February 2022 – A good month

| Updated: |(Disclosure: Some of the links below may be affiliate links)

February was a better month than January. We did not have to deal with COVID again. And we managed to do a few things again with friends and family.

Overall, not much happened this month.

Financially, it was quite a good month. We had a good income and a few extra expenses, but nothing too expensive. So we managed to save a substantial portion of our income.

February 2022

Overall, February is much better than January. There was no COVID on the radar, so no quarantine or isolation, and we could see our friends and family again. With the easing (or removal) of the measures, we plan to invite a few friends in tiny groups starting next month. It will give us a change of pace.

We are still not sleeping much. It is getting more difficult during the days since he is not sleeping much and demands constant attention. And continuous attention is more difficult while we are tired.

I have filled and sent my tax declaration this month. I thought our taxes would go down, but this is unfortunately not the case. We get a tax reduction thanks to my son, but on the other hand, our taxable income increased enough to offset that. We are slowly reaching an obscene amount of taxes to pay…

Financially, it was an excellent month. We had some extra expenses and some extra earnings (RSU and ESPP). Also, we only paid municipality taxes this month, making our total expenses significantly lower. We managed to save 80% of our income this month. It is definitely a great result.

Expenses

Let’s see the details of our expenses in February 2022:

| Category | Total | Status | Details |

|---|---|---|---|

| Insurances | 843 | Average | Health insurance |

| Transportation | 3 | Below average | Just one parking fee |

| Communications | 65 | Average | Only internet bill |

| Blog | 283 | Average? | A few small bills and email system yearly bill |

| Personal | 2237 | Above average | New laptop, stuff for the office, physiotherapy, … |

| Food | 300 | Below average | Very reasonable groceries |

| Housing | 550 | Average | Mortgage and heating |

| Taxes | 1061 | Below average | Municipality taxes only |

Overall, we had a very reasonable month on the expenses side. In total, we spent 5346 CHF. Without taxes, we spent 4284 CHF, which is a good result considering we bought a new laptop.

We only paid municipality taxes this month. For stupid reasons, the municipality gives me ten bills, the canton nine, and the country six. So, there are a few cheaper months. For instance, I will not have to pay any taxes next month. I prefer to receive more bills and have a smoother budget every month.

On the unusual expenses, we had to pay a large physiotherapy bill for Mrs. The Poor Swiss. And I also got a new laptop for home. With the current situation, I often have to stay in the living room, and having the single laptop of Mrs. The Poor Swiss was not enough. So, now we have two laptops for the living room. I still have my computers in the office, but I do not use them as much as I would like.

Other than that, the expenses were reasonably standard this month. I also spent some money on improving the office, but the bulk of the costs will come next month.

We bought a new tropical shower, but we made the mistake of buying it at Lidl. The quality is horrible. As soon as I installed it, the water exchanger stopped working. I will stop buying anything else than food groceries at Lidl. I was not expecting high quality for this price, but I was not expecting them to sell such poor products. I am really disappointed there.

Overall, it was a good month for our expenses, we cannot complain!

2022 Goals

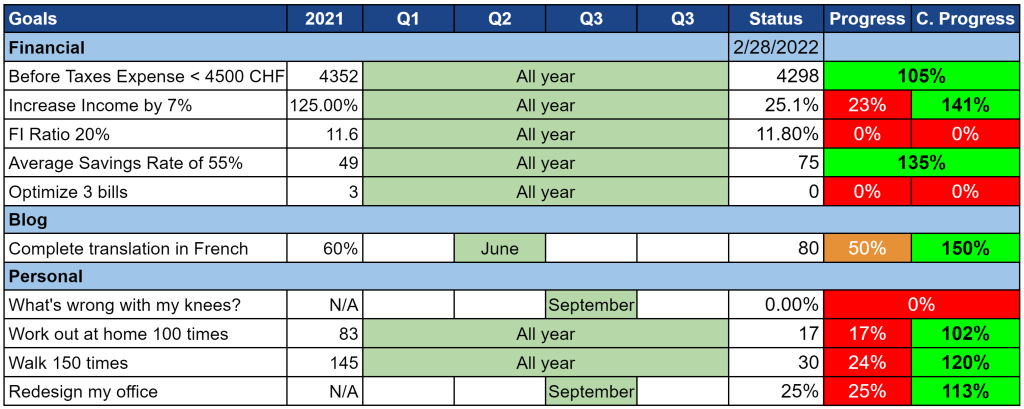

Let’s take a look at our goals by the end of February 2022:

Overall, our goals are doing fine. We have made good progress towards our financial goals.

We are still below our spending target and above our savings rate target. Next month will challenge the spending target. But it is still good to start well!

I have been able to force myself to work on my office redesign. I have moved things already and have made many decisions about what I need to do. I have a pretty clear picture of what I want at this point. Next month, I will order a new desk. And once I receive it, I will be able to start the main changes. Normally, I have finished all the planning at this point.

I have still not done anything for my knee. I am still waiting until COVID cases go down a little before seeing a doctor. But I may go in March.

I also have not reduced any bills yet. However, I have two ideas of what I can do this year. I just need to implement them. I still have no clue about the third one.

Our FI ratio is also well below our target—more on that in the next section.

But overall, our goals are doing nicely.

FI Ratio

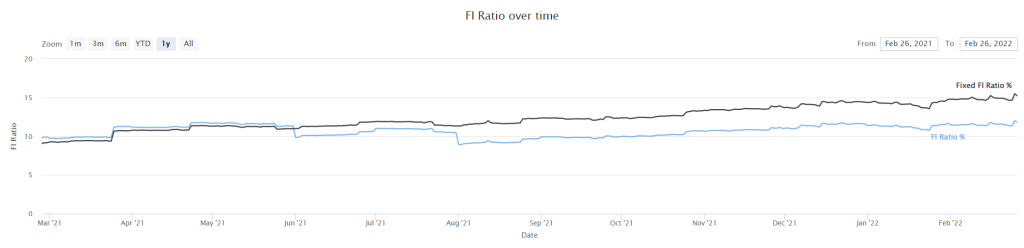

Let’s take a look at our progress towards Financial Independence:

Our FI ratio barely moved this month, from 11.40% to 11.80%. Our average expenses are now slightly lower with a good month.

On the other side, the stock market was not on our side this month. Even before the events in Ukraine, the stock market was more on the downside. It means that even though we saved a lot of money this month, our net worth barely moved.

I am not worried about that since we are far from early retirement anyway. Also, this allowed us to buy stocks cheaper this month. Nevertheless, I will never be able to reach my goal of 20% this year. I would already be surprised if I reach 15% by the end of the year. We will see what happens.

The Blog

The blog is back on its previous behavior and started losing traffic again. This month, the blog lost more than 10% of traffic.

I got a big issue with two plugins not working well together. This led to many links being broken on the French version of the site. And I had to spend many hours investigating the issue and doing a fix myself. And fixing all the links afterward also took a long time.

So, with that issue, I could not get a lot done on the blog this month. I do not have many articles planned in advance and progress on the French translation has been halted.

And on top of that, I have had other issues with the translation plugin I am using (WPML). I cannot believe how much time I waste dealing with plugins issues. At this point, I am entirely disgusted with translations. I was thinking of doing German after French, but I do not feel like I can deal with it. WordPress has some good things, but overall, I like it less and less.

Other than that, I have been working on securing emails sent from the mailing list. This should help not having them fall into the spam folder for some people.

Next month, I hope I will pick up momentum on the French translation and keep up with the blogging schedule.

Next month – March 2022

We do not have anything particular planned for next month. It should be a fairly standard month. Hopefully, the number of COVID cases will go down enough that we will see the end of the tunnel.

Financially, it should be a good month. In March, I should receive my bonus. That will make a significant bump in our income. On the other hand, we have several expensive things to buy, so that will not be a frugal month by any means.

What about you? How was March for you?

Download this e-book and optimize your finances and save money by using the best financial services available in Switzerland!

Download The FREE e-book

Hi Baptiste! I’ve been reading your blog for a couple of years, but never commented. Then I saw how much taxes you pay and had to make an intervention here!🙈

Just to give context. I’m in my 30s, married, no children, live and own a house in Basel-City, which has the second most expensive tax rate in Switzerland. My husband’s and mine incomes combined make a total of ca. CHF 180’000 brutto per year. We pay a total of CHF 27’000-30’000 in taxes yearly (and I get upset everytime I have to pay this amount!!).

You have similar life circumstances as mine, but have a SINGLE income and pay CHF 47’000 in taxes.

Am I the only one who thinks something is not quite right here?

As I see it, you either have a HUGE monthly income or you definitely need to optimize your tax declaration. Ever thought of meeting with a tax consultant? He might have some great tipps for you!🙂

Hi Yelena,

Just keep in mind that 47’000 was only in part due to not having paid enough in 2020. However, my planned taxes for 2022 is about 45K.

My salary and blog together make up 180K taxable income, so I get in the upper brackets of taxes. And we have very low deductions. With a single income, we have a single 3a, single work deductions and such.

Fribourg is not much behind Basel-City in terms of taxes, they are both bad places to live for taxes.

I have looked at all the possible deductions on our tax declaration and there seems to be nothing I could do. I don’t think a tax consultant would make a significant difference. But this could confirm that I am not doing something wrong least.

It is very impressive how you published this on the first day of the new month. My attempts at tracking my expenses have always been a painstaking process of manually entering data from bank statements into a spreadsheet. This would take hours of my time so I would eventually lose discipline and give up on the exercise. Any tips on how to be as efficient as you are in tracking expenses?

Hi Jaco,

I actually cheat a little. I start the article early in the month, almost complete it on the da of my salary and then schedule it one or two days before the first Tuesday of the month. So, there can be one or two expenses slipping through, but they will always make it to the budget, not always to the article.

This should not take hours. In February, I got 40 expenses entries in my system. It takes less than a minute for each. On average, I seem to have 50 expenses per month.

For me, I dump the tickets on my desk and once I have 2-3 tickets, I put them in the system and then throw away the tickets. For credit card statements, I do generally directly and check the statement at the end of the month to make sure I did not miss anything. It takes me at most an hour per month to do that.

Your number of expenses is lower than mine. With that you have encouraged me to shop less often, thereby reducing the number of expenses and the time it takes to track them. Maybe this will also reduce the value of the expenses too. I am excited to find out. Looking forward to your next update.

Hi Jaco,

It’s true that the fewer expenses you have, the easier it gets to track them :)

We do groceries usually once a week and have sometimes an extra run at Aligro or at the local cheese shop or bread shop.

We haved some months with about 60-70, but that really depends on how often we go out and what we do.

Good luck shopping less often (and saving more)!

Hello,

did you buy ETF this month as well with your savings, or are you waiting for markets to stabilize? Although we can buy at a cheaper price at the momen, I think prices will drop further and couldn’t take the decision to buy anything yet.

Hi Bax,

Yes, I bought more of VT and CHSPI. I have no idea where the markets will go, so I simply buy blindly :)

Impressive to see your monthly grocery expenditure. Shopping in Coop and looking at most peoples trollies I suspect they are spending 300CHF per trip

Is your grocery budget line ONLY food items or do you include all the additional costs such as cleaning products, dental, cosmetics etc? If they are included then the monthly expenditure is even more impressive

Also do you purchase wine, beer or spirits?

I am trying to see how we could approach you levels of expenditure

Many thanks

Hi,

Yes, I also suspect that most people spend much more than us, even at Lidl. But I also see trollies at Lidl loaded with junk food, that’s definitely not helping lower their bills.

It’s everything we buy at Lidl. If we buy a big thing like I bought some home appliances there, we would separate. But this includes shower products, shaving products, toilet papers, and such.

Cosmetics are generally in another category since my wife buys them in other shops.

We very rarely buy wine since we generally don’t drink it with my friends and we end up regifting wine bottles. We do buy beer at Lidl from time to time, but I would say that it’s less than 10 bottles a month since we don’t invite much (at least these days) and we never drink alcohol when we have no guests. We also don’t buy any soft drinks.

Many thanks for the clarification – certainly a challenge that will be interesting to see if we can make economies, without necessarily down trading quality

Hi, please share how you manage to spend only 300 chf on food per month for the whole family.

Thanks

Hi Natalia,

have an article about saving money on groceries. We don’t go out much, we cook everything ourselves, we buy meat in bulk in Aligro and we shop everything at Lidl.

Hi! Your savings are impressive (80%, wow!) and I would love to learn more.

1. I am curious how is it possible to only spend 300,- CHF per month for groceries. Do you have an article about this?

2. What health insurance are you using?

3. How come you pay so little on transportation?

4. Don’t you use any children help (babysitter, krippe etc)? These are very expensive, but I cannot imagine living without some kind of help in taking care of children.

Hi Zurich Girl,

Keep in mind that our taxes were on the minimal side this month, otherwise it would not be possible.

1) I have an article about saving money on groceries. We don’t go out much, we cook everything ourselves, we buy meat in bulk in Aligro and we shop everything at Lidl.

2) We have Assura for our 3 health insurance and Helsana for our complimentary, but we will soon move our complimentary insurance to Assura as well for simplicity’s sake.

3) I work from home since the beginning of the pandemic and we don’t go out much with our baby :)

4) Not at this time. But we are thinking of kindergarten although it’s probably a little late or maybe a daymom (probably not a good translation from maman de jour).

Hi Baptiste,

I can feel your frustration about WordPress. When you were looking around for plugins did you try TranslatePress. So far it is fine for my site. Which two plugins conflicted with one another?

I am also shopping around for a laptop. Any recommendations?

Thanks! I always enjoy your blog!

Hi MM,

When I looked, I indeed saw WMPL and TranslatePress. It looked like (at the time) WPML was a better solution. I am not entirely sure about that now… But it’s a bit too late to switch.

Lasso introduce a new HTML attribute into each link and there was a bug in WPML when processing these links that was screwing everything.

I also recently found another bug that would mess up all my images if I were using SVG images (never again…).

I opted for an HP laptop (HP ProBook 450 G8). Since it was a side laptop (not my main machine), I did not need very high specs and I wanted something that could be up to date for a while.

Thanks for stopping by!