First Pillar: All you need to know to retire in Switzerland

| Updated: |(Disclosure: Some of the links below may be affiliate links)

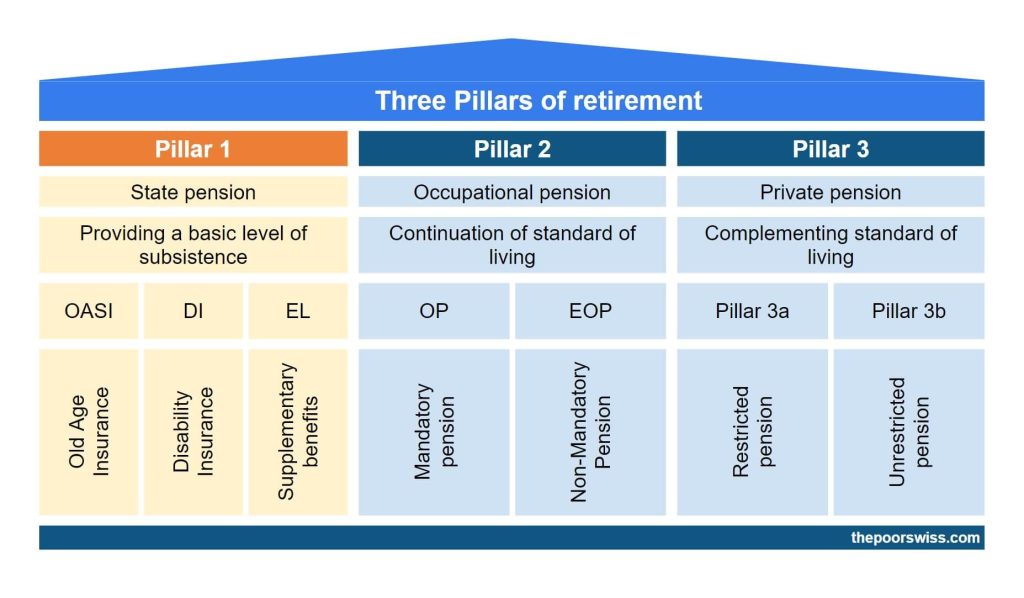

The retirement system of Switzerland is a system with three pillars. Each pillar is paid differently and will cover different needs. The first pillar is the state pension.

If you are working in Switzerland, it is essential to know these three pillars. Even if you do not plan to retire in Switzerland, understanding how they work will help you plan your retirement.

This article discusses the first pillar in detail. It should contain everything you need to know about the first pillar to retire in Switzerland.

I use the French acronyms in this article. But the figure at the top of this article has the acronyms in English as well.

Introduction to The three pillars

Here are the three pillars of retirement in Switzerland:

- The first pillar (state pension). This first pillar will grant a pension to every Swiss employee after retirement. It is a state pension between 1175 CHF and 2350 CHF per month if you have worked every year since you were 20. Each employee in Switzerland finances this pillar.

- The second pillar (occupational pension). The second pillar will grant a pension to every Swiss retired employee. You will only receive money from this pension if you work and have an annual salary of more than 21150 CHF (currently). You will pay for this pillar with a deduction of your salary each month.

- The third pillar (private pension). The third pillar is a personal saving system. While the first two pillars are mandatory, the third pillar is optional. You can only save a certain amount each year into the third pillar. The essential part is that the third pillar has tax advantages.

Every pillar will improve your quality of life after retirement. The first pillar is only there to cover your basic needs. With the first pillar, the second pillar should cover from 75% to 80% (on average) of your last salary. And the third pillar, which is optional, should help you cover the missing part of the second pillar.

The first pillar

The first pillar is a state pension.

Every Swiss person registered with this global insurance will receive this pension. The Assurance-Vieillesse et Survivants (AVS) insurance is what makes the first pillar. This insurance covers the basic needs of every person in Switzerland after retirement.

This pension is paid by every Swiss employee (and independent people) after 17 years old through a deduction from their salary.

You pay for the AVS insurance and two other insurances: the insurance for invalids (AI) and when you serve in the army (APG). Each month, 8.7% of your raw salary goes to the AVS, 1.4% to the AI insurance, and 0.45% to the APG insurance, for a total of 10.55%.

Employees pay half of the full contribution, and the employer pays the other half. Therefore, you should see a deduction of 5.275% each month for these three insurances together.

These contributions can change every year. For instance, in 2020, the contribution for AVS insurance (the first pillar) increased from 8.4% to 8.7%.

For completeness’ sake, we also need to talk about Unemployment Insurance. It is not directly related to the retirement system. But you will also pay for it monthly. You will also pay 1.1% of your salary for it. If you get more than 148’200 CHF per year, you will pay 0.5% of the part higher than this number. This insurance will cover the needs, for some time, of people who lose their jobs and cannot find a new one.

Unemployed people also have to pay this fee. People who do not have a salary have to pay the minimum fee of 478 CHF per year, starting from their 20-year birthday. An exception is if their spouse pays at least twice the minimum fee (956 CHF) per year. For instance, I have enough salary that my wife does not have to pay AVS.

If you have a significant net worth, the minimum fee will increase. For instance, with a one million net worth, you must pay 2054.60 CHF (as of 2020) as a minimum each year. There are exceptions if paying this fee would reduce your living standards too much. You can use this calculator to see how much the tax is for unemployed people.

How much will I get from the first pillar?

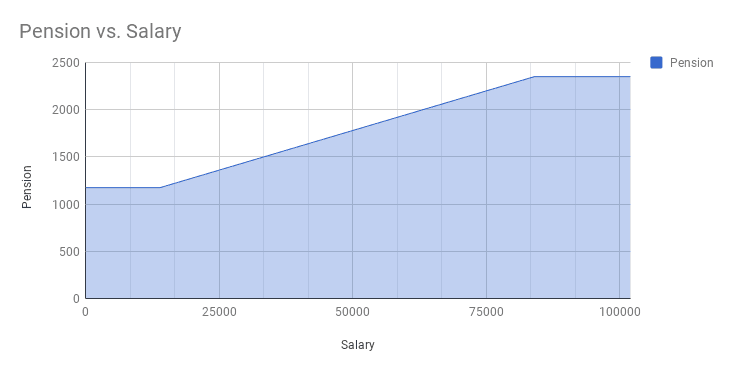

The full pension is a minimum of 1225 CHF per month, up to a maximum of 2450 CHF per month. How much you get depends on several factors:

- How much income you got during your working life.

- The number of years you have contributed to the first pillar.

- Contributions for caring for children or relatives.

First, the amount of your salary determines the amount of the full pension. The minimum pension is up to a salary of 14’100 CHF per year. To reach the maximum pension, you must have an average annual salary of 88’200 CHF. You can see in the previous image how that scales. Between those two milestones, the full pension scales linearly.

The second factor is how many years you paid the AVS insurance. To get the full pension, a man should pay for 44 years and a woman for 43. If you have missing years, you will receive a pension prorated for the years you have paid the insurance.

The third factor is when you care for children below the age of 16 or care for relatives. During the years when you are in this situation, you cannot have contribution gaps. Even if you did not pay during this time because you had no income, it would not count as a gap in your contributions.

The first pillar and marriage

Importantly, a married couple cannot receive two full pensions, only 150% of a full pension (3525 CHF per month).

Fortunately, the minimum is still 200% of the minimum pension (2350 CHF monthly). It is unfair to married couples with both a large income. But some things are unfair to married couples in Switzerland (taxes, for instance).

This first pillar of pension also covers the case of widowed people. If the dead spouse were eligible for a pension, the surviving spouse would receive this pension.

Several things need to be considered in the case of divorce. First, each spouse will get a pension based on half the combined income during the marriage. The care contribution credits are also divided in half. If one of the divorced spouses dies without retirement, the other spouse will get 80% of the deceased pension.

The first pillar and early retirement

The first pillar only covers official retirement, at 65 for men and 64 for women.

If you want to retire earlier, you can ask for a pension one or two years in advance. However, this means you will get a reduced pension of 6.8% per year of advance. You can also take it later, as seen in the next section.

If you want to retire earlier than two years before the official retirement age, you will only be eligible for the pension when you reach retirement age. Before that, you must rely on your net worth to cover your expenses.

Official calculator

If you want an official estimation, there is a cool official tool for estimating your pension.

Remember that this is only an estimation, not an official number. But in my experience, it seems pretty accurate. It can compute the results based on your income and marital status.

If you have not worked in Switzerland your entire life, you can enter your income for each year and get a good picture of what you will get based on the holes in contributions.

The first pillar and leaving Switzerland

If you leave Switzerland, you will usually still be entitled to the pension. So, once you reach retirement age, you will receive your pension.

However, there are a few exceptions. For instance, if you are not Swiss and move to a country without a social security treaty, you will lose the first pillar pension.

If you lose the right to the first pillar pension, you are generally entitled to reimbursements of your first pillar contributions.

In any case, it is mandatory to announce that you are leaving the country. If you want all the details, you can read about them on the official Switzerland website.

Optimize your first pillar

You cannot do much to optimize your pension from the first pillar. Since it is mandatory, you are already paying for it.

It is essential to avoid any years when you do not pay the AVS insurance. All these years will significantly reduce the amount you will receive. If you go to a foreign country for a long time, you should continue to pay the minimum each year to avoid penalties.

Even living abroad after retirement, you should receive your pension. But the country where you retire should have a social security agreement with Switzerland.

When you are studying, you should also pay the minimum to avoid any missing years. If you missed a year of contribution, you could pay for it in the next five years. After five years, you cannot compensate for it anymore.

If you are moving to Switzerland, you will not be able to fill your gaps. These gaps can be filled if you are in Switzerland and then living abroad for a few years for instance.

If you want to increase your pension, the biggest thing you can do is increase your salary. Although it may not be evident, you should probably try to increase your income regardless of the pension.

There is one other thing you can do to increase your pension. You can delay the time at which you start to receive the first pillar pension. If you delay the pension by one year, you will get a pension increase by 5.2%. It increases to 10.8% for two years, 17.1% for three years, 24% for four years, and 31.5% after five years (maximum delay). It is a gamble on your life expectancy. If you expect to live until 100 years old and can afford to delay the pension, you should delay it for five years.

Accounting

I do not account for the first pillar in my net worth. There are several reasons for this.

- You do not only pay this insurance for yourself. It is global social insurance. The people with more salary will pay more for people with a smaller salary.

- Then, since I plan to retire in Switzerland, I will never touch the capital, only the pension.

- I am not entirely confident it will still exist once I reach the official retirement age.

However, I should account for this in my computation of my Financial Independence (FI) ratio. Since it is a guaranteed pension after retirement age, you will need less money stashed for your needs. But it is a bit weird to account for it, and I still have not done it. Indeed, it is only starting at the official retirement age. And your retirement may begin early.

Another argument for not accounting for the first pillar is that it may not be solvent once I reach retirement age. It is a somewhat pessimistic point of view. But the population is rapidly aging, and Swiss couples have fewer and fewer children. I prefer to ignore it for now in my strategy, and I will rethink it when I am closer to retirement. If you are optimistic about it or close to retirement, you should account for the first pillar in your retirement strategy.

FAQ

What is the first pillar in Switzerland?

The first pillar of retirement in Switzerland is a state pension. Every person in Switzerland is eligible for this state pension.

How much will I receive from the first pillar?

This will depend on your salary. The minimum is 1175 CHF per month, and the maximum is 2350 CHF per month. The minimum is up to a salary of 14’100 CHF per year, and the maximum is 84’600 CHF per year.

How can I optimize my first pillar?

You cannot do much to optimize for your first pillar. You need to make sure you pay for it every year. Having holes in your contribution will lower the money you receive.

Conclusion

The first pillar is the first part of the Swiss retirement system. It should cover the basic needs of every retired Swiss person. Employees pay it from their salary, and unemployed people pay a minimal amount each year. The pension is quite low (2350 CHF per month at most).

Most people cannot live only on this pension after retirement. The other two pillars are here to complete your needs during retirement.

Next, I cover the second pillar, which is an occupational pension that should make up a significant part of your retirement income.

What about you? Do you have any tips regarding the first pillar? Do you have any questions about the first pillar?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-bookRecommended reading

- More articles about Retire in Switzerland

- More articles about Retirement

- How many years until you can retire?

- Should You Contribute to Your Second Pillar in 2024?

- Early retiree in Switzerland – Dror’s Story

Great articles, I am struggling understand swiss retirement system. I would say I am now clear about it since I found your blog. Great job! and thanks a lot.

Hi Sikarin,

I am glad these articles help you understand the retirement system!

Thanks for stopping by and good luck in your learning :)

> Therefore, you should see a deduction of 5.125% each month for these three insurances together.

I believe this was increased to 5.275% in 2020. At least that’s what my salary slips say now on.

Hi Ilias,

You are absolutely right, I will have to update my article about that!

Thanks for letting me know!

Sure thing! I am very grateful for the great content you put up here! Neither French nor German is my mother-tongue, so it’s great to find quality content in a language I can fully comprehend, regarding financing and investing while living in CH :)

Glad to be of service :)

Hello,

First of all thanks for taking the time to write such interesting content about the pension system in Switzerland. Quick question from my side: I’m relocating to Switzerland after having contributed to mandatory pension in Brazil during 7 years and in Portugal during 1,5 year. Would you know if this period of contribution in other countries could count for retirement in Switzerland? In line with it, is there a list a of countries or blocs like the EU which Switzerland has a pension agreement with? I really appreciate your report on this one! Any guidance is very welcome! :)

Hi Pietro,

You are welcome!

I am not 100% certain, but I think this will not count. You would need to check with your local first pillar (AVS) office.

On the other hand, it is possible that you can get your pension back from Brazil if you relocate definitely in Switzerland. But this, you will have to check with Brazil administration.

Thanks for stopping by!

Hi,

very interesting blog !

Quick question (if you know) … I have worked in Switzerland for 2.5 years and now I am changing employer (still in CH). I will have 2 months gap between the previous employment contract and the new one … 1) is it mandatory to keep paying the AHV insurance and if yes how and 2) if it’s not mandatory would you recommend it doing in on a voluntary basis

thanks and keep up the great work !

Lux

Hi Lux,

It’s mandatory to pay it every year, but not every month. If you work 10 months during a single year, you will have paid enough for the entire year.

So with only two months gap, you really do not have to worry about it.

Thanks for stopping by!

Hi,

Just reading this article and correct this :

“If you have no income (early retirement) and a fortune of 1 million CHF, you’ll pay 1’947.50 CHF each year for the AVS.”

I will actually be 1’996.20 as they are taking 48.70 as fees.

For 2020 it will be : 2’054.60

With 2 Mio it will be : 4’487.70

With 3 Mio it will be : 7’731.85

https://www.caisseavsvaud.ch/calculs-en-ligne/calcul-en-ligne-pour-une-personne-sans-activite-lucrative/

Hi DivHunter,

Thanks for pointing that out. I will add this information to the article. I did not know there were fees as well.

Thanks for stopping by!

Hello,

first of all, congrats for very useful blog! Currently I’m going through all your posts as I found it yesterday :).

I have some questions as regards the first pillar. We were working in Switzerland as frontaliers for a few years and moved here this year.

1. How we can calculate what we would get after reaching retirement age? Let’s say for a man, contributing only for 27 years until retirement age is reached and having salary always bigger than 84’600 CHF per year?

2. If I started working let’s say 6 years ago, can I still contribute for missing years or it is too late (5 years back only)? What about the case when someone works less than 5 years? And finally – do you think it is good idea to contribute for missing years or it is better to pay more for 2nd pillar (assuming max for 3rd pillar is being paid each year)?

Thanks in advance!

Hello Szymon,

Thanks :) I’m glad you like it!

1) My understanding is that you would get 2350 * (27/44) = 1442 CHF per month. This could change since, in 20 years, the maximum could change.

2) It is going to be too late. You can only fill back the years up to 5 years later.

3) It could be worth it to pay for missing years, but I do not think you can in your case. However, contributing to your second pillar could be interesting. I have a post that is scheduled for today about contributing to your second pillar ;) It should be out in a few hours, keep tuned ;) In short, it is a very good short-term investment but a poor long-term one.

Remember that I am no expert, not an advisor, you should get more points of view than mine ;)

I hope this helps :)

Thanks for stopping by :)

If you want more information about whether to contribute to the second pillar, my last post just got published: https://thepoorswiss.com/should-you-contribute-to-your-second-pillar/ ;)

Hi! Awesome blog. This is by far the best blog in Switzerland!

Thank you so much for making this blog!

I have a few questions related to pension system, and I was wondering if you will be able to answer me.

Thank you so much in advance:

1. I am not Swiss but moved here to do a PhD in 2013 at the age of 26.

Is it still possible to pay for any of the Years when I wasn’t in Switzerland.

2. My salary has been less than 86400 until 2018, but increased significantly after that. In this case how would my pension be computed. Would it be an average of my salaries by number of years.

3. I had an account with Publica with my university, but now I have an AXA account. Can I merge these accounts into the same account. I assume Publica is also pillar 2. If not, how can I get access to the money in the account.

4. I had an internship with my current employer and then I joined them again after finishing my PhD. However, I noticed that I only got around half of my contributions into the vested benefits which was then transferred to my current account.

Why is this the case? Is it not possible to access the remaining money. Why are only half of my contributions accessible and transferred through the vested accounts.

Best regards,

Amit

Hi,

Thanks for your kind words :)

I am going to try to answer these questions. But keep in mind that I am not a professional. If you want the official answer, you will need to contact the official offices.

1) I would believe yes. You should be able to pay for the last five missing years

2) Yes, it will be the average salary over the years. I just do not know if they count the average with all the years or only the contributed years. But over the long-term, it won’t matter.

3) Normally, you should have moved your Publica holdings in a vested benefits account after you stopped working. And then, you can move your vested benefits account into your new AXA second pillar

4) This, I have no idea, sorry. Keep in mind that each month some contribution go to second pillar, the other part to first pillar, disability and unemployment insurance, not everything goes to second pillar. But I am not sure that is what you mean? Was your second pillar divided by 2 before and after the move?

Thanks for stopping by!

Good article, kudos!

AVS is one thing concerning me with fiRE. Contributions have to be paid even if you are not working and are then calculated according to your net worth. Do you see where I am going? AVS may work actively against early retirement.

Can you say sth about this – how much to be paid for 1 Mio.? Would getting AVS-retired early make the contributions end earlier?

Hi Martin,

Thanks :)

I’m not very concerned about this. If you have no income (early retirement) and a fortune of 1 million CHF, you’ll pay 1’947.50 CHF each year for the AVS. I don’t think it’s a very big expense. But of course, it has to be taken into account.

I’m not sure I understood your last question. You can only get AVS up to two years early. At that point, you’ll stop paying contributions, but you’ll loose part of the pension. If you have a huge net worth, it may be worth doing it.

I’m seeing the first pillar more as helping for the RE part of fiRE. You can consider that you’ll have more income after your official retirement and then need to save mostly for the part between early and official retirement.

I hope that helps :)

It does – thanx for the in-debth reply! 😎

You’re very welcome :)

It will be interesting to see how that third pillar works. Right now I can’t see any reason to essentially invest in an annuity instead of building a portfolio of stock index funds but I’m sure there must be something to it. Our system pretty much leaves retirement up to the individual with only the first pillar of social security, I look forward to seeing your next posts.

I agree that you could maybe make more returns by investing entirely yourself into a capital and manage it yourself. However, the first pillar (and the second pillar) is mandatory. Therefore, even if you see no reason, you have to contribute to it if you are in Switzerland ;) This is the equivalent to the US social security.

I still think it make sense to have a basic level of security after retirement for everybody even if some people end up paying more for the others.

The post about the second pillar should come soon, stay tuned ;)

Ah. Thanks for the deep explanation , This article is a great help for me to understand Swiss pension system !!!

You are welcome :)

I’m glad it’s helping to understand this complex system.

Thanks for sharing this. I basically don’t understand the Swiss pension system at all but this helps a lot!

Hi Janet,

You’re welcome, I’m glad it helps :)

Don’t hesitate to ask question. I’m no expert either but I’d be glad to help.