swiss, mostly because I work from home as much as possible.

I do not see this changing a lot in 2024 unless we have to change our car and switch to an electric car.

New expenses

We had two large expenses for the house in 2023.

- In 2022, we ordered new windows on the house. At that point, we had only paid the advance payment of 10’000 CHF. In 2023, we paid the final payment of 6738 CHF.

- We had to change the boiler. We chose a heat pump boiler to replace the old electric boiler. It cost us 7242 CHF.

Other than these two large house bills, we did not have any significant new expenses in 2023. We had many small things that piled up and made our personal expenses higher than they ought to be.

Things we improved in 2023

I do not feel like we improved a lot in 2023.

We did well with the heating system. Our monthly bill went down to 165 CHF (as of September only) instead of 220 CHF. Some of it is due to clement weather, but some of it is also due to better management of the heating system, which is very difficult to tune.

We canceled our complementary health insurance from Helsana and switched a few of them to Assura. This allowed us to spend less on health insurance in 2023 than we did in 2022.

Things that will change in 2024

I do not foresee any major changes to our expenses in 2024.

The blog category should entirely die down now that the LLC is completed. We may have a few more expenses in 2024, but hopefully, we should be done with most of it.

Several things will become more expensive, but we do have not much to do in the matter:

- Our power bill will increase by 40% (thanks to Groupe E!).

- Our health insurance will increase slightly.

Since the blog income is now separated from ours and the salary we get out of it is lower than the total income, our total taxable income should go down slightly.

Things to improve in 2024

There are a few things we want to improve in 2024 with our expenses, but nothing drastic.

In 2024, we want to be more careful about small expenses that pile up. Many of our personal expenses are not necessary and are not well thought out. We often think that 50 CHF is too little to worry about. But these small expenses can quickly add up. So, we should be careful about them and think about the added value.

We will also need to be more careful about our groceries. We were keeping a very nice food budget before. But this has now gotten out of control. Of course, some of it is due to inflation, but some of it is also due to us not being careful enough anymore.

So, overall, there should not be any large improvement in 2024, but rather more of an improvement towards the smaller expenses.

Conclusion

In 2023, we spent very slightly less than in 2022. This is a good result, but it is mostly due to not having paid as much taxes (the tax office is late). That being said, considering the current inflation, our expenses are really not too bad.

In 2024, we want to be more careful about our small expenses in all budget categories. We want to think harder about the value of everything we buy. We spent too much on small things that pile up on our budget for no real value. We are far from the worst, and the situation is not too bad. But we can do better.

What about you? How was 2023 for your expenses?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Just saw it used everywhere for complementary insurance:

https://www.merriam-webster.com/grammar/complement-and-compliment-usage-difference

Yes, you are absolutely right, I make this mistake often :( I will address this.

How on earth have you had to pay so much in taxes? That is crazy? We have 4 kids, live in canton Vaud and rent, and have had to pay only around 23,000 and we have income of around 150,000 – how is it that you are paying more than a third of your income on taxes? That doesn’t seem normal for switzerland, even if you go on the official state calculator for taxes for your area and everything it wouldnt be that high for the year?? I am confused, please explain?

Hi Rach

Taxes are 35% of our budget, not of our income. In 2023, our taxes were about 18% of our total income. This will likely go because our taxes have not been adapted yet.

We only have 1 son and only one day per week in daycare, so not that much reduction. And our house actually increases our taxes.

Oh that makes a lot more sense ;) Thanks for clarifying! :)

Thank you for sharing your insights on your past year. You are indeed very disciplined to do this healthy review and reflect on possible improvements. Well done!

Thanks, Eon! I am glad this is interesting!