VIAC vs Finpension 3a – Which is the best third pillar for 2024?

| Updated: |(Disclosure: Some of the links below may be affiliate links)

VIAC was unchallenged as Switzerland’s best third pillar until the end of 2020. Then came Finpension 3a, another great third-pillar offer.

I have already reviewed these two excellent services. But we also need to compare VIAC vs. Finpension 3a in detail to see which is the best third pillar in Switzerland.

In this article, I compare VIAC vs Finpension 3a in detail. We see their investing strategies, fees, and everything you need to know to choose!

|

5.0

|

4.5

|

Finpension 3a

Finpension 3a is the newest challenger in the third pillar world. They started in October 2020. But they are not a new company. Finpension is already behind the best vested benefits account there is in Switzerland.

Finpension 3a started as a mobile-only third pillar but added web support only a few months after its launch.

So what makes Finpension 3a so interesting?

- You can invest up to 99% in stocks!

- The fees are very low, at 0.39% per year.

- You have considerable freedom in your portfolio.

So, while they are new to the third pillar world, they are already exciting. They also have extensive experience managing vested benefits accounts.

For more information, you can read my review of Finpension 3a.

VIAC

VIAC started in 2018 as the first mobile third pillar. When it started, it was the only mobile-only third pillar and started a small revolution in the third pillar world. There are now several mobile alternatives. And now, VIAC also offers a web application.

VIAC has two significant advantages:

- You can invest up to 99% in stocks. They were the first ones to offer such high allocation to stocks.

- The fees are low, at 0.41% per year, for the most interesting strategy. For the Swiss third pillars, this is as low as it gets.

On top of that, VIAC is a very transparent and honest company with clear communication.

All these advantages made it the best third pillar when they started. And they now have more than 15’000 customers.

For more information, you can read my review of VIAC.

Investing Strategies

We start by comparing the investing strategies of VIAC vs Finpension 3a.

Both third pillars invest in mutual funds. They do not use ETFs because pension companies can access much better funds than private investors. Therefore, they can access funds with close to zero (or even zero) TER. So, it is an excellent reason to invest in mutual funds instead of ETFs.

Both companies invest in passive mutual funds. These funds are index funds that minimize costs and try to replicate the market’s performance. Once again, this is a great thing.

Finpension 3a and VIAC let you choose between Credit Suisse and Swisscanto index funds. On top of that, Finpension 3a also gives you access to UBS, making it a small advantage for Finpension.

Both companies let you invest up to 99% in stocks.

Both companies differ in what they do with the money not invested in stocks. At Finpension, only 1% is kept in cash. The rest is invested in bonds. With VIAC, you can choose between keeping it in bonds or cash.

Some people dislike bonds because they yield negative interest for a few years. However, bonds are currently earning more than cash again, so it is a matter of timing. Nevertheless, it is good that VIAC lets you hold cash should you wish to.

However, with Finpension, you can invest in a money market fund. A money market fund is similar to cash and would yield the same.

Overall, both third pillar providers have a great investing strategy! But Finpension 3a is better for aggressive investors like me.

Custom Strategies

Looking at what advanced investors can do with custom strategies is always good. So, we compare VIAC vs FInpension 3a on that point.

Both third pillars let you choose a custom strategy.

With VIAC, there are some limits to what you can do with a custom strategy:

- They will only let you invest up to 60% in foreign currencies.

- You can only invest up to 90% in Swiss Stocks.

- VIAC will prevent you from having too much in a single company (this impacts only the SMI)

- They will prevent having more than 20% in Emerging Markets.

Most of these limitations are not that bad. I wish the first limitation was relaxed. All the other limitations make sense, and I would not want to overcome them. However, having 40% of CHF in my portfolio will limit my diversification.

With Finpension 3a, you also have some limits:

- Maximum of 20% in precious metals

- Maximum of 50% in Real Estate

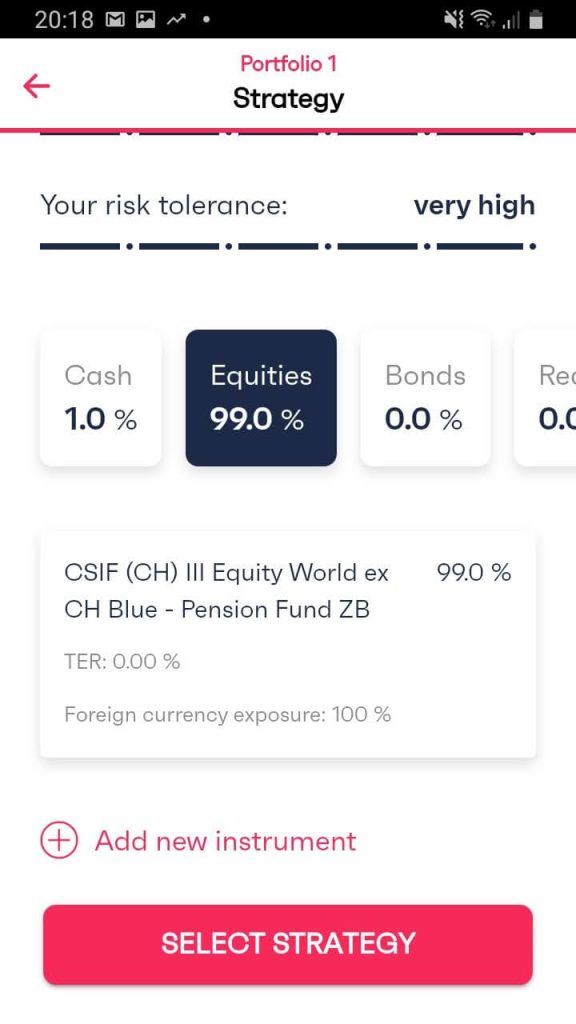

And that is about it for the limits. You can have 99% in foreign currencies (1% needs to stay in cash). And you can have 99% in a single World fund, for instance.

And you can even optimize for having 0% TER:

So, Finpension 3a is significantly more flexible regarding custom investing strategies than VIAC. You will be able to boost your international diversification higher. But VIAC still offers great custom strategies.

Fees

In the long term, it is essential to consider the investing fees. You will pay these fees for a very long time. And you will pay regardless of the market conditions. So, we need to compare the fees of VIAC vs Finpension 3a.

VIAC charges a base administration fee of 0.52% on the invested assets, with a total administration fee cap of 0.40%. You also pay some fees for the funds themselves.

So, the fees will depend on which strategy you are using. Using the standard Global 100 portfolio (99% in stocks, globally diversified), you will pay 0.41% in fees per year.

You also pay fees for currency conversion, which are 0.75% per conversion. However, this is optimized by netting conversions together. VIAC estimates the annual average to be 0.05%. It is difficult to say if this is accurate. I think it is likely to be slightly higher.

Finally, the index funds used by VIAC also have some subscription and redemption fees. These are almost negligible in the long term since you only buy and sell once, so we can ignore them for now.

This gives a fee of about 0.46% per year for a fully invested and well-diversified portfolio at VIAC.

We can examine Finpension 3a now. The base fee is 0.39% annually and includes VAT and product costs.

Finally, the funds also have some subscription and redemption fees, just like for VIAC. They are mostly using the same funds. The foreign exchange fee is 0.05%. With netting, this will be negligible on average.

This gives us a total fee of about 0.39% for Finpension 3a for an excellent portfolio.

When we compare VIAC vs Finpension 3a, Finpension 3a is cheaper than VIAC. You may think this is not a significant difference, but a 0.39% fee is about 5% cheaper than a 0.41% fee!

There is another advantage to Finpension 3a: its tax domicile. If you are withdrawing your third pillar abroad if you have left Switzerland, the tax domicile of the pension will be important for the taxes. Finpension 3a is domiciled in Schwyz, the canton with the lowest taxes for pension withdrawals! This could make a significant difference for people withdrawing from outside Switzerland.

On top of that, you can save money on fees with both products by recommending the service to friends and families.

If you have 100’000 CHF in your third pillar, you will save 20 CHF per year with Finpension 3a.

In the previous section, I mentioned that VIAC lets you hold cash. When you do that, you do not pay fees on the cash portion. So, a 100% cash portfolio at VIAC would be free of fees. And with 40% cash, you would only pay 60% of the normal fees. At Finpension, you are always fully invested. Therefore, you will pay more fees at Finpension 3a for a low stock allocation.

Extra Fees

Both of these third pillars have some extra fees that we should also consider.

First, VIAC will charge you 300 CHF if you withdraw your third pillar to buy a house.

Finpension will charge 250 CHF for a withdrawal and 200 CHF for a pledge for real estate, which is slightly cheaper than VIAC.

However, Finpension has some extra fees. If you transfer your 3a out of Finpension less than a year after creating it, you will pay 150 CHF. And if you withdraw abroad, you will pay 250 CHF (750 CHF if that happens during your first year).

So, overall, VIAC has a slight advantage for extra fees since they do not charge any fees for withdrawing abroad. However, Finpension 3a is slightly cheaper for withdrawing for real estate.

Extra features – Insurance

We can also look at the extra features that these two great services offer. It is pretty simple since only VIAC has an extra feature, and it is the only one.

Indeed, VIAC started offering life or disability insurance in its package. For each 10’000 CHF invested in securities, you will get free protection of 2500 CHF. You have to choose yourself if you want life or disability insurance. You cannot choose both.

We should try to quantify the value of such insurance. In Switzerland, men have a 6% chance of dying before retirement as of 2021. If you have 100’000 CHF invested in your portfolio, you get 25’000 CHF insurance. Based on the probability of dying before retirement, we can put a value of 1500 CHF for your investments’ entire duration.

If you invest for 30 years, you will get a life insurance value of:

- 50 CHF per year if you invest 100’000 CHF in your third pillar

- 100 CHF per year if you invest 200’0000 CHF in your third pillar

- 200 CHF per year if you invest 400’000 CHF in your third pillar

For disability, about 2% of people in Switzerland are concerned with disability insurance as of 2021. So, we will take 2% as the probability of being disabled.

If you invest for 30 years, you will get a life insurance value of:

- 16.66 CHF per year if you invest 100’000 CHF in your third pillar

- 33.33 CHF per year if you invest 200’0000 CHF in your third pillar

- 66.66 CHF per year if you invest 400’000 CHF in your third pillar

These are only rough estimates. But you need a lot of money invested for this insurance to be interesting. And even then, the amounts are relatively low. I prefer paying lower fees and being optimistic. But, for people already customers of VIAC, it is an attractive, although minimal, advantage.

Security

We should compare the security of VIAC vs Finpension 3a.

Both applications are technically secure, and both companies have a strong security record. I have not heard of any leaks or breaches in these two companies.

With Finpension 3a, you can configure the second factor of authentication (SMS or a good authenticator). This helps with security since this will require your phone. This is much better than VIAC (no second factor). However, you cannot do much from these two applications since the money is blocked until you can use it. Nevertheless, there is plenty of important information, and I would prefer a second authentication factor.

Both services let you identify yourself with your identity documents. This makes sure that nobody can open an account in your name. At finpension, you can choose to do that while it is mandatory at VIAC.

From a safety point of view, both third pillars are equivalent. VIAC and Finpension 3a manage the assets, but they are held in a pension foundation’s balance sheets. The assets are saved in a custody bank in both cases. So, in cases of VIAC or Finpension 3a going bankrupt, the foundation must find a new manager.

Overall, I feel like the security of both third pillars is good. But Finpension 3a has the advantage of a second factor of authentication. So, I would say Finpension 3a is slightly safer.

Reputation

Finally, we look at the reputation of VIAC vs Finpesion 3a.

Both companies are young, and finding many reviews about them is challenging. I have never heard any public bad news about either of them. And both companies seem to have an excellent reputation.

VIAC has 82 reviews on Google and got an average score of 5 out of 5 stars. It is a really impressive score. There are only two reviews with less than five stars, and none point out a real issue. Now, most reviews are advertising codes for their referral programs. So, I would probably not pay attention to most of these reviews.

On the App Store, VIAC got 152 notes and an average score of 4.7 out of 5 stars. On the Play Store, VIAC got 239 reviews for an average 4.8 out of 5 stars.

Finpension 3a has no reviews on Google. They have ten reviews on the Play Store with an average score of 5 out of 5. And they have no reviews on the App Store.

Both companies have the same good reputation. VIAC has slightly more experience with third pillars. But Finpension has more experience with second pillars (1e and vested benefits). So, overall, I have high trust in both of them!

Applications

I do not care about the applications, especially for the third pillar. It is unimportant because you rarely use it and have to do very little with it.

But some people consider this very important. I would much rather invest in a terrible app (with good security!) and low fees than in a beautiful app with higher fees. But it is up to you to decide what you want to prioritize. So, we compare VIAC vs Finpension 3a in terms of their applications.

VIAC offers a mobile and a web application. Both applications are pretty good. They look good and are very easy to use. They did a great job of polishing them.

Finpension 3a is also available as a mobile application and a web application. The mobile application could use some extra polishing, and VIAC is a little better.

On the criteria of applications, VIAC is slightly better than Finpension 3a. Their mobile application feels a little better, but nothing significant.

Summary – VIAC vs Finpension 3a

We can draw a table summary of our findings:

|

5.0

|

4.5

|

|

|

|

|

|

0.44

|

0.50

|

|

Good

|

Good

|

- Invest 99% in stocks

- Great investing strategy

- Outstanding fees

- Great customization

- Does not let you invest in cash

- Great investing strategy

- Good fees

- Only 97% in stocks

- Not great for aggressive investors

We can draw a few conclusions from this summary:

- Finpension 3a is better for aggressive investors

- Better expected returns in the long-term with Finpension 3a

- VIAC is better for conservative investors who do not want bonds

- VIAC applications are a little more polished than Finpension 3a

- VIAC offers life or disability insurance coverage

VIAC vs Finpension 3a – Conclusion

Finpension 3a is the best third pillar in Switzerland.

Use the FEYKV5 code to get a fee credit of 25 CHF*!

*(if you deposit 1000 CHF in the first 12 months)

- Invest 99% in stocks

We are now done comparing VIAC vs Finpension 3a. The first important point to note is that both are great third pillars. They are the two best third pillars available in Switzerland.

But we have to choose a better one! Finpension 3a has advantages over VIAC for long-term investing! Being able to invest 99% in stocks is good. And reducing the fees by about 10% is a great thing.

Considering that custom strategies can lower fees and maximize foreign exposure, I think Finpension is an excellent third pillar!

In 2021, I contributed to Finpension instead of VIAC. Given my long-term horizon and aggressive investing, it fits me best. I think it is the better option for most people who will retire soon. As of 2022, I now have four accounts at Finpension 3a and will open a new one in 2023.

VIAC would only be better for more conservative people who do not want bonds. Indeed, the fees will be slightly lower (especially if you go lower than 80%). However, you could use a money market fund instead with Finpension 3a.

If you open a Finpension 3a account, please use my code FEYKV5. This will give you a 25 CHF fee credit (if you deposit 1000 CHF in the first 12 months) and will also help the blog.

Which of VIAC vs Finpension 3a do you think is the best? Which third pillar provider are you using?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Best retirement accounts

- More articles about Retirement

- What is the best third pillar in Switzerland for 2024?

- Freya 3a Review (Discontinued) 2024 – Pros & Cons

- Finpension 3a Review 2024: Pros & Cons

Good comparison, thoroughly researched as always.

I have used VIAC for a couple of years now and for 2021, I tried Finpension. Can’t say much about it now, since the money there sits around uninvested until February 1st…

In the end, I think the differences are pretty small, so for “normal” people, it won’t matter too much.

One comment about the fees: they can be reduced at VIAC by using referral codes. Since the maximum amount managed for free is 5500 Francs, this will give you a discount of 28.60 per year.

If anybody needs one, here is one of mine:

mCO6zwd

Cheers

Peter

Hi Peter,

Thanks for sharing your experience. I am in the same boat as you. My previous third pillar is in VIAC and the 2021 one is at Finpension.

You are right, the differences are marginal. For most people, it won’t make enough of a difference to switch.

Yes, you can reduce the fees a little with referral, but that would still not be enough to make VIAC cheaper than finpension once you get larger sums.

Thanks for stopping by!

It is also true that last year viac increased unexpectedly the amount of free managed money from 2000 to 5500 chf, so actually almost 3 times more than before. they justified this with the customer base getting bigger. The program could get bigger anytime soon again

Hi Karl,

It’s true. If they make it significantly bigger, it could start to make a difference. However, we need to keep in mind that the fee is on the total assets. 0.1% fee on 100’000 third pillar already makes a 100 CHF per year difference. And this only goes higher as the third pillar grows.

Thanks for stopping by!

Thank you for your useful information as always!

Last year I moved to CH and your blog saved my money to a great extent :)

As for 3a, I almost decided to take Finpension, however, apparently its exit charge is costly when I need to leave Switzerland to another country. As I am an expat, not 100% sure about my future in Switzerland, Finpension may be more expensive for me. So I eventually chose VIAC.

For the year 2021 I am wondering whether I should open another account/portfolio for 3a. I will keep reading other posts of yours to get more information on this. Thank you in advance again :)

Hi Hiro,

Thanks for your kind words :)

It is a good idea to have several third pillars, for tax reasons.

But if you think you are going to leave Switzerland, it may be good to avoid finpension indeed.

Thanks for stopping by!

What is actually the early withdrawal fee for Finpension if leaving Switzerland?

I think they charge 250 CHF for processing the capital withdrawal abroad.

What would be interesting to know is the process of consolidating VIAC invested funds into Finpension and if you recommend this.

I am not sure I understand you question. Do you mean transferring equities from VIAC to finpension?

This is not possible. You will have to sell all your assets on VIAC, transfer the cash to finpension and wait for it to be reinvested on the other side.

Thanks for the article. I am with VIAC since 2-3 years now and won’t change again soon (kind of getting tired to switch again and again).

I was wondering how the insurance coverage is calculated. I.e. if I have 2 VIAC accounts with each 50’000, I would expect to have 25’000 total coverage (assuming both 50’000 are invested). In my case the VIAC app shows less and I cannot figure out why exactly this is. Is it maybe because I don’t have a “GLOBAL 100” plan (meaning a plan with more cash)!?

Hi P.,

I completely understand not wanting to change :) VIAC is still very good, there is no issue staying with it.

I do not know if the portfolios are simply added together or if they do something different.

However, it’s true that if you have more cash, you will reduce the coverage. Only money invested in equities will count towards the insurance.

It is a bit counter-intuitive since people with aggressive strategies will get more insurance than more conservative people. And generally people more conservative are the people that want more insurance.

Thanks for stopping by!

Hey there,

Have chosen for the plan in the screenshot or was it just an example?

Thanks

Hi,

The plan in the screenshot is a good example of replicating VT somehow.

I have chosen the default 100 strategy for now.

Thanks for stopping by!

If I’m not mistaken, in the default 100 there are also hedge funds, right?

Hi Wavemotion,

Do you mean hedge funds? Or hedged-funds?

hey, I was on the phone sorry.

I meant this one:

CSIF (CH) III Equity World ex CH – Pension Fund ZBH

Hi,

Yes, that’s correct, some of the funds are hedged by default. The default strategies have a higher allocation to CHF than many people would like. This is common to most third pillars.

If you want to reduce the hedging to CHF, you can do a custom portfolio, which is great.

finpension now has a web app; much easier to change the strategy that way compared with the mobile app.

Hi Michael,

Thanks, I have updated the article to add a mention of that :)

Hi!

This was very interesting review. Thank you doing it! I am kind of new in this so may I ask you couple of questions:

1. I know that the maximum amount in 3a is around 6800 chf a year. Is it possible to have more than one pillar 3a? Is it possible to switch between different 3a providers easily? Does this cost a lot of money?

2. If I want to leave Switzerland in 3-4 years would I be penalized by one of these 2 companies? I have heard that insurance companies and banks are heavily penalizing people if they don’t stay at least 5 years and leave Switzerland. Is this the case with these new 3a funds?

Thank you very much for your time and consideration!

Regards!

Hi George,

1. Yes, you can have third pillars in several providers, although there is little advantage of doing that. What is interesting is that you can have up to five portfolios with both VIAC and finpension and this lets you optimize taxes. It’s generally free to change providers unless you change more frequently than once a year.

2. Both companies have a fee for leaving Switzerland. But to my knowledge, there is no fee for leaving before 5 years.

Thanks for stopping by!

Thank you very much!!!

Does Finpension allow …

– to invest with ESG?

– to create annually a new portfolio? (important for tax in the future)

– to adjust the strategy on a monthly basis (or even more frequently)? (diversification strategy)

I am curious. Thx for replay

Hi,

* When you choose Sustainable investing, they invest in ESG ETFs

* Both let you create up to five portfolios, which is enough for tax advantages

* Both let you change your strategy at any time, but it’s rebalanced once a month.

Nice review, but it leaks some information: finpension has already a webapp: https://app.finpension.ch/

Thanks, I have added mention of the web interface.

No NASDAQ in Finpension is an issue. (Viac has it).

That said the World ex CH quality in Finpension is interesting as it offers a chance to avoid investing in poor quality “value” stocks that are the bane of index investing.

I queried this with finpension on twitter but they didn’t get back to me.

I wonder if any of these providers will ever offer a free choice of individual stocks? It’s bizzare you aren’t allowed to make your own investment decisions in a pillar that is voluntary.

Hi Joe,

Since I recommend investing in as broad as possible indexes, I do not see the lack of NASDAQ as a disadvantage or an advantage. Most people will not need it.

I do not think we will see individual stocks any time soon in third pillars. This would need a change in regulations that is going to take decades to happen in Switzerland.

Thanks for stopping by!