February 2024 – A very cheap month

| Updated: |(Disclosure: Some of the links below may be affiliate links)

February 2024 was a good month, with just the right amount of events. Our goals are doing well, even though I need to find more balance for my health goals.

It was also a very cheap month with a nice income. As a result, we saved significantly more than usual this month.

February 2024

February 2023 was a relatively nice month. We had a few events with family and friends and did some things on our side. It was a good, balanced month.

The weather was average overall, and we could do some things outside, but not as many as I would have liked.

We pay little taxes in February every year because we only have the municipality taxes left to pay. And in March, we will not pay any taxes. The timing is not great because February and March are usually months with significant income.

I got a large set of shares vesting this month. This makes a very significant difference to our income. On top of the low expenses, our savings rate is very high. With all this, we saved 86% of our income this month!

Expenses

Here are the details of our expenses in February 2024:

| Category | Total | Status | Details |

|---|---|---|---|

| Insurances | 776 | As expected | Health insurance only |

| Transportation | 106 | As expected | Bus and parking and fuel |

| Communications | 19 | As expected | Phone plan |

| Personal | 741 | Lower than expected | Some gifts, some medicine, a new stair gate… |

| Food | 774 | As expected | Groceries and a lunch out |

| Housing | 470 | As expected | Heating and mortgage |

| Taxes | 1784 | As expected | Only municipality taxes |

In total, we spent 4673 CHF. This is a fantastic result. Without taxes, this is only 2888 CHF.

Overall, it was an excellent month for our expenses. It has been a long time since we spent so little in a month. I am glad we can still achieve this level of expenses when we are careful about our miscellaneous expenses.

This month, we only paid the taxes for the municipality. This makes a huge difference in our savings rate, of course. Next month, we will not pay any taxes, and then taxes will be back shortly.

Our food budget is slightly higher than expected. We went once to a restaurant and then had people over for lunch twice. Next month will be more expensive because we have bought a quarter of a veal.

Overall, I am pleased about our expenses this month.

2024 Goals

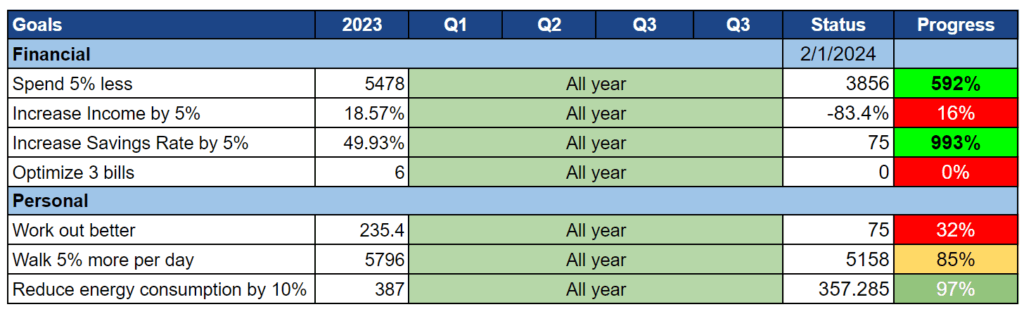

Here is the status of our goals by the end of February 2024:

Overall, our goals are mostly doing well.

Our financial goals are going very well. And since next month is the month with the highest income of the year, it will become even better next month. Of course, our savings rate will decrease once we start paying taxes again.

However, this month was really bad for my daily steps goal. My son started waking up earlier again, and this meant I had to either shorten my morning walk or sometimes cut it. After a few days with significantly fewer steps, I can already feel my back getting worse. I still have to figure out a good way to increase my daily steps.

During the week, I try to walk with my son, but when going around the village, we do not walk many steps before he does something, as kids of this age do.

On the other hand, my workouts are doing well. I am consistently doing them, and each one with three rounds. On top of that, I am still doing my indoor bicycle exercises.

Our energy consumption is slightly higher than our goal but already lower than last year’s. So it is starting well.

Next month, I plan to clean up my goals table a little. As mentioned, this is only a small part of my tracking. And since I don’t have quarterly goals anymore, having this large unused space in the middle does not make sense. So, by next month, I should have a new table here. By the way, my tracking spreadsheets are available for download: My KPIs and Goals Spreadsheet

Overall, I am happy about the state of our goals! I only wish I could find more balance to focus on my health.

FI Ratio

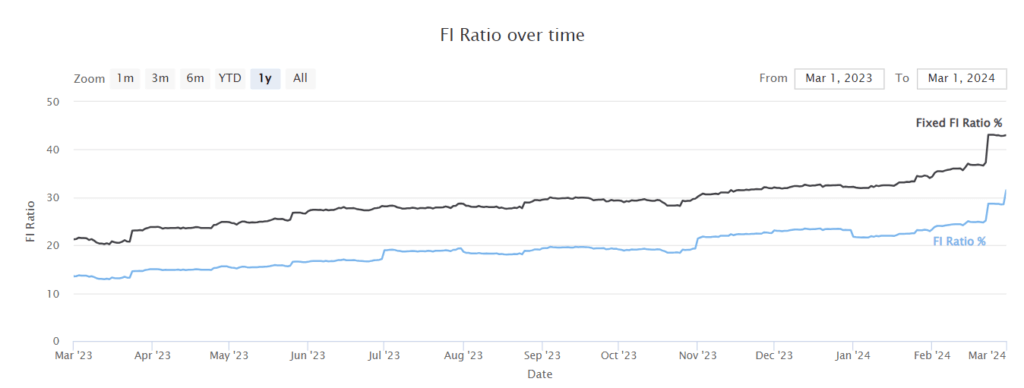

Here is the progress of our FI Ratio as of February 2024:

We had solid progress towards our FI Ratio this month. Of course, we had a very nice month, but this does not explain everything. The main driver was some payments from the blog that are annual only, and that came up this month.

On top of that, our expenses in February 2024 are much lower than those in February 2023. This makes a very significant in our target and, therefore, in our FI ratio.

Currently, a lot of this month’s savings have not been invested. Indeed, some of the savings are still in my employer’s shares, and I also have some more cash in my eTrade account. Once everything is settled, I can move that to my portfolio. On top of that, some of the money is also in cash in the LLC. We must see what we do with this cash in the next few months.

Next month, we will likely add 20’000 CHF to our pension fund. That way, we will have filled the withdrawal we took for our house. This will allow us to then save on taxes in 2025 by contributing more to save on taxes.

We will not increase our FI ratio by that much often. Next month, it should also increase because of my bonus, but the increase will be far less significant.

Overall, I am pleased about our FI progress this month!

The Blog

On the side of the blog, there is not much to report. I have made some improvements in many of the review articles. I also improved some of the German translations. But there was really nothing special.

In the next few months, I hope to start working on the next version of my budget spreadsheet to tailor it to more advanced needs. But the progress will highly depend on the time I have for the blog.

It is also worth mentioning the forum now. Since sharing the information about the forum in my newsletter, the forum has been quite active. Of course, this is the beginning, and we can expect more activity.

But there seems to be an interest in the forum. We will see what the future holds, but it makes a great new place to help each other with financial questions.

I am considering organizing a small meetup in the coming months. There seems to be an interest in doing that as well. It will be much easier to arrange this on the forum than on the blog.

Next Month – March 2024

Overall, we have very little planned in March, except for the Easter weekend at the very end of the month.

March is usually the best month of the year financially. March is when I get my bonus. And March is also one of the few months we do not pay taxes. So, our savings rate is usually very high. It is also a month where we splurge a little to celebrate the bonus.

What about you? How was February 2024 for you?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Bravo!

Do you think that you will get FIRE way before you turn 50 (as you planned originally)? If there will be no global financial crisis and you won’t lose your job, you will reach it very soon (in 5 years?).

Do you have already a plan how to quit the rat race and live FIRE? I think mentally it will be challenging.

Or do you plan to continue working part-time?

Because of your son I guess you cannot leave Switzerland and become a full-time traveller, you need to stay here until your son will get independent.

Maybe it is worth to write your thoughts in the blog.

Hi Thomas

My metrics tell me I will be FI in 10 years, so 4 years ahead of schedule.

I do have a plan in place. I talked about it in the past, but I should update this article: What Would I Do If I Retired?

I will probably keep up with the blog because I think it’s helping people.

I am really not interested in becoming a full time traveller, I don’t like traveling that much.

How do you calculate FI ratio? What does it mean?

HI Anand

It’s basically the ratio of my FI Net Worth (the current status) to my FI Number (the target).

I have an article about that: How to Calculate your Financial Independence (FI) Ratio

So extrapolating you had an income of over 33k in one month? Given that and the income you can guess from your 2023 review, don’t you think it’s time to rethink the name of the blog?

Also, if you want to rebalance taxes over the year, you can and pay the most in months like this. And why do you not pay any in March especially, when the national ones are due?

The name of the blog is not to say I am poor (not that I am rich either). The name of the blog was a play on words because everybody believes each Swiss citizen is rich, which is far from true. The average Swiss has it easy compared to many country, but he is not rich.

All the bills I receive are marked with a data and I tend to follow these dates.

At least in Fribourg, there are no taxes due in March. It is likely different in each canton.

I meant the state (Bundes) taxes. Don‘t they have 31st of March as due date? (This will be my first year receiving tax bills on a C permit, so I‘ve only read this).

This is only due if you have not paid taxes in advance. I pay federal taxes in 6 tranches in advance and therefore I have nothing due on the 31st of March.

When do you get your provisional bill? Before the year even starts? I thought bills came at the start of the year and federal taxes are due end of March and the rest end of September?

Coming back to your first answer, I don’t know anyone who thinks ALL Swiss people are rich, just that a lot of rich people from everywhere like to hide their money in Switzerland because taxes are low.

In fact, when I was planning on moving to Switzerland what I heard again and again as a counter-argument to what my salary would be, was: Well, but costs of living are twice as high as well, so you won’t really have more from your salary.

Around February, we get the provisional bills, which are based on the tax declaration of two years ago.

Then, sometimes starting from April, we get the tax decision. And if this is higher than the provisional bills, we have to pay extra.

In our case, we receive 6 bills to spread federal taxes, 9 bills for the canton and 10 for the municipality.

When traveling abroad, I met quite a few people that thought I was rich simply because I was Swiss. This is still a common thinking. But it’s true that some of it comes from the reputation of luxury watches and bank secrecy.

Bravo Baptiste,

The kind of month that gives your FI project a big boost. 👌

Bravo for your perseverance and your ability to juggle your job, the blog, the forum, and as I’ve read, soon the meet-up…

An example of productivity.

Thanks, Dror!

I may be overdoing it and I am still struggling to find the proper balance but I am getting there!

Good luck with all your own endeavors!