November 2023 – A rainy month

| Updated: |(Disclosure: Some of the links below may be affiliate links)

November 2023 started as a very rainy month after months of nice weather. After that, we even got several days of snow, beginning the winter for real now.

Other than that, it was not a very eventful month. Our income was slightly higher than usual while our expenses were low. This gave us a great savings rate of more than 60%.

November 2023

Overall, November 2023 was relatively quiet. It started to be very rainy, and we finally got some snow. It looks like we are finally in winter mode.

We had only a few events planned. And my wife finally finished her courses for her day-mom job. These courses were pretty taxing for both of us, taking many of our Saturdays away. So, we are glad this is over.

We could finally invite all our friends for a nice lunch. This is something we wanted to do for a while. It went well. We are now looking forward to the Christmas parties.

Our son’s sleep was better this month. We got about 75% of nights without any wakeup. This is an excellent result because we are used to much worse results. It seems we are finally headed in the proper direction.

On the other hand, he has started waking up significantly earlier (from 7:30 to 6:30). As long as he sleeps, this is fine. But this may mean I will not have time for the blog at some point in the future if this trend continues. Indeed, I work primarily on the blog in the early hours.

Financially, it was a pretty average average month. We spent less than usual, which is suitable for a change. And some of the shares from my employer were vested last month, increasing our income. Other than that, our revenue was standard this month.

With these, we saved about 60% of our income, which is fantastic.

Expenses

Here are the details of our expenses in November 2023:

| Category | Total | Status | Details |

|---|---|---|---|

| Insurances | 762 | Average | Our three health insurance policies |

| Transportation | 91 | Average | Fuel once, some parking, and some buses |

| Communications | 19.95 | Average | Only one phone plan |

| Blog | 69 | N/A | One missing bill |

| Personal | 1407 | Average | Kindergarten, shopping, a new luggage piece, … |

| Food | 948 | Above average | Usual groceries, some snacks, and meals out, one invitation at home |

| Housing | 930 | Above average | One bill for installation of the new boiler, heating, and mortgage. |

| Taxes | 5827 | Average | The usual three taxes |

In total, we spent 10056 CHF in November 2023. Not counting the blog and the taxes, this amounts to 4160 CHF. This is an excellent result for us.

Our expenses were relatively standard this month. Our food bill is more than usual. We invited many people at home, which was significantly more costly than normal. We also bought a few non-standard things.

Other than the food category, our different categories have nothing particular.

We still have not paid for the boiler. We should receive the bill next month. We have paid for the power installation, though, about 400 CHF.

Overall, I am pretty happy about our expenses this month. This is the month we spent the least of this year.

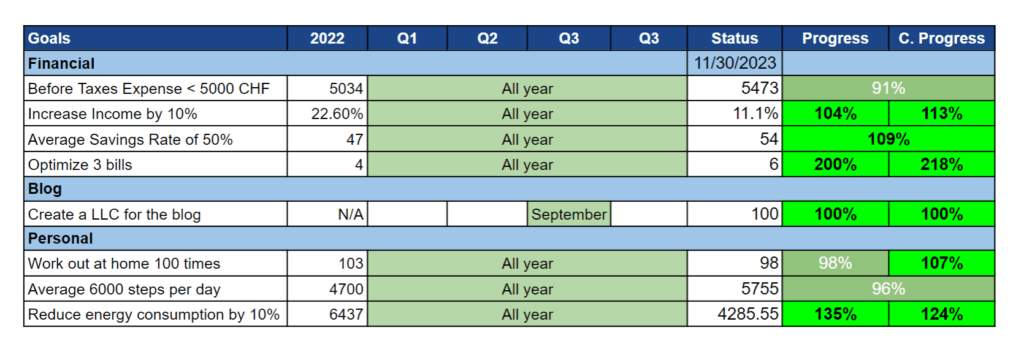

2023 Goals

Here is the status of our goals by the end of November 2023:

Overall, our goals are going well. Only two goals are behind: our expenses and my daily steps.

We did a great month on the expenses side, driving our average down. But we will not reach this goal unless we spend nothing next month. But our current level of expenses is relatively reasonable at this point.

My health goals did not do so well this month. I had to spend almost a week in the office, disturbing my routine. This made me miss several workouts. Also, due to the rain, I reduced the distance of my morning walks several times (I now have rain pants, which should be better). And then I was a little sick for a few more days, skipping even more.

These are obviously excuses! I know I should invest time in health activities regardless of these points. But this is something that does not come naturally to me.

I do not know whether this relates to the new heat pump boiler, but our power consumption decreased significantly this month. So this is great. I expect the heat pump to save us power in the long term.

So, overall, I am happy about the state of our goals.

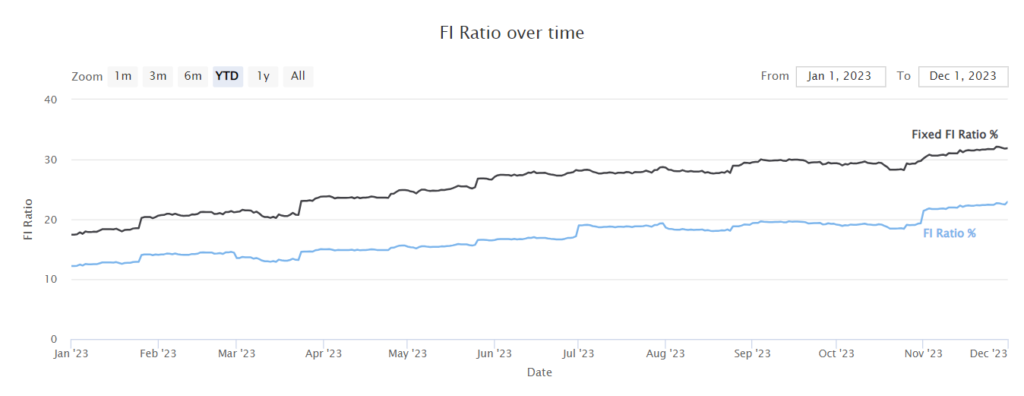

FI Ratio

Here is the progress of our FI Ratio as of November 2023:

In November 2023, the stock market rebounded nicely. This helped our net worth increase. On the other hand, the dollar fell even lower, reducing our returns (but helping our new investments). With that and the good savings of the month, our net worth has increased nicely.

We also spent very reasonably this month, lowering our average expenses.

With that, we have now reached a 22.9% FI ratio. This is our best result so far.

The Blog

As discussed in the previous update, I have started implementing the new design for the review articles. For instance, you can have a peek at the Interactive Brokers Review. I am doing something similar in my comparison articles (such as Neon vs Yuh).

As many of you have told me, I have an issue with Avast Antivirus flagging my website as malicious. This comes from the Plausible analytics script. But there were very few details.

I have contacted Avast, and they told me they removed this issue from their database. This cleared out the problem for a while, but it returned. I will have to contact them again.

Other than that, I had time to refresh some older articles. Some articles still deserve a substantial update, but I will not have much time on them for a while.

Next month, I have nothing special planned. But I am low on articles written, so I must speed up on writing. I am also planning two weeks without articles around Christmas, which will save me time.

Next Month – December 2023

Next month should be a slow month. The usual family and friends events are planned next month, but nothing too crazy. My wife is finally done with her courses, which will make our weekends much less taxing for both of us.

Financially, we expect the bill for the boiler installation to come. Other than that, we should not have special income or expenses.

What about you? How was November 2023 for you?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Hi Baptiste

Just discovered your blog and loving your content so far! Just starting out on my FI journey and your articles have been an eye opener – especially the ones on the trinity study.

What’s the difference between the Fixed FI ratio % and the other FI ratio % lines in your chart above?

Cheers,

AP

Hi AP,

Thanks, I am glad you like my content!

The FI Ratio is based on our average expenses of the last 12 months. The Fixed FI Ratio is based on yearly expenses of 100’000 CHF, which is what we would aim for in retirement but since retirement is so far away, I currently use the FI Ratio (not fixed) as my reference.

It’s very nice to read the personal side to your blog. It makes me happy that you are doing well. You deserve it!

Hi Simon,

Thanks, I am glad you like this part of the blog!

Hi Baptiste,

What are you referring to with the usual 3 taxes?

Thanks,

Juan

Hi,

I am talking about the three levels of taxes and three bills:

* Federal taxes

* Canton taxes

* Municipality taxes

Well done, Baptiste! It’s remarkable how you can keep family+FI together, maybe you should change the title of the blog? :) congrats!

Haha :)

The name of the blog is more related to the fact that everybody thinks that every Swiss is rich while it’s really not the case. But I am not poor, I agree :)